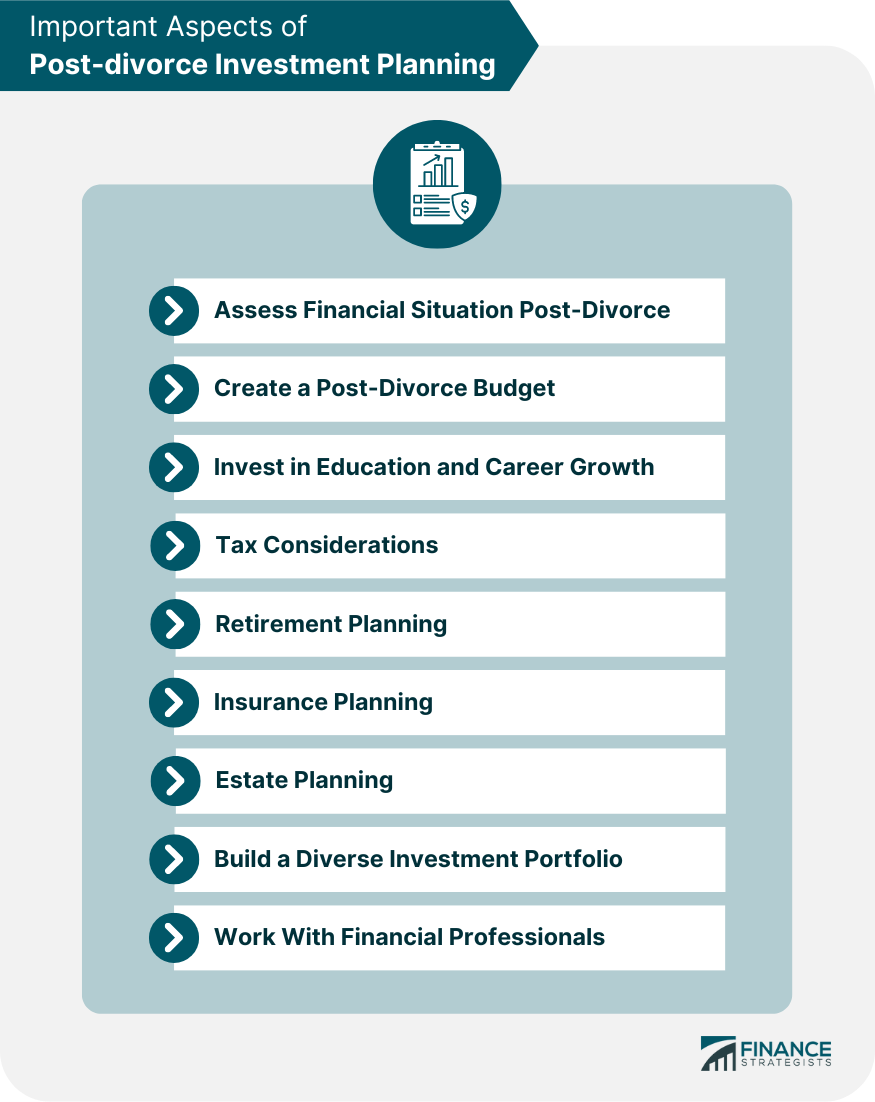

Post-divorce investment planning is an essential process that involves developing a new investment strategy following the dissolution of a marriage. When a couple gets divorced, their financial assets are typically divided, and each party is left with a portion of the shared wealth. This means that the investment goals and risk tolerance of each individual may change, which requires a reassessment of their investment plans. The following shows important aspects of post-divorce investment planning: After a divorce, your financial goals and priorities may have changed. Take the time to reassess your short-term and long-term objectives, considering factors such as retirement, education, and homeownership. Your income and expenses are likely to change following a divorce. Ensure that you have a clear understanding of your new financial situation, including any alimony or child support payments. Take stock of your assets and liabilities, including joint accounts, investments, and property. This will help you determine your net worth and financial standing post-divorce. Update all relevant financial documents, such as beneficiary designations and joint account information, to reflect your new marital status and financial circumstances. List all sources of income, including salary, alimony, child support, and investment income, to determine your total monthly earnings. Outline your fixed and variable expenses, such as housing, utilities, insurance, and discretionary spending, to get a clear picture of your monthly outgoings. Set up an emergency fund to cover unexpected expenses and provide financial security during times of uncertainty. Develop a plan to pay off high-interest debts, such as credit cards and personal loans, to improve your financial stability and credit score. Plan for your children's educational expenses, including college tuition, by exploring options such as 529 plans and education savings accounts. Consider furthering your education or acquiring new skills to improve your career prospects and earning potential. Invest in professional development opportunities to enhance your skills and increase your marketability in the job market. Understanding Tax Filing Status Changes: Familiarize yourself with the implications of your new tax filing status, such as filing as a single taxpayer or head of household. Claiming Exemptions and Deductions: Determine which exemptions and deductions you're eligible for to optimize your tax return. Handling Alimony and Child Support Payments: Understand the tax implications of alimony and child support payments, both as a payer and a recipient. Reviewing Retirement Accounts and Beneficiaries: Examine your retirement accounts, including pensions, 401(k)s, and IRAs, to ensure that they are up to date and that beneficiaries are accurately designated. Adjusting Contributions and Investment Strategies: Reevaluate your retirement savings contributions and investment strategies, taking into account your new financial situation and retirement goals. Considering Catch-up Contributions: If you're behind on your retirement savings, explore catch-up contribution options to help close the gap. Reviewing Life, Health, and Disability Insurance Policies: Examine your existing insurance policies to ensure they provide adequate coverage for your new circumstances. Adjusting Coverage Levels and Beneficiaries: Update coverage levels and beneficiaries on your insurance policies to align with your post-divorce financial needs. Exploring Long-Term Care Insurance: Consider purchasing long-term care insurance to protect your financial future and provide peace of mind. Updating Wills and Trusts: Review your wills and trusts to ensure that they align with your new post-divorce financial situation and objectives. Reviewing Powers of Attorney and Healthcare Directives: Make sure that your powers of attorney and healthcare directives are updated to reflect your post-divorce wishes and decision-makers. Coordinating Estate Plans with Ex-Spouse for Children's Welfare: Consider coordinating your estate plans with your ex-spouse to ensure that your children's welfare is prioritized and that there are no conflicting instructions. Determine your risk tolerance and investment horizon, taking into account your financial objectives and personal circumstances. Diversify your portfolio across various asset classes to manage risk and maximize returns. Regularly rebalance your portfolio to ensure that it remains aligned with your investment goals and risk tolerance. Consider hiring a financial advisor to provide personalized guidance and support as you navigate your post-divorce financial journey. Work with tax professionals to optimize your tax strategies and ensure that you're taking advantage of all available deductions and credits. Consult with a legal professional to ensure that your estate planning documents are accurate and aligned with your post-divorce wishes. Post-divorce investment planning is a complex process that requires careful consideration and planning. Reassessing financial goals, creating a budget, and developing a new investment strategy are all essential steps to take. It is also important to address tax considerations, retirement planning, insurance planning, estate planning, and building a diverse investment portfolio. Seeking guidance from financial and legal professionals can be incredibly helpful in navigating the complexities of post-divorce investment planning. By taking these steps, individuals can take control of their finances and secure their financial future after a divorce. Start implementing these steps today to ensure financial stability and success in the long run.Overview of Post-divorce Investment Planning

Assessing Your Financial Situation Post-divorce

Revisiting Financial Goals and Priorities

Understanding New Income and Expense Levels

Evaluating Assets and Liabilities

Updating Financial Documents

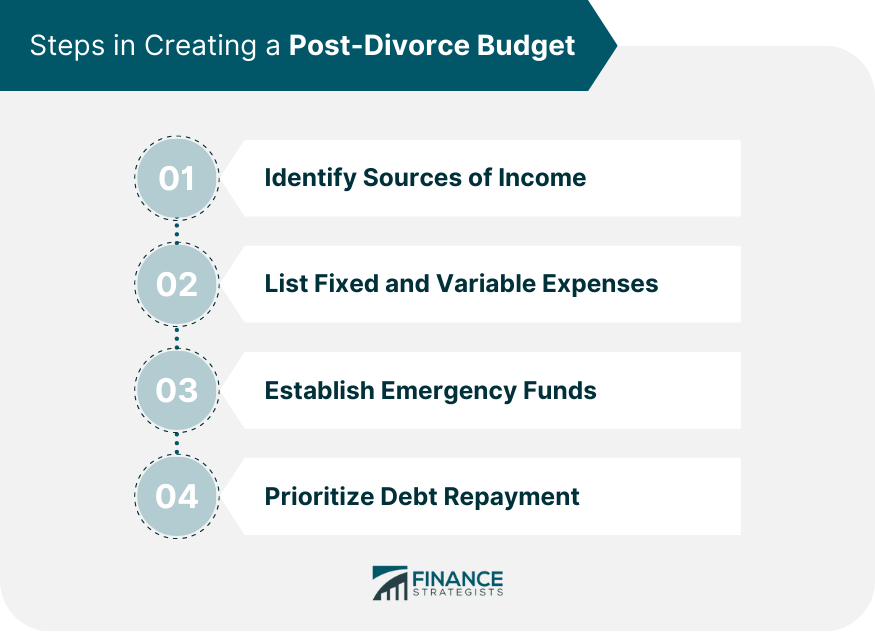

Creating a Post-divorce Budget

Identifying Sources of Income

Listing Fixed and Variable Expenses

Establishing Emergency Funds

Prioritizing Debt Repayment

Investing in Education and Career Growth

Funding Children's Education

Exploring Educational Opportunities for Self-Improvement

Developing Skills for Career Advancement

Tax Considerations

Retirement Planning

Insurance Planning

Estate Planning

Building a Diverse Investment Portfolio

Analyzing Risk Tolerance and Investment Horizon

Diversifying Assets Across Various Classes

Periodically Rebalancing the Portfolio

Working With Financial Professionals

Hiring a Financial Advisor for Personalized Guidance

Collaborating With Tax Professionals to Optimize Tax Strategies

Seeking Legal Advice on Estate Planning

Conclusion

Post-divorce Investment Planning FAQs

Post-divorce investment planning is important because it helps individuals reassess their financial situation, set new financial goals, and create a plan for their future. Divorce can significantly impact one's financial stability, so it's crucial to develop a strategy for managing assets, debt, and investments.

A post-divorce budget should include sources of income, fixed and variable expenses, emergency funds, and a plan for debt repayment. This budget will help individuals manage their finances effectively and make informed investment decisions.

When planning for retirement post-divorce, individuals should review their retirement accounts and beneficiaries, adjust their contributions and investment strategies, and consider catch-up contributions. It's important to reassess retirement goals and make necessary adjustments to ensure financial security in the future.

Individuals can optimize their tax strategies post-divorce by understanding their new tax filing status, claiming eligible exemptions and deductions, and handling alimony and child support payments appropriately. Working with a tax professional can also help individuals make informed decisions and reduce their tax burden.

While it's possible to create a post-divorce investment plan independently, working with financial professionals can provide valuable guidance and support. Financial advisors, tax professionals, and legal experts can help individuals make informed decisions and create a comprehensive plan for their financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.