Yellow Sheets refer to a daily publication providing information on bond and money market prices, as well as other relevant financial data. Yellow Sheets offer a wealth of information beyond just bond and money market prices. They are widely used in the financial industry for market analysis, investment decision-making, and tracking fixed-income securities. They provide comprehensive and consolidated information on bond and money market prices, enabling wealth managers to make informed investment decisions, assess risk and performance, and enhance their market insights and analysis. Apart from providing up-to-date pricing data, Yellow Sheets also offer details on bid and ask prices, yields, maturity dates, and other relevant financial indicators. By utilizing Yellow Sheets, financial professionals gain a competitive edge by enhancing their understanding of the bond and money market landscape and gaining valuable market insights that can guide their strategies. Yellow Sheets have a long-standing history in the financial industry. They originated as a physical publication, printed on yellow paper, and were used by market participants to exchange information on bond prices and trading activity. Over time, Yellow Sheets have evolved in format and distribution. With advancements in technology, they are now often available electronically and offer a wider range of financial data, catering to the changing needs of wealth managers and market participants. Yellow Sheets provide a comprehensive listing of bond and money market prices. This includes information on various types of bonds, such as government bonds, corporate bonds, municipal bonds, and asset-backed securities. Yellow Sheets also offer detailed information on corporate and municipal bonds. This includes the issuer's name, bond characteristics, maturity date, coupon rate, and yield. Such information is essential for wealth managers to assess the risk and potential returns of these securities. The yield and price data provided in Yellow Sheets enable wealth managers to monitor the performance of fixed-income securities. This data helps in evaluating the relative attractiveness of different bonds and making investment decisions based on prevailing market conditions. In addition to bond and money market information, Yellow Sheets often include other relevant financial data. This can include interest rate data, foreign exchange rates, and economic indicators. This comprehensive information helps wealth managers to conduct in-depth market analysis and make well-informed investment decisions. Wealth managers rely on the information provided in Yellow Sheets to understand market trends, assess the performance of fixed-income securities, and identify potential investment opportunities. Yellow Sheets help wealth managers in tracking and evaluating fixed-income securities. By monitoring bond prices, yields, and other relevant data, wealth managers can assess the risk and potential returns of various bonds in their portfolios. Yellow Sheets facilitate the identification of investment opportunities. Wealth managers can use the information provided to identify bonds that are undervalued or offer attractive yields. This enables them to capitalize on market inefficiencies and generate returns for their clients. Yellow Sheets provide wealth managers with the necessary data to assess the risk and performance of fixed-income securities. By analyzing historical data, yield trends, and other relevant information, wealth managers can make informed decisions regarding portfolio allocation and risk management. Yellow Sheets provide wealth managers with comprehensive and consolidated information on bond and money market prices. This saves time and effort by offering a single source for accessing a wide range of financial data. Yellow Sheets enhance market insights and analysis for wealth managers. The detailed information on bond prices, yields, and other financial data enables them to gain a deeper understanding of market trends and dynamics. With the comprehensive data available in Yellow Sheets, wealth managers can make more informed investment decisions. They can assess the risk and potential returns of different fixed-income securities and align their investment strategies accordingly. Yellow Sheets support portfolio diversification efforts. By providing information on various types of bonds and money market instruments, wealth managers can identify opportunities to diversify their portfolios and manage risk more effectively. One limitation of Yellow Sheets is their reliance on historical data. While they provide valuable insights into past bond prices and yields, they may not capture real-time market conditions or account for future developments. Yellow Sheets may not provide real-time information on bond prices and trading activity. This can limit their usefulness in fast-paced markets where up-to-date information is crucial for making timely investment decisions. Yellow Sheets primarily focus on bond and money market data, which may be seen as a limitation by wealth managers who require a broader range of financial information to make comprehensive investment decisions. Yellow Sheets refer to a financial publication that provides stock quotes, trading information and other relevant financial data. Originally printed on yellow paper, served as an essential resource for investors and traders. The publication included details such as bid and ask prices, trading volume, and other relevant data for. Yellow Sheets played a crucial role in facilitating transparency and access to information for securities. They allowed investors to track stock performance, make informed trading decisions, and assess the liquidity and trading activity of stocks. The benefits of Yellow Sheets included increased market visibility and the ability to identify potential investment opportunities. However, with the digitization of financial markets, Yellow Sheets have become less prevalent, and investors now rely on electronic platforms for up-to-date trading information.What Are Yellow Sheets?

History of Yellow Sheets

Origin and Background

Evolution and Development

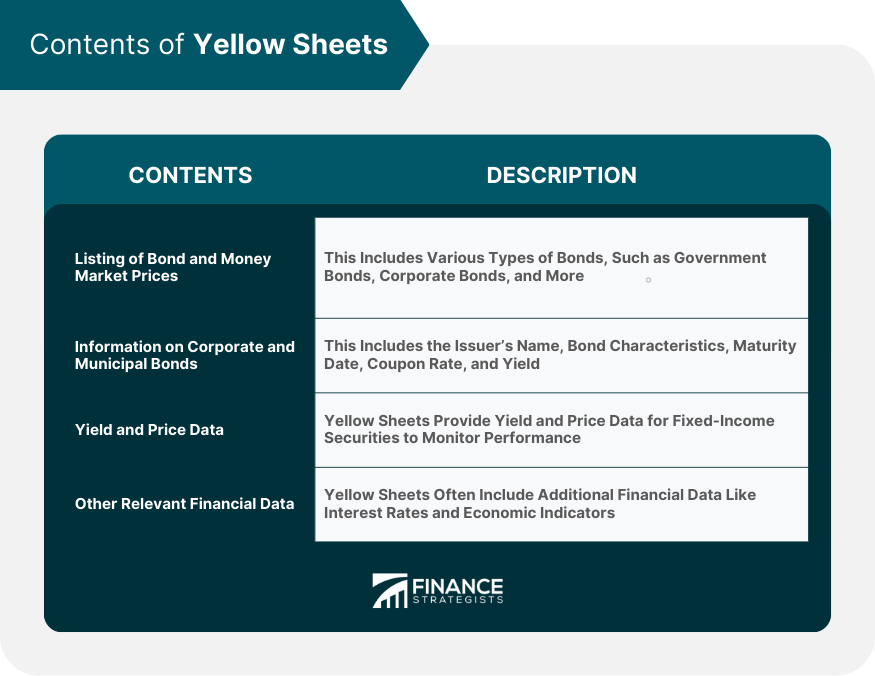

Contents of Yellow Sheets

Listing of Bond and Money Market Prices

Information on Corporate and Municipal Bonds

Yield and Price Data

Other Relevant Financial Data

Role of Yellow Sheets in Wealth Management

Market Analysis and Investment Decision-Making

Tracking and Evaluating Fixed-Income Securities

Identifying Investment Opportunities

Assessing Risk and Performance

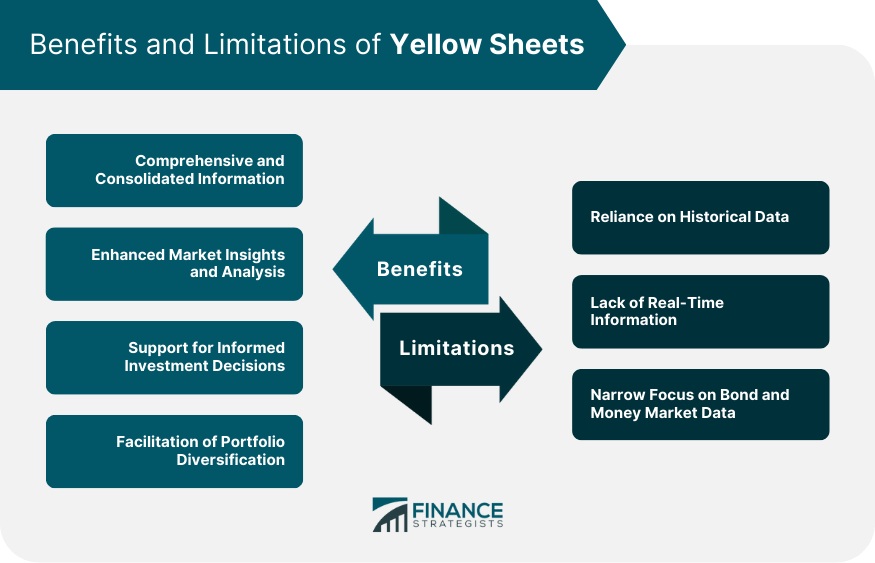

Benefits of Yellow Sheets in Wealth Management

Comprehensive and Consolidated Information

Enhanced Market Insights and Analysis

Support for Informed Investment Decisions

Facilitation of Portfolio Diversification

Limitations and Criticisms of Yellow Sheets

Reliance on Historical Data

Lack of Real-Time Information

Narrow Focus on Bond and Money Market Data

Conclusion

Yellow Sheets FAQs

Yellow Sheets are daily publications that provide information on bond and money market prices, helping wealth managers track and evaluate fixed-income securities.

Yellow Sheets support wealth management by providing comprehensive data on bond prices, yields, and other financial information. They facilitate market analysis, investment decision-making, and the identification of investment opportunities.

The benefits of using Yellow Sheets include access to consolidated and comprehensive information, enhanced market insights and analysis, support for informed investment decisions, and facilitation of portfolio diversification.

Limitations of Yellow Sheets include their reliance on historical data, lack of real-time information, and a narrow focus on bond and money market data, which may not provide a complete picture of the market.

Yellow Sheets provide wealth managers with yield and price data, historical information, and other relevant financial data to assess the risk and performance of fixed-income securities in their portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.