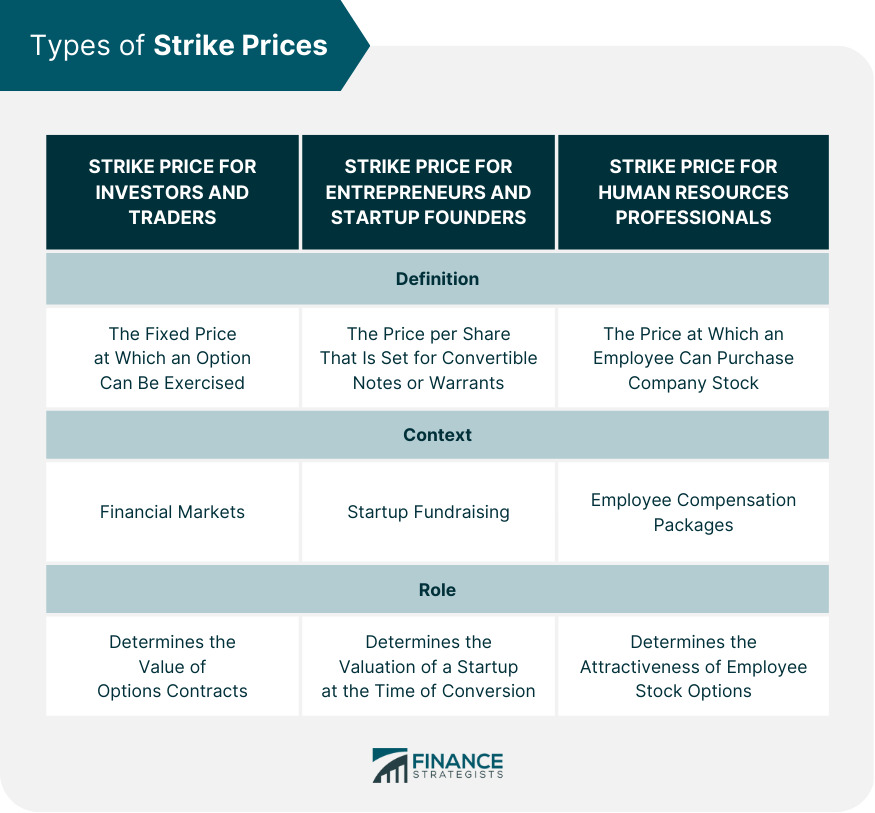

In financial markets, the strike price is a term used to describe the fixed price at which an option can be exercised. It is an essential element of options trading, which allows traders and investors to speculate on the future price movements of stocks, currencies, and other financial assets. Strike prices are also used in other financial instruments, such as convertible notes, warrants, and employee stock options. Options trading is a popular way for traders and investors to speculate on the price movements of underlying financial assets. A call option holder has the right but not the duty to purchase the underlying asset at the strike price by the option's expiration date. Similarly, a put option grants the owner the right, but not the responsibility, to sell the underlying asset at the strike price by the option's expiration date. The strike price plays a crucial role in determining the value of an options contract. If the strike price is lower than the current market price of the underlying asset, the call option is "in the money," and the put option is "out of the money." Conversely, if the strike price is higher than the current market price of the underlying asset, the call option is "out of the money," and the put option is "in the money." The value of an options contract is also affected by the time left until expiration, the volatility of the underlying asset, and the level of interest rates. However, the strike price is one of the most critical factors in determining the value of an options contract. A higher strike price will typically result in a lower value for a call option and a higher value for a put option. In comparison, a lower strike price will typically result in a higher value for a call option and a lower value for a put option. The factors that influence the determination of strike prices include the current market price of the underlying asset, the time left until expiration, the level of volatility in the market, and the interest rates. These factors are considered by the options market makers who set the strike prices for different options contracts. In the context of startup fundraising, the strike price refers to the price per share set for convertible notes or warrants. Convertible notes and warrants are financial instruments that allow startups to raise capital from investors without issuing equity immediately. Instead, the investors receive the right to convert their investment into equity at a later date, typically when the startup raises its next round of funding. The strike price of convertible notes and warrants is important because it determines the startup's valuation at the time of conversion. If the strike price is too low, the investors will receive a more significant ownership stake in the startup when they convert their investment into equity. On the other hand, if the strike price is set too high, the investors may not see a sufficient return on their investment. The impact of different strike prices on the valuation of convertible securities is significant. For example, suppose a startup raises $1 million through convertible notes with a conversion price of $1 per share. In that case, the investors will receive 1 million shares of the startup when they convert their investment into equity. If the startup is later valued at $10 million when it raises its next round of funding, the investors' shares will be worth $10 each, resulting in a total value of $10 million for their investment. However, if the conversion price had been set at $2 per share, the investors would receive only 500,000 shares, resulting in a total value of $5 million for their investment. In the context of employee stock options, the strike price is the price at which an employee can purchase company stock. Employee stock options are a form of compensation that many companies offer to their employees as a way to incentivize and retain talented employees. The strike price of employee stock options is typically set at the market price of the company's stock on the grant date. The employee has the right to purchase the stock at the strike price at a later date, typically after a vesting period has elapsed. If the stock's market price has increased above the strike price by the time the employee exercises their options, they can purchase the stock at the strike price and sell it at the market price, resulting in a profit. The strike price is an important factor in determining the value and attractiveness of employee stock options. A lower strike price will typically make the options more valuable to the employee, as there is a greater potential for the stock price to increase above the strike price. However, a lower strike price also means that the company is offering the employee a larger potential profit, which can be costly for the company if the stock price rises significantly. The strike price is a topic of interest to academics and researchers in finance, economics, and related fields. The academic literature on strike prices covers a wide range of topics, including the role of strike prices in options pricing models, the impact of strike prices on the volatility of financial markets, and the use of strike prices in risk management strategies. One area of research that has received particular attention is the impact of strike prices on market volatility. Some studies have suggested that the pricing of options contracts can influence the level of volatility in financial markets, as traders and investors adjust their trading strategies based on the current strike prices of options contracts. Other studies have examined the use of strike prices in risk management strategies, such as hedging and speculation, and have explored the potential benefits and risks associated with these strategies. In conclusion, the strike price is critical to many financial instruments, including options contracts, convertible securities, and employee stock options. The strike price plays a crucial role in determining the value and profitability of these instruments, and it is influenced by a range of factors, including the current market price of the underlying asset, the time left until expiration, the level of volatility in the market, and the interest rates. The financial market, risk management, investment strategy investors, traders, entrepreneurs, startup founders, human resources experts, and academics must understand strike pricing. By considering the factors that influence the determination of strike prices, individuals and organizations can make informed decisions about their investments, fundraising, compensation packages, and research agendas. Given the complex nature of financial instruments and the multitude of factors that affect their value, it is advisable to seek the guidance of a professional financial advisor who specializes in wealth management. A financial advisor can help you navigate the intricacies of financial markets and provide customized solutions based on your unique needs and goals. What Is a Strike Price?

Strike Price for Investors and Traders

Strike Price for Entrepreneurs and Startup Founders

Strike Price for Human Resources Professionals

Academic and Research Perspectives on Strike Price

Conclusion

Strike Price FAQs

The strike price is the fixed price at which an option can be exercised. It plays a crucial role in determining the value and profitability of options contracts. Factors such as market prices, expiration dates, volatility levels, and interest rates influence it.

In the context of startup fundraising, the strike price refers to the price per share set for convertible notes or warrants. A high or low strike price can significantly impact the valuation of a startup at the time of conversion, affecting the investors' potential return on investment.

The strike price is the price at which an employee can purchase company stock in the context of employee stock options. A lower strike price can make employee stock options more valuable to the employee, but it can be costly for the company if the stock price rises significantly.

The strike price is a topic of interest to academics and researchers in finance, economics, and related fields. Research has explored the impact of strike prices on market volatility, risk management strategies, and options pricing models.

The strike price is used in risk management strategies, such as hedging and speculation, and it can influence the level of volatility in financial markets. Traders and investors adjust their trading strategies based on the current strike prices of options contracts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.