Smart contracts on the blockchain are self-executing agreements with the terms of the contract embedded directly into lines of code. These contracts are stored on a decentralized blockchain network, enabling parties to deal directly with each other without the need for intermediaries. Smart contracts go beyond simple contractual clauses. They embody sophisticated logic that automates the contractual process, including the execution and enforcement of agreed-upon terms. Essentially, smart contracts serve as trusted, programmable scripts that automate the process of contract execution. Each smart contract is a program stored on the blockchain that runs when pre-set conditions are met. The rules of the agreement are hard-coded into the contract. When those conditions are met, the smart contract automatically executes the corresponding contractual clause. In a simple, smart contract for a bet on a soccer match, the contract could be programmed to pay out to one party if Team A wins and the other if Team B wins. Once the match result is input into the blockchain, the smart contract automatically enforces the outcome, distributing the winnings as programmed. They are programmed to run automatically once certain conditions are met, eliminating the need for human intervention. This self-execution dramatically streamlines contract enforcement and helps reduce costs and inefficiencies. These smart contracts don't just 'execute'; they enforce the rules of the agreement, too. Due to the decentralized architecture of blockchain, the contract's rules are transparent to all parties involved and cannot be altered or ignored, ensuring the sanctity of the contract. Blockchain's decentralized nature brings about another key advantage—enhanced trust and transparency. Because these smart contracts live on a shared and synchronized database visible to all parties involved, they guarantee transparency of contractual terms. Moreover, due to their decentralized and cryptographic nature, smart contracts foster trust among participants. In traditional contracts, trust is often imposed by a centralized authority or legal system, whereas, in the blockchain world, trust is inherent in the system's design. Once a smart contract is deployed on a blockchain, it cannot be modified, ensuring the permanence of the contract terms. In addition, this immutability makes smart contracts inherently tamper-proof. This is because changing even a single bit of a smart contract's data would result in a completely different hash output, making any alteration quickly detectable and preventing fraudulent activities. By embedding payment conditions into smart contracts, businesses can automate their payment processes, significantly reducing the time and cost associated with traditional payment systems. Consider a smart contract between a content creator and a platform that agrees to pay per view. Once the view count reaches a certain number, the smart contract can automatically trigger a payment to the content creator's digital wallet, eliminating delays and reducing administrative overhead. They serve as the backbone for decentralized lending and borrowing platforms, enabling peer-to-peer lending without the need for intermediaries. For example, borrowers can take out loans by depositing collateral into a smart contract. The smart contract then issues the loan and automatically manages the repayment schedule and interest calculations, effectively becoming a 'bank' without the need for a centralized authority. In the insurance industry, smart contracts could transform the way risk is managed, and claims are processed. Insurance policies written as smart contracts on the blockchain can automate claim payouts, reducing administrative costs and increasing efficiency. For instance, a travel insurance policy could be written as a smart contract that automatically pays out when a certain flight is canceled. The blockchain could receive flight status data from trusted sources, and if a cancellation occurs, the smart contract would automatically execute the payout to the insured. Smart contracts can bring unprecedented transparency and efficiency to supply chain finance. They enable real-time visibility of goods as they move through a supply chain, and automatic payments can be triggered at each stage of the process. For instance, a smart contract could be set up to automatically release payment to a supplier once a shipping company confirms the receipt of goods. This reduces payment delays and disputes, ensuring smoother and more efficient supply chain operations. By automating contractual obligations and eliminating the need for intermediaries, smart contracts can speed up business processes and reduce administrative and enforcement costs. Smart contracts also remove the need for paperwork, leading to a more streamlined, digital process. This reduction in paperwork not only saves time and money but also decreases the chance of manual errors and misinterpretations that can lead to costly legal disputes. Due to the cryptographic and tamper-proof nature of blockchain, smart contracts are highly secure and resistant to hacking. Additionally, the transparency of smart contracts can deter fraudulent activity, as every transaction is recorded and visible on the blockchain. Furthermore, smart contracts execute automatically once their conditions are met, meaning that they cannot be manipulated or ignored. This reduces the risk of non-performance or breach of contract. Every smart contract is visible to all parties involved, and all transactions are recorded on the blockchain. This transparency fosters a sense of trust, as no party can alter the contract after it is written, and every contractual action is traceable. Moreover, because blockchain is a decentralized system, there is no need for a trusted intermediary to enforce contracts. Trust is instead built into the system itself, as the contract execution is automated and guaranteed by the smart contract. The legal status of smart contracts is still unclear in many jurisdictions, and there are questions about how they would be treated in court. The lack of regulation and legal precedent creates uncertainty, which may discourage some businesses from adopting smart contracts. There are also issues around jurisdiction and enforceability. Since blockchain operates globally, it can be unclear which jurisdiction's laws apply to a smart contract. Moreover, enforcing a smart contract's obligations in the real world can be challenging, as the law may not recognize the automated actions of a smart contract as legally binding. There is currently no standardized programming language for smart contracts, and different blockchain platforms use different languages. This lack of standardization can create barriers to the widespread adoption of smart contracts. In addition, smart contracts on different blockchain platforms are not inherently interoperable. This means that a smart contract on the Ethereum blockchain, for example, cannot directly interact with one on the Bitcoin blockchain. This lack of interoperability can limit the utility and efficiency of smart contracts. Bugs and errors in the contract's code can lead to unintended consequences, potentially causing significant financial losses. Unlike traditional contracts, once a smart contract is deployed on the blockchain, it cannot be easily altered or stopped, making it crucial to thoroughly test and audit the code before deployment. Moreover, while the blockchain itself may be secure, the external systems that the smart contract interacts with, called "oracles," can present security risks. If an oracle is compromised, it could feed false data to the smart contract, leading to incorrect contract execution. Smart contracts on blockchain technology offer increased efficiency, enhanced security, and improved trust and transparency in finance. They automate contractual obligations, reduce administrative costs, and eliminate intermediaries, resulting in streamlined processes and cost savings. The tamper-proof nature of blockchain ensures the integrity and security of smart contracts, while their transparency fosters trust among participants. However, challenges such as legal and regulatory considerations, standardization issues, and smart contract vulnerabilities exist. The legal status and enforceability of smart contracts vary across jurisdictions, hindering their widespread adoption. Lack of standardization and interoperability limits their efficiency, and code bugs and security risks pose potential threats. Addressing these challenges, along with establishing proper governance and regulation, will be crucial for realizing the full potential of smart contracts on blockchain in revolutionizing the finance industry.What are Smart Contracts on Blockchain?

How Do Smart Contracts on Blockchain Work?

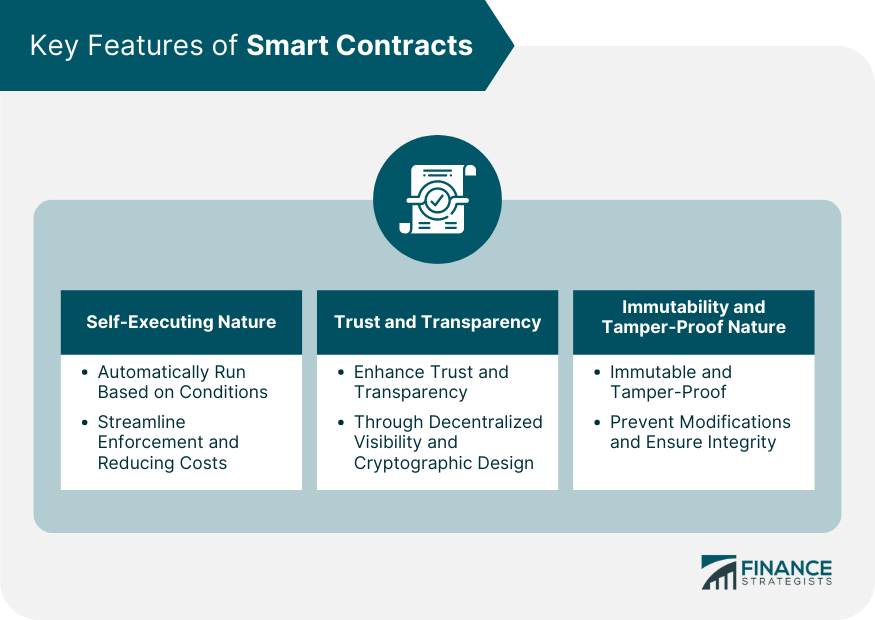

Key Features of Smart Contracts

Self-Executing Nature

Trust and Transparency

Immutability and Tamper-Proof Nature

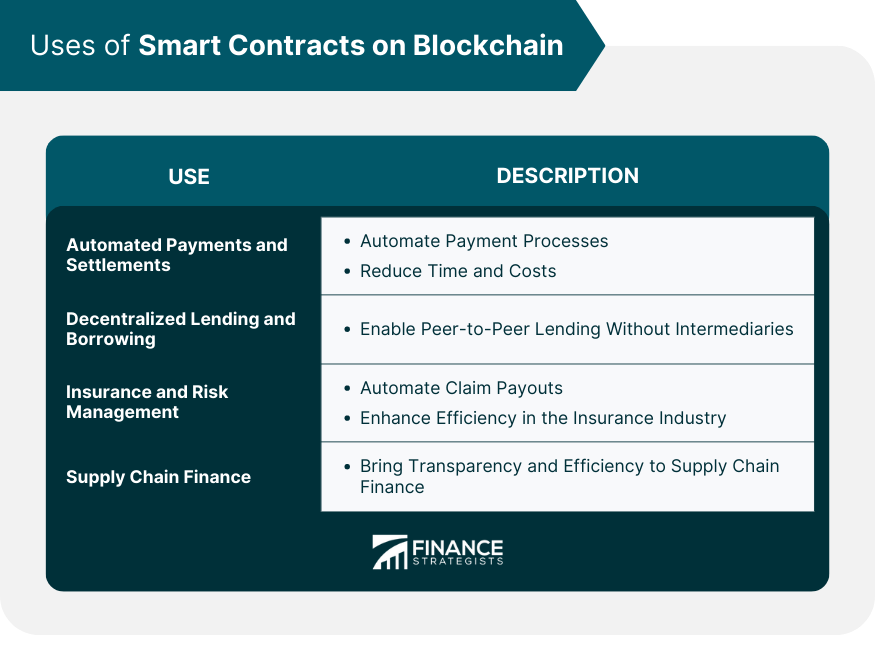

Uses of Smart Contracts on Blockchain

Automated Payments and Settlements

Decentralized Lending and Borrowing

Insurance and Risk Management

Supply Chain Finance

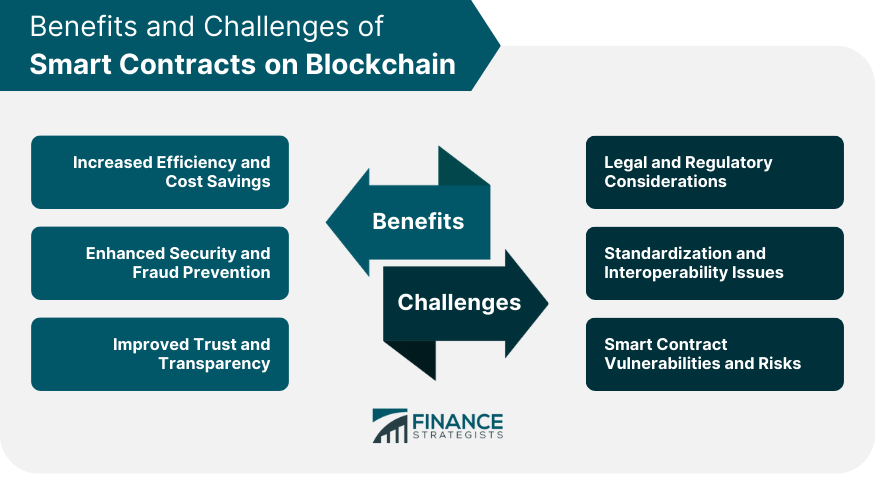

Benefits of Smart Contracts on Blockchain

Increased Efficiency and Cost Savings

Enhanced Security and Fraud Prevention

Improved Trust and Transparency

Challenges of Smart Contracts on Blockchain

Legal and Regulatory Considerations

Standardization and Interoperability Issues

Smart Contract Vulnerabilities and Risks

Conclusion

Smart Contracts on Blockchain FAQs

A smart contract is a self-executing contract with the terms of the agreement directly written into code. Stored on a decentralized blockchain network, it allows parties to transact directly with each other without needing intermediaries.

Smart contracts work by embedding the rules of an agreement into code. When predetermined conditions are met, the smart contract automatically executes the corresponding terms of the contract without requiring human intervention.

Smart contracts have a wide range of applications, including automated payments and settlements, decentralized lending and borrowing in DeFi, insurance, and risk management, and supply chain finance.

Smart contracts offer several benefits, including increased efficiency and cost savings by automating contractual obligations, enhanced security, and fraud prevention due to the tamper-proof nature of blockchain, and improved trust and transparency as all transactions are recorded and visible on the blockchain.

Despite their advantages, smart contracts face several challenges, including legal and regulatory considerations, standardization and interoperability issues, and potential vulnerabilities and risks in the contract's code or the external systems it interacts with.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.