Algorithmic trading, also known as algo trading or automated trading, is a method of executing trades using computer programs and algorithms. These algorithms are designed to make trading decisions based on predefined parameters, such as technical indicators, market conditions, and historical data. The primary goal of algorithmic trading is to maximize profits while minimizing risk and reducing transaction costs. The advent of algorithmic trading can be traced back to the 1970s when computers were first employed to execute trades on the stock market. The development of electronic trading platforms and the proliferation of the internet in the 1990s further fueled the growth of algorithmic trading. Over the past few decades, advancements in technology, data processing, and communication have allowed algorithmic trading to become more sophisticated and widely adopted by institutional investors, hedge funds, and retail traders. Algorithmic trading has grown significantly in recent years, accounting for a substantial portion of trading volume in financial markets. According to estimates, algorithmic trading makes up over 70% of the trading volume in the US equity market and a significant percentage in other markets, such as foreign exchange, commodities, and fixed income. A crucial component of any algorithmic trading system is the market data feed, which provides real-time or historical price and volume data for various financial instruments. The data must be processed efficiently and accurately to ensure that the trading algorithms can make informed decisions. Data processing techniques include data cleansing, normalization, and aggregation. Developing and refining trading strategies is an essential aspect of algorithmic trading. Traders and developers use historical data to create and test trading algorithms, ensuring that they perform well in various market conditions. This process, known as backtesting, allows traders to assess the effectiveness of their strategies before deploying them in live markets. Risk management is a crucial aspect of algorithmic trading. Algorithms must be designed with safeguards to prevent excessive losses. This could include setting stop losses, limiting the size of trades, diversifying investments across different assets or markets, and constantly monitoring trading activities. Furthermore, rigorous stress testing should be performed on the algorithms to ensure they can handle extreme or unusual market conditions. Once a trading decision has been made, the order execution component of the algorithmic trading system carries out the trade. This involves selecting the appropriate trading venue, determining the optimal order type (market, limit, stop, etc.), and managing order placement to minimize impact cost. Algorithmic trading systems can execute trades at lightning speed, often in milliseconds, which can be a critical advantage in fast-moving markets. Continuous monitoring of trading activities is necessary to ensure the algorithms are performing as expected and to detect any anomalies or issues promptly. Additionally, maintaining detailed records of trades and trading decisions is essential for compliance purposes and for evaluating and improving the trading strategies over time. High-frequency trading is a subset of algorithmic trading that involves executing a large number of trades at extremely high speeds, often within microseconds or milliseconds. HFT strategies are designed to exploit small price discrepancies and fleeting market opportunities, taking advantage of the speed and efficiency of computer algorithms. Arbitrage strategies seek to profit from price discrepancies between related financial instruments, such as stocks, futures, or currencies. Algorithmic trading platforms can quickly identify and exploit these pricing differences, which are often too small or short-lived for human traders to capitalize on. Examples of arbitrage strategies include statistical arbitrage, triangular arbitrage, and index arbitrage. Market making strategies involve providing liquidity to the market by placing both buy and sell orders for a particular security. The goal is to profit from the bid-ask spread – the difference between the buying and selling prices. Algorithmic market makers can rapidly adjust their orders to accommodate changes in market conditions, ensuring that they remain profitable. Statistical arbitrage strategies involve identifying and exploiting price discrepancies between related securities based on statistical relationships, such as correlation or cointegration. These strategies often rely on sophisticated mathematical models and historical data analysis to identify profitable trading opportunities. Trend following strategies aim to capitalize on the momentum of market trends. These strategies typically use technical indicators, such as moving averages, relative strength index (RSI), or trendlines, to identify and enter trades in the direction of the prevailing trend. Algorithmic trading platforms can automate the process of identifying trends and executing trades, allowing traders to profit from market movements with minimal manual intervention. The primary advantage of algorithmic trading is its speed and efficiency. Trading algorithms can analyze vast amounts of data and make trading decisions in fractions of a second, much faster than any human trader could. This allows algorithmic traders to seize fleeting market opportunities and react instantly to changing market conditions. Algorithmic trading can also help reduce transaction costs. By breaking up large orders into smaller ones and executing them strategically over time, trading algorithms can minimize market impact and avoid moving the price adversely. Furthermore, algorithmic trading eliminates the need for human traders, reducing labor costs. Trading algorithms operate based on predefined rules and logic, eliminating the influence of human emotions such as fear and greed. This can lead to more rational and consistent trading decisions, avoiding common pitfalls such as overtrading, chasing losses, or deviating from the trading plan. By placing numerous buy and sell orders in the market, algorithmic traders contribute to market liquidity. This makes it easier for other market participants to execute their trades and can lead to more efficient price discovery. Algorithmic trading ensures the consistent execution of trading strategies. Once a strategy is programmed into an algorithm, it will be carried out exactly as designed, regardless of market conditions or the volume of trades. This can be particularly beneficial for complex strategies that require precise timing or execution. Algorithmic trading relies heavily on technology and infrastructure. Any malfunction, outage, or error in the trading algorithms, data feeds, order execution systems, or communication networks could lead to substantial losses. Therefore, robust system design, thorough testing, and ongoing maintenance are essential. As algorithmic trading becomes more prevalent, it has attracted increasing regulatory scrutiny. Algorithmic traders must comply with a myriad of rules and regulations, such as those regarding market manipulation, risk management, and record keeping. Non-compliance can result in hefty fines, trading bans, and reputational damage. Algorithmic trading has been implicated in several high-profile market events, including the 2010 Flash Crash. Some critics argue that certain algorithmic trading strategies, such as high-frequency trading and spoofing, can manipulate the market and cause sudden, dramatic price swings. These events can lead to significant losses for other market participants and undermine confidence in the financial markets. As more players enter the algorithmic trading space, competition intensifies, and profitable strategies can become less effective over time. This crowding out of strategies can reduce the potential returns from algorithmic trading and force traders to constantly innovate and adapt their strategies. Algorithmic trading raises several ethical questions, particularly around fairness and transparency. There is a debate over whether high-frequency traders have an unfair advantage over other market participants due to their ability to trade faster. Additionally, the complexity and opacity of trading algorithms can make it difficult to monitor and regulate their activities. Many large financial institutions and hedge funds use proprietary trading platforms developed in-house. These platforms are tailored to the specific needs of the institution and can offer a competitive advantage in terms of speed, flexibility, and security. However, they require significant resources to develop and maintain. There are also numerous third-party trading platforms available, which offer a range of features for algorithmic trading, including strategy development tools, backtesting capabilities, market data feeds, and order execution interfaces. Examples of popular algorithmic trading platforms include MetaTrader, NinjaTrader, and Quantopian. Algorithmic trading involves a significant amount of programming. Commonly used languages include Python, R, C++, and Java. These languages offer powerful libraries and packages for data analysis, statistical modeling, machine learning, and other tasks relevant to algorithmic trading. Algorithmic trading, the method of executing trades using computer programs and predefined algorithms, has significantly transformed financial markets. Its introduction has increased speed and efficiency in trading, reduced transaction costs, and allowed for more consistent execution of trading strategies. It has also contributed to market liquidity, which facilitates easier execution of trades for other market participants. Despite these benefits, algorithmic trading introduces technology and infrastructure risks, regulatory and compliance challenges, market manipulation concerns, competition, and crowding out of strategies. Ethical considerations around fairness and transparency are also notable points of contention. Available tools for algorithmic trading include proprietary and third-party trading platforms and programming languages and libraries. Looking forward, the landscape of algorithmic trading is expected to continue evolving. As these developments progress, all market participants will need to adjust and adapt to the transforming financial environment.What Is Algorithmic Trading?

Components of Algorithmic Trading Systems

Market Data Feed and Data Processing

Strategy Development and Backtesting

Risk Management

Order Execution

Trade Monitoring and Record Keeping

Types of Algorithmic Trading Strategies

High-Frequency Trading (HFT)

Arbitrage Strategies

Market Making Strategies

Statistical Arbitrage

Trend Following Strategies

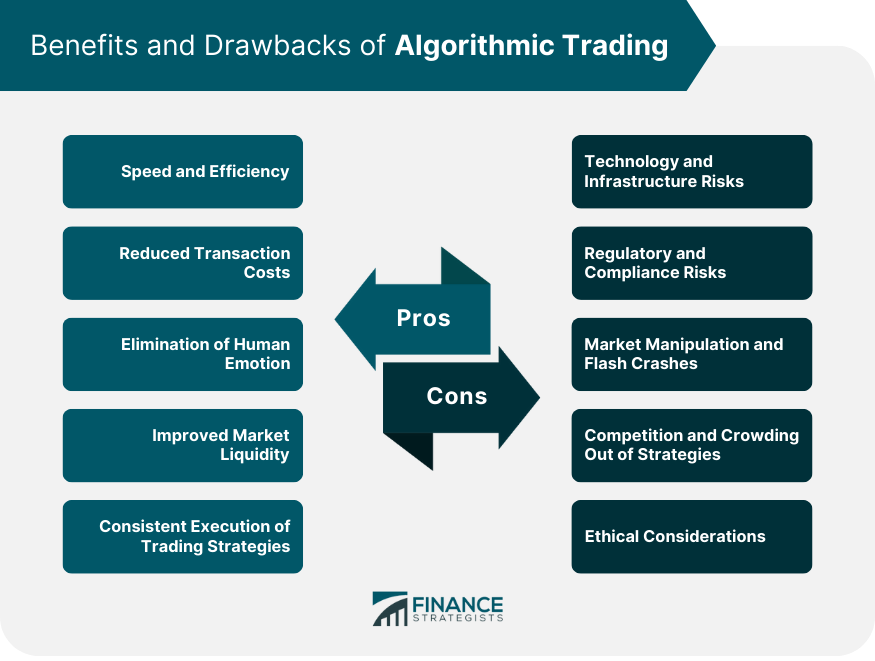

Benefits of Algorithmic Trading

Speed and Efficiency

Reduced Transaction Costs

Elimination of Human Emotion

Improved Market Liquidity

Consistent Execution of Trading Strategies

Drawbacks of Algorithmic Trading

Technology and Infrastructure Risks

Regulatory and Compliance Risks

Market Manipulation and Flash Crashes

Competition and Crowding Out of Strategies

Ethical Considerations

Algorithmic Trading Platforms and Tools

Proprietary Trading Platforms

Third-Party Trading Platforms

Programming Languages and Libraries

Final Thoughts

Algorithmic Trading FAQs

Algorithmic trading refers to the use of computer programs or algorithms to automatically execute trades in financial markets. These algorithms are designed to analyze market data and identify trading opportunities based on pre-set criteria.

Algorithmic trading works by using complex mathematical models and computer algorithms to analyze large amounts of market data, identify trading opportunities, and automatically execute trades based on pre-set parameters. This allows traders to make more informed and timely trading decisions, and can also reduce the potential for human error.

The benefits of algorithmic trading include faster and more accurate trade execution, reduced trading costs, and the ability to analyze large amounts of market data in real-time. Algorithmic trading can also help traders to reduce emotional biases in their decision-making, and can help to reduce the potential for human error.

The risks associated with algorithmic trading include technical glitches and malfunctions, which can lead to large and unexpected losses. There is also the risk of over-optimizing algorithms to historical data, which may not perform as well in real-world market conditions. Additionally, algorithmic trading can increase market volatility and create market distortions.

Algorithmic trading is used by a wide range of market participants, including hedge funds, institutional investors, and retail traders. High-frequency trading (HFT) is a type of algorithmic trading that is commonly used by proprietary trading firms and market makers to execute large volumes of trades in a very short amount of time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.