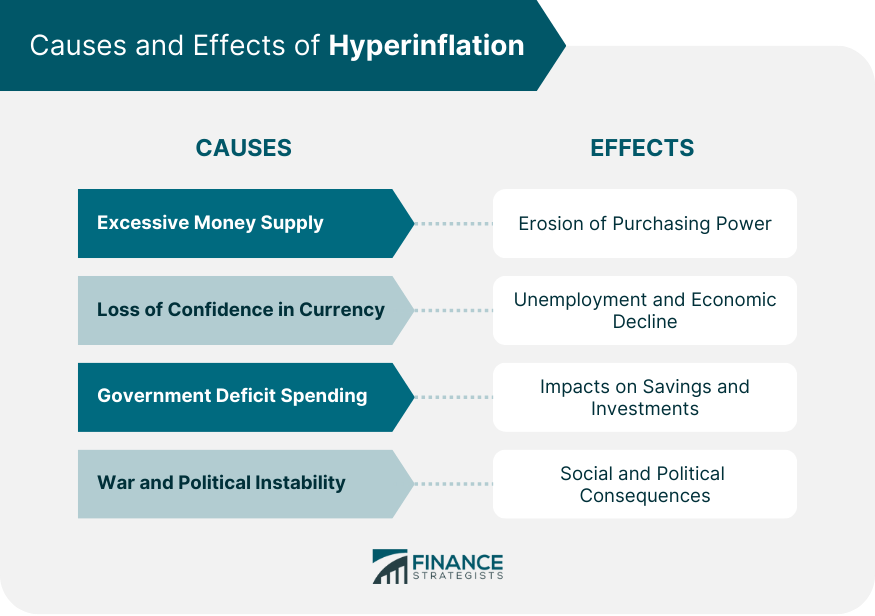

Hyperinflation refers to an extreme and rapid rise in the prices of goods and services within an economy, leading to a significant loss of the currency's purchasing power. It's an economic cataclysm where prices skyrocket, often doubling in a matter of days or even hours. This phenomenon is often characterized by a monthly inflation rate exceeding 50% and can result in severe economic instability and social consequences. Hyperinflation can undermine confidence in the national currency, deplete savings, and disrupt normal economic activities. It is typically caused by factors such as excessive money supply, loss of confidence in the currency, and unsustainable government fiscal policies. Historical examples of hyperinflation include the Weimar Republic in Germany during the 1920s and Zimbabwe in the late 2000s. When a country prints money without a corresponding growth in goods and services, it dilutes the value of each monetary unit. Too much money chasing too few goods can lead to a rapid increase in prices, sparking the nightmare of hyperinflation. Confidence is the bedrock of any currency. When people begin doubting their currency's value, they tend to hold tangible assets or foreign currencies instead. This rejection can escalate into a vicious cycle: as confidence dwindles, demand for the local currency drops, pushing its value further down, leading to higher prices and eroding trust even more. Governments, at times, finance their expenditure by printing money rather than borrowing or raising taxes. While it might seem like a quick fix, it's a double-edged sword. Pumping more money without concurrent economic growth or productivity can lead to hyperinflation, as the money supply outpaces demand. In times of war or significant political upheaval, normal economic activities can be disrupted, leading to a decline in the production of goods and services. Concurrently, governments might print more money to fund war efforts. The lethal combination of reduced supply and increased money can fan the flames of hyperinflation. The most immediate and palpable effect of hyperinflation is the drastic erosion of purchasing power. With prices spiraling upwards, money's worth diminishes by the day, hour, or even minute. Suddenly, life savings might only be enough for a loaf of bread, and salaries, however hefty, may not cover basic necessities. Hyperinflation is an economic wrecking ball. With prices changing rapidly, businesses struggle to set prices, leading to reduced consumer spending. As sales plummet, companies may be forced to lay off workers or shut down, resulting in increased unemployment and economic stagnation. The financial landscape becomes a minefield during hyperinflation. Savings evaporate, and the real value of investments can plunge. Interest rates may not keep pace with inflation, leading to negative real interest rates. As a result, traditional investment avenues might turn unattractive, pushing people towards more volatile options. Beyond economics, hyperinflation can have profound social and political ramifications. As life savings vanish and unemployment rises, social unrest and crime rates can increase. Politically, governments might face severe backlash, and in extreme cases, hyperinflation can catalyze regime changes or revolutions. Combatting hyperinflation often requires a tight leash on the money supply. Central banks can hike interest rates, making borrowing expensive and saving attractive. By reining in the excessive flow of money, economies can stabilize and regain trust. Government spending plays a pivotal role. Fiscal discipline involves reducing deficit spending, possibly by slashing non-essential expenditures or raising taxes. A balanced budget can alleviate the need to print excessive money, mitigating the risk of hyperinflation. Sometimes, to regain trust, a complete currency overhaul is necessary. This might involve introducing a new currency or pegging the local currency to a stable foreign one. Such reforms, while drastic, can restore faith and stabilize the economy. At times, nations grappling with hyperinflation turn to international organizations like the International Monetary Fund for assistance. External support can come in the form of loans, advice, or stabilization measures, helping countries navigate the treacherous waters of hyperinflation. In the face of hyperinflation, diversifying assets becomes crucial. Holding a mix of foreign currencies, tangible assets like gold, and other investments can shield wealth from hyperinflation's devastating effects. While hyperinflation ravages traditional investments, it also presents opportunities. Investing in tangible assets, real estate, or stocks of companies with real assets can offer protection. The key is flexibility and the ability to adapt to changing economic landscapes. Understand the signs of hyperinflation and have a plan in place. This might involve consulting financial experts, adjusting investment portfolios, or considering international diversification to safeguard assets. Hyperinflation is a cataclysmic economic phenomenon characterized by an extreme and rapid rise in prices, causing a loss of purchasing power in a currency. Excessive money supply, loss of confidence in the currency, government deficit spending, and political instability are the primary causes of hyperinflation. Its effects include the erosion of purchasing power, unemployment, financial instability, and social unrest. Combatting hyperinflation requires tight monetary policy, fiscal discipline, currency reforms, and international assistance. To prepare for hyperinflation, diversifying assets, adopting flexible investment strategies, and implementing risk management plans are essential. Understanding the nature of hyperinflation and being proactive in safeguarding wealth can mitigate its devastating impact and protect individuals and economies from its destructive consequences.What is Hyperinflation?

Causes of Hyperinflation

Excessive Money Supply

Loss of Confidence in Currency

Government Deficit Spending

War and Political Instability

Effects of Hyperinflation

Erosion of Purchasing Power

Unemployment and Economic Decline

Impacts on Savings and Investments

Social and Political Consequences

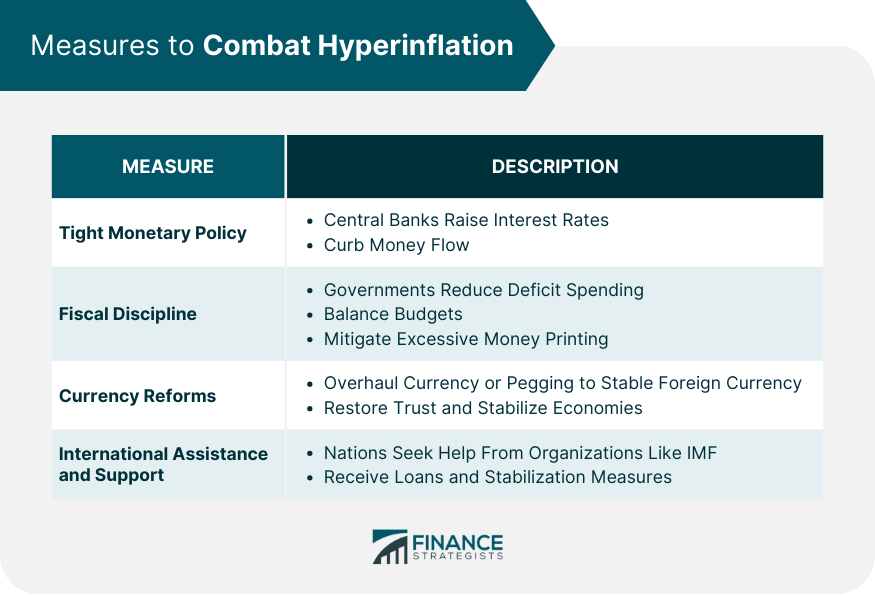

Measures to Combat Hyperinflation

Tight Monetary Policy

Fiscal Discipline

Currency Reforms

International Assistance and Support

How to Prepare for Hyperinflation

Diversify Assets

Invest Strategically

Manage Risk

Conclusion

Hyperinflation FAQs

Hyperinflation arises when there's a rapid and unchecked increase in the money supply, not supported by a corresponding growth in goods and services. This can be due to excessive money printing, loss of confidence in currency, deficit government spending, or external factors like war.

Hyperinflation erodes purchasing power, meaning people need more money to buy the same goods. This can deplete life savings, lead to unemployment, and generally disrupt normal economic activities, causing financial and psychological distress.

While both involve a rise in prices, hyperinflation is an extreme form where prices increase exponentially in a short period, often more than 50% a month. Regular inflation, though it might erode purchasing power, is typically slower and less disruptive.

Recovery often requires a combination of measures like tight monetary policy, fiscal discipline, currency reforms, and sometimes, international assistance. Restoring confidence in the currency and stabilizing the economy are paramount.

While not impossible, hyperinflation is less likely in developed economies with established financial systems, checks and balances, and historical adherence to fiscal and monetary policies. However, economic mismanagement can lead to crises in any country.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.