The New York Mercantile Exchange (NYMEX) is a leading commodities exchange that facilitates the trading of futures and options contracts on various commodities, such as energy, metals, and agricultural products. NYMEX is a crucial marketplace for hedgers, speculators, and investors looking to manage risk and gain exposure to commodities markets. The exchange plays a vital role in setting global commodity prices and provides critical data for economic indicators. NYMEX is a key player in global financial markets due to its role in facilitating the trading of commodities futures and options contracts. It serves as a critical venue for price discovery, allowing market participants to negotiate and agree upon the future prices of various commodities. This price discovery process is essential for market stability and enables businesses to manage the risk associated with fluctuating commodity prices. Additionally, the data generated by NYMEX is used by governments, economists, and investors to track global economic trends and inform policy decisions. The exchange's influence on global commodity prices and economic indicators highlights its central role in financial markets. NYMEX, founded in 1872 as the Butter and Cheese Exchange of New York, evolved into the New York Mercantile Exchange. It grew by adding commodities like eggs, poultry, and potatoes. In the 1970s, it introduced energy futures contracts for heating oil and crude oil. Natural gas, electricity, and metals futures contracts followed in the 1980s and 1990s. In 2008, NYMEX merged with the Chicago Mercantile Exchange to become the CME Group. Today, NYMEX operates as a division of CME Group, facilitating trading of commodities futures and options contracts, making it a leading global financial marketplace. NYMEX operates under the umbrella of the CME Group, which also includes other prominent exchanges such as the Chicago Mercantile Exchange, the Chicago Board of Trade, and the Commodity Exchange (COMEX). The CME Group's organizational structure comprises a board of directors, executive management, and various committees responsible for overseeing the exchange's operations, risk management, and compliance with regulatory requirements. Various roles and responsibilities exist within NYMEX to ensure the smooth functioning of the exchange. Key participants include: 1. Traders: Individuals or firms that buy and sell futures and options contracts on the exchange. Traders can be classified as hedgers, who seek to manage risk associated with commodity price fluctuations, or speculators, who aim to profit from price movements. 2. Clearing Members: Firms responsible for guaranteeing the financial performance of their clients' trades. Clearing members play a vital role in maintaining market integrity by ensuring that all trades are settled promptly and accurately. 3. Market Makers: Participants who provide liquidity to the market by consistently quoting bid and ask prices for specific contracts. Market makers help to ensure efficient price discovery and minimize price volatility. 4. Regulators: Organizations such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) that oversee the exchange's compliance with laws and regulations. Trading activities on NYMEX involve the buying and selling of futures and options contracts on various commodities. These contracts are standardized agreements that obligate the buyer to purchase, and the seller to sell, a specific quantity of a commodity at a predetermined price at a future date. Trading on NYMEX can be conducted either electronically through the CME Globex trading platform or via open outcry in the trading pits. While electronic trading has become the dominant method in recent years, open outcry trading remains an important part of NYMEX's operations, particularly for complex transactions and during periods of high market volatility. As one of the world's leading commodities exchanges, NYMEX plays a pivotal role in global commodities trading. Its futures and options contracts provide a standardized, transparent, and liquid market for trading a wide range of commodities. These contracts enable producers, consumers, and speculators to manage price risks, gain exposure to commodities markets, and profit from price changes. Furthermore, NYMEX's price discovery process is critical to global commodities markets. The prices determined on the exchange reflect the market's collective view of current and future supply and demand conditions for various commodities. These prices serve as a global benchmark for commodities trading and are used by businesses, governments, and investors worldwide. NYMEX provides a marketplace for various financial instruments, primarily futures and options contracts on a wide range of commodities. These include energy products like crude oil, natural gas, and gasoline, agricultural products like cocoa and coffee, and metals such as gold, silver, and copper. The exchange also offers futures and options contracts on financial products, such as interest rates and currency exchange rates. Futures contracts are agreements to buy or sell a specific quantity of a commodity or financial instrument at a predetermined price at a future date. These contracts are used by producers and consumers to hedge against price risks and by speculators to profit from price changes. Options contracts, on the other hand, give the holder the right, but not the obligation, to buy or sell a specific quantity of a commodity or financial instrument at a predetermined price before the contract's expiration date. Options are used for various purposes, including hedging against price risks, speculating on price movements, and gaining leverage in the markets. NYMEX plays a crucial role in setting standards for futures and options contracts traded on its platform. These standards include contract specifications such as the quantity, quality, and delivery terms of the underlying commodity or financial instrument. By standardizing these contracts, NYMEX ensures their fungibility, which enhances market liquidity and efficiency. NYMEX interacts with other financial markets in several ways. First, the prices discovered on NYMEX are used as global benchmarks for various commodities, influencing prices in other commodity markets worldwide. Second, NYMEX contracts are used by investors to diversify their portfolios, providing a link between commodities markets and other asset classes such as equities, bonds, and currencies. Finally, the economic data generated by NYMEX trading activities is used by market participants and policymakers globally to assess economic trends and inform financial decisions. As one of the world's leading commodities exchanges, NYMEX has a significant influence on global commodity prices. The futures and options contracts traded on NYMEX enable market participants to negotiate and agree upon the future prices of various commodities, which serve as global price benchmarks. These prices are used by businesses, governments, and investors worldwide, impacting global commodity markets and the broader global economy. The data generated by NYMEX trading activities provides valuable insights into global economic trends. For example, the prices of oil and natural gas futures contracts on NYMEX can indicate future energy costs, which are key inputs for many economic indicators, such as inflation and industrial production. Similarly, the prices of agricultural futures contracts can signal future food prices, affecting consumer spending and inflation expectations. Thus, NYMEX data plays a crucial role in shaping global economic indicators. In 2008, NYMEX merged with the Chicago Mercantile Exchange (CME) to form the CME Group, one of the world's largest and most diverse derivatives marketplaces. The merger combined NYMEX's leading position in commodities futures and options trading with CME's extensive offerings in interest rate, equity index, and foreign exchange derivatives. The merger was driven by several factors, including the desire to create a more diversified and competitive global exchange, the need to achieve economies of scale, and the opportunity to leverage synergies between the two exchanges' complementary product offerings. The merger of NYMEX and CME has had significant implications for both exchanges and the broader financial market. For NYMEX and CME, the merger has resulted in a more diverse product offering, increased trading volumes, and improved operational efficiencies. For the broader financial market, the merger has provided market participants with a single platform for trading a wide range of derivatives, promoting market liquidity and efficiency. NYMEX operates within a robust regulatory environment, overseen by the c (CFTC) and the National Futures Association (NFA). These regulators enforce laws and regulations designed to maintain market integrity, protect market participants, and ensure the financial soundness of the exchange. The Commodity Futures Trading Commission (CFTC) is the federal agency responsible for regulating futures and options markets in the United States. The CFTC oversees NYMEX's operations, ensuring compliance with laws and regulations relating to market integrity, financial integrity, and customer protection. Regulations have significant implications for NYMEX operations. They dictate how the exchange conducts its business, from the listing of new contracts to the settlement of trades. Regulations also require NYMEX to maintain adequate financial resources, implement risk management practices, and provide fair and transparent markets. Compliance with these regulations is crucial for maintaining market confidence and the exchange's reputation. New York Mercantile Exchange (NYMEX) is a leading commodities exchange facilitating futures and options contracts on various commodities. It sets global commodity prices, providing data for economic indicators. NYMEX plays a central role in financial markets, enabling price discovery and risk management. It offers contracts on energy, metals, agricultural products, and financial instruments. Traders, clearing members, market makers, and regulators are key participants. NYMEX's trading occurs electronically and through open outcry. It interacts with other financial markets, influencing prices and providing diversification. NYMEX's merger with CME formed the CME Group, enhancing product offerings. Regulatory oversight ensures market integrity, customer protection, and compliance.What Is the New York Mercantile Exchange (NYMEX)?

Brief History of NYMEX

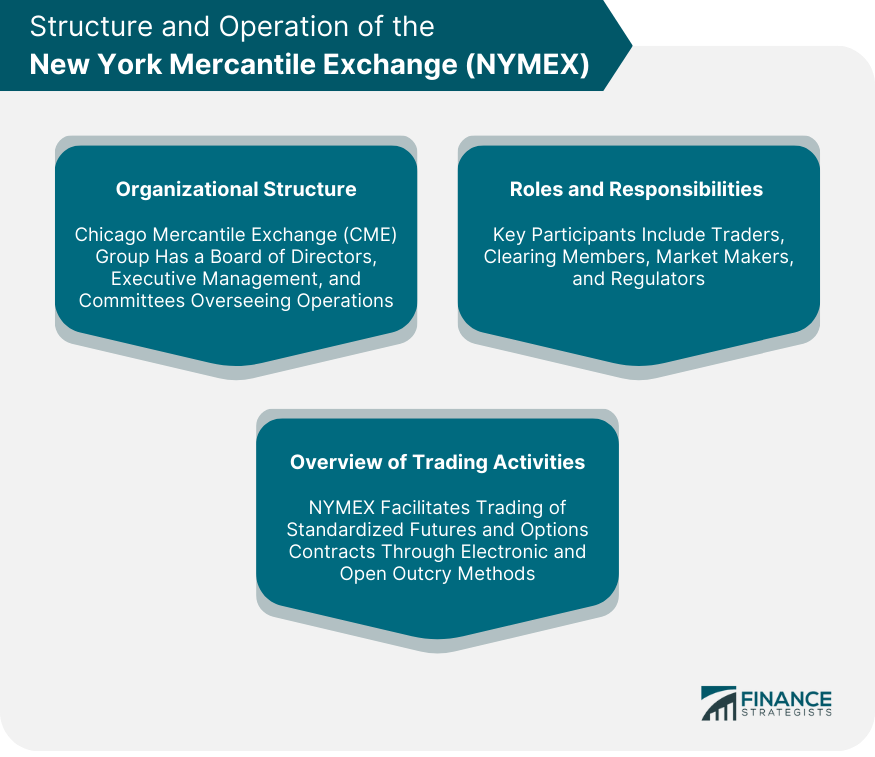

Structure and Operation of the NYMEX

Organizational Structure

Roles and Responsibilities Within NYMEX

Overview of Trading Activities

Role of the NYMEX in Commodities Trading

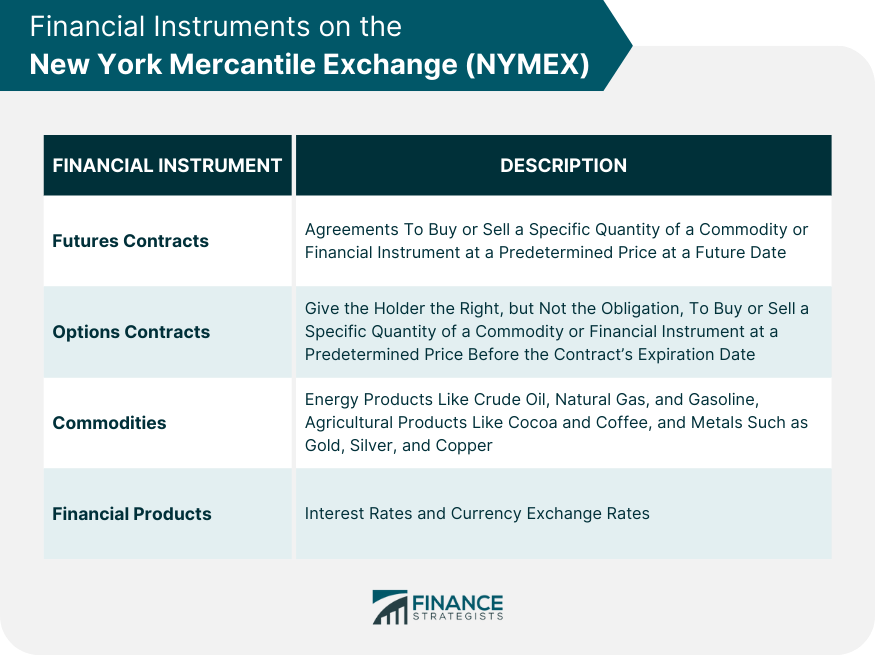

Financial Instruments on the New York Mercantile Exchange (NYMEX)

Different Types of Contracts Traded on NYMEX

Futures and Options Contracts

Role in Setting Standards for These Contracts

NYMEX and Global Financial Markets

How NYMEX Interacts With Other Financial Markets

NYMEX's Influence on Global Commodity Prices

Impact of NYMEX Data on Global Economic Indicators

Merger of the NYMEX With the Chicago Mercantile Exchange (CME)

Details of the Merger

Reasons Behind the Merger

Impact of the Merger on NYMEX, CME, and the Broader Financial Market

Regulatory Framework of the NYMEX

Description of the Regulatory Environment

Role of the Commodity Futures Trading Commission (CFTC)

Implications of Regulations on NYMEX Operations

Final Thoughts

New York Mercantile Exchange (NYMEX) FAQs

The New York Mercantile Exchange (NYMEX) is a commodities exchange that facilitates the trading of futures and options contracts on various commodities and financial instruments.

NYMEX trades futures and options contracts on a wide range of commodities, including energy products, agricultural products, and metals, as well as financial products such as interest rates and currency exchange rates.

NYMEX influences global commodity prices through its role in facilitating the trading of futures and options contracts. The prices determined on the exchange serve as global benchmarks for various commodities.

NYMEX is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), which ensure the exchange's compliance with laws and regulations relating to market integrity, financial integrity, and customer protection.

The merger resulted in the creation of the CME Group, one of the world's largest and most diverse derivatives marketplaces. The merger provided market participants with a single platform for trading a wide range of derivatives, promoting market liquidity and efficiency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.