Portfolio analytics refers to the process of evaluating, optimizing, and managing a collection of financial assets, known as a portfolio. It involves the application of quantitative methods, financial theory, and technological tools to analyze the performance and risk characteristics of a portfolio. Portfolio analytics plays a crucial role in investment management, helping investors make informed decisions and optimize their investment strategies. The main stakeholders in portfolio analytics include asset managers, financial advisors, institutional investors, and retail investors. These stakeholders use portfolio analytics to design, manage, and evaluate their investment portfolios in line with their risk tolerance and financial goals. Portfolio construction is the process of assembling a portfolio of financial assets to achieve specific investment objectives. Asset allocation involves distributing investments across various asset classes, such as stocks, bonds, and cash, to optimize the risk-return profile of a portfolio. Security selection refers to the process of identifying specific securities, like stocks and bonds, to include in a portfolio based on their individual risk-return characteristics. Diversification is the strategy of spreading investments across different securities, sectors, and asset classes to reduce the overall risk of a portfolio. Risk management involves identifying, assessing, and mitigating the potential risks associated with a portfolio, such as market risk, credit risk, and liquidity risk. Portfolio performance measurement evaluates the historical returns and risk characteristics of a portfolio. Absolute performance refers to the total return generated by a portfolio over a specified period, without comparing it to any benchmark or market index. Relative performance measures the return of a portfolio in comparison to a benchmark or market index to determine if the portfolio has outperformed or underperformed the market. Risk-adjusted performance accounts for the level of risk taken to achieve a certain return, enabling investors to compare the performance of different portfolios on a risk-adjusted basis. Risk analysis involves assessing the various risks associated with a portfolio. Market risk is the risk of losses in a portfolio due to fluctuations in market prices and other macroeconomic factors. Credit risk is the risk of loss due to a borrower's inability to repay a loan or meet their financial obligations. Liquidity risk is the risk that an investor may not be able to buy or sell a security at a desirable price or in a timely manner. Operational risk is the risk of losses resulting from internal factors, such as inadequate processes, systems, or human errors. Attribution analysis helps identify the sources of a portfolio's performance and risk. Return attribution breaks down the sources of a portfolio's returns, such as asset allocation, security selection, and market timing. Risk attribution analyzes the sources of a portfolio's risk, such as market risk, credit risk, and liquidity risk. MPT is a mathematical framework for constructing efficient portfolios by optimizing the trade-off between risk and return. The efficient frontier is a graphical representation of the optimal portfolios that offer the highest expected return for a given level of risk. CAPM is a widely used model that calculates the expected return of a security or a portfolio based on its systematic risk, or beta, and the expected market return. Beta measures a security's sensitivity to market movements, while alpha represents the excess return of a security or portfolio over its expected return based on CAPM. Factor analysis is a technique used to identify the underlying factors that drive the returns and risks of securities in a portfolio. Style factors represent investment styles, such as value, growth, or momentum, which help explain the return differences between various securities. Macroeconomic factors include economic indicators, such as GDP growth, inflation, and interest rates, which can influence the performance of securities and portfolios. Fundamental factors are the financial characteristics of individual securities, such as earnings, dividends, and cash flow, which can help explain their returns and risk profiles. Optimization techniques are used to construct efficient portfolios by minimizing risk, maximizing return, or achieving a specific risk-return trade-off. Mean-variance optimization is a technique that constructs portfolios by optimizing the trade-off between expected return and portfolio risk, as measured by variance. The Black-Litterman model is a portfolio optimization approach that combines investors' views on asset returns with market equilibrium returns to generate optimal portfolio weights. Robust optimization is a technique that constructs portfolios that perform well under various market conditions and uncertainties, providing more stable and reliable investment outcomes. Various portfolio analytics software and platforms are available in the market, offering a range of features and capabilities to meet the diverse needs of investors and asset managers. Portfolio analytics software typically offers features such as performance measurement, risk analysis, attribution analysis, and portfolio optimization to help investors manage their portfolios effectively. Many portfolio analytics platforms can be integrated with other investment management tools, such as trading platforms, research databases, and financial planning software, to streamline investment processes and improve decision-making. Advanced portfolio analytics platforms provide customizability and scalability options, allowing users to tailor the software to their specific needs and adapt to changes in their investment strategies or market conditions. Passive investment strategies, such as index-tracking and smart beta, aim to replicate the performance of a market index or follow specific investment rules. Portfolio analytics can help investors evaluate and optimize these strategies to achieve desired risk-return profiles. Index-tracking strategies involve constructing a portfolio that replicates the composition and performance of a market index. Portfolio analytics can help identify tracking errors and optimize portfolio weights to minimize these errors. Smart beta strategies use alternative weighting schemes or factor-based rules to construct portfolios that seek to outperform traditional market-cap-weighted indices. Portfolio analytics can help analyze factor exposures, risk characteristics, and performance attribution for these strategies. Active investment strategies, such as fundamental analysis, quantitative analysis, and technical analysis, aim to outperform the market by exploiting investment opportunities and market inefficiencies. Portfolio analytics can help investors evaluate the effectiveness of these strategies and optimize their portfolios accordingly. Fundamental analysis involves evaluating securities based on their financial health, growth prospects, and valuation metrics. Portfolio analytics can help investors analyze the fundamental factors driving portfolio returns and risk. Quantitative analysis employs mathematical models and statistical techniques to identify patterns, trends, and relationships between securities and their returns. Portfolio analytics can help investors assess the performance and risk characteristics of quantitative strategies. Technical analysis uses historical price and volume data to identify patterns and trends that may predict future price movements. Portfolio analytics can help investors evaluate the performance and risk of technical strategies and optimize their portfolios accordingly. Alternative investment strategies, such as hedge funds, private equity, and real assets, involve investing in non-traditional assets or employing unconventional investment approaches. Portfolio analytics can help investors assess the performance, risk, and diversification benefits of these strategies within their overall portfolios. Hedge funds employ a wide range of investment strategies, including long/short equity, event-driven, and global macro. Portfolio analytics can help investors analyze the risk-return profiles, factor exposures, and performance attribution of hedge fund investments. Private equity investments involve acquiring stakes in privately held companies or participating in leveraged buyouts. Portfolio analytics can help investors evaluate the performance, risk, and diversification benefits of private equity investments, as well as assess the impact of various exit strategies and holding periods on investment outcomes. Real assets, such as real estate, infrastructure, and commodities, can provide diversification benefits and inflation protection to investors' portfolios. Portfolio analytics can help investors analyze the performance, risk, and correlation characteristics of real assets within their overall portfolios. Artificial Intelligence (AI) and Machine Learning (ML) are expected to play an increasingly important role in portfolio analytics by automating complex analytical tasks, uncovering hidden patterns in data, and improving investment decision-making. As the volume and variety of available data continue to grow, portfolio analytics will increasingly rely on big data techniques and alternative data sources, such as social media sentiment, satellite imagery, and web traffic data, to enhance investment insights and generate alpha. As investors become more focused on sustainable investing, portfolio analytics will need to incorporate environmental, social, and governance (ESG) factors into risk and performance analysis, as well as portfolio construction and optimization processes. Portfolio analytics will need to evolve to address changing regulatory and compliance requirements, such as reporting standards, disclosure requirements, and risk management guidelines, to help investors navigate an increasingly complex investment landscape. Portfolio analytics is a vital process in investment management that involves evaluating, optimizing, and managing a collection of financial assets. The main stakeholders in portfolio analytics include asset managers, financial advisors, institutional investors, and retail investors. The components of portfolio analytics include portfolio construction, portfolio performance measurement, risk analysis, and attribution analysis. Quantitative tools and techniques, such as Modern Portfolio Theory, Factor Analysis, and Optimization Techniques, play an essential role in portfolio analytics. Different investment strategies, such as passive, active, and alternative, can benefit from portfolio analytics to achieve their investment objectives. The future of portfolio analytics is expected to incorporate Artificial Intelligence and Machine Learning, big data, ESG integration, and regulatory and compliance considerations to help investors navigate an increasingly complex investment landscape. By utilizing portfolio analytics, investors can make informed decisions and optimize their investment strategies to achieve their risk-return profiles.Definition of Portfolio Analytics

Key Stakeholders in Portfolio Analytics

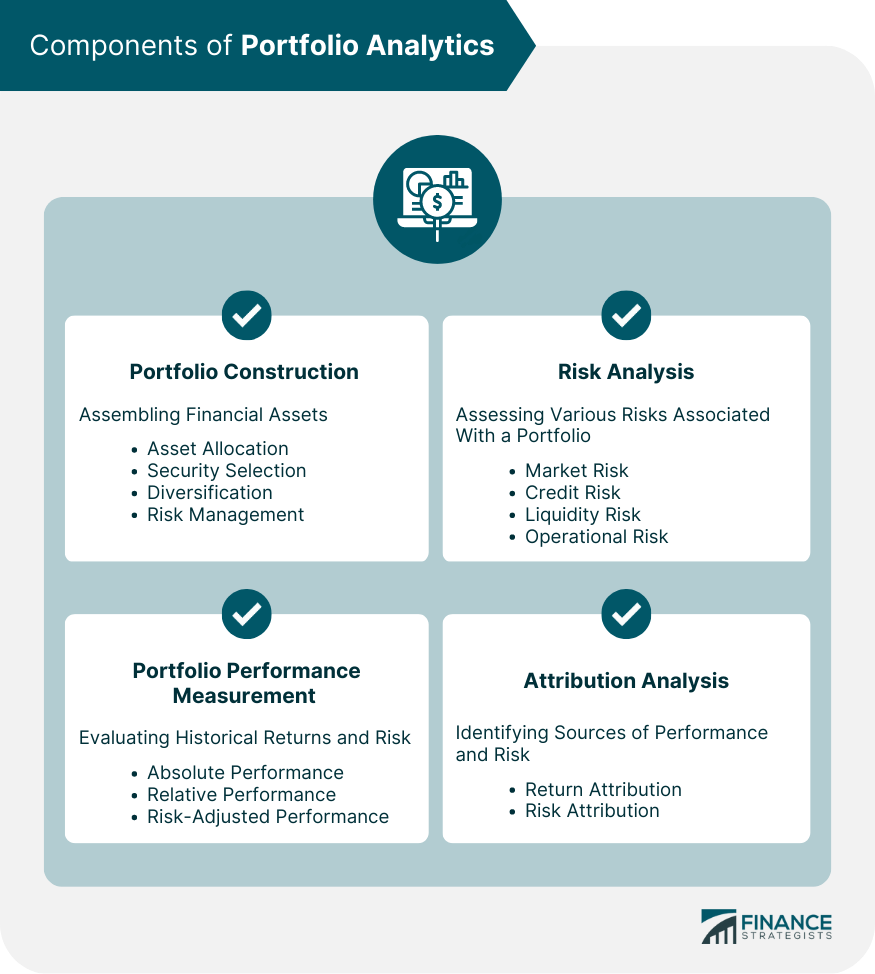

Components of Portfolio Analytics

Portfolio Construction

Asset Allocation

Security Selection

Diversification

Risk Management

Portfolio Performance Measurement

Absolute Performance

Relative Performance

Risk-Adjusted Performance

Risk Analysis

Market Risk

Credit Risk

Liquidity Risk

Operational Risk

Attribution Analysis

Return Attribution

Risk Attribution

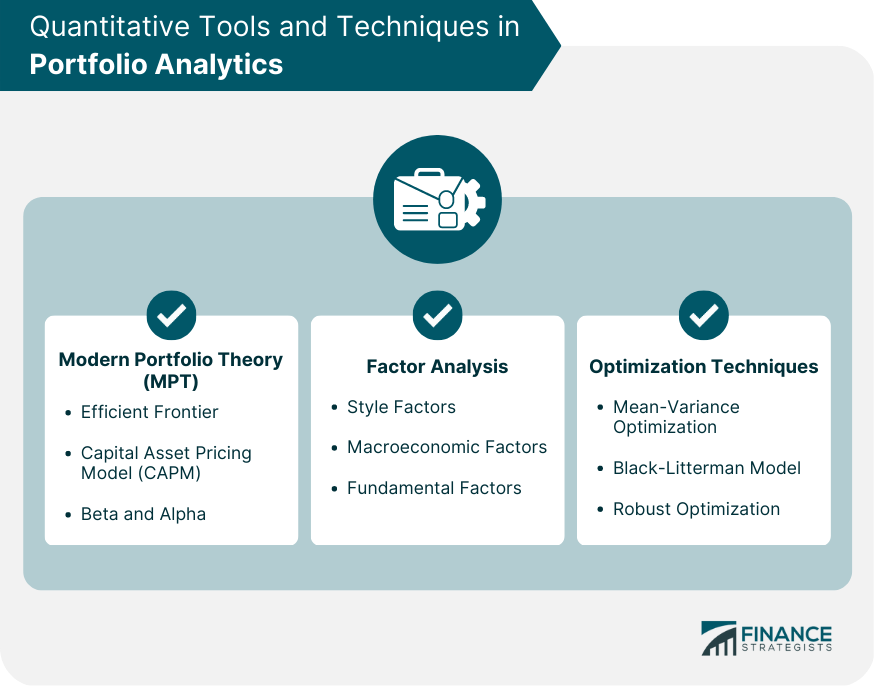

Quantitative Tools and Techniques in Portfolio Analytics

Modern Portfolio Theory (MPT)

Efficient Frontier

Capital Asset Pricing Model (CAPM)

Beta and Alpha

Factor Analysis

Style Factors

Macroeconomic Factors

Fundamental Factors

Optimization Techniques

Mean-Variance Optimization

Black-Litterman Model

Robust Optimization

Portfolio Analytics Software and Platforms

Overview of Popular Portfolio Analytics Software

Features and Functionality

Integration With Other Investment Management Tools

Customizability and Scalability

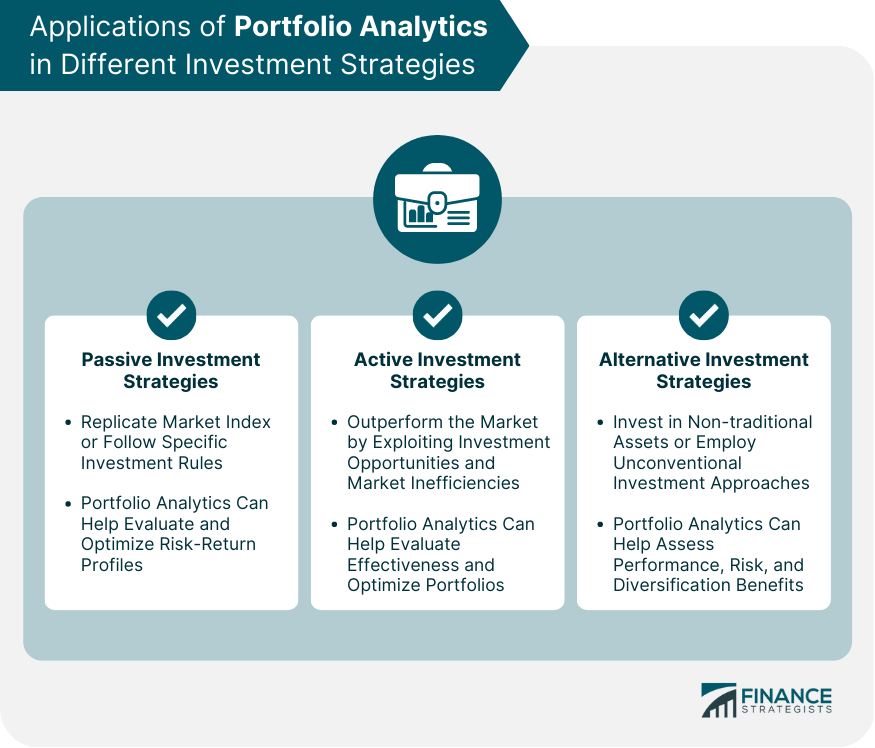

Applications of Portfolio Analytics in Different Investment Strategies

Passive Investment Strategies

Index-Tracking

Smart Beta

Active Investment Strategies

Fundamental Analysis

Quantitative Analysis

Technical Analysis

Alternative Investment Strategies

Hedge Funds

Private Equity

Real Assets

Future Trends in Portfolio Analytics

Artificial Intelligence and Machine Learning

Big Data and Alternative Data Sources

Environmental, Social, and Governance (ESG) Integration

Regulatory and Compliance Considerations

Conclusion

Portfolio Analytics FAQs

The main components of portfolio analytics include portfolio construction (specify asset allocation, security selection, diversification, and risk management), portfolio performance measurement (specify absolute performance, relative performance, and risk-adjusted performance), risk analysis (specify market risk, credit risk, liquidity risk, and operational risk), and attribution analysis (specify return attribution and risk attribution).

Modern Portfolio Theory (MPT) contributes to portfolio analytics by providing a mathematical framework for constructing efficient portfolios that optimize the trade-off between risk and return. Key concepts in MPT include the efficient frontier, the Capital Asset Pricing Model (CAPM), and beta and alpha, which help investors analyze and optimize their portfolios.

Yes, many portfolio analytics software and platforms can be integrated with other investment management tools, such as trading platforms, research databases, and financial planning software. This integration streamlines investment processes and improves decision-making for investors and asset managers.

Portfolio analytics can be applied to various investment strategies to evaluate their performance, risk, and diversification benefits. In passive strategies (specify index-tracking and smart beta), it helps optimize risk-return profiles. In active strategies (specify fundamental analysis, quantitative analysis, and technical analysis), it helps evaluate the effectiveness of the strategies and optimize portfolios. In alternative strategies (specify hedge funds, private equity, and real assets), it helps assess performance, risk, and diversification benefits within the overall portfolio.

Future trends in portfolio analytics include the increasing importance of artificial intelligence (AI) and machine learning (ML) for automating analytical tasks and improving investment decision-making, the growing reliance on big data and alternative data sources for enhancing investment insights, the integration of environmental, social, and governance (ESG) factors into portfolio analytics, and the need to address changing regulatory and compliance requirements in the investment landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.