Fitch Ratings is a globally recognized credit rating agency that provides independent credit opinions, research, and ratings for various entities, including governments, corporations, financial institutions, and structured finance products. Their ratings serve as an assessment of creditworthiness and provide insights into the risks associated with investments. Fitch Ratings plays a significant role in the financial industry by providing valuable information to investors, wealth managers, and other market participants. Fitch Ratings was established in 1913 and has since grown to become one of the leading credit rating agencies worldwide. With a rich history and experience spanning over a century, Fitch Ratings has developed a reputation for its analytical expertise and credibility in the financial markets. The agency has a global presence, with offices in major financial centers and a broad coverage of issuers and industries. Fitch Ratings' rigorous and transparent rating methodologies, along with their commitment to independence and objectivity, have contributed to their reputation as a trusted source of credit information. Their ratings provide valuable insights into the creditworthiness, financial stability, and default risk of issuers, enabling investors and wealth managers to make informed investment decisions. The agency's strong track record in accurately assessing credit risks has earned them the trust and reliance of market participants worldwide. Fitch Ratings plays a crucial role in the field of wealth management by providing valuable credit rating services and evaluating investment risks. Wealth managers rely on Fitch Ratings' assessments and ratings to make informed decisions regarding their clients' investment portfolios. The agency's credit ratings provide an objective evaluation of the creditworthiness and default risk of various investment options, including corporate bonds, government securities, and structured financial products. By utilizing Fitch Ratings' credit ratings, wealth managers can effectively assess the risk-reward profile of potential investments. The ratings provide insights into the financial stability, operational performance, and market risk factors associated with issuers. This helps wealth managers in selecting suitable investments that align with their clients' risk tolerance and investment objectives. The independent analysis and objective opinions provided by Fitch Ratings assist wealth managers in identifying opportunities and avoiding potential pitfalls in the investment landscape. Additionally, Fitch Ratings' research and analysis reports offer valuable market intelligence and industry insights that aid wealth managers in understanding broader economic trends, market risks, and regulatory developments. This information equips wealth managers with a comprehensive view of the investment landscape, enabling them to develop effective investment strategies and optimize portfolio performance for their clients. Fitch Ratings considers several key factors when assessing creditworthiness and evaluating investment risks in the context of wealth management: Fitch Ratings evaluates the creditworthiness of issuers by analyzing their financial health, debt repayment ability, and access to capital markets. Factors such as revenue generation, profitability, leverage ratios, and cash flow dynamics are considered to gauge the issuer's ability to meet its financial obligations. The agency assesses the credit risk associated with different issuers and assigns credit ratings accordingly, which provide insights into the likelihood of default. Fitch Ratings examines the financial performance and stability of issuers by assessing factors such as revenue growth, earnings stability, debt levels, and liquidity position. This analysis helps determine the issuer's ability to generate consistent cash flows, meet financial commitments, and withstand adverse market conditions. The agency evaluates the financial metrics of issuers over time to identify trends and assess the issuer's resilience to economic fluctuations. Fitch Ratings considers the market and industry risks associated with investments when providing credit ratings. This includes analyzing the competitive landscape, regulatory environment, market dynamics, and macroeconomic factors that can impact the issuer's operations and financial performance. By evaluating these risks, Fitch Ratings provides insights into the potential challenges that issuers may face and the impact on their creditworthiness. Fitch Ratings provides a comprehensive evaluation of investment risks in wealth management, empowering wealth managers to make informed decisions and construct well-diversified portfolios for their clients. Fitch Ratings offers several benefits to wealth managers and investors in the field of wealth management: Fitch Ratings' credit ratings provide valuable information that enables wealth managers to make more informed investment decisions. The ratings offer an independent assessment of creditworthiness, default risk, and financial stability of issuers. This helps wealth managers in evaluating investment options and selecting securities that align with their clients' risk tolerance and investment objectives. The transparent and reliable nature of Fitch Ratings' assessments enhances the decision-making process by providing a standardized framework for evaluating investment risks. Fitch Ratings' credit ratings help in mitigating investment risks and constructing well-diversified portfolios. By assessing the creditworthiness and default risk of issuers, wealth managers can identify potential risks and adjust their portfolio allocations accordingly. The ratings provide insights into the likelihood of default and the relative riskiness of different investment options. This allows wealth managers to spread their clients' investments across a range of securities with varying credit ratings, reducing the concentration risk and increasing the overall stability of the portfolio. Fitch Ratings' credit ratings play a significant role in facilitating access to capital markets for issuers. Higher credit ratings enhance an issuer's credibility and creditworthiness in the eyes of investors, making it easier for them to raise capital. Wealth managers can leverage Fitch Ratings' ratings to identify investment opportunities in the primary market, participate in initial public offerings (IPOs), and access new debt issuances. This broader access to capital markets provides wealth managers with a wider range of investment options to meet their clients' objectives. By utilizing Fitch Ratings' assessments and ratings, wealth managers can make more informed investment decisions, effectively manage investment risks, and gain access to a broader universe of investment opportunities. The independent and credible nature of Fitch Ratings' evaluations adds value to the wealth management process, ultimately benefiting investors and their portfolios. While Fitch Ratings is widely recognized and respected, there are some criticisms and limitations associated with their ratings: Critics argue that credit rating agencies like Fitch Ratings may be influenced by potential biases and conflicts of interest. The agencies rely on fees generated from issuers for their services, which could potentially create conflicts in their objectivity. Although regulatory frameworks aim to mitigate these conflicts, the possibility of bias still exists. Additionally, the agencies' reliance on publicly available information may limit their ability to obtain a complete and accurate picture of an issuer's financial health. Fitch Ratings, like other credit rating agencies, relies on historical financial data to assess creditworthiness and predict default risk. This approach assumes that historical trends will continue into the future. However, it may not capture sudden changes in an issuer's financial condition or unforeseen events that can significantly impact credit risk. The reliance on historical data poses limitations in assessing the dynamic nature of credit risk and may result in delayed or inadequate ratings adjustments. Credit ratings provided by Fitch Ratings are opinions based on available information and analysis at a particular point in time. The ratings reflect the agency's assessment of credit risk, but they are not infallible. Inaccurate ratings can occur due to limitations in data quality, unforeseen events, or changes in market conditions that were not anticipated. Investors and wealth managers should consider credit ratings as one piece of information among other factors when making investment decisions and conduct their own due diligence. It is important for wealth managers to be aware of the limitations of credit ratings and use them as a tool in conjunction with other research and analysis to make well-informed investment decisions. While Fitch Ratings provides valuable insights and analysis, it is essential to conduct thorough due diligence and consider other factors such as market trends, economic indicators, and issuer-specific information. Fitch Ratings is a leading credit rating agency that provides independent assessments of creditworthiness and risk for various entities and financial instruments. Their ratings serve as a valuable tool for investors and wealth managers in evaluating investment risks and making informed decisions. Fitch Ratings plays a crucial role in wealth management by offering credit rating services and evaluating investment risks. Wealth managers rely on their ratings to assess the creditworthiness of issuers and make informed investment decisions that align with their clients' risk profiles and investment objectives. The benefits of Fitch Ratings include enhanced investment decision-making, risk mitigation through portfolio diversification, and improved access to capital markets. However, it is important to acknowledge the limitations, such as potential biases, reliance on historical data, and the possibility of inaccurate ratings. Wealth managers should consider these factors and use Fitch Ratings' assessments as part of a comprehensive investment strategy. Fitch Ratings holds importance in the financial industry as an independent and reputable credit rating agency. Their assessments provide valuable insights into credit risks and assist wealth managers in managing investment risks, optimizing portfolios, and meeting their clients' financial goals.What Are Fitch Ratings?

Background of Fitch Ratings

Role of Fitch Ratings in Wealth Management

Factors Considered by Fitch Ratings in Wealth Management

Assessment of Creditworthiness

Analysis of Financial Performance and Stability

Evaluation of Market and Industry Risks

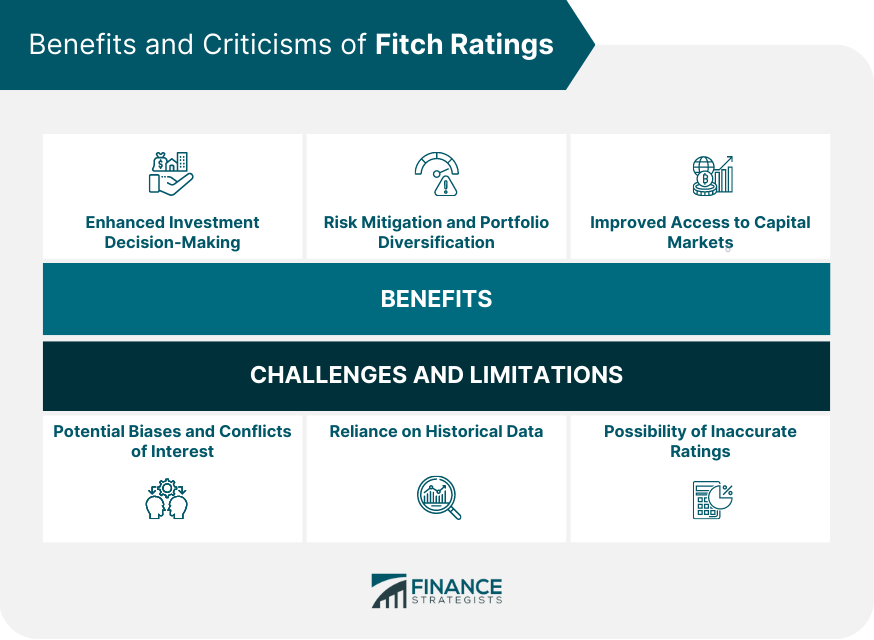

Benefits of Fitch Ratings

Enhanced Investment Decision-Making

Risk Mitigation and Portfolio Diversification

Improved Access to Capital Markets

Criticisms and Limitations of Fitch Ratings

Potential Biases and Conflicts of Interest

Reliance on Historical Data

Possibility of Inaccurate Ratings

Final Thoughts

Fitch Ratings FAQs

Fitch Ratings updates their credit ratings on an ongoing basis. The frequency of updates depends on various factors, such as the issuer's financial reporting schedule, material events, and changes in market conditions. Major rating updates are typically announced and communicated to the market promptly.

Yes, Fitch Ratings' credit ratings can change over time. The agency continuously monitors issuers' financial performance, industry dynamics, and economic conditions to assess credit risks. As new information becomes available or circumstances change, ratings may be revised to reflect the issuer's evolving creditworthiness.

Yes, Fitch Ratings' credit ratings are internationally recognized and widely used by market participants, including investors, wealth managers, and financial institutions. Their ratings provide a common language for evaluating credit risks and facilitate global investment decision-making.

Fitch Ratings' credit ratings reflect an assessment of creditworthiness based on historical data and analysis. While they provide insights into the issuer's financial health, they do not predict future financial performance with certainty. Investors and wealth managers should consider other factors, such as market trends and economic indicators, when forecasting future financial performance.

No, Fitch Ratings' credit ratings are just one factor to consider when making investment decisions. It is important to conduct comprehensive research, analyze market conditions, and assess issuer-specific factors. Investors and wealth managers should also consider their clients' risk tolerance, investment objectives, and other sources of information to make well-informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.