Smart Beta refers to investment strategies that aim to capture market returns by selecting securities based on specific factors or characteristics. These strategies differ from traditional market capitalization-weighted indexing or active management. The term "Smart Beta" was first used in 2006 to describe the use of alternative weighting schemes and factor-based investing in portfolio construction. Since then, the popularity of Smart Beta has grown significantly. The investment landscape has evolved significantly over the past few decades. Investors have moved from traditional passive strategies, such as market capitalization-weighted indexing, to active management, seeking higher returns. However, active management has not always delivered superior returns, leading to a rise in factor-based investing and Smart Beta strategies. Smart Beta strategies fall between traditional passive and active investing. While traditional passive strategies rely on market capitalization to weight securities, Smart Beta strategies use alternative weighting methodologies and factor-based investing to capture specific characteristics of securities. In contrast, active management involves extensive research and analysis to select securities and time the market. Smart Beta strategies provide a middle ground between passive and active investing, offering a rules-based approach with the potential for enhanced returns. Factor-based investing involves selecting securities based on specific characteristics or factors historically associated with higher returns. Common factors include value, momentum, quality, size, and volatility. For example, a value-based strategy might involve selecting securities with lower price-to-earnings ratios or higher dividend yields. Investors can also customize factors based on their investment objectives. For instance, an investor may choose to overweight securities based on environmental, social, and governance (ESG) factors or earnings growth potential. Equal weighting involves allocating an equal amount of capital to each security in the portfolio. This approach reduces concentration risk and provides diversification across securities. Fundamental weighting involves weighting securities based on their fundamental characteristics, such as earnings or book value. This approach can provide exposure to value and quality factors. Risk-based weighting involves weighting securities based on their risk characteristics, such as volatility or downside risk. This approach can provide exposure to the low volatility factor. Smart Beta strategies use a rules-based approach to select securities based on specific factors or weighting methodologies. This approach reduces the reliance on subjective judgments or predictions. Portfolio optimization techniques involve combining securities to achieve a specific investment objective, such as maximizing returns or minimizing risk. These techniques use mathematical algorithms to select the most efficient portfolio. Rebalancing involves adjusting the portfolio's composition to maintain the desired exposure to specific factors or weighting methodologies. The frequency of rebalancing depends on the investment objective and the volatility of the portfolio. Smart Beta strategies are most commonly used in equities. The most popular strategies are those that provide exposure to value, momentum, quality, size, and low volatility factors. Smart Beta strategies are becoming more popular in fixed income, particularly in corporate bonds. The most popular strategies are those that provide exposure to credit quality, duration, and yield curve factors. Smart Beta strategies are also used in commodities, particularly in exchange-traded products that provide exposure to specific commodities, such as gold or oil. Smart Beta strategies can also be used in multi-asset portfolios, providing exposure to specific factors across different asset classes. Smart Beta strategies can be used as a core holding in a passive portfolio, providing exposure to specific factors or weighting methodologies. Active strategies can then be used as satellite holdings to provide additional exposure to specific securities or sectors. Smart Beta strategies can also be blended with active strategies to provide a more diversified investment solution. For example, an investor may choose to combine a value-based Smart Beta strategy with an active growth strategy. Investors can customize Smart Beta strategies to achieve specific investment objectives, such as maximizing returns or minimizing risk. This customization can involve the use of specific factors or weighting methodologies. Smart Beta ETFs are becoming increasingly popular, providing investors with exposure to specific factors or weighting methodologies. Exchange-traded Funds (ETFs) typically have lower management fees compared to actively managed funds. Smart Beta mutual funds are also available, providing investors with exposure to specific factors or weighting methodologies. Mutual funds typically have higher management fees compared to Smart Beta ETFs. Separately Managed Accounts (SMAs) provide investors with customized Smart Beta solutions, tailored to their specific investment objectives. These accounts typically have higher minimum investment requirements and fees compared to ETFs or mutual funds. Smart Beta strategies provide exposure to specific factors or weighting methodologies that may offer diversification benefits and reduce concentration risk. Additionally, the rules-based approach to portfolio construction and rebalancing can help manage risk. Smart Beta strategies aim to capture specific factors or characteristics that have historically been associated with higher returns. By providing exposure to these factors, Smart Beta strategies may offer enhanced returns potential. Smart Beta strategies use a rules-based approach to portfolio construction and rebalancing, reducing the need for extensive research and analysis that is required in active management. As a result, Smart Beta strategies typically have lower management fees compared to actively managed funds. Smart Beta strategies use a rules-based approach to portfolio construction and rebalancing, making them transparent and easy to understand. This approach also eliminates the influence of subjective judgments or predictions, providing investors with a more objective investment solution. The quality and availability of data on specific factors or characteristics can impact the effectiveness of Smart Beta strategies. Additionally, different providers may use different definitions of the same factors, making it difficult to compare strategies. The effectiveness of Smart Beta strategies can be impacted by the timing and persistence of specific factors. For example, a value-based strategy may perform poorly during a growth market cycle. As Smart Beta strategies become more popular, there is a risk of overcrowding in specific factors or securities, leading to a reduction in the effectiveness of the strategy. Additionally, capacity constraints can limit the ability of Smart Beta strategies to scale. Smart Beta strategies involve frequent rebalancing, which can result in higher transaction costs. Additionally, the implementation of customized factors or weighting methodologies can be more challenging and expensive. Smart Beta strategies that incorporate ESG frameworks and sustainability factors are becoming more popular, reflecting the growing importance to investors of environmental, social, and other considerations beyond financial rewards. Artificial intelligence and machine learning are increasingly being used to identify and analyze factors that may provide enhanced returns. These technologies can provide a more data-driven and objective approach to factor analysis. The use of technology is also enabling the development of customized Smart Beta solutions for individual investors, providing a more personalized investment experience. Innovations in portfolio construction and risk management are helping to improve the effectiveness of Smart Beta strategies. For example, the use of optimization techniques that incorporate downside risk can help manage risk during periods of market volatility. Smart Beta strategies have become increasingly popular in recent years, providing investors with a rules-based approach to portfolio construction and the potential for enhanced returns. While Smart Beta strategies offer significant benefits, there are also challenges and limitations that need to be considered. These include data quality and factor definitions, factor timing and persistence, and implementation and transaction costs. As the investment landscape continues to evolve, Smart Beta strategies will need to adapt to meet the changing needs and preferences of investors. This may involve incorporating new factors or weighting methodologies, or leveraging technology to provide a more personalized investment experience. Consult with a wealth management professional or a qualified financial advisor for further guidance on Smart Beta and how it can help achieve financial goals based on risk tolerance and individual investment philosophy.What Is Smart Beta?

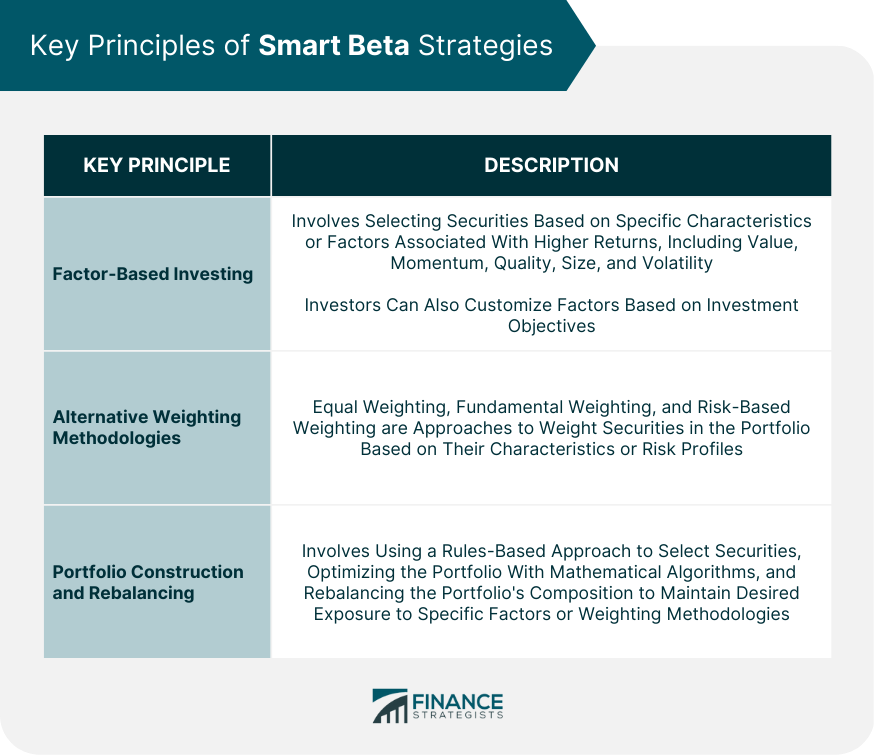

Key Principles of Smart Beta Strategies

Factor-Based Investing

Alternative Weighting Methodologies

Equal Weighting

Fundamental Weighting

Risk-Based Weighting

Portfolio Construction and Rebalancing

Security Selection Process

Portfolio Optimization Techniques

Rebalancing Frequency

Smart Beta in Different Asset Classes

Equities

Fixed Income

Commodities

Multi-Asset Portfolios

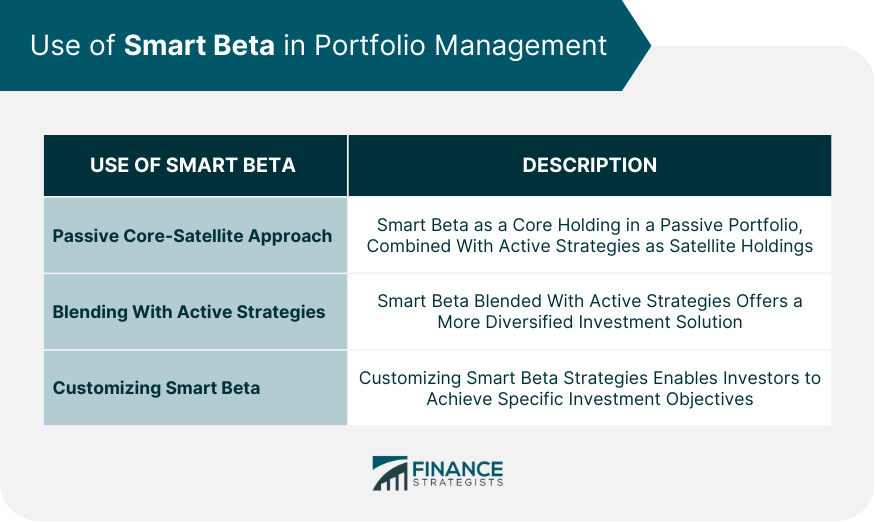

Use of Smart Beta in Portfolio Management

Passive Core-Satellite Approach

Blending With Active Strategies

Customizing Smart Beta for Specific Investment Objectives

Popular Smart Beta Products and Providers

Exchange-traded Funds (ETFs)

Mutual Funds

Separately Managed Accounts (SMAs)

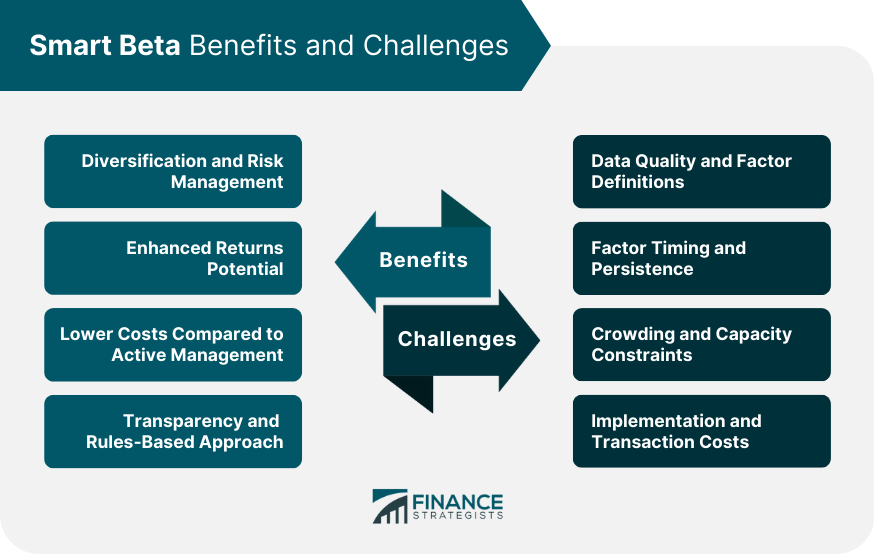

Benefits of Smart Beta Strategies

Diversification and Risk Management

Enhanced Returns Potential

Lower Costs Compared to Active Management

Transparency and Rules-Based Approach

Challenges and Limitations of Smart Beta

Data Quality and Factor Definitions

Factor Timing and Persistence

Crowding and Capacity Constraints

Implementation and Transaction Costs

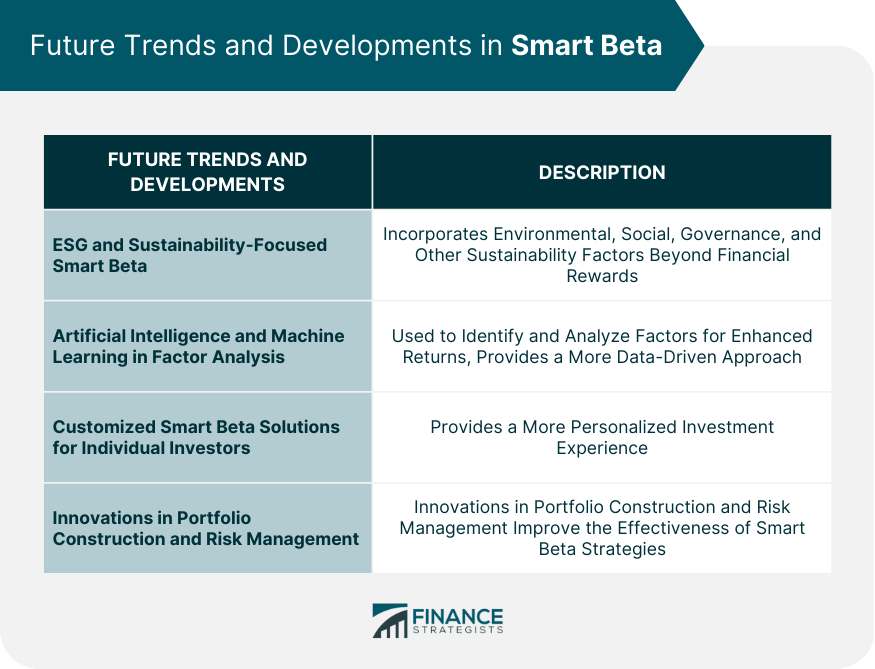

Future Trends and Developments in Smart Beta

ESG and Sustainability-Focused Smart Beta

Artificial Intelligence and Machine Learning in Factor Analysis

Customized Smart Beta Solutions for Individual Investors

Innovations in Portfolio Construction and Risk Management

Final Thoughts

Smart Beta FAQs

Smart Beta refers to investment strategies that aim to capture market returns by selecting securities based on specific factors or characteristics.

Smart Beta strategies fall between traditional passive and active investing. While traditional passive strategies rely on market capitalization to weight securities, Smart Beta strategies use alternative weighting methodologies and factor-based investing to capture specific characteristics of securities. In contrast, active management involves extensive research and analysis to select securities and time the market.

Smart Beta strategies provide diversification and risk management benefits, enhanced returns potential, lower costs compared to active management, and a transparent and rules-based approach to investing.

The challenges and limitations of Smart Beta include data quality and factor definitions, factor timing and persistence, crowding and capacity constraints, and implementation and transaction costs.

The future trends and developments in Smart Beta include the incorporation of ESG and sustainability factors, the use of artificial intelligence and machine learning in factor analysis, the development of customized Smart Beta solutions for individual investors, and innovations in portfolio construction and risk management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.