Rebalancing is a critical investment strategy employed by investors to ensure that their investment portfolio maintains its desired asset allocation over time. It involves adjusting the relative weights of different assets within a portfolio to bring it back to its original target allocation. The primary purpose of rebalancing is to manage the risk of an investment portfolio. This is achieved by preventing the portfolio from becoming too heavily weighted in any one particular asset class, which could increase the portfolio's exposure to market fluctuations and other risks. An investor can ensure that their portfolio remains aligned with their investment goals and risk tolerance by periodically rebalancing a portfolio. Rebalancing differs from other investment strategies in that it is not focused on maximizing returns. Instead, the goal is to maintain a desired level of risk exposure over time. This approach is in contrast to other investment strategies, such as market timing or stock picking, which are focused on generating higher returns by predicting market movements or selecting individual stocks. Portfolio rebalancing is an essential investment strategy that provides a range of benefits to investors. The purpose of rebalancing is to maintain a targeted asset allocation and risk profile within a portfolio, which helps investors to achieve their long-term investment goals. In this regard, rebalancing is an important part of a sound investment strategy. It helps to manage risk as over time, market fluctuations and other factors can cause the relative weights of different assets within a portfolio to drift from their original target allocation. This drift can increase the portfolio's exposure to certain types of risks, such as market volatility or inflation. By rebalancing the portfolio, investors can realign the relative weights of different assets to their target allocation, thus reducing the overall level of risk in the portfolio. Rebalancing can also help investors to achieve higher long-term returns. By periodically selling assets that have appreciated in value and buying assets that have declined in value, rebalancing forces investors to "buy low and sell high." Furthermore, portfolio rebalancing can help investors to remain disciplined in their investment approach. It is easy for investors to become emotionally attached to specific assets or investment strategies, which can lead to biased decision-making and potentially lower returns. Systematic rebalancing allows investors to remain focused on their long-term investment goals and avoid making impulsive decisions based on short-term market movements. Besides, rebalancing a portfolio involves only a small percentage of holdings. Investors who may be concerned with the idea of selling stocks that have performed well and purchasing those that have underperformed in the short term can take comfort in the fact that it involves only a modest portion of their total investment portfolio. Portfolio rebalancing is a process that involves adjusting the relative weights of different assets within a portfolio. Rebalancing typically involves selling assets that have outperformed their target allocation and using the proceeds to purchase assets that have underperformed. The goal of this process is to ensure that the portfolio maintains its desired asset allocation and risk profile over time. To begin the rebalancing process, an investor must first determine their desired asset allocation. This involves determining the target percentages for each asset class within the portfolio, such as stocks, bonds, and cash. Once the target allocation has been established, the investor can compare it to the current asset allocation of their portfolio to identify any discrepancies. If the portfolio has drifted from its target allocation, the investor will need to sell assets that have become overweight and use the proceeds to purchase assets that have become underweight. This ensures that the portfolio maintains a consistent level of risk and return. If stocks have appreciated in value and now represent a larger percentage of the portfolio than desired, the investor may sell some of their stocks and use the revenue to purchase bonds or other assets to bring the portfolio back into balance. Rebalancing can be done on a predetermined schedule, quarterly or annually, or when the portfolio has drifted significantly from its target allocation. The frequency of rebalancing will depend on the investor's goals, risk tolerance, and the level of volatility in the market. There are several types of portfolio rebalancing methods that investors can use to keep their portfolios in line with their investment goals and risk tolerance. This is the most straightforward type of rebalancing. This method involves setting a specific date or time interval, such as quarterly or annually, to review and adjust the portfolio. Investors need to determine the best rebalancing frequency. The frequency will be based on their time constraints, transaction cost tolerance, and value drift allowance. Calendar rebalancing has certain advantages over more frequent methods, as it requires less time and is less costly for the investor. It involves fewer rebalancing occasions and potentially fewer trades. However, one drawback of this method is that it does not involve rebalancing at other times, even if the market experiences significant changes. This approach involves setting a target percentage allocation for each asset class within the portfolio and then rebalancing the portfolio whenever the allocation of any asset class deviates from its target by a certain amount. Considered as a more responsive approach to rebalancing, it involves focusing on the allowable percentage composition of assets in a portfolio. The constant-mix approach is ideal for investors who want to maintain a consistent level of risk exposure in their portfolios. This involves assigning a target weight and a corresponding tolerance range to each asset class or individual security in the portfolio. When the weight of any asset exceeds its allowable band, the entire portfolio is rebalanced to reflect the original target composition. Constant proportion portfolio insurance (CPPI) involves setting a floor or minimum value for the portfolio and then adjusting the allocation between stocks and bonds to maintain the floor. When the portfolio value falls below the floor, the investor will shift assets. This intensive strategy can shift assets from bonds to stocks to increase the portfolio's value. When the portfolio value rises above the floor, the investor will shift assets from stocks to bonds to maintain the floor. This approach involves two asset classes: namely, a risky asset like equities or mutual funds, and a conservative asset like cash, cash equivalents, or treasury bonds. The allocation to each asset class depends on a cushion value. Smart beta rebalancing is a method that involves adjusting the weights of assets within a portfolio based on specific factors, such as price-to-earnings ratios, dividends, or market capitalization. It utilizes a rules-based approach to allocate holdings across a selection of stocks. This approach is often used by investors who want to achieve better risk-adjusted returns than traditional passive index funds. Smart beta strategies can be more complicated to implement than other types of rebalancing, but they may offer higher returns in certain market conditions. Smart beta rebalancing uses additional criteria, such as performance measures like book value or return on capital, to create a more systematic analysis of the investment compared to simple index investing. It can also be used to rebalance across asset classes by comparing risk-weighted returns and adjusting the exposure accordingly. The periodic rebalancing helps realize profits regularly rather than relying on market sentiment for maximum profit. Investors can use rebalancing to manage the risk and return in the following instances: Rebalancing retirement accounts is a common strategy that involves periodically selling assets that have become overweight and using the proceeds to purchase assets that have become underweight in order to maintain the desired asset allocation. In many cases, investors prefer to take on more risk in their younger years and adopt a more conservative strategy as retirement age approaches. As a result, rebalancing is applied to increase the allocation of fixed-income securities to align with the investor's retirement plans. Diversification helps to reduce risk by spreading investments across various asset classes, such as bonds, stocks, and commodities. However, market movements can cause certain asset classes to become overweight or underweight, which can undermine the benefits of diversification. In some cases, investors may discover that a significant portion of their assets is concentrated in a particular area, which can result in a high level of risk exposure. This situation could cause severe losses if one stock experiences a sudden decline. Rebalancing can help by allowing the investor to transfer some of the funds currently allocated to the declining stock to another investment. Gains in other areas can partly offset any losses experienced in one area. Rebalancing a portfolio can be a challenging task, especially for novice investors. Following some practical steps can help make the process more straightforward and less intimidating. The target allocation is the desired percentage allocation of each asset class within your portfolio. It is essential to ensure that your target allocation aligns with your investment goals, risk tolerance, and time horizon. Develop a clear investment strategy that outlines your desired distribution of stocks to bonds, domestic to international investments, and allocation across various sectors. Without a target allocation, it can be challenging to identify if and how much rebalancing is needed. Creating bands means setting an acceptable range of percentage deviations from your target allocation. This will allow some flexibility and avoid the need to rebalance your portfolio frequently. You can create guidelines to determine when it is necessary to rebalance. It is recommended to consider how much deviation from your target allocation is tolerable for you. The bands should be tighter for more concentrated positions, such as individual stocks, than for more diversified funds. Monitoring your portfolio periodically is crucial, but you should avoid checking your portfolio too frequently, as it can lead to emotional decision-making, which can negatively affect your returns. Most investors usually check once a week or monthly if they prefer. Quarterly checks are advised at a minimum. However, even if you can only check once a year, it is better than not checking at all. There's no need to rebalance every year if your portfolio hasn't drifted too far from your target allocation. When rebalancing, it is strategic to choose between taxable and tax-advantaged accounts to minimize taxes or rebalance a specific account due to changes in investment goals or life circumstances. It is important to be mindful of the tax implications before rebalancing your portfolio. If you sell an investment that has appreciated in value in a taxable account, you'll have to pay taxes on the gains. Rebalance within tax-sheltered accounts like IRAs if possible. Look at your entire portfolio holistically. If you need to rebalance in a taxable account, pay attention to the timing of when you purchased the appreciated shares. The tax-loss harvesting technique involves selling losing positions to offset gains, up to a maximum of $3,000 per year, from other investments and reinvesting the proceeds in a similar, but not identical, asset. Avoid triggering a wash sale, which can occur if you buyback a substantially identical asset within 30 days of selling it at a loss. This would disallow your loss, so it is essential to wait at least 30 days before repurchasing a similar asset. Finally, avoid making impulsive decisions and remain committed to your investment strategy. Stay disciplined and focused on your long-term financial goals. This means avoiding the temptation to act based on short-term market fluctuations or emotional reactions to financial news. Instead, you should regularly review portfolios and rebalance them as necessary to ensure they are staying on track with their investment objectives. It can also be helpful to work with a financial advisor who can provide objective guidance. Rebalancing is a vital investment strategy for managing risk and ensuring that an investor's portfolio remains aligned with their investment objectives. This is done by periodically adjusting the weights of different assets within a portfolio. The goal is to calibrate the relative weights of different assets within a portfolio to bring it back to its original target allocation. The process typically involves selling assets that have outperformed and using the proceeds to purchase assets that have underperformed. This enables the investor to maintain a balanced asset allocation and risk profile over time, which can help them achieve their long-term investment goals and build wealth. The choice of rebalancing method depends on the investor's goals, risk tolerance, and market conditions. They can either use calendar rebalancing, constant-mix rebalancing, constant proportion portfolio insurance, or smart beta rebalancing. These methods can be used to rebalance retirement accounts or for the purpose of diversification. Rebalancing a portfolio can be achieved by determining a target allocation, creating bands to identify when it is time to rebalance, monitoring the portfolio periodically, strategizing which accounts to rebalance, and taking a systematic and rational approach to investment.What Is Rebalancing?

Why Rebalance Your Portfolio?

How Rebalancing Works

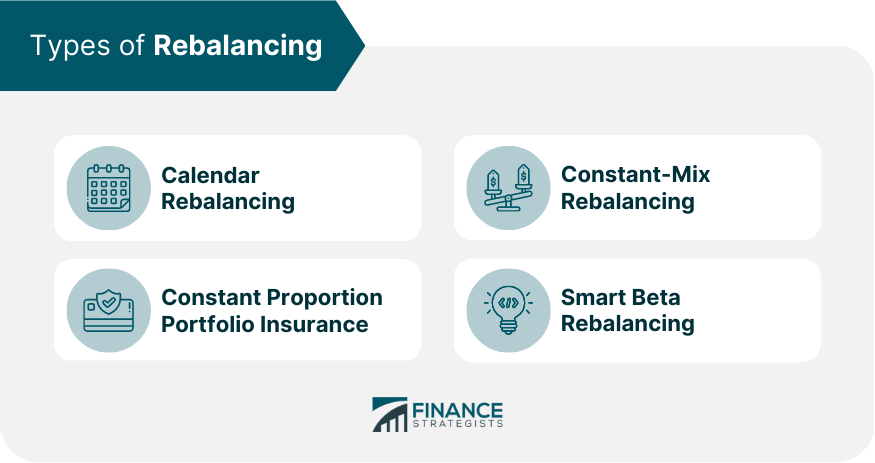

Types of Rebalancing

Calendar Rebalancing

Constant-Mix Rebalancing

Constant Proportion Portfolio Insurance

Smart Beta Rebalancing

Examples of Rebalancing

Rebalancing Retirement Accounts

Rebalancing for Diversification

How to Rebalance Your Portfolio

Determine Your Target Allocation

Create Bands Around Your Positions

Monitor Your Portfolio Periodically, but Do Not Overdo It

Be Strategic in Selecting Accounts to Rebalance

Apply Tax-Loss Harvesting Techniques to Purchase Underperforming Assets on Sale

Take a Systematic and Rational Approach

Final Thoughts

Rebalancing FAQs

Rebalancing can be an effective strategy for managing investment portfolios that exhibit volatility, where gains and losses occur frequently and may become out of sync with the rest of the portfolio. However, this approach may not be as effective when one investment consistently outperforms the others, as rebalancing may result in selling the outperforming investment and missing out on further gains. Therefore, the effectiveness of rebalancing can vary depending on the specific characteristics of the investments in the portfolio and the overall market conditions.

The importance of rebalancing lies in maintaining a portfolio's desired asset allocation and risk level over time. Without rebalancing, a portfolio can become overweight in certain asset classes that have performed well, leaving it more exposed to risk than the investor intended. Rebalancing ensures that the portfolio stays aligned with the investor's goals and objectives, and reduces the impact of market volatility on investment returns.

The frequency of rebalancing depends on an individual's investment goals, risk tolerance, and portfolio size. Generally, it is recommended to rebalance at least annually, but some investors prefer to rebalance more frequently, such as quarterly or even monthly.

Rebalancing can result in selling high and buying low, which provides the opportunity to sell over-performing assets and buy underperforming ones, potentially boosting returns in the long run.

Rebalancing can be taxable. Whenever an investor sells an appreciated investment in a taxable account, they will have to pay taxes on the capital gains. However, investors can mitigate taxes through strategies such as rebalancing within tax-sheltered accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.