A qualified purchaser is a term used in the United States to define an individual or entity that meets specific financial and regulatory criteria. These individuals or entities are allowed to invest in certain private investment funds and securities that are not available to the general public. Qualified purchasers play a significant role in the investment landscape, as they can access alternative investment opportunities unavailable to the average investor. This access helps to diversify their portfolios and potentially increase returns while providing capital to private investment funds. The Securities Act of 1933 was established to protect investors and regulate the issuance of securities. The act requires companies to provide accurate and transparent information about securities offered to the public, but it also contains exemptions for certain private offerings, including those involving qualified purchasers. The Investment Company Act of 1940 regulates the organization and operation of investment companies. This act seeks to protect investors by imposing various requirements and restrictions on investment companies, but it also includes exemptions for certain private funds offered exclusively to qualified purchasers. Rule 2a51-1 under the Investment Company Act provides the specific criteria for determining who qualifies as a qualified purchaser. The rule outlines different categories of qualified purchasers, including individuals, family-owned companies, trusts, and other entities, each with its own set of requirements. To qualify as a qualified purchaser, an individual must have at least $5 million in investments. This net worth requirement ensures that only individuals with significant financial resources can invest in certain private investment funds and securities. Individuals may also qualify as qualified purchasers if they make joint investments with their spouse. In this case, the combined investments of the individual and their spouse must equal or exceed $5 million. Family-owned companies can qualify as qualified purchasers if they are owned entirely by family members. This means that all voting securities of the company must be held by the family members, directly or indirectly. For a family-owned company to qualify as a qualified purchaser, the company must have at least $5 million in investments. Similar to individual investors, this requirement ensures that only family-owned companies with significant financial resources can invest in certain private investment funds and securities. Both revocable and irrevocable trusts can qualify as qualified purchasers, provided they meet certain criteria. These trusts must be established by a qualified purchaser and include only qualified purchasers as beneficiaries. To qualify as a qualified purchaser, a trust must have a trustee who is either a qualified purchaser or a professional fiduciary. This ensures that the trust's investments are managed by someone with the necessary financial resources and expertise. Investment companies, such as mutual funds, can qualify as qualified purchasers if they are either registered under the Investment Company Act or are exempt from registration due to their exclusive offerings to qualified purchasers. Employee benefit plans, such as pension funds, can also qualify as qualified purchasers if they have total assets of at least $5 million. Partnerships and limited liability companies can qualify as qualified purchasers if they have at least $5 million in investments. This requirement ensures that these entities have the necessary financial resources to invest in certain private investment funds and securities. As a qualified purchaser, one gain access to investment opportunities in hedge funds. Hedge funds are private investment vehicles that utilize various strategies and asset classes to generate returns, often aiming to outperform traditional investment options. Qualified purchasers can also invest in private equity funds, which pool capital to acquire and manage private companies or engage in leveraged buyouts. Private equity funds often target companies with the potential for significant growth and value creation. Venture capital funds are another type of private investment fund accessible to qualified purchasers. These funds provide financing to early-stage, high-potential startup companies, aiming to generate substantial returns if the startups succeed. Being a qualified purchaser offers the opportunity to diversify one's investment portfolio beyond traditional stocks and bonds. Access to alternative investments, such as hedge funds, private equity funds, and venture capital funds, can help mitigate risk and improve overall portfolio performance. Alternative investments available to qualified purchasers often has the potential to generate higher returns than traditional investments. While these investments may carry higher risks, the potential for outsized returns can be attractive to investors with sufficient financial resources and risk tolerance. Private investment funds offered exclusively to qualified purchasers are subject to fewer regulatory requirements than public investment funds. This reduced regulatory burden can result in lower costs for the funds, which may translate into higher returns for investors. Qualified purchasers must conduct thorough due diligence before investing in private investment funds or securities. This involves researching and understanding the investment's underlying strategy, management team, past performance, and potential risks to make informed investment decisions. Investing in alternative investments available to qualified purchasers often involves higher risks than traditional investments. Qualified purchasers must be aware of these risks, including market volatility, liquidity constraints, and the potential for loss of capital, to ensure they are comfortable with their investment choices. Qualified purchasers must actively monitor their investment portfolios and adjust their holdings as needed to meet their investment objectives and risk tolerance. This may involve rebalancing, adding or removing investments, or changing investment strategies based on market conditions or personal circumstances. Investments made by qualified purchasers may have unique tax implications, including potential exposure to unrelated business taxable income (UBTI) or complex tax reporting requirements. Qualified purchasers should consult with tax professionals to understand and manage these tax implications. Qualified purchasers may be subject to legal liabilities related to their investments in private investment funds or securities. These liabilities can arise from various sources, such as breaches of fiduciary duty or regulatory violations, and can result in financial loss or reputational damage. Accredited investors are individuals or entities that meet specific financial criteria established by the Securities and Exchange Commission (SEC). Like qualified purchasers, accredited investors can invest in certain private investment opportunities that are not available to the general public. Both accredited investors and qualified purchasers must meet specific financial criteria to access private investment opportunities. However, the criteria for qualified purchasers are more stringent, requiring higher net worth or investment thresholds than those for accredited investors. Accredited investors and qualified purchasers both have access to private investment opportunities, such as private placements or Regulation D offerings. However, qualified purchasers can also invest in certain private investment funds, like 3(c)(7) funds, that are exclusively available to them. While both accredited investors and qualified purchasers face fewer regulatory restrictions than the general public, the regulatory landscape differs between the two groups. Qualified purchasers are subject to additional exemptions under the Investment Company Act, providing them with access to a wider range of investment opportunities. Financial advisors play a crucial role in helping clients determine if they qualify as qualified purchasers. They assess clients' financial situations, investment holdings, and net worth to determine if they meet the required criteria. Once clients are identified as qualified purchasers, financial advisors can recommend suitable investment opportunities that align with their client's investment objectives, risk tolerance, and financial situation. Financial advisors help qualified purchasers navigate the complex regulatory landscape surrounding private investment funds and securities. They ensure clients are aware of the relevant regulations, exemptions, and reporting requirements associated with their investments. Financial advisors assist qualified purchasers in actively monitoring and adjusting their investment portfolios. They provide ongoing guidance and advice, helping clients adapt their portfolios to changing market conditions or personal circumstances. Qualified purchasers are individuals or entities meeting specific criteria outlined by the SEC and possessing significant financial resources. Their participation in the investment landscape enables access to alternative investment opportunities, diversification, higher returns, and a broader range of investment options. This contributes to the growth and development of private investment funds and securities, providing capital to businesses and fueling economic growth. As economic conditions and investor needs change, policymakers may update financial criteria and expand investment opportunities for qualified purchasers. To navigate this regulatory landscape and make informed investment decisions, aspiring qualified purchasers should seek professional wealth management services. Financial advisors can assess eligibility, recommend suitable investment opportunities, and provide ongoing guidance for optimized portfolios. By maximizing investment potential, qualified purchasers can contribute to a thriving economy.What Are Qualified Purchasers?

Legal and Regulatory Background Related to Qualified Purchasers

Securities Act of 1933

Investment Company Act of 1940

Rule 2a51-1 under the Investment Company Act

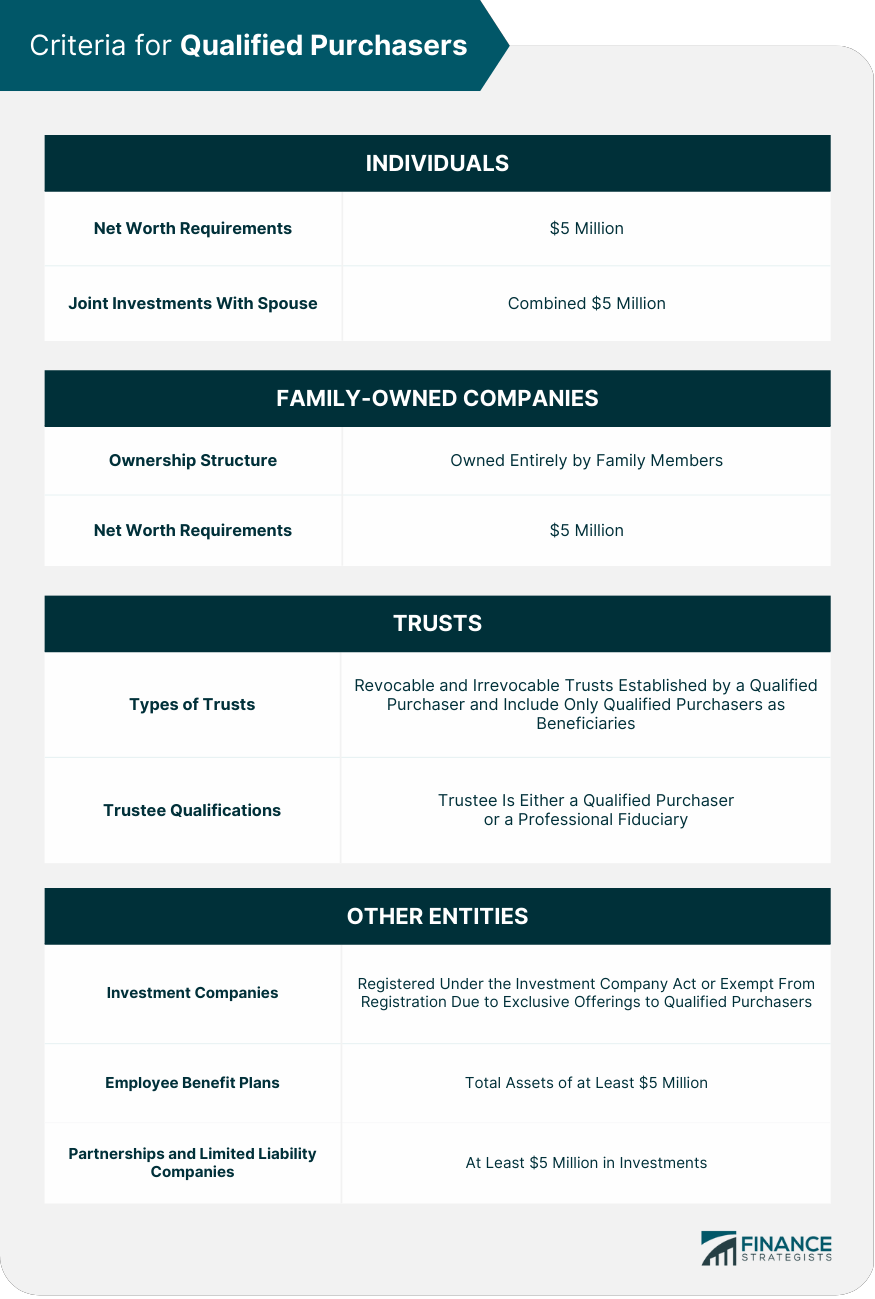

Criteria for Qualified Purchasers

Individuals

Net Worth Requirements

Joint Investments with Spouse

Family-Owned Companies

Ownership Structure

Net Worth Requirements

Trusts

Types of Trusts

Trustee Qualifications

Other Entities

Investment Companies

Employee Benefit Plans

Partnerships and Limited Liability Companies

Benefits of Being a Qualified Purchaser

Access to Private Investment Funds

Hedge Funds

Private Equity Funds

Venture Capital Funds

Diversification Opportunities

Potential for Higher Returns

Reduced Regulatory Requirements

Responsibilities of Being a Qualified Purchaser

Thorough Due Diligence of Requirements

Understanding Investment Risks

Monitoring and Adjusting Portfolio

Understanding Tax Implications

Reviewing Legal Liabilities

Qualified Purchasers Comparison to Accredited Investors

Role of Financial Advisors to Qualified Purchasers

Helping Clients Determine Their Qualified Purchaser Status

Recommending Suitable Investments

Navigating Regulatory Requirements

Monitoring and Adjusting Portfolios

Final Thoughts

Qualified Purchasers FAQs

Qualified purchasers are individuals or entities that meet specific financial and regulatory criteria, allowing them to invest in certain private investment funds and securities that are not available to the general public.

The Securities Act of 1933 and the Investment Company Act of 1940 regulate the organization and operation of investment companies. Rule 2a51-1 under the Investment Company Act provides the specific criteria for determining who qualifies as a qualified purchaser.

Being a qualified purchaser offers access to private investment funds, diversification opportunities, the potential for higher returns, and reduced regulatory requirements.

Qualified purchasers must conduct due diligence, understand investment risks, monitor and adjust their portfolio, understand tax implications, and review legal liabilities related to their investments in private investment funds or securities.

Financial advisors can help determine clients' qualified purchaser status, recommend suitable investments, navigate regulatory requirements, and monitor and adjust their portfolios to meet their investment objectives and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.