Contrarian investing is an investment strategy that involves making decisions opposite to the prevailing market sentiment. This approach is based on the belief that the majority of market participants often exhibit herd mentality, leading to the mispricing of assets. The philosophy of contrarian investing revolves around capitalizing on market inefficiencies and identifying undervalued or overvalued assets. Contrarian investors maintain a skeptical view of the market consensus and seek opportunities where the majority opinion may be incorrect. The potential benefits of contrarian investing include the possibility of achieving above-average returns and reduced exposure to market bubbles. However, contrarian investing also involves risks, such as the possibility of mistiming the market and facing short-term losses due to the persistence of prevailing trends. Contrarian investors believe that the majority of market participants often follow the herd, leading to the mispricing of assets. Investors aim to capitalize on these inefficiencies and exploit the market's overreactions by taking a contrarian stance. An essential aspect of contrarian investing is maintaining an independent mindset. Contrarian investors do not rely on popular opinion but rather conduct their own thorough research and analysis to make informed decisions. Contrarian investing is based on the premise that markets can be inefficient, leading to the mispricing of assets. These inefficiencies can be caused by various factors, such as investor overconfidence, irrational exuberance, or panic selling. To identify undervalued assets, contrarian investors employ various financial ratios and valuation metrics. These tools help investors assess a company's financial health, competitive position, and potential for growth, ultimately enabling them to make informed investment decisions. Contrarian investing requires patience and a long-term perspective, as the market may take time to recognize the true value of an asset. Contrarian investors must be prepared to wait for market sentiment to change and for their investment thesis to materialize. Contrarian investors need to be resilient in the face of short-term market fluctuations. By maintaining a long-term perspective, they can avoid making impulsive decisions based on temporary market trends and focus on the fundamental value of their investments. Value investing is a contrarian strategy that focuses on identifying undervalued stocks with strong fundamentals. Value investors believe that the market often overreacts to negative news or poor financial performance, creating opportunities to buy high-quality stocks at a discount. Investors analyze various financial ratios and metrics to identify value stocks, such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. These metrics help investors determine if a stock is trading below its intrinsic value and if it has the potential to generate above-average returns. Short selling is a contrarian strategy that involves selling borrowed shares of a stock with the expectation that the stock price will decline. Short sellers aim to profit from overvalued assets by selling high and later buying the shares back at a lower price to return them to the lender. Contrarian investors employing a short-selling strategy analyze financial ratios, valuation metrics, and market trends to identify overvalued assets. By examining factors such as high P/E ratios, excessive market hype, and unsustainable growth rates, they can determine if a stock is overpriced and may be due for a correction. Market timing is a contrarian investment strategy that involves making buy or sell decisions based on predictions of future market movements. Contrarian investors who engage in market timing aim to capitalize on market cycles and trends by identifying turning points and making investment decisions accordingly. Contrarian investors analyze various economic indicators, historical data, and technical analysis tools to identify market cycles and trends. By recognizing patterns in market behavior, they can make informed decisions about when to enter or exit specific investments, potentially generating above-average returns. Herd mentality is a cognitive bias that causes investors to follow the crowd in making investment decisions. Contrarian investors recognize that herd behavior often leads to market inefficiencies and mispricing of assets, providing opportunities for those who go against the grain. Confirmation bias is the tendency to seek out and prioritize information that confirms one's existing beliefs, while ignoring contradictory evidence. Contrarian investors must be aware of this bias and remain open to alternative viewpoints in order to make unbiased investment decisions. Overconfidence is a cognitive bias that leads investors to overestimate their abilities, knowledge, and the accuracy of their predictions. Contrarian investors should maintain a healthy skepticism of their abilities and recognize their knowledge's limitations to avoid falling victim to overconfidence. Emotional discipline is crucial for contrarian investors, as it enables them to remain rational and objective in the face of market fluctuations. By controlling emotions and maintaining a long-term perspective, contrarian investors can avoid making impulsive decisions based on short-term market trends. Fear and greed are powerful emotions that can drive investor behavior and lead to irrational decision-making. Contrarian investors must learn to manage these emotions and maintain a balanced approach, avoiding excessive fear and optimism. A well-diversified portfolio includes a mix of contrarian and conventional investments, which can help to reduce overall risk and provide exposure to various market conditions. This approach ensures that investors do not become overly reliant on a single investment strategy. Proper asset allocation is key to managing risk in a contrarian investment portfolio. By allocating assets across different asset classes and investment strategies, investors can mitigate the risks associated with market volatility and economic downturns. To construct a contrarian investment portfolio, investors must identify undervalued or overvalued assets and select investment opportunities based on thorough research and analysis. This process involves using financial ratios, valuation metrics, and market trends to make informed decisions. Contrarian investing should be incorporated within a broader investment plan that includes a range of strategies and asset classes. This approach ensures that the overall portfolio remains diversified and resilient in the face of changing market conditions. Regularly reviewing the performance of a contrarian investment portfolio and monitoring market conditions is essential for maintaining its effectiveness. This process helps investors identify opportunities for adjustment and rebalancing, ensuring that the portfolio remains aligned with their investment goals. Rebalancing and adjusting positions within a contrarian investment portfolio is an important aspect of portfolio management. This process involves realigning the portfolio's asset allocation, taking into account changes in market conditions and individual investment performance. Contrarian investing offers the potential for above-average returns and reduced exposure to market bubbles, but also involves risks such as mistiming the market and short-term losses. Investors can make informed decisions and navigate these challenges by understanding the key principles, strategies, and psychological aspects of contrarian investing. Incorporating contrarian investing as part of a balanced investment strategy helps to diversify risk and provide exposure to various market conditions. A well-rounded portfolio includes a mix of contrarian and conventional investments, ensuring resilience and flexibility in the face of changing market dynamics. Successful contrarian investing requires continuous learning and adaptation to evolving market conditions. Investors must remain vigilant, open to new information, and prepared to adjust their strategies as needed to capitalize on market inefficiencies and mispriced assets. To further explore the potential of contrarian investing and develop a tailored investment strategy, consider seeking the guidance of professional wealth management services. Expert advisors can help you navigate the complexities of contrarian investing and create a diversified, risk-adjusted portfolio that aligns with your financial goals and risk tolerance.What Is Contrarian Investing?

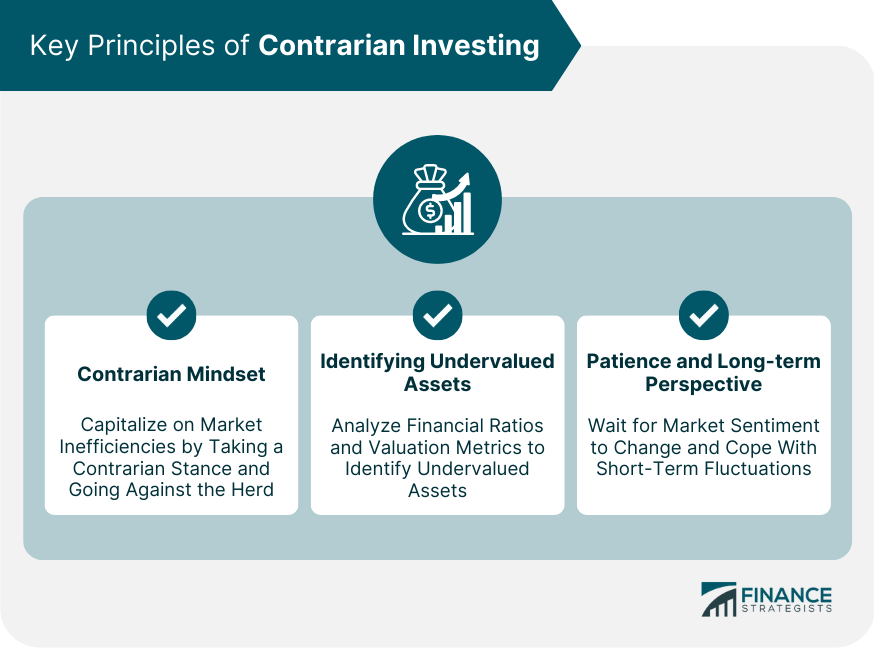

Key Principles of Contrarian Investing

Contrarian Mindset

Going Against the Herd Mentality

Embracing Independent Thinking

Identifying Undervalued Assets

Market Inefficiencies

Analyzing Financial Ratios and Valuation Metrics

Patience and Long-term Perspective

Waiting for Market Sentiment to Change

Coping with Short-term Fluctuations

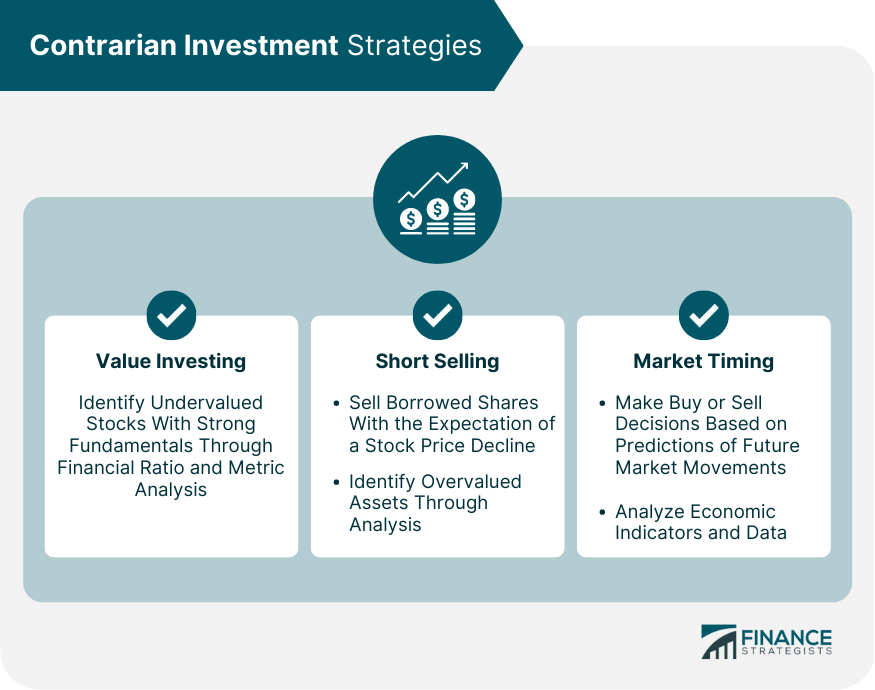

Contrarian Investment Strategies

Value Investing

Short Selling

Market Timing

Behavioral Finance and Contrarian Investing

Cognitive Biases Affecting Investment Decisions

Herd Mentality

Confirmation Bias

Overconfidence

Psychological Aspects of Contrarian Investing

Emotional Discipline

Managing Fear and Greed

Implementing a Contrarian Investment Approach

Diversification and Risk Management

Balancing Contrarian and Conventional Investments

Managing Risk through Asset Allocation

Portfolio Construction

Selecting Contrarian Investment Opportunities

Incorporating Contrarian Strategies within a Broader Investment Plan

Monitoring and Adjusting the Contrarian Investment Portfolio

Reviewing Performance and Market Conditions

Rebalancing and Adjusting Positions

Final Thoughts

Contrarian Investing FAQs

Contrarian investing is an investment strategy that involves making decisions opposite to the prevailing market sentiment. This approach is based on the belief that the majority of market participants often exhibit herd mentality, leading to the mispricing of assets.

The key principles of contrarian investing include embracing independent thinking, going against the herd mentality, identifying undervalued assets, and having patience and a long-term perspective.

Contrarian investment strategies include value investing, short selling, and market timing. These strategies involve identifying undervalued or overvalued assets and making investment decisions based on market inefficiencies and trends.

Investors can manage risk when implementing a contrarian investment approach by diversifying their portfolio, balancing contrarian and conventional investments, and managing risk through asset allocation. Regularly reviewing the performance of the portfolio and monitoring market conditions is also essential for maintaining its effectiveness.

Incorporating contrarian investing as part of a balanced investment strategy helps to diversify risk and provide exposure to various market conditions. A well-rounded portfolio includes a mix of contrarian and conventional investments, ensuring resilience and flexibility in the face of changing market dynamics.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.