Insider trading refers to the buying or selling of securities by individuals who have access to non-public information about a company or its securities. This information can be about financial performance, strategic plans, or other material events that can significantly impact the price of the company's securities. Such practice is illegal and considered a form of securities fraud. It weakens the integrity of financial markets and harms other investors who do not have access to the same information. Understanding insider trading is crucial for investors, traders, legal professionals, business executives, students, and the general public. Insider trading can have a significant impact on the financial markets, leading to a distortion of market prices, discouraging other investors from trading, and reducing liquidity. Ethical considerations for investors and traders include the importance of transparency, fairness, and ensuring a level playing field for all investors. Insider trading is illegal under US federal securities laws. Several regulations and laws govern insider trading, including the Securities Exchange Act of 1934, the Insider Trading and Securities Fraud Enforcement Act of 1988, the Sarbanes-Oxley Act of 2002, and Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. These laws provide a legal framework to ensure that investors have access to material information and prevent insiders from taking advantage of non-public information. The Securities Exchange Act of 1934 was executed to protect investors and ensure the integrity of the financial markets. Section 10(b) of the act makes it illegal to use or employ any manipulative or deceptive device in connection with the purchase or sale of any security. The act also requires companies to file periodic reports with the SEC and disclose material information to the public. The Insider Trading and Securities Fraud Enforcement Act of 1988 amended the Securities Exchange Act of 1934 to provide additional enforcement tools for insider trading violations. The act increased penalties for insider trading, including fines, imprisonment, disgorgement of profits, and civil penalties. It also extended the statute of limitations for insider trading from two to five years. The Sarbanes-Oxley Act of 2002 was enacted in response to accounting scandals involving Enron and WorldCom. The act provides additional protections for investors and requires companies to establish and maintain internal controls and financial reporting procedures. It also mandates that CEOs and CFOs certify the accuracy of financial statements. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was enacted in response to the financial crisis of 2008. The act aims to improve transparency and accountability in the financial industry and includes provisions to address insider trading. The act requires companies to establish whistleblower programs and provides protections for whistleblowers who report insider trading violations. Insider trading is prohibited under US federal securities laws, and engaging in illegal trading activities can result in severe penalties. This section will explore the types of illegal trading activities, the penalties and consequences of insider trading, and the exceptions to insider trading. Illegal trading activities can include tipping off others, misappropriating information, and trading based on material non-public information. Tipping off others involves disclosing non-public information to another party, who then uses that information to buy or sell securities. Misappropriating information refers to the theft or unauthorized use of confidential information for personal gain. Trading based on material non-public information means using information not yet available to the public to buy or sell securities. The penalties and consequences of insider trading can be severe. Criminal penalties can include up to 20 years in prison and fines of up to $5 million for individuals and $25 million for corporations. Civil penalties can include fines of up to three times the profits gained or losses avoided as a result of the violation. Additionally, insider trading can damage an individual's reputation and lead to career and financial setbacks. There are exceptions to insider trading, such as pre-arranged trading plans and trades based on public information. Pre-arranged trading plans are trading plans that are established in advance, and the trades are made at a later date regardless of any non-public information that may be available. Trades based on public information are trades that are made based on information that is available to the general public. However, even with these exceptions, individuals must still ensure that their trading activities comply with all applicable regulations and laws governing insider trading. Companies may have additional policies and procedures in place to prevent insider trading, and individuals should seek advice from legal professionals if they are unsure about the legality of their trading activities. Insider trading can have a significant impact on the financial markets. It can create an unfair advantage for insiders, leading to a distortion of market prices. It can also harm market efficiency by discouraging other investors from trading and reducing liquidity. Insider trading can create an unfair advantage for those who have access to non-public information. This can result in a distortion of the market and undermine the trust of investors, leading to a loss of confidence in the fairness and integrity of the financial system. It can affect the stock price of a company. When insiders buy or sell shares based on privileged information, the market may interpret this as a signal of the company's future prospects, leading to a change in the stock's value. This can cause fluctuations in the market and create uncertainty for investors. Lastly, insider trading can lead to illegal activity and be harmful to investors. The Securities and Exchange Commission (SEC) has established regulations to prevent insider trading and to ensure that all investors have equal access to information. Violations of these regulations can result in fines, penalties, and even imprisonment. In addition to the legal implications, insider trading raises ethical concerns for investors and traders. It can create an uneven playing field for investors, leading to distrust in the financial markets. It can also harm companies by reducing their ability to raise capital and eroding investor confidence. Investors and traders have a responsibility to act ethically and avoid engaging in illegal activities such as insider trading. Ethical considerations include the importance of transparency, fairness, and ensuring a level playing field for all investors. They should be aware of the regulations and laws governing insider trading and seek advice from legal professionals if they are unsure about the legality of their trading activities. Insider trading can also affect market efficiency, which is the extent to which prices reflect all available information. When insider trading occurs, prices may not reflect all available information, leading to distortions in the market. This can lead to a misallocation of resources and harm market efficiency. Companies have insider trading policies and procedures to prevent insider trading. These policies require employees and executives to report their trading activities and prohibit them from trading based on non-public information. Companies also provide training and education on insider trading to ensure that their employees understand the legal and ethical implications of insider trading. Monitoring and reporting suspected insider trading is essential to prevent illegal activities. Training and education on insider trading are crucial for ensuring that employees and executives understand the legal and ethical implications of insider trading. Companies can provide training through seminars, online courses, and other educational resources. The training should cover the regulations and laws governing insider trading, the penalties for violating insider trading laws, and ethical considerations for investors and traders. Companies must monitor and report suspected insider trading to prevent illegal activities. Companies can use internal controls, such as trading blackout periods, to prevent insiders from trading based on non-public information. Companies can also establish whistleblower programs to encourage employees to report suspected insider trading violations. Insider trading has been a focus of law enforcement for many years, and several high-profile cases have made headlines. These cases have involved well-known individuals and companies, highlighting the importance of upholding the law and the potential consequences of violating insider trading regulations. One of the most famous insider trading cases involves Martha Stewart, a well-known businesswoman and television personality. In 2004, Stewart was convicted of insider trading and sentenced to five months in prison and two years of supervised release. She was found guilty of selling shares of a company called ImClone Systems after receiving non-public information about an FDA decision that was expected to negatively affect the company's stock price. The Raj Rajaratnam case involved the founder of the Galleon Group, a hedge fund that was accused of engaging in insider trading. Rajaratnam was found guilty in 2011 of multiple counts of securities fraud and conspiracy to commit insider trading. He was sentenced to 11 years in prison and ordered to pay a fine of $92.8 million. Rajaratnam was found to have made over $50 million in illegal profits by trading on non-public information about companies such as Goldman Sachs and Intel. The Steve Cohen case involved Cohen's hedge fund, SAC Capital Advisors, which was accused of engaging in insider trading. The hedge fund was fined $1.8 billion in 2013 for insider trading violations. Cohen was not charged with a crime, but the case highlighted the importance of upholding ethical standards in the financial markets and the potential consequences of insider trading violations. Insider trading is a serious offense that can lead to legal and reputational risks for individuals and companies. Understanding the legal and ethical implications of insider trading is crucial for investors, traders, legal professionals, business executives, students, and the general public. Companies must have strict policies and procedures in place to prevent insider trading, and individuals must abide by these regulations to ensure fair and transparent financial markets. By upholding the law and acting ethically, we can ensure that the financial markets remain a level playing field for all investors. Insider trading activities should be reported to the appropriate authorities. This can include the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), or your company's internal compliance department. Additionally, individuals can take steps to prevent insider trading by adhering to regulations and laws governing insider trading, monitoring and reporting suspected insider trading, and seeking advice from legal professionals when in doubt. By working together to prevent insider trading, we can help ensure that financial markets remain fair and transparent for everyone. For general guidance about trading, consider speaking to a wealth management professional.What Is Insider Trading?

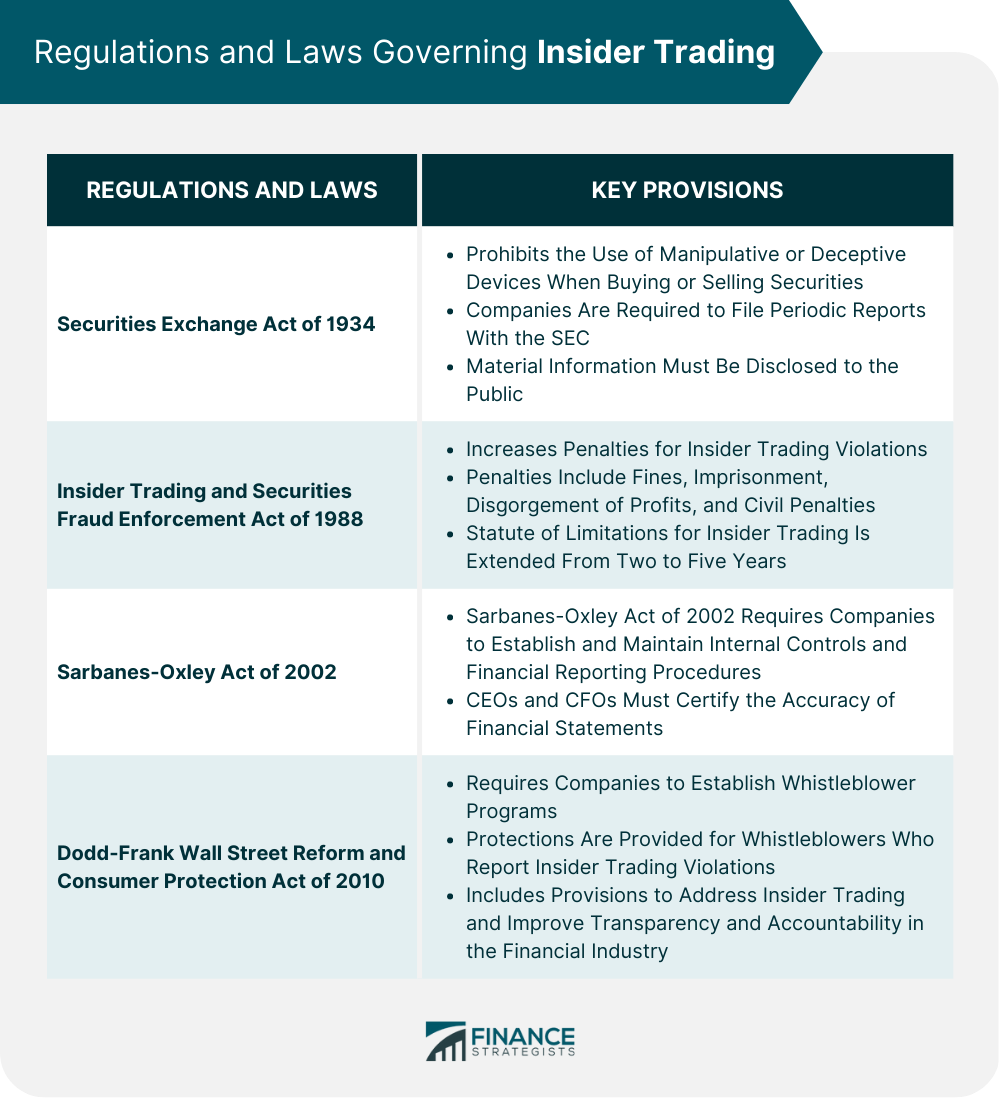

Regulations and Laws Governing Insider Trading

Securities Exchange Act of 1934

Insider Trading and Securities Fraud Enforcement Act of 1988

Sarbanes-Oxley Act of 2002

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

Prohibitions on Insider Trading

Illegal Trading

Penalties and Consequences of Insider Trading

Exceptions to Insider Trading

Insider Trading and the Financial Markets

Impact of Insider Trading on the Financial Markets

Ethical Considerations for Investors and Traders

Insider Trading and Market Efficiency

Preventing Insider Trading

Training and Education on Insider Trading

Monitoring and Reporting Suspected Insider Trading

Famous Cases of Insider Trading

Martha Stewart Case

Raj Rajaratnam Case

Steve Cohen Case

Final Thoughts

Insider Trading FAQs

Insider trading refers to the buying or selling of securities by individuals who have access to non-public information about a company or its securities.

Insider trading is illegal under US federal securities laws, and the penalties for violating insider trading laws can be severe, including fines, imprisonment, disgorgement of profits, and civil penalties.

Insider trading can create an unfair advantage for insiders, leading to a distortion of market prices, discouraging other investors from trading, and reducing liquidity. It can also harm market efficiency by affecting the extent to which prices reflect all available information.

Companies have insider trading policies and procedures to prevent insider trading, and individuals can abide by regulations and laws governing insider trading to ensure fair and transparent financial markets. This includes monitoring and reporting suspected insider trading, providing training and education on insider trading, and establishing whistleblower programs.

Some notable cases of insider trading include the Martha Stewart case, the Raj Rajaratnam case, and the Steve Cohen case. These cases highlight the importance of upholding the law and the potential consequences of insider trading.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.