A financial overlay is an advanced investment approach that tactically modifies a portfolio's risk and return profile without changing its underlying constituents, predominantly through the use of derivative instruments. The types of overlay strategies include currency overlay for managing foreign exchange risk, risk overlay for comprehensive risk management, portable alpha overlay for enhancing returns, and environmental, social, and governance (ESG) overlay for sustainable investing. These strategies provide multiple benefits, such as the potential for enhanced returns, precise risk control, and increased investment flexibility. However, they are not without their risks. Implementing overlay strategies can lead to increased portfolio complexity and potential losses from poor execution. Moreover, since these strategies often employ derivatives, they can introduce additional risks, such as counterparty risk and liquidity risk. Hence, a comprehensive understanding and effective management of these strategies are vital for investors and portfolio managers alike. The primary goal of financial overlays is to improve the risk-return profile of a portfolio. By deploying an overlay strategy, portfolio managers can gain exposure to certain asset classes or markets, hedge against potential risks, or take advantage of market inefficiencies without having to buy or sell the underlying assets. This flexibility makes overlays an important tool in modern portfolio management. In risk management, an overlay can be used to protect a portfolio against adverse market movements. This is typically achieved by taking offsetting positions in derivative instruments. For instance, a portfolio manager who is concerned about potential losses from a market downturn could use a risk overlay strategy involving put options, which would increase in value if the underlying assets decline in price. Overlay strategies can also be employed to enhance returns. For instance, a manager might use a derivatives overlay to gain leveraged exposure to a certain market or asset class. This allows the manager to potentially earn higher returns without needing to invest additional capital. Financial overlays can help improve portfolio diversification. By using derivatives, a manager can gain exposure to asset classes or markets that may be difficult or expensive to access directly. This can help reduce the portfolio's overall risk by spreading investments across a wider range of assets. Currency overlay involves managing the foreign exchange risk in a portfolio of international investments. This can involve hedging against currency fluctuations or taking speculative positions to profit from anticipated currency movements. Risk overlay strategies are designed to manage a portfolio's exposure to various risks, such as market risk, interest rate risk, or credit risk. This might involve using derivatives to hedge against potential losses, or to take advantage of market inefficiencies. A portable alpha strategy involves separating the alpha (the return above a benchmark) from the beta (the return from market exposure) in a portfolio. The alpha is then 'ported' or applied to a different portfolio to enhance returns. This strategy requires the use of complex derivative instruments and advanced risk management techniques. An ESG overlay strategy involves integrating ESG factors into the investment process. This could involve screening out companies with poor ESG performance, or using derivatives to gain exposure to companies with strong ESG credentials. Derivatives play a crucial role in overlay strategies. These financial instruments derive their value from an underlying asset and allow portfolio managers to adjust the risk and return characteristics of a portfolio without having to buy or sell the underlying assets. Common derivatives used in overlay strategies include futures, options, and swaps. Quantitative models are essential tools in the implementation of overlay strategies. They help in predicting market movements, managing risk, and making investment decisions. From simple statistical models to advanced machine learning algorithms, these models provide the analytical power needed to manage complex overlay strategies. Implementing an overlay strategy begins with portfolio construction, where the manager decides on the mix of assets and overlay strategies that best meet the investor's objectives. Once the portfolio is constructed, the manager must regularly rebalance it to maintain the desired risk and return characteristics. This involves adjusting the overlay strategy in response to changes in market conditions or the investor's needs. Overlay strategies can offer a number of benefits. They can enhance portfolio performance, provide risk control, and offer greater flexibility. Overlays can also be cost-effective, as they allow managers to adjust portfolio exposure without incurring the transaction costs of buying or selling the underlying assets. While overlays can offer many benefits, they are not without risks. These include the risk of loss from poor strategy execution, the potential for increased portfolio complexity, and the risk of unintended exposures. Also, because overlays often involve the use of derivatives, they can introduce additional risks, such as counterparty risk and liquidity risk. Overlays can help to manage portfolio volatility. By allowing managers to adjust portfolio exposure quickly and efficiently, they can help to smooth out portfolio returns and reduce the impact of market volatility. However, if not managed properly, overlays can also increase portfolio volatility, particularly if the overlay strategy involves taking on leveraged or speculative positions. When evaluating the performance of overlay strategies, investors should consider both the return enhancement and risk control provided by the strategy. Key performance metrics include the strategy's return relative to its benchmark, the volatility of returns, and the strategy's Sharpe ratio, which measures risk-adjusted performance. Benchmarking involves comparing the performance of an overlay strategy to a relevant benchmark. The choice of benchmark will depend on the type of overlay strategy. For example, a currency overlay strategy might be benchmarked against a currency index, while a risk overlay strategy might be benchmarked against a volatility index. In addition to quantitative metrics, investors should consider qualitative factors when evaluating overlay strategies. These include the manager's experience and expertise, the robustness of the manager's investment process, and the manager's ability to execute the strategy effectively. A financial overlay is a sophisticated investment strategy that adjusts a portfolio's risk and return characteristics without modifying the underlying assets, primarily through the use of derivatives. Various types of overlay strategies exist, including currency overlay, risk overlay, portable alpha overlay, and environmental, social, and governance overlay. Each serves unique purposes, such as managing foreign exchange risk, controlling portfolio exposure, enhancing returns, or integrating ESG factors into investment decisions. While overlay strategies offer numerous benefits, including enhanced portfolio performance, increased risk control, and greater flexibility, they also carry inherent risks. These include potential losses from poor strategy execution, increased portfolio complexity, and exposure to additional risks introduced by derivatives. Thus, understanding and effectively managing these strategies are crucial for successful portfolio management.Definition of Overlays

The Importance of Overlays

The Role of Overlays in Portfolio Management

Overlay in Risk Management

Overlays in Return Enhancement

Overlays in Diversification Strategies

Types of Overlay Strategies

Currency Overlay

Risk Overlay

Portable Alpha Overlay

Environmental, Social, and Governance (ESG) Overlay

The Mechanics of Overlay Strategies

The Role of Derivatives in Overlay Strategies

Quantitative Models in Overlay Management

Implementing Overlay Strategies: Portfolio Construction and Rebalancing

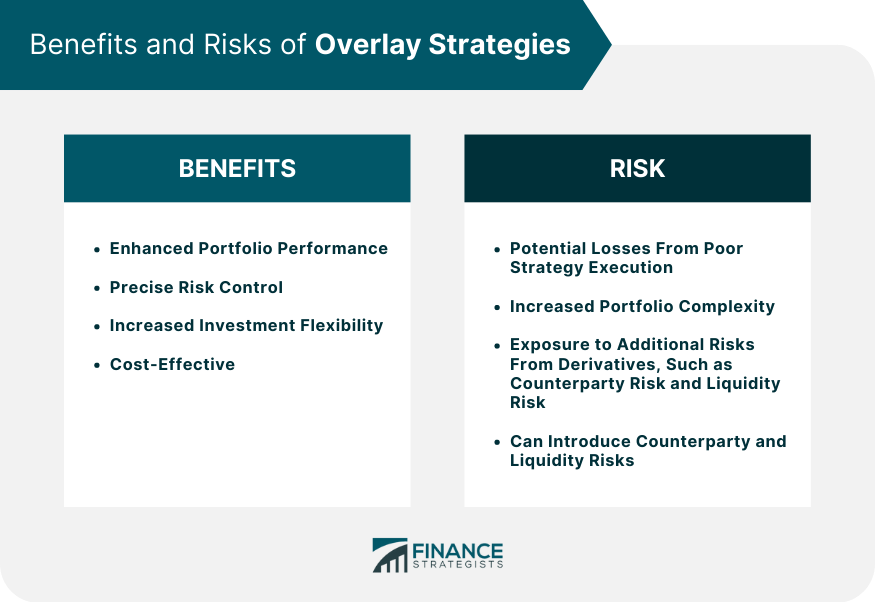

Benefits and Risks of Overlay Strategies

Performance and Cost Benefits of Overlays

Potential Risks of Overlays

The Impact of Overlays on Portfolio Volatility

Evaluating Overlay Strategies

Performance Metrics for Overlay Strategies

Benchmarking Overlay Strategies

Qualitative Factors in Overlay Strategy Evaluation

Conclusion

Overlay FAQs

A financial overlay strategy is a sophisticated investment technique that uses derivative instruments to adjust a portfolio's risk and return characteristics without changing the underlying investments. It's like an additional layer applied over the core portfolio, providing additional control over exposure to various risks.

A currency overlay strategy involves managing the foreign exchange risk in a portfolio of international investments. This can be accomplished through hedging against currency fluctuations or taking speculative positions to profit from anticipated currency movements.

Overlay strategies can enhance portfolio performance, provide risk control, and offer greater flexibility. They can also be cost-effective, as they allow managers to adjust portfolio exposure without incurring the transaction costs of buying or selling the underlying assets.

One example of a successful overlay strategy is a risk overlay used by a large pension fund during the 2008 financial crisis. By using derivatives to hedge against market risk, the fund was able to protect its portfolio from significant losses, demonstrating the value of overlay strategies in risk management.

Technological innovations are expected to play an increasingly significant role in overlay strategies. Advances in artificial intelligence and machine learning provide new tools for managing overlays, while developments in blockchain and smart contracts could revolutionize the way derivatives are traded and managed. These advancements promise to make overlay strategies more efficient, transparent, and accessible.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.