The Joseph Effect is a term in financial market theory referring to the persistence of trends over time, indicating that price changes are not entirely random and can often exhibit a degree of autocorrelation. Named after the biblical story of Joseph, who predicted seven years of abundance followed by seven years of famine in Egypt, this effect suggests that periods of market growth and contraction can persist longer than expected. Understanding the Joseph Effect can help investors better predict and navigate long-term market trends. However, it's essential to note that while the Joseph Effect might indicate a tendency for trends to persist, it does not guarantee specific outcomes. In the context of financial markets, the Joseph Effect challenges the Efficient Market Hypothesis by suggesting that past performance can, to some degree, inform future results. The Joseph Effect is rooted in a narrative from the Bible, where Joseph, using his prophetic abilities, anticipates seven years of prosperity, succeeded by seven years of scarcity in Egypt. He advises Pharaoh to store grain during the years of plenty to provide for the famine years. This biblical story has been analogized to financial markets, where periods of volatility are often followed by periods of calm and vice versa. The financial interpretation of the Joseph Effect suggests that large price changes tend to be followed by more large price changes, and small price changes are likely to be succeeded by more small changes. This concept contradicts the Efficient Market Hypothesis, which asserts that price changes are independent and identically distributed. Benoit Mandelbrot, a Polish-born French-American mathematician, is widely recognized for his research in fractal geometry. His work in the field of finance led to the introduction of the Joseph Effect. Mandelbrot's findings were crucial in showing the burstiness and long-range dependence found in financial data, an insight that has had a profound influence on financial modeling and forecasting. The Fractal Market Hypothesis presents a more nuanced view of market behavior compared to the EMH. It accounts for the fact that markets are made up of investors who operate on different investment horizons and use different information sets to make decisions. The Joseph Effect is central to the Fractal Market Hypothesis. This hypothesis posits that markets exhibit a fractal structure, implying the existence of patterns that repeat at different scales. This effect implies that market trends and volatility are often persistent, characterized by long periods of trend and volatility clustering, hence challenging the EMH. Unlike the EMH, which suggests that market prices are always at their "fair value" and instantly reflect all available information, the FMH, and the Joseph Effect assume that market participants interpret and react to information differently, causing persistent patterns and trends. These differences underline the more realistic, albeit complex, interpretation of financial markets by the FMH compared to the EMH. The long memory phenomenon, an important aspect of the Joseph Effect, describes a situation where market changes display dependencies over long time periods. In essence, the long memory phenomenon suggests that market fluctuations have 'memory,' and what occurs now can influence events far into the future. Given its nature, the Joseph Effect suggests some degree of predictability in financial markets, as trends and periods of volatility tend to persist. This stands in contrast to the EMH, which posits that markets move in a "random walk," and therefore, future price movements cannot be predicted based on past information. While the Joseph Effect suggests some market predictability, it's critical to understand its limitations. The existence of long-term dependencies doesn't guarantee profitable trading opportunities, primarily due to transaction costs, risk, and the potential for abrupt changes in market conditions. In stock market analysis, the Joseph Effect has been instrumental in understanding and modeling volatility clustering. Traders often use this information to make informed decisions about their risk exposure. The foreign exchange (Forex) market, with its high liquidity and 24-hour trading, is also known for volatility clustering. Traders who understand the Joseph Effect can potentially capitalize on these patterns to generate trading signals. In the volatile and relatively new field of cryptocurrencies, the Joseph Effect's implications are increasingly being explored. Trends and volatility clustering can be especially pronounced in cryptocurrency markets, providing a rich area for applying the Joseph Effect. While the Joseph Effect offers valuable insights, it's important to avoid overinterpreting its implications. It does not imply that markets are predictable in a simple or linear way. Understanding the Joseph Effect is more about recognizing the market's potential for persistent trends and volatility. One of the key challenges in applying the Joseph Effect in trading is the difficulty of precisely timing entries and exits. While it may signal periods of increased volatility or trending behavior, it does not offer specific price level predictions. The Joseph Effect, though valuable, is only one facet of market dynamics. Other factors, such as economic indicators, political events, and technological changes, can also significantly influence financial markets, sometimes causing sudden shifts that diverge from the expected patterns. The Joseph Effect presents a compelling argument challenging the Efficient Market Hypothesis by underscoring the persistence of financial market trends. Derived from the biblical narrative of Joseph, it suggests that markets exhibit autocorrelation, which can inform future trends. This concept has found significant application in stock market analysis, forex trading, and the burgeoning field of cryptocurrencies, providing valuable insights into volatility clustering. However, the Joseph Effect has limitations. While indicating the potential for trend persistence, it doesn't offer specific price level predictions and can't account for sudden shifts caused by external factors like economic indicators or political events. As the field of fractal finance evolves, the integration of the Joseph Effect into advanced trading algorithms promises to enhance risk management and trading efficiency, reaffirming its crucial role in understanding complex market dynamics.Overview of the Joseph Effect

Origin and Concept

Biblical Connection

Financial Interpretation

Introduction to Benoit Mandelbrot and His Work

Joseph Effect and Fractal Market Hypothesis

Understanding the Fractal Market Hypothesis (FMH)

Role of the Joseph Effect in FMH

Comparison Between FMH and Efficient Market Hypothesis (EMH)

Understanding the Joseph Effect in Financial Markets

Long Memory Phenomenon

Implications of the Joseph Effect on Market Predictability

Limitations of the Joseph Effect in Market Forecasting

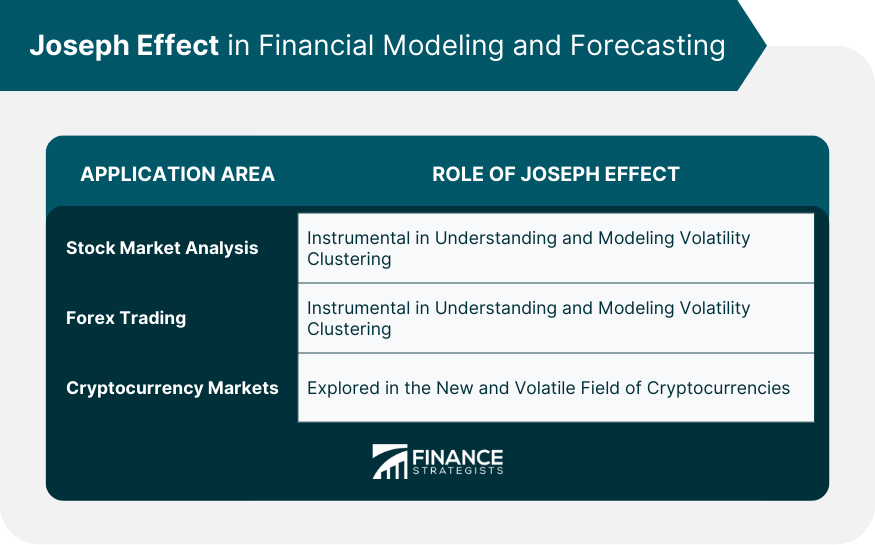

Joseph Effect in Financial Modeling and Forecasting

Joseph Effect on Stock Market Analysis

Application of the Joseph Effect in Forex Trading

Role of the Joseph Effect in Cryptocurrency Markets

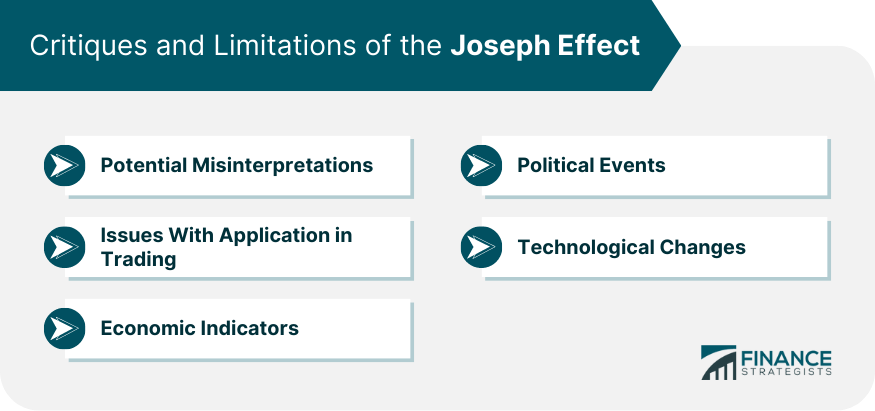

Critiques and Limitations of the Joseph Effect

Potential Misinterpretations of the Joseph Effect

Issues With Applying the Joseph Effect in Financial Trading

Other Limitations

Conclusion

Joseph Effect FAQs

The Joseph Effect refers to a market phenomenon where large price changes tend to be followed by more large price changes, and small price changes are likely to be succeeded by more small changes. It is named after the biblical character Joseph and suggests some level of predictability in financial markets.

The Joseph Effect is central to the Fractal Market Hypothesis (FMH). FMH posits that financial markets exhibit a fractal structure with patterns repeating at different scales. This pattern repetition suggests that market trends and volatility, aspects central to the Joseph Effect, are often persistent, challenging the Efficient Market Hypothesis.

In stock market analysis, the Joseph Effect aids in understanding and modeling volatility clustering, which are periods during which price changes are large (either up or down), followed by periods during which changes are small. This understanding helps traders make informed decisions about risk exposure.

The Joseph Effect's implications can be explored in Forex trading and cryptocurrency markets, which are known for their volatility. By understanding and leveraging the persistence of volatility in these markets, traders can potentially generate profitable trading signals.

The future implications of the Joseph Effect are expansive. With continued innovations in fractal finance and the integration of the Joseph Effect into advanced trading algorithms, the concept promises to further refine financial forecasting and trading. However, ongoing research is needed to fully harness its potential.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.