Spread betting is a type of derivative strategy in the financial markets where participants do not own the underlying asset they bet on, such as a stock, commodity, or currency. Instead, spread bettors speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker. The 'spread' in spread betting refers to the difference between the buying (bid) and selling (offer) price quoted by a broker. The potential profit or loss from a spread bet is determined by the difference between the opening and closing price of the asset multiplied by the stake chosen by the bettor. Spread betting plays a crucial role in financial markets as it provides a platform for speculation, which is essential for market liquidity. It allows investors to profit from price movements in assets without owning the asset itself. Moreover, it provides an alternative investment strategy that can be used to hedge other investments. The 'spread' in spread betting refers to the difference between the buy (bid) and sell (offer) price quoted by a broker. The buy price is always slightly higher than the market price, while the sell price is slightly lower. This spread is essentially the broker's commission. In spread betting, you bet a certain amount of money per point of movement in the underlying asset's price. If you believe the price will rise, you 'go long' or buy. If you think the price will fall, you 'go short' or sell. Long and short positions in spread betting simply refer to the direction you expect an asset's price to move. If you think the price will go up, you go long, and if you think it will go down, you go short. Spread betting operate on margin, meaning you only need to deposit a percentage of the full value of your position. This is known as leverage, and it can amplify your profits. However, it can also amplify losses if the market moves against you. Financial spread betting involves wagering on the price movement of a wide variety of financial markets, including indices, shares, currencies, commodities, and more. In sports spread betting, bettors wager on whether a specified outcome in a sports event will end up being above or below a 'spread' offered by a sports spread betting firm. Binary spread betting is a type of spread betting that involves a simple 'yes' or 'no' outcome. You either win a fixed amount or lose your stake, depending on whether the market is above or below a specific level at a certain time. The main advantage of spread betting is the ability to profit from rising and falling markets. Additionally, profits from spread betting are tax-free in some jurisdictions, such as the UK. It's also noteworthy that spread betting provides access to a wide range of markets. Spread betting is high risk and isn't suitable for everyone. You can lose more than your initial deposit if the market moves significantly against you. It requires a thorough understanding of the markets and a disciplined approach to managing risks. Risk management is crucial in spread betting to protect your capital. This can include setting stop losses, limiting your leverage, diversifying your positions, and having a well-thought-out trading plan. In traditional share trading, you buy shares of a company with the expectation that they will increase in value. In contrast, spread betting allows you to speculate on price movements, regardless of whether the market is rising or falling. Spread betting also offers tax advantages in some countries and the ability to trade on margin. Both spread betting and CFD trading allow you to speculate on price movements without owning the underlying asset. However, the main difference is their tax treatment. In the UK, spread betting is free from Capital Gains Tax and Stamp Duty, while CFD trading is not. Unlike traditional betting, where you bet a certain amount to win another, in spread betting, the more right you are, the more you win, and vice versa. In traditional betting, you either lose your stake or win a fixed amount. In the UK and Ireland, profits from spread betting are not subject to Capital Gains Tax or Stamp Duty. This is one of the key reasons for its popularity among traders. However, tax laws can vary in other countries and can be subject to change. In the UK spread betting is regulated by the Financial Conduct Authority (FCA). In other countries, it may fall under the jurisdiction of different regulatory bodies. It's important to understand the regulations in your country before engaging in spread betting. There are numerous spread betting providers, and choosing the right one requires careful consideration. Look for a provider that offers a user-friendly platform, competitive spreads, strong customer service, and comprehensive educational resources. A successful spread betting strategy is one that helps you identify profitable opportunities and manage risks effectively. This may involve technical analysis, fundamental analysis, or a combination of both. Most spread betting providers offer demo accounts where you can practice trading with virtual money. This is a great way to familiarize yourself with the platform and develop your trading strategies in a risk-free environment. Scalping is a short-term trading strategy where you aim to profit from small price changes. Day trading, on the other hand, involves opening and closing positions within a single trading day. Swing trading is a medium-term strategy where traders aim to catch price swings within a trend. Position trading is a long-term strategy where traders hold positions for weeks or even months. Hedging is a strategy used to offset potential losses in other investments. In spread betting, this could involve placing a bet that moves in the opposite direction to an existing position. Spread betting case studies underscore the importance of understanding this highly speculative trading method. Key lessons include: 1. The necessity of risk management strategies, as potential losses can exceed the initial deposit 2. The importance of market knowledge and research to predict price movements accurately 3. The benefit of using stop loss orders to limit losses 4. Understanding the impact of leverage which can amplify both gains and losses 5. The need for emotional control and discipline to avoid rash decisions These lessons highlight the significant risks and the need for thoughtful strategy in spread betting Spread betting is a unique and potent financial tool that allows investors to speculate on the price movement of a wide variety of assets without actually owning them. It provides opportunities to profit from both rising and falling markets and offers leverage, enabling traders to multiply their exposure to a market with a relatively small initial deposit. However, it's essential to remember that spread betting is not without risks. The very same leverage that can amplify profits can also magnify losses. As such, effective risk management strategies, a thorough understanding of the markets, and disciplined trading are crucial. Given its complexities and potential for significant losses, those interested in spread betting are encouraged to seek professional services. Engaging a financial advisor or an experienced spread betting firm could be a valuable step to navigating the intricacies of spread betting and ensuring informed decision-making.Definition of Spread Betting

Role of Spread Betting in the Financial Market

Mechanics of Spread Betting

Understanding the Spread in Spread Betting

How Spread Betting Works

Long and Short Positions in Spread Betting

Margin and Leverage in Spread Betting

Types of Spread Betting

Financial Spread Betting

Sports Spread Betting

Binary Spread Betting

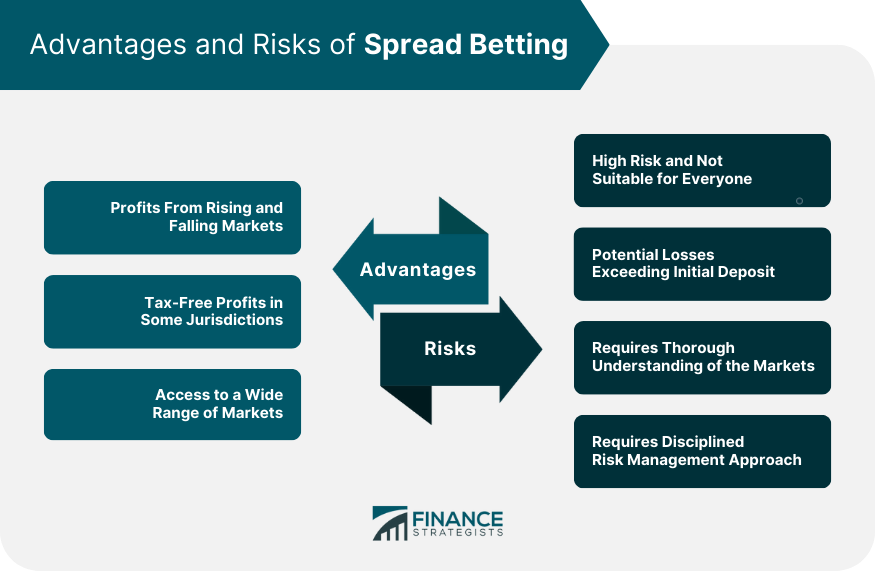

Advantages and Risks of Spread Betting

Advantages of Spread Betting

Risks Associated With Spread Betting

Risk Management in Spread Betting

Spread Betting vs Other Investment Methods

Spread Betting vs Share Trading

Spread Betting vs Contracts for Difference (CFDs)

Spread Betting vs Traditional Betting

Legal and Regulatory Aspects of Spread Betting

Tax Implications of Spread Betting

Regulation of Spread Betting in Different Countries

Getting Started With Spread Betting

Choosing a Spread Betting Provider

Developing a Spread Betting Strategy

Using Demo Accounts for Spread Betting Practice

Advanced Spread Betting Strategies

Scalping and Day Trading in Spread Betting

Swing Trading and Position Trading in Spread Betting

Hedging With Spread Betting

Lessons Learned From Spread Betting Case Studies

Conclusion

Spread Betting FAQs

Spread betting is a form of derivative trading that allows you to speculate on the price movement of a range of financial markets. Unlike traditional trading, you do not own the underlying asset; instead, you bet on whether the asset's price will rise or fall.

Unlike traditional trading, where you own the asset, spread betting involves betting on the price movement of an asset. It allows you to profit from both rising and falling markets. Also, spread betting offers tax advantages in some jurisdictions and the ability to trade on margin.

Spread betting is a high-risk activity. The use of leverage means that you can lose more than your initial deposit if the market moves significantly against you. It's crucial to have a good understanding of the markets and a disciplined approach to managing risk.

To start spread betting, you'll need to open an account with a spread betting provider. It's also a good idea to spend some time learning about the markets and practicing with a demo account before you start trading with real money.

Strategies in spread betting can range from short-term approaches like scalping and day trading to medium and long-term strategies like swing trading and position trading. Hedging is also a common strategy used to offset potential losses in other investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.