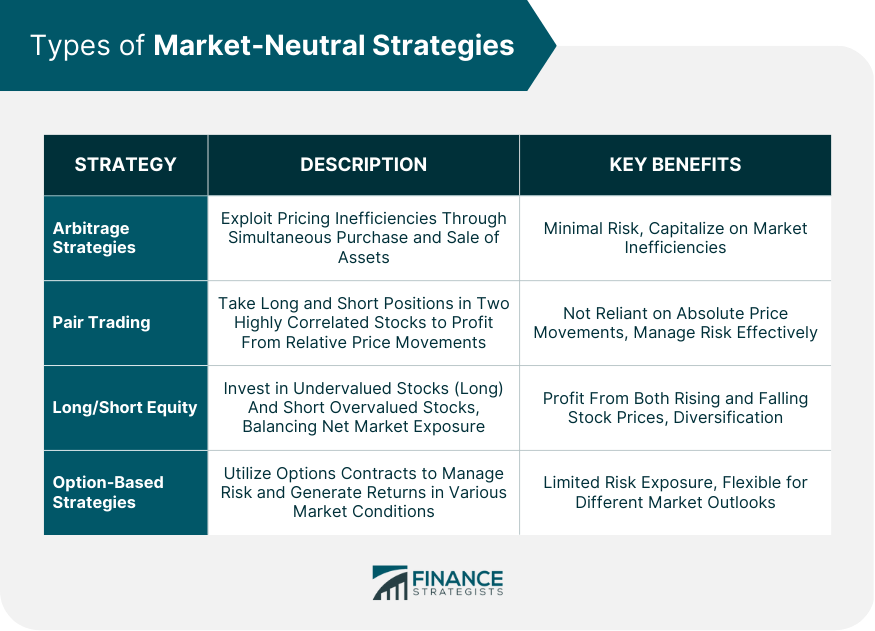

Market-neutral strategies are investment strategies that aim to generate returns by exploiting pricing inefficiencies in financial markets while minimizing exposure to overall market movements. These strategies typically involve taking both long and short positions in different securities, with the goal of profiting from the difference in their prices. By doing so, market-neutral strategies attempt to generate alpha (returns above the market benchmark) while minimizing beta (systematic risk associated with overall market movements). Market-neutral strategies can be implemented using a variety of instruments, such as stocks, bonds, options, and derivatives. Arbitrage involves the simultaneous purchase and sale of an asset to profit from pricing differences in different markets or financial instruments. This strategy exploits inefficiencies in the market and typically involves minimal risk. Merger Arbitrage: involves investing in the stocks of companies involved in a merger or acquisition. The strategy bets on the successful completion of the deal and profits from the difference in stock prices between the target and acquiring companies. Convertible Arbitrage: involves the simultaneous purchase of a convertible security and short-selling its underlying stock. The aim is to profit from the price discrepancies between the convertible security and the stock, regardless of the direction of the stock's price movement. Statistical Arbitrage: is a quantitative trading strategy that identifies pricing inefficiencies by analyzing historical price data and statistical relationships between financial instruments. Traders use statistical arbitrage to exploit deviations from expected price relationships. Fixed-Income Arbitrage: seeks to profit from pricing discrepancies in fixed-income securities, such as bonds, interest rate swaps, and futures contracts. Traders may use strategies such as yield curve arbitrage, swap spread arbitrage, and mortgage-backed securities arbitrage. Pair trading is a market-neutral strategy that involves taking long and short positions in two highly correlated stocks. The goal is to profit from the relative price movement between the two stocks rather than the absolute price movement of the individual stocks. Fundamental Analysis: Traders analyze companies' financial statements, market positions, and industry outlooks to find fundamentally similar stocks that are likely to move together. Technical Analysis: Traders use historical price data and technical indicators to identify pairs with similar price patterns and correlations. Quantitative Analysis: Traders utilize statistical methods, such as cointegration and correlation analysis, to quantify the relationship between two stocks and identify suitable pairs for trading. Long and Short Positions: Traders go long on the stock expected to outperform and short on the stock expected to underperform, aiming to profit from the relative price movement between the two stocks. Risk Management: Pair traders use stop-loss orders, position sizing, and other risk management techniques to limit potential losses. Profit and Loss: The profit and loss in a pair trade result from the difference in the relative price change between the two stocks. Long/short equity strategies involve taking long positions in undervalued stocks and short positions in overvalued stocks. The goal is to generate positive returns regardless of market conditions by profiting from both rising and falling stock prices. Long Positions: Traders identify undervalued stocks with strong fundamentals, attractive valuations, and positive growth prospects. Short Positions: Traders identify overvalued stocks with weak fundamentals, high valuations, and negative growth prospects. Market Exposure: Traders manage the portfolio's net market exposure by adjusting the balance between long and short positions. Sector Allocation: Traders maintain a balanced sector allocation to minimize industry-specific risks. Diversification: Traders diversify their portfolio across multiple stocks and sectors to reduce unsystematic risk. Option-based strategies use options contracts, such as calls and puts, to manage risk and generate returns in various market conditions. These strategies can be market-neutral and offer potential for profit with limited risk exposure. Covered Call Writing: involves holding a long position in a stock and selling a call option on the same stock. The strategy generates income from the option premium and can offer downside protection in a falling market. Protective Puts: involves holding a long position in a stock and buying a put option on the same stock. This strategy provides downside protection and limits potential losses in case the stock's price declines. Collars: involves holding a long position in a stock, selling a call option, and buying a put option on the same stock. This strategy limits both potential gains and losses, creating a defined risk-return profile. Iron Condors: involves selling an out-of-the-money call and put option, while simultaneously buying a further out-of-the-money call and put option on the same underlying asset. This strategy generates income from the premiums received and profits when the underlying asset remains within a defined price range. Calendar Spreads: the simultaneous purchase and sale of two options with the same strike price but different expiration dates. This strategy seeks to profit from the time decay of options and can be adjusted for different market outlooks. Execution risk arises from the potential failure to successfully implement a market-neutral strategy due to issues like poor trade execution, incorrect trade entry, or inadequate risk management. Model risk is the potential for a strategy's quantitative or analytical model to be flawed, leading to incorrect predictions or suboptimal investment decisions. Liquidity risk refers to the potential difficulty in buying or selling a security at a desired price or in a timely manner, which could lead to increased transaction costs or unfavorable trade execution. Counterparty risk arises when a counterparty in a financial transaction fails to fulfill their obligations, potentially resulting in financial losses. Benchmarking involves comparing the performance of a market-neutral strategy to an appropriate benchmark, such as a market index or a peer group of similar strategies. Risk-adjusted performance measures, such as the Sharpe ratio or the Sortino ratio, help evaluate a strategy's return relative to its risk exposure. Portfolio optimization techniques can be employed to adjust a market-neutral strategy's portfolio composition to maximize risk-adjusted returns. Market-neutral strategies offer a valuable approach for investors seeking consistent returns and reduced risk exposure, regardless of market conditions. These strategies encompass various techniques, including arbitrage strategies, pair trading, long/short equity, and option-based strategies, each with its unique benefits and methods. By taking advantage of pricing inefficiencies, relative price movements, and risk management using options, market-neutral strategies can provide diversification and stability to investment portfolios. However, investors should be aware of the potential risks, such as execution risk, model risk, liquidity risk, and counterparty risk, and employ effective risk management techniques to mitigate them. Performance evaluation and portfolio optimization are crucial in enhancing the effectiveness of market-neutral strategies, ensuring they contribute positively to an investor's overall investment objectives.What Are Market-Neutral Strategies?

Types of Market-Neutral Strategies

Arbitrage Strategies

Definition and Purpose of Arbitrage

Types of Arbitrage Strategies

Pair Trading Strategies

Definition and Purpose of Pair Trading

Identifying Suitable Pairs

Pair Trading Execution

Long/Short Equity Strategies

Definition and Purpose of Long/Short Equity

Stock Selection

Portfolio Construction

Option-Based Strategies

Definition and Purpose of Option-Based Strategies

Types of Option-Based Strategies

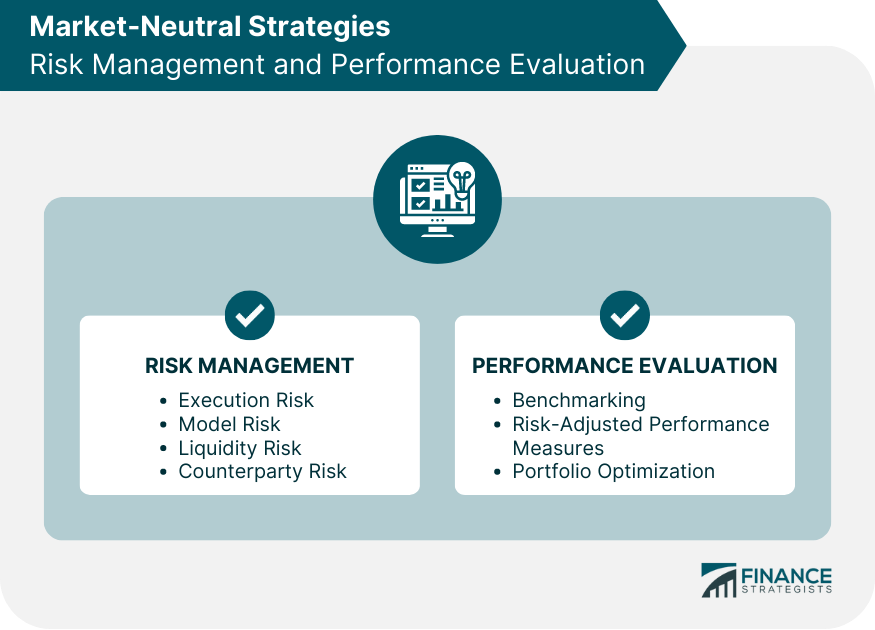

Risk Management and Performance Evaluation

Key Risks of Market-Neutral Strategies

Execution Risk

Model Risk

Liquidity Risk

Counterparty Risk

Performance Evaluation

Benchmarking

Risk-Adjusted Performance Measures

Portfolio Optimization

The Bottom Line

Market-Neutral Strategies FAQs

Market-neutral strategies are investment techniques designed to generate consistent returns regardless of market conditions by minimizing exposure to systematic risk. They are important in investment portfolios because they provide diversification, reduce overall risk, and help investors achieve more stable returns.

Market-neutral strategies can take advantage of arbitrage opportunities by exploiting pricing inefficiencies in financial markets. Arbitrage involves the simultaneous purchase and sale of an asset to profit from pricing differences in different markets or financial instruments. Market-neutral strategies using arbitrage can include merger arbitrage, convertible arbitrage, statistical arbitrage, and fixed-income arbitrage.

Pair trading is a market-neutral strategy that involves taking long and short positions in two highly correlated stocks. The goal is to profit from the relative price movement between the two stocks rather than the absolute price movement of the individual stocks. By carefully selecting correlated pairs and managing risk, pair trading can generate consistent returns irrespective of overall market trends.

Option-based market-neutral strategies use options contracts, such as calls and puts, to manage risk and generate returns in various market conditions. These strategies offer potential for profit with limited risk exposure. Examples of option-based market-neutral strategies include covered call writing, protective puts, collars, iron condors, and calendar spreads.

Key risks associated with market-neutral strategies include execution risk, model risk, liquidity risk, and counterparty risk. These risks can be mitigated through proper trade execution, robust quantitative models, diversification, effective risk management techniques, and working with reliable counterparties. Performance evaluation and portfolio optimization can also help enhance the effectiveness of market-neutral strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.