Equity-Linked Securities (ELKS) are hybrid financial instruments that combine features of both debt and equity securities. These securities offer investors the potential for capital appreciation tied to the performance of an underlying asset, typically a stock or a stock index, while providing a fixed-income stream in the form of periodic interest payments. ELKS are typically issued by financial institutions and provide a way for investors to gain exposure to a particular asset or market segment. ELKS play a vital role in wealth management, offering investors a means to diversify their investment portfolios and pursue different investment objectives. By combining the features of debt and equity securities, ELKS can help investors achieve a balance of risk and reward, potentially increasing returns while mitigating the impact of market volatility. The structure and design of ELKS can vary significantly, depending on the issuer and the specific financial instrument. However, all ELKS share a common feature: they are linked to the performance of an underlying asset, such as a stock or an index. The terms of the ELKS, including the interest rate, the maturity date, and the conversion ratio, are determined at the time of issuance and are specified in the offering document. The linkage between a security and its underlying asset can be expressed through a conversion feature or a cash settlement mechanism based on the asset's value relative to a predetermined reference price. The degree of exposure to the underlying asset's performance can also vary, with some ELKS offering a greater potential for capital appreciation than others. ELKS have a fixed-income component in the form of periodic interest payments. The interest rate, payment frequency, and other related terms are specified in the offering document. These interest payments provide a steady income stream for investors, regardless of the performance of the underlying asset. This fixed-income feature can be particularly appealing to investors who seek a stable source of income while still participating in the potential capital appreciation of the underlying asset. The equity component of ELKS allows investors to participate in the potential capital appreciation of the underlying asset. This component can take different forms, including conversion rights allowing investors to exchange ELKS for underlying asset shares at a predetermined ratio, or cash settlement mechanisms based on the difference between the asset's value and a reference price. The equity component exposes investors to the risk and reward dynamics of the underlying asset, offering the potential for higher returns while also increasing the level of risk. Callable ELKS give the issuer the right, but not the obligation, to redeem the securities prior to their maturity date. The issuer may choose to call the ELKS if the underlying asset performs well or if market conditions change, resulting in more favorable terms for issuing new securities. Investors in callable ELKS should be aware that their investment may be redeemed before the maturity date, which can impact their overall return. Puttable ELKS grant investors the right, but not the obligation, to sell the securities back to the issuer at a predetermined price before the maturity date. This feature provides investors with a measure of protection against potential declines in the value of the underlying asset, as they can choose to sell the ELKS back to the issuer if the asset's performance is unfavorable. However, this added protection may come at the cost of lower interest payments or reduced potential for capital appreciation. Dual Currency ELKS pay interest and principal in different currencies, offering investors an opportunity to benefit from fluctuations in exchange rates. These securities are typically structured so that interest payments are made in one currency, while the principal repayment at maturity is made in another currency. This type of ELKS can be attractive to investors seeking exposure to foreign currencies or those looking to hedge their currency risk. Reverse Convertible ELKS are structured to provide investors with a high-interest rate in exchange for bearing the risk of potential declines in the value of the underlying asset. If the value of the underlying asset falls below a predetermined threshold, investors may receive shares of the asset instead of the cash principal repayment at maturity. This structure can result in potentially higher income for investors, but also exposes them to the risk of receiving shares of a poorly performing asset. ELKS can be an effective tool for diversifying an investment portfolio, as they provide exposure to both fixed-income and equity assets. By allocating funds to ELKS, investors can spread their risk across different asset classes and potentially reduce the impact of market fluctuations on their overall portfolio. The equity component of ELKS offers the potential for higher returns than traditional fixed-income investments, such as bonds. This can be particularly attractive to investors seeking to enhance their portfolio's growth potential without taking on the full risk associated with direct equity investments. ELKS can be tailored to meet the specific needs and goals of individual investors. The wide variety of available structures, underlying assets, and maturity dates allows wealth managers to create customized investment solutions that align with their clients' risk tolerance, investment objectives, and preferences. ELKS can serve as a valuable tool for hedging against market risks, as they provide exposure to both fixed-income and equity assets. By allocating funds to ELKS, investors can take advantage of the potential for capital appreciation offered by the equity component while still benefiting from the stability and income provided by the fixed-income component. As the return on ELKS is tied to the performance of an underlying asset, these securities are exposed to market risk. Changes in the value of the underlying asset can directly impact the return on the ELKS, and investors may experience losses if the asset's value declines. Investors in ELKS are exposed to credit risk, as they are essentially lending money to the issuer of the security. If the issuer experiences financial difficulties or defaults on its obligations, the investor may not receive the interest payments or principal repayment they expect. ELKS can be less liquid than other investment types, such as stocks or bonds. This means that it may be more difficult for investors to sell their ELKS in the secondary market, particularly if market conditions are unfavorable or if the issuer's creditworthiness has deteriorated. The pricing structure of ELKS can be complex, as they combine features of both debt and equity securities. This complexity can make it challenging for investors to accurately assess the potential return and risks associated with these instruments, particularly if they are not familiar with the intricacies of ELKS. Before investing in ELKS, it is crucial for investors to evaluate their investment objectives and risk tolerance. These securities may be more suitable for investors who seek a balance of capital appreciation and income, while being willing to accept the risks associated with the underlying asset's performance. Investors with a low risk tolerance or a short investment horizon may want to consider alternative investment options. A thorough understanding of the underlying asset is essential when investing in ELKS. Investors should research the asset's historical performance, market trends, and potential risks to make informed decisions about the suitability of the investment. Keeping a close eye on market conditions and trends is important for investors in ELKS, as these factors can directly impact the performance of the underlying asset and the overall return on the investment. Regularly reviewing and adjusting the ELKS holdings in response to changing market conditions can help optimize the investment's performance and manage risks. Before investing in ELKS, it is essential to review the creditworthiness of the issuer. A strong credit rating is an indication of the issuer's financial stability and ability to meet its obligations. Investing in ELKS issued by companies with weak credit ratings can expose investors to additional risks, including the possibility of default. ELKS can be an effective tool for generating income, as they provide periodic interest payments to investors. The fixed-income component of these securities can offer a stable source of income, while the equity component allows for the potential of capital appreciation. The equity component of ELKS offers investors the potential for capital appreciation, as it is linked to the performance of an underlying asset. Investors who are seeking growth opportunities can allocate a portion of their portfolios to ELKS to benefit from the potential upside offered by the equity component. ELKS can be used as a risk management tool, as they provide exposure to both fixed-income and equity assets. By allocating funds to ELKS, investors can spread their risk across different asset classes, potentially reducing the impact of market fluctuations on their overall portfolio. Depending on the jurisdiction and the specific structure of the ELKS, these securities may offer certain tax advantages to investors. For instance, interest payments from some ELKS may be taxed at a lower rate than dividends from stocks. Investors should consult with a tax advisor to understand the potential tax implications of investing in ELKS. Equity-Linked Securities (ELKS) are hybrid financial instruments that combine the features of both debt and equity securities. They offer the potential for capital appreciation tied to the performance of an underlying asset, while providing a fixed-income stream in the form of periodic interest payments. ELKS offer investors a means to diversify their investment portfolios and pursue different investment objectives. In wealth management, ELKS can be used to achieve a variety of objectives, such as income generation, capital appreciation, risk management, and tax planning. Investors can make informed decisions about whether ELKS are a suitable addition to their investment portfolio by taking the time to understand the underlying asset, reviewing the issuer's creditworthiness, and monitoring market conditions, Additionally, by implementing a well-thought-out strategy and regularly reviewing the performance of their ELKS holdings, investors can optimize their portfolios and work towards their financial goals.What Is Equity-Linked Security (ELKS)?

Characteristics of ELKS

Structure and Design

Linked to the Performance of an Underlying Asset

Fixed-Income Component

Equity Component

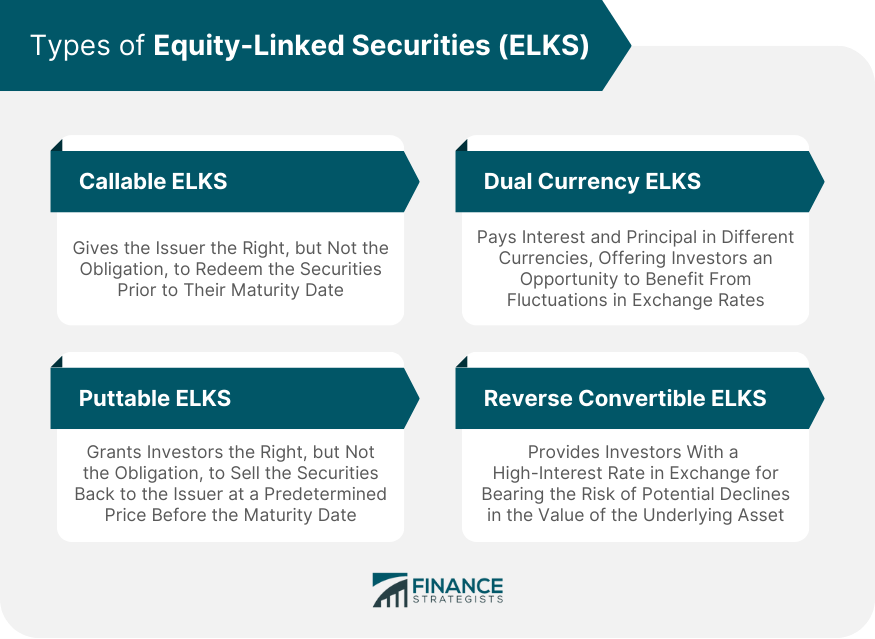

Types of Equity-Linked Securities

Callable ELKS

Puttable ELKS

Dual Currency ELKS

Reverse Convertible ELKS

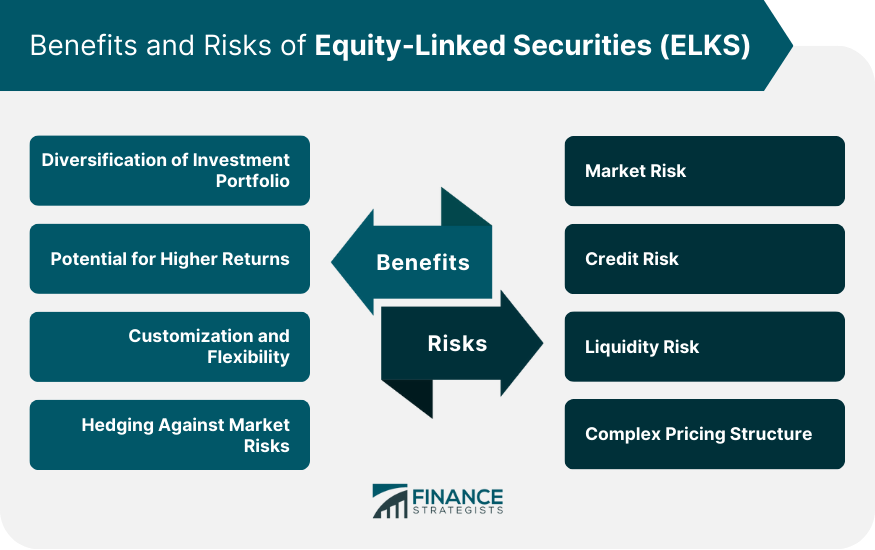

Benefits of Equity-Linked Securities

Diversification of Investment Portfolio

Potential for Higher Returns

Customization and Flexibility

Hedging Against Market Risks

Risks Associated With Equity-Linked Securities

Market Risk

Credit Risk

Liquidity Risk

Complex Pricing Structure

Considerations for Investing in Equity-Linked Securities

Investment Objectives and Risk Tolerance

Understanding the Underlying Asset

Monitoring Market Conditions and Trends

Reviewing Issuer's Creditworthiness

Strategies for Using ELKS in Wealth Management

Income Generation

Capital Appreciation

Risk Management

Tax Planning

The Bottom Line

Equity-Linked Security (ELKS) FAQs

ELKS are linked to the performance of an underlying asset, such as a stock or an index. They offer fixed-income payments and potential equity-like returns.

The types of ELKS include Callable ELKS, Puttable ELKS, Dual Currency ELKS, and Reverse Convertible ELKS, each with different features and structures.

Investing in ELKS offers portfolio diversification, potential for higher returns, customization options, and the ability to hedge against market risks.

ELKS carry risks such as market risk, credit risk, liquidity risk, and the complexity of their pricing structure. Understanding these risks is crucial before investing.

ELKS are linked to the performance of an underlying asset, such as a stock or an index. They offer fixed-income payments and potential equity-like returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.