A variable-rate demand bond (VRDB) is a type of municipal bond with a floating interest rate that adjusts periodically, usually weekly or daily. This type of bond provides investors with the flexibility to benefit from changes in market interest rates while also offering issuers the ability to refinance at a lower cost if rates decline. VRDBs are popular among institutional investors, such as money market funds, due to their unique combination of liquidity, income potential, and risk management features. Variable-rate demand bonds play an important role in the municipal bond market by providing a source of flexible, short-term financing for municipalities, public utilities, and other governmental entities. These bonds help to finance essential public services and infrastructure projects, such as schools, hospitals, roads, and water treatment facilities. By offering the potential for lower borrowing costs and enhanced liquidity compared to traditional fixed-rate bonds, VRDBs can help public entities manage their debt obligations more effectively and efficiently. One of the key features of variable-rate demand bonds is their floating interest rate structure. The interest rate on a VRDB adjusts periodically, typically daily or weekly, based on a reference rate, such as the London Interbank Offered Rate (LIBOR) or the Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index. This feature allows investors to benefit from changes in market interest rates, as higher rates will translate into higher interest payments on their bonds. Another notable feature of VRDBs is the call option, which gives the issuer the right, but not the obligation, to redeem the bonds before their scheduled maturity date. This option allows issuers to refinance their debt at lower interest rates if market conditions become more favorable. Conversely, if interest rates rise, issuers can choose not to exercise their call option and continue paying the current interest rate on their bonds. Variable-rate demand bonds are designed to offer high liquidity for investors. They typically come with a "put" feature, which allows bondholders to sell their bonds back to the issuer or a third-party financial institution, known as a remarketing agent, at par value on specified dates, usually coinciding with the interest rate reset dates. This feature provides investors with the ability to quickly and easily sell their bonds, making VRDBs an attractive option for those seeking short-term, liquid investments. The credit rating of a variable-rate demand bond is an important factor to consider for both issuers and investors. A higher credit rating generally translates to lower borrowing costs for issuers and lower risk for investors. Credit rating agencies, such as Moody's, Standard & Poor's, and Fitch, evaluate the creditworthiness of bond issuers based on factors like their financial strength, revenue stability, and debt management practices. To maintain a high credit rating, issuers of VRDBs may use credit enhancements, such as bond insurance or letters of credit from banks, to reduce the perceived risk for investors. Yield curve risk is a concern for investors in variable-rate demand bonds, as changes in the shape of the yield curve can impact the returns on their investment. The yield curve plots the interest rates on bonds of varying maturities, and its shape can change due to factors like shifts in market expectations, economic conditions, or monetary policy. VRDBs are particularly sensitive to changes in short-term interest rates, as their coupon rates are typically reset based on short-term reference rates. Investors should be aware of the potential impact of yield curve fluctuations on their VRDB investments and consider diversifying their portfolios to manage this risk. One of the main advantages of variable-rate demand bonds is their flexible interest rate structure. This allows investors to benefit from rising interest rates, as higher rates will lead to higher interest payments on their bonds. Conversely, if interest rates decline, issuers can take advantage of lower borrowing costs by exercising their call option and refinancing their debt. This flexibility can be an attractive feature for both investors and issuers in a changing interest rate environment. Variable-rate demand bonds have lower interest rate risk compared to fixed-rate bonds, as their coupon rates adjust periodically to reflect changes in market interest rates. This means that the market value of a VRDB is less likely to be impacted by fluctuations in interest rates, providing investors with greater stability and reducing the potential for capital losses due to changes in market rates. Another advantage of VRDBs is their high liquidity, which is largely due to their put feature. This feature allows investors to sell their bonds back to the issuer or a remarketing agent at par value on specified dates, providing them with a convenient way to exit their investment if needed. This liquidity can be especially beneficial for short-term investors or those who need access to their capital on short notice. Variable-rate demand bonds can offer attractive yields compared to other short-term, liquid investments, such as money market funds or Treasury bills. The floating interest rate structure of VRDBs allows investors to benefit from higher interest rates in the market, leading to potentially higher returns on their investment. This can make VRDBs an appealing option for investors seeking income potential in addition to liquidity and low interest rate risk. One of the primary disadvantages of variable-rate demand bonds is credit risk, which refers to the potential for the bond issuer to default on their interest or principal payments. While issuers may use credit enhancements to reduce the perceived risk for investors, credit risk is still a concern, particularly for lower-rated bonds. Investors should carefully evaluate the creditworthiness of bond issuers and consider diversifying their bond portfolios to mitigate credit risk. Call risk is another potential drawback of VRDBs, as issuers have the option to redeem their bonds before the scheduled maturity date if interest rates decline. This can result in investors receiving lower returns on their bonds than anticipated, as they may be forced to reinvest the proceeds from the called bonds at lower market interest rates. To manage call risk, investors may consider incorporating bonds with different call features and maturities into their portfolios. Variable-rate demand bonds can be more complex than traditional fixed-rate bonds, as they involve features like floating interest rates, call options and put options. This complexity may make VRDBs less suitable for some investors, particularly those who are new to bond investing or prefer a more straightforward investment experience. It's important for investors to understand the features and risks of VRDBs before investing in them. While variable-rate demand bonds are designed to offer high liquidity, there is still the potential for liquidity risk. In periods of market stress or financial instability, remarketing agents may be unable or unwilling to purchase bonds from investors who exercise their put options, which could make it difficult for investors to sell their bonds at par value. To manage liquidity risk, investors should diversify their bond portfolios and consider holding a mix of bonds with different liquidity characteristics. Fixed-rate bonds pay a fixed interest rate throughout their entire term, providing investors with predictable income and a stable market value. While fixed-rate bonds offer more certainty in terms of interest payments, they also expose investors to greater interest rate risk compared to variable-rate demand bonds. If market interest rates rise, the market value of fixed-rate bonds may decline, potentially resulting in capital losses for investors. Floating-rate bonds are similar to variable-rate demand bonds in that they have a floating interest rate that adjusts periodically based on a reference rate. However, they generally do not have the same level of liquidity as VRDBs, as they typically lack a put option that allows investors to sell their bonds back to the issuer or a remarketing agent. Floating-rate bonds may be more suitable for investors who are comfortable with slightly lower liquidity in exchange for the potential to benefit from rising interest rates. Zero-coupon bonds do not pay regular interest payments and are instead issued at a discount to their face value. Investors receive the full face value of the bond upon its maturity, with the difference between the purchase price and the face value representing the interest earned. Zero-coupon bonds can be more sensitive to interest rate fluctuations than variable-rate demand bonds, as their market value is primarily impacted by changes in market interest rates. They may be more suitable for investors seeking a long-term investment with a known return at maturity. Variable-rate demand bonds are a unique type of municipal bond that offers investors the benefits of flexible interest rates, low interest rate risk, high liquidity, and attractive yields. They are an important financing tool for municipalities and other public entities, helping to fund essential public services and infrastructure projects. Key features of VRDBs include floating interest rates, call options, liquidity provisions, credit ratings, and sensitivity to changes in the yield curve. Investors should be familiar with these features and understand the potential risks and rewards associated with investing in variable-rate demand bonds. While variable-rate demand bonds offer several advantages, such as flexible interest rates, low interest rate risk, high liquidity, and attractive yields, they also come with some potential drawbacks, including credit risk, call risk, complexity, and liquidity risk. Investors should carefully consider the advantages and disadvantages of VRDBs before adding them to their investment portfolios, and may also want to compare them to other types of bonds, such as fixed-rate bonds, floating-rate bonds, and zero-coupon bonds.What Is a Variable-Rate Demand Bond?

Importance of Variable-Rate Demand Bonds

Features of Variable-Rate Demand Bonds

Interest Rate

Call Option

Liquidity

Credit Rating

Yield Curve Risk

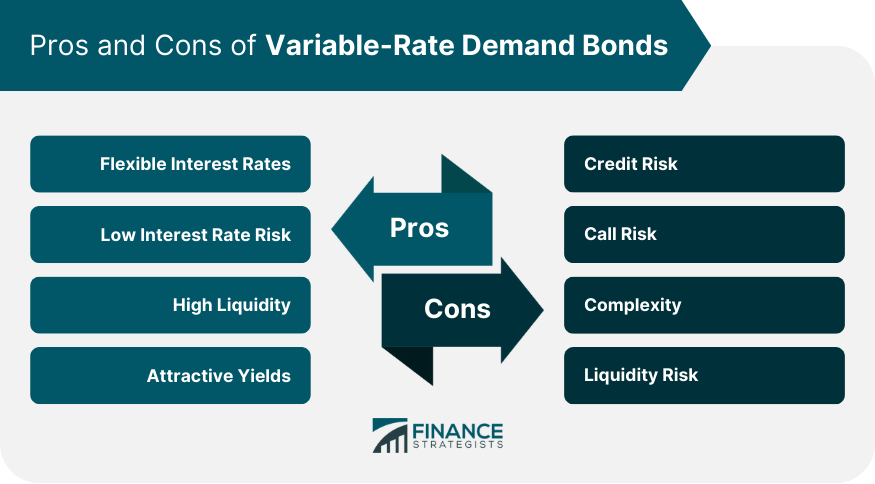

Advantages of Variable-Rate Demand Bonds

Flexible Interest Rates

Low Interest Rate Risk

High Liquidity

Attractive Yields

Disadvantages of Variable-Rate Demand Bonds

Credit Risk

Call Risk

Complexity

Liquidity Risk

Comparison With Other Types of Bonds

Fixed-Rate Bonds

Floating-Rate Bonds

Zero-Coupon Bonds

Final Thoughts

Variable-Rate Demand Bond FAQs

A Variable-Rate Demand Bond is a type of municipal bond that has a floating interest rate and can be redeemed at any time by the bondholder.

The features of a Variable-Rate Demand Bond include a floating interest rate, a call option, high liquidity, and credit rating.

The advantages of investing in Variable-Rate Demand Bonds include flexible interest rates, low interest rate risk, high liquidity, and attractive yields.

The risks associated with Variable-Rate Demand Bonds include credit risk, call risk, complexity, and liquidity risk.

A Variable-Rate Demand Bond is different from other types of bonds because it has a floating interest rate and can be redeemed at any time by the bondholder.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.