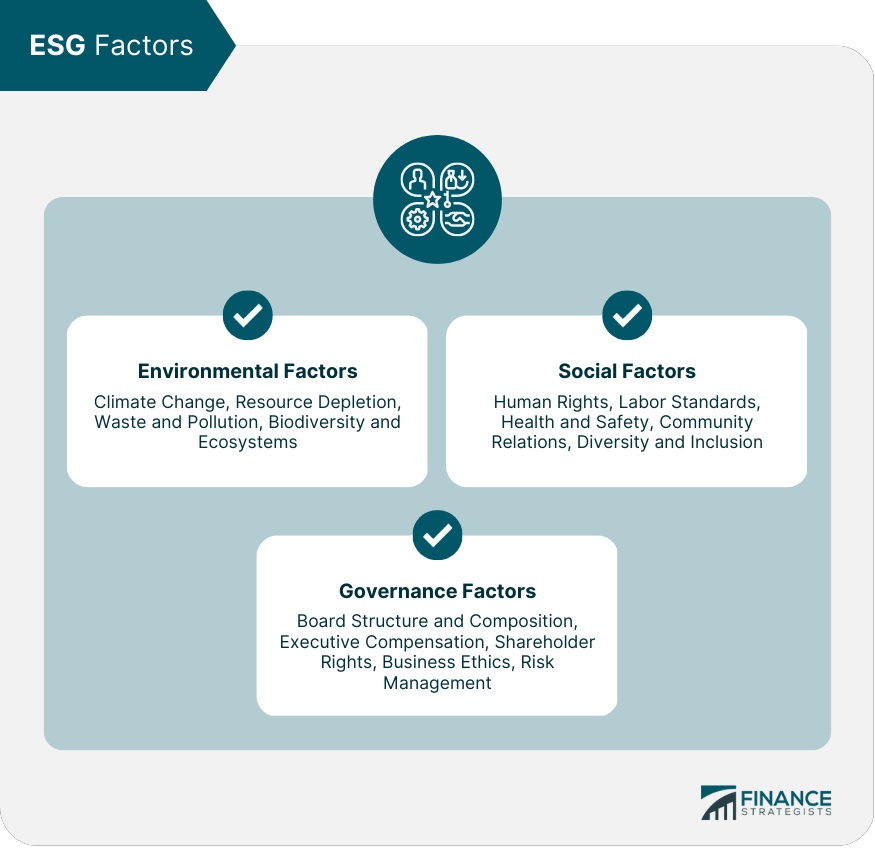

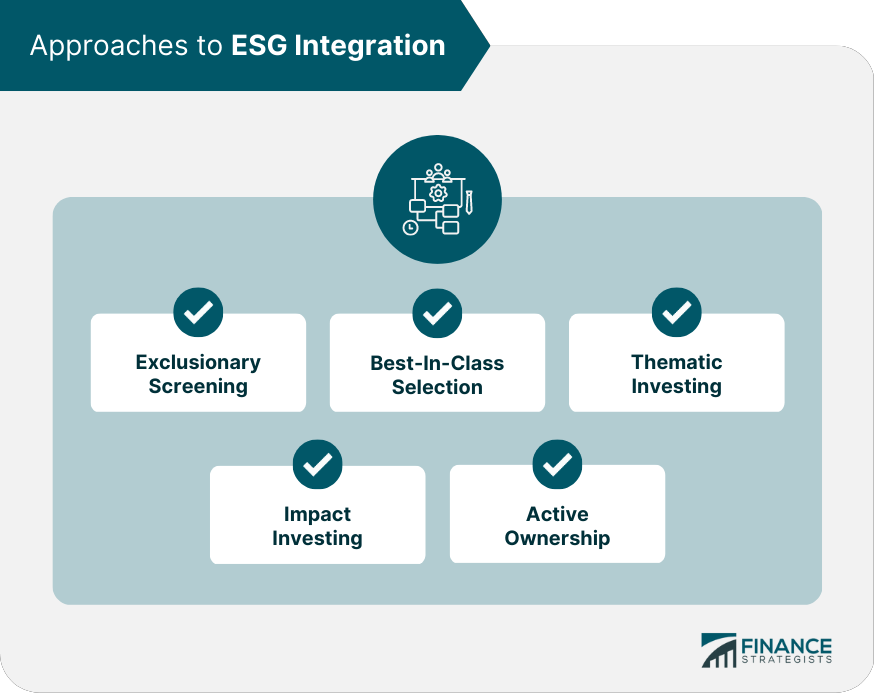

ESG integration is the systematic consideration of environmental, social, and governance factors in investment analysis and decision-making. Incorporating ESG factors into investment decisions is crucial for identifying risks and opportunities that traditional financial analysis may overlook. ESG integration can lead to better investment outcomes by promoting sustainable business practices and mitigating long-term risks. ESG integration has evolved significantly in recent years, driven by growing investor demand for sustainable investments and increased recognition of the financial materiality of ESG factors. As a result, investors and asset managers are increasingly adopting ESG integration in their investment processes. ESG factors encompass a wide range of environmental, social, and governance issues that can influence the financial performance and sustainability of investments. These factors can help identify potential risks and opportunities for long-term value creation. Environmental factors include issues related to climate change, resource depletion, waste and pollution, and biodiversity and ecosystems. Incorporating these factors into investment decisions can help identify companies with strong environmental practices and mitigate potential environmental risks. Social factors cover aspects such as human rights, labor standards, health and safety, community relations, and diversity and inclusion. Assessing these factors can help investors identify companies that promote fair labor practices, maintain strong community relations, and foster a diverse and inclusive workforce. Governance factors encompass issues related to board structure and composition, executive compensation, shareholder rights, business ethics, and risk management. Evaluating these factors can provide insights into a company's corporate governance practices and help identify potential governance risks and opportunities. There are several approaches to integrating ESG factors into investment decision-making. These approaches can be used individually or in combination, depending on an investor's objectives and preferences. Exclusionary screening involves excluding companies or sectors with poor ESG performance or those involved in controversial activities from an investment portfolio. This approach aims to minimize exposure to ESG risks and align investments with ethical considerations. Best-in-class selection involves selecting companies with superior ESG performance within their industry. This approach seeks to identify companies that are more likely to outperform their peers in terms of long-term financial performance and sustainability. Thematic investing focuses on investments in specific sectors, industries, or themes with strong ESG characteristics. This approach aims to capitalize on long-term trends and opportunities related to environmental and social issues, such as clean energy or social impact investing. Impact investing targets investments that generate measurable environmental, social, or governance benefits alongside financial returns. This approach aims to directly contribute to positive societal or environmental outcomes through investments in companies or projects with a clear ESG impact. Active ownership involves engaging with companies to encourage improved ESG performance and practices. This approach can include voting on shareholder resolutions, participating in collaborative engagements, or directly engaging with company management on ESG issues. ESG data and analytics are crucial for assessing the ESG performance of companies and making informed investment decisions. These data sources and tools can help investors identify ESG risks and opportunities, as well as monitor the progress of their investments in addressing ESG issues. ESG data can be obtained from various sources, including company disclosures, government and regulatory reports, and third-party data providers. This information can help investors evaluate the ESG performance of companies and identify potential risks and opportunities. ESG rating agencies provide assessments of companies' ESG performance based on their proprietary methodologies. These ratings can serve as a useful starting point for investors in their ESG integration process, offering insights into companies' strengths and weaknesses across ESG factors. ESG data can be subject to limitations and challenges, such as inconsistencies in reporting, lack of standardized metrics, and potential biases in rating methodologies. Investors should be aware of these limitations and use multiple data sources to enhance their ESG analysis. Technological advancements and increased demand for ESG data have led to improvements in ESG data collection and analysis. Innovations such as artificial intelligence, machine learning, and natural language processing are helping investors better understand and incorporate ESG factors into their investment decisions. The regulatory and industry landscape surrounding ESG integration is evolving rapidly, with governments and industry bodies introducing new rules and initiatives to promote sustainable investing and enhance ESG disclosure. Governments and regulators worldwide are increasingly recognizing the importance of ESG integration and are implementing policies and regulations to encourage sustainable investing. These regulations can vary across jurisdictions and may include mandatory ESG disclosure requirements or incentives for sustainable investments. Industry initiatives and standards, such as the Principles for Responsible Investment (PRI) and the Task Force on Climate-related Financial Disclosures (TCFD), aim to establish best practices and guidelines for ESG integration and reporting. These initiatives help promote transparency and consistency in ESG practices across the investment industry. Stock exchanges play a vital role in promoting ESG integration by requiring listed companies to disclose ESG information and by offering sustainable investment products. Some exchanges have also introduced ESG indices to help investors track the performance of companies with strong ESG characteristics. ESG disclosure and reporting are essential for investors to evaluate the ESG performance of companies and make informed investment decisions. Companies are increasingly adopting ESG reporting frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), to enhance the quality and comparability of their ESG disclosures. The relationship between ESG integration and financial performance has been a subject of debate and research in recent years. Understanding this relationship can help investors make more informed decisions about the potential risks and rewards of integrating ESG factors into their investment strategies. Numerous studies have found a positive relationship between ESG factors and financial performance, indicating that companies with strong ESG performance tend to outperform their peers in terms of long-term financial returns and risk-adjusted performance. ESG integration can contribute to long-term value creation by identifying companies that are better positioned to navigate future risks and opportunities related to environmental, social, and governance issues. These companies are more likely to be resilient and adaptive in the face of changing market conditions and regulatory environments. Incorporating ESG factors into investment decisions can help investors better understand and manage potential risks associated with a company's environmental, social, and governance practices. Companies with strong ESG performance are generally considered more resilient to adverse events and better equipped to manage potential risks, leading to more stable and sustainable financial performance. ESG integration is the systematic consideration of environmental, social, and governance factors in investment analysis and decision-making. This approach aims to improve risk management and identify investment opportunities that can generate long-term value.Definition of ESG Integration

This approach aims to improve risk management and identify investment opportunities that can generate long-term value.ESG Factors

Environmental Factors

Social Factors

Governance Factors

Approaches to ESG Integration

Exclusionary Screening

Best-In-Class Selection

Thematic Investing

Impact Investing

Active Ownership

ESG Data and Analytics

Sources of ESG Data

ESG Rating Agencies and Methodologies

Limitations and Challenges of ESG Data

Advances in ESG Data Collection and Analysis

Regulatory and Industry Developments

Global Regulatory Landscape

Industry Initiatives and Standards

The Role of Stock Exchanges

ESG Disclosure and Reporting

ESG Integration and Financial Performance

The Relationship Between ESG Factors and Financial Performance

Long-Term Value Creation

Risk Management and Resilience

Conclusion

ESG factors encompass a wide range of environmental, social, and governance issues that can influence the financial performance and sustainability of investments.

There are several approaches to integrating ESG factors into investment decision-making, including exclusionary screening, best-in-class selection, thematic investing, impact investing, and active ownership.

ESG data and analytics are crucial for assessing the ESG performance of companies and making informed investment decisions. Technological advancements and increased demand for ESG data have led to improvements in ESG data collection and analysis.

The regulatory and industry landscape surrounding ESG integration is evolving rapidly, with governments and industry bodies introducing new rules and initiatives to promote sustainable investing and enhance ESG disclosure.

ESG Integration FAQs

ESG integration is the process of analyzing environmental, social, and governance factors to assess the long-term financial performance and sustainability of investments.

The key factors considered in ESG integration are environmental impact, social responsibility, and governance practices of a company or investment.

The different approaches to ESG integration include negative screening, positive screening, thematic investing, and active ownership.

The challenges associated with ESG integration include lack of standardization, limited data availability, and the subjective nature of ESG assessments.

Investors can benefit from ESG integration by gaining insights into the long-term sustainability of investments, identifying potential risks and opportunities, and aligning their investments with their values and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.