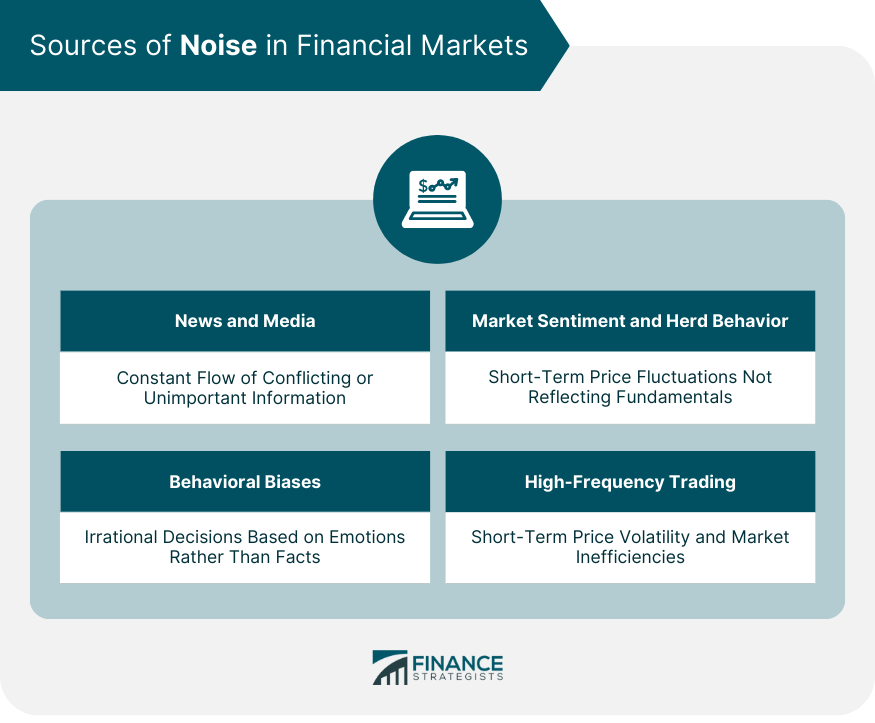

In the financial context, noise refers to irrelevant or misleading information, random fluctuations, or short-term price movements that can cloud an investor's ability to make sound investment decisions. It can create confusion and distort the true picture of a company's fundamental value or market trends. Understanding noise and its impact on financial markets is crucial for investors to make informed decisions and avoid falling prey to short-term distractions or misinformation. Recognizing and understanding noise in financial markets is essential for investors to maintain a clear perspective on their investment objectives and strategies. By differentiating between noise and valuable information, investors can avoid making impulsive decisions based on misleading or irrelevant data. Understanding noise also helps investors to stay focused on the long-term outlook and avoid reacting to short-term market fluctuations that may not have a lasting impact on their investment goals. News and media are significant sources of noise in financial markets. The constant flow of news headlines, market commentaries, and expert opinions can often contain conflicting or unimportant information, making it challenging for investors to discern valuable insights. Investors must develop the ability to filter out noise from relevant news and focus on the information that directly impacts their investment strategies and objectives. Market sentiment and herd behavior can also contribute to noise in financial markets. When a large group of investors reacts to market events in a similar manner, it can create short-term price fluctuations that may not accurately reflect the underlying fundamentals of a security or market. Investors should be cautious about following the crowd and instead make decisions based on their own research and analysis, rather than succumbing to market sentiment and herd behavior. Behavioral biases, such as overconfidence, loss aversion, and confirmation bias, can generate noise in financial markets by leading investors to make irrational decisions based on emotions rather than facts. These biases can cloud investors' judgment and lead them to make poor investment choices. Recognizing and managing behavioral biases is crucial for investors to maintain objectivity and make sound investment decisions based on factual information. High-frequency trading (HFT) and algorithmic trading can also contribute to noise in financial markets. These trading strategies rely on advanced technology and complex algorithms to execute trades at high speeds, often exploiting short-term market inefficiencies and price fluctuations. While HFT and algorithmic trading can provide liquidity and enhance market efficiency, they can also create noise and contribute to short-term price volatility, which can be challenging for individual investors to navigate. Noise can lead to increased volatility and price fluctuations in financial markets, as investors react to misleading or irrelevant information. This heightened volatility can create challenges for investors, making it difficult to identify stable, long-term investment opportunities. By recognizing and filtering out noise, investors can focus on the underlying fundamentals and trends, potentially reducing the impact of short-term market volatility on their investment decisions. Noise can contribute to inefficient pricing and misallocation of resources in financial markets, as investors may base their decisions on irrelevant or misleading information. This can result in overvalued or undervalued securities, distorting the allocation of capital and resources in the market. Investors who can differentiate between noise and valuable information can potentially capitalize on these market inefficiencies, identifying undervalued investment opportunities and avoiding overvalued securities. Noise can reduce market efficiency and increase information asymmetry, as investors struggle to discern relevant information from the constant barrage of news and data. This can create an uneven playing field, where some investors have access to more accurate or timely information than others. By learning to filter out noise and focus on valuable information, investors can improve their decision-making processes and help contribute to a more efficient and transparent market. Fundamental analysis and value investing are effective noise reduction strategies, as they focus on the underlying financial health and performance of a company. By analyzing a company's financial statements, growth prospects, and competitive advantages, investors can make more informed decisions and avoid being swayed by short-term market fluctuations and noise. Value investing involves seeking out undervalued stocks with strong fundamentals, enabling investors to capitalize on market inefficiencies and potentially generate higher returns over the long term. Technical analysis and trend-following strategies can also help investors filter out noise and focus on the underlying market trends. These approaches rely on historical price data and chart patterns to identify trends and potential trading opportunities. By employing technical analysis and trend-following strategies, investors can develop a more systematic and disciplined approach to trading, reducing the impact of noise and emotional biases on their decision-making processes. Implementing effective risk management techniques is crucial for investors to mitigate the impact of noise and market volatility on their investment portfolios. Some common risk management strategies include diversification, position sizing, and setting stop-loss orders. By employing robust risk management techniques, investors can protect their capital and reduce the impact of short-term market fluctuations and noise on their overall portfolio performance. Adopting a long-term investment approach can help investors focus on the bigger picture and avoid being swayed by short-term market noise. By concentrating on the long-term outlook for a company or market, investors can develop a more stable and resilient investment strategy that is less susceptible to noise and short-term fluctuations. Ignoring noise can lead to financial losses and poor investment decisions, as investors may be influenced by irrelevant or misleading information. By failing to filter out noise, investors risk making impulsive decisions based on emotions, rather than facts and analysis, potentially resulting in significant financial losses. Investors who cannot differentiate between noise and valuable information may miss out on profitable investment opportunities. By being swayed by short-term market fluctuations and noise, investors may overlook undervalued securities with strong fundamentals and long-term growth potential. Noise can negatively impact portfolio performance by causing investors to make impulsive decisions, chase market trends, or succumb to behavioral biases. By recognizing and managing the impact of noise on their investment decisions, investors can maintain a more disciplined and rational approach to investing, potentially enhancing their overall portfolio performance. Noise, in the financial context, refers to irrelevant or misleading information, random fluctuations, or short-term price movements that can cloud an investor's ability to make sound investment decisions. Key sources of noise in financial markets include news and media, market sentiment and herd behavior, behavioral biases, and high-frequency trading and algorithmic trading. Investors can employ noise reduction strategies such as fundamental analysis and value investing, technical analysis and trend-following strategies, risk management techniques, and long-term investment approaches to mitigate the impact of noise on their investment decisions and portfolio performance.What Is Noise?

Sources of Noise in Financial Markets

News and Media

Market Sentiment and Herd Behavior

Behavioral Biases

High-Frequency Trading and Algorithmic Trading

Effects of Noise on Financial Markets

Increased Volatility and Price Fluctuations

Inefficient Pricing and Misallocation of Resources

Reduced Market Efficiency and Information Asymmetry

Noise Reduction Strategies

Fundamental Analysis and Value Investing

Technical Analysis and Trend-Following Strategies

Risk Management Techniques

Long-Term Investment Approaches

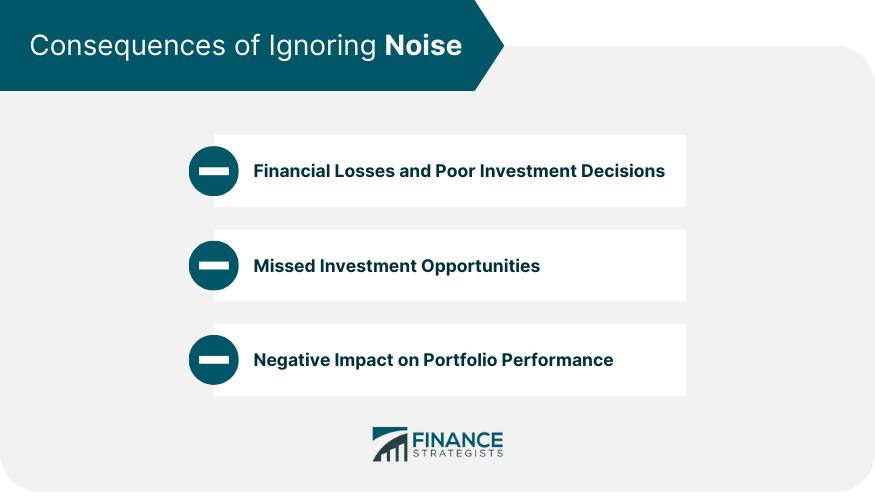

Consequences of Ignoring Noise

Financial Losses and Poor Investment Decisions

Missed Investment Opportunities

Negative Impact on Portfolio Performance

Final Thoughts

Noise FAQs

Financial noise refers to irrelevant or random market information that can distort investment decisions and create market inefficiencies.

Noise in financial markets can stem from sources such as news and media, market sentiment, behavioral biases, and high-frequency trading.

Noise can lead to increased volatility, inefficient pricing, and reduced market efficiency due to its influence on investor behavior and decision-making.

Noise trading refers to the activity of traders who make investment decisions based on random or irrelevant information, leading to market inefficiencies.

Strategies to reduce the impact of noise include fundamental analysis, technical analysis, risk management techniques, and adopting long-term investment approaches.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.