Variable prepaid forward contracts are financial derivatives that allow an owner of an asset, typically a large stockholder, to receive a percentage of the current value of their asset immediately while deferring the decision to sell and the subsequent tax consequences. Essentially, it is a contract between two parties: the owner of an asset and an investor, typically a financial institution. The asset owner agrees to sell the asset at a future date for a price within a range determined by the contract. The purpose of these contracts is to help asset owners access liquidity and manage risk. Key features include the upfront cash payment, the variable delivery obligation based on the contract's terms, and the deferral of tax consequences. The variable delivery feature allows the asset owner to deliver varying amounts of the asset at maturity based on the asset's price. Two parties are involved in a variable prepaid forward contract: the asset owner, also known as the holder or seller, and the investor, typically a financial institution or bank. The prepaid amount refers to the initial cash payment made by the investor to the asset owner. This amount is typically a percentage of the current market value of the assets covered by the contract. The forward price is the range of prices at which the asset might be sold. This price is set at the contract's inception and is based on the expected future value of the asset. The term or maturity of the contract is the predetermined period after which the contract expires. At this point, the asset owner must deliver a certain number of shares or the cash equivalent. The participation rate in a variable prepaid forward contract refers to the proportion of the asset's future appreciation that the asset owner retains. Dividend treatment is a crucial aspect of these contracts, as the asset owner retains the dividends during the contract period. Upon the contract's maturity, it can be settled by delivering the assets, delivering a cash equivalent, or rolling over the contract. Variable prepaid forward contracts can be tailored to fit an individual's or institution's specific financial and risk management needs. This level of customization allows for considerable flexibility. These contracts allow asset owners to generate liquidity without an outright sale, helping preserve capital and defer capital gains tax. Variable prepaid forward contracts can enhance returns by allowing the asset owner to receive an upfront payment while still participating in potential asset appreciation. Market risk involves the potential asset value decline during the contract term. Counterparty risk is when the financial institution or investor fails to fulfill their contractual obligations. Liquidity risk in variable prepaid forward contracts arises from the contract’s obligation to deliver assets or cash at maturity. The credit risk is the risk of default by the investor, which could result in financial loss to the asset owner. Under Generally Accepted Accounting Principles (GAAP), variable prepaid forward contracts are typically considered derivative instruments, requiring mark-to-market accounting. The tax implications of variable prepaid forward contracts can be complex. The initial prepaid amount may not be taxable, and tax on the capital gain from the future sale can be deferred until the contract’s maturity. Variable prepaid forward contracts can be used as a hedging strategy to protect against potential future losses in the value of an asset. The asset owner can limit their downside risk by setting a range for the future sale price. These contracts can be used to leverage an asset owner's position. The upfront cash payment can be reinvested, potentially increasing overall returns. A key application of variable prepaid forward contracts is in tax planning. The deferral of capital gains tax can provide significant tax advantages for asset owners. In estate planning, these contracts can provide liquidity for estate taxes without requiring the asset's sale, helping maintain the estate's value. Unlike options, variable prepaid forward contracts require an obligation to sell the asset at maturity, whereas options provide the right but not the obligation to buy or sell. Unlike futures contracts, which require the delivery of a fixed amount of an asset, variable prepaid forward contracts involve a variable delivery amount based on the asset's price at contract maturity. While swaps involve the exchange of cash flows, variable prepaid forward contracts involve the potential sale of an asset at a future date. Unlike ETFs, which are investment funds traded on stock exchanges, variable prepaid forward contracts are private agreements between two parties. Variable prepaid forward contracts are subject to securities regulations. For instance, in the US, the Securities and Exchange Commission (SEC) has rules and guidelines for these contracts. There are specific disclosure requirements for public companies and large shareholders using variable prepaid forward contracts. Given their complexity and risks, these contracts are typically suitable for sophisticated investors with a high-risk tolerance. Variable prepaid forward contracts are complex financial derivatives that allow asset owners to receive an upfront payment, participate in potential future asset appreciation, and defer the tax consequences of a sale. These contracts offer several benefits: liquidity, risk management, tax deferral, and potential return enhancement. However, they also carry market, counterparty, liquidity, and credit risks. Investors considering these contracts should understand their complexities, potential benefits, and risks. They should also consider their financial situation, risk tolerance, and investment objectives. The future of variable prepaid forward contracts looks promising, with increasing market adoption and innovations. However, potential challenges include regulatory changes and market volatility.What Are Variable Prepaid Forward Contracts?

Mechanics of Variable Prepaid Forward Contracts

Parties Involved

Contract Terms and Conditions

Prepaid Amount

Forward Price

Term or Maturity

Participation Rate

Dividend Treatment

Settlement Methods

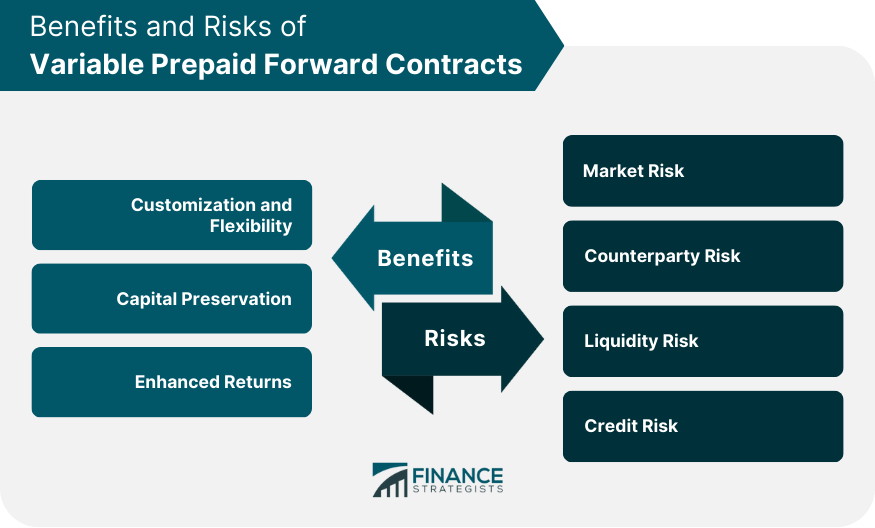

Benefits and Risks of Variable Prepaid Forward Contracts

Benefits

Customization and Flexibility

Capital Preservation

Enhanced Returns

Risks

Market Risk

Counterparty Risk

Liquidity Risk

Credit Risk

Accounting and Tax Considerations for Variable Prepaid Forward Contracts

Accounting Treatment

Tax Implications

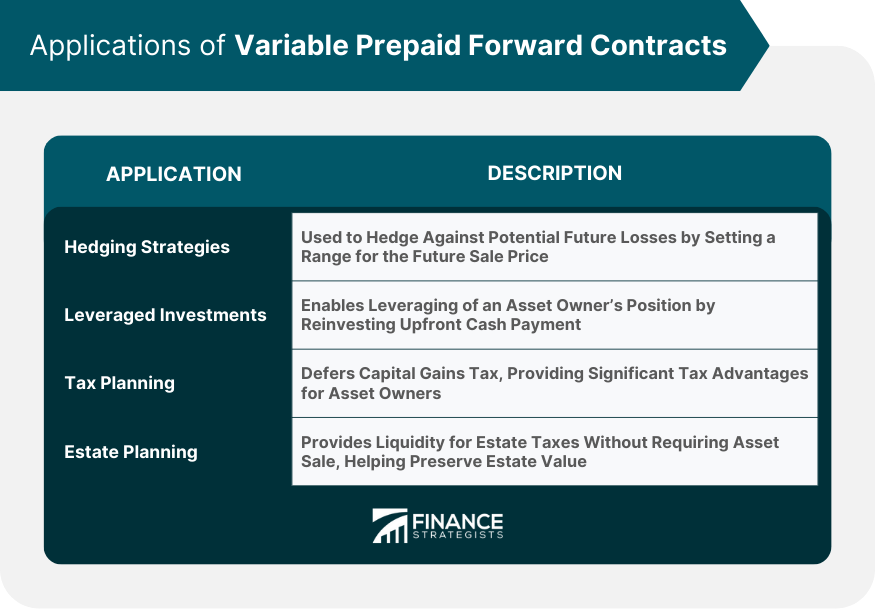

Applications of Variable Prepaid Forward Contracts

Hedging Strategies

Leveraged Investments

Tax Planning

Estate Planning

Comparison With Other Financial Instruments

Options

Futures Contracts

Swaps

Exchange-Traded Funds (ETFs)

Regulatory and Legal Considerations

Securities Regulations

Disclosure Requirements

Investor Suitability

Conclusion

Variable Prepaid Forward Contracts FAQs

A variable prepaid forward contract is a financial derivative that allows an asset owner to receive an upfront payment and defer the tax consequences of a sale until the contract's maturity.

Large stockholders, real estate investors, and institutions often use variable prepaid forward contracts to unlock liquidity from their assets and manage risk while deferring the tax implications of an outright sale.

Risks include market, counterparty, liquidity, and credit risks. Investors must understand these risks and consider their financial situation and risk tolerance before entering such contracts.

In their obligations, flexibility, and tax treatment, these contracts differ from other instruments like options, futures, swaps, and ETFs. Unlike options, they involve an obligation to sell the asset. Unlike futures, they involve a variable delivery amount, and unlike swaps and ETFs, they are private agreements that allow for tax deferral.

These contracts are subject to securities regulations, and there are specific disclosure requirements for public companies and large shareholders. Given their complexity, they are typically suitable for sophisticated investors with a high-risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.