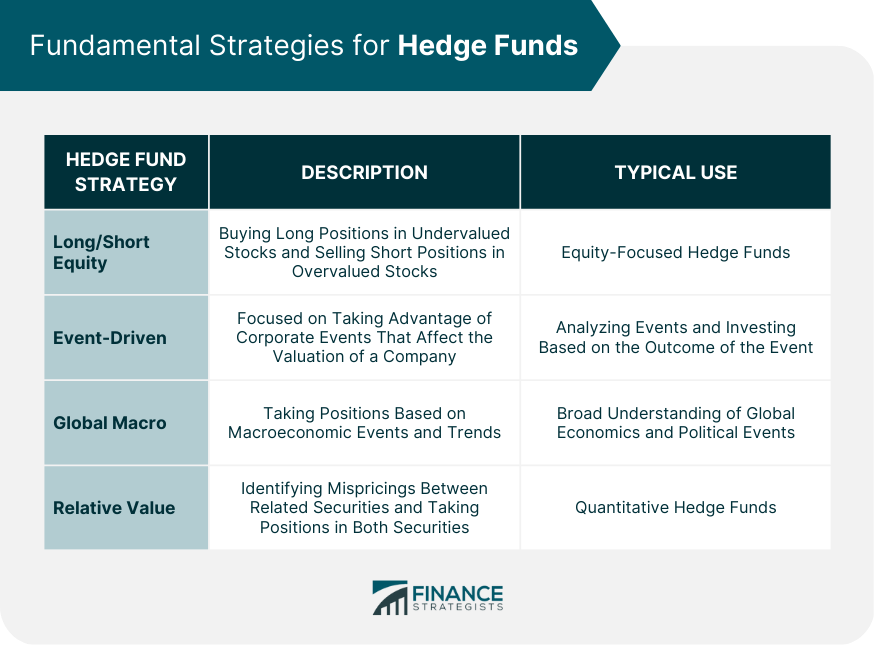

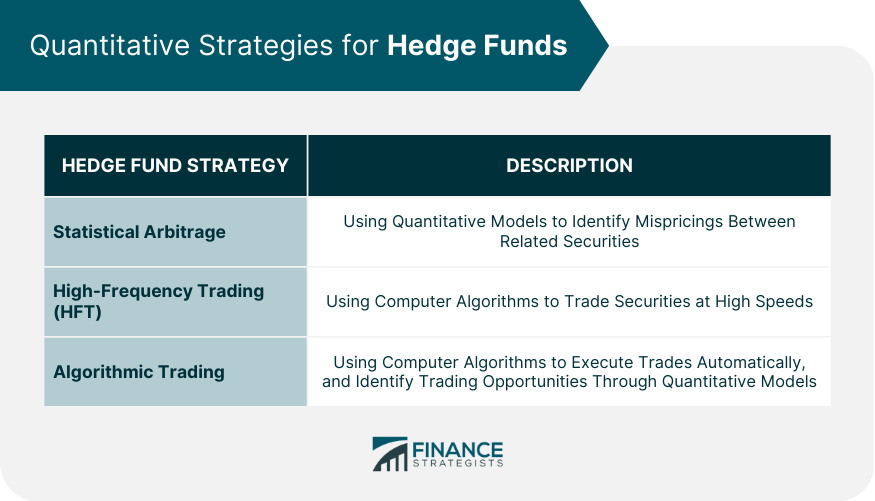

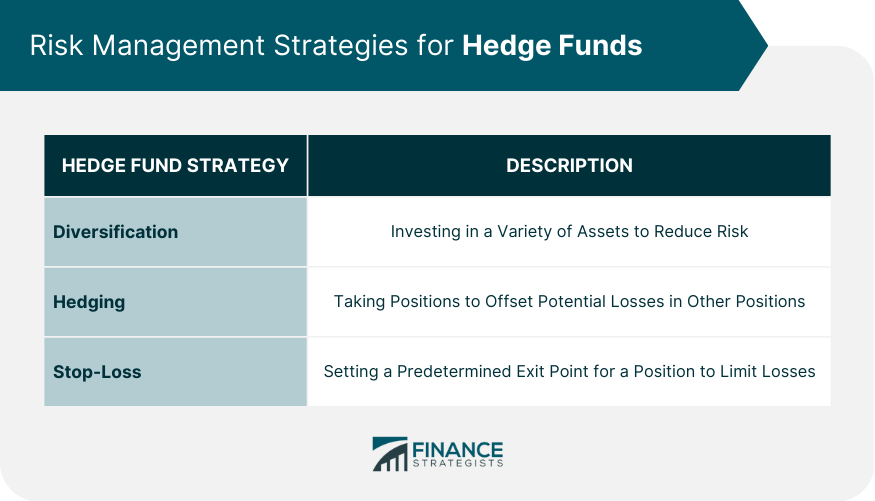

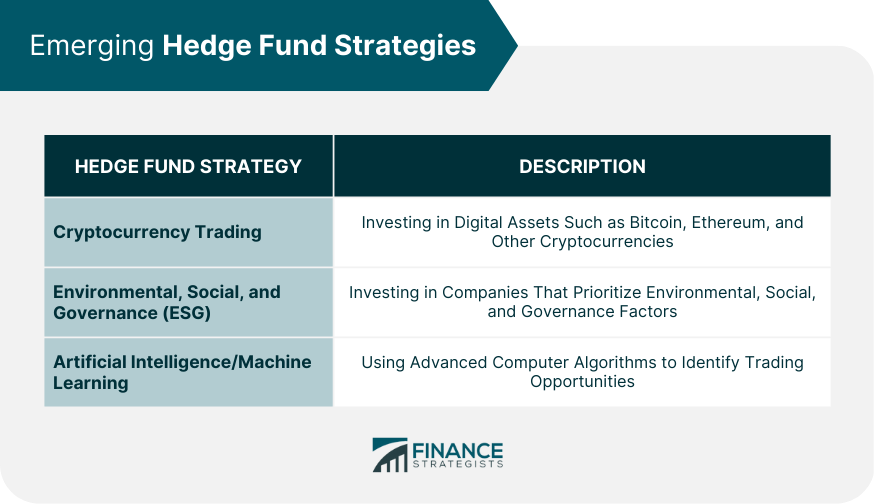

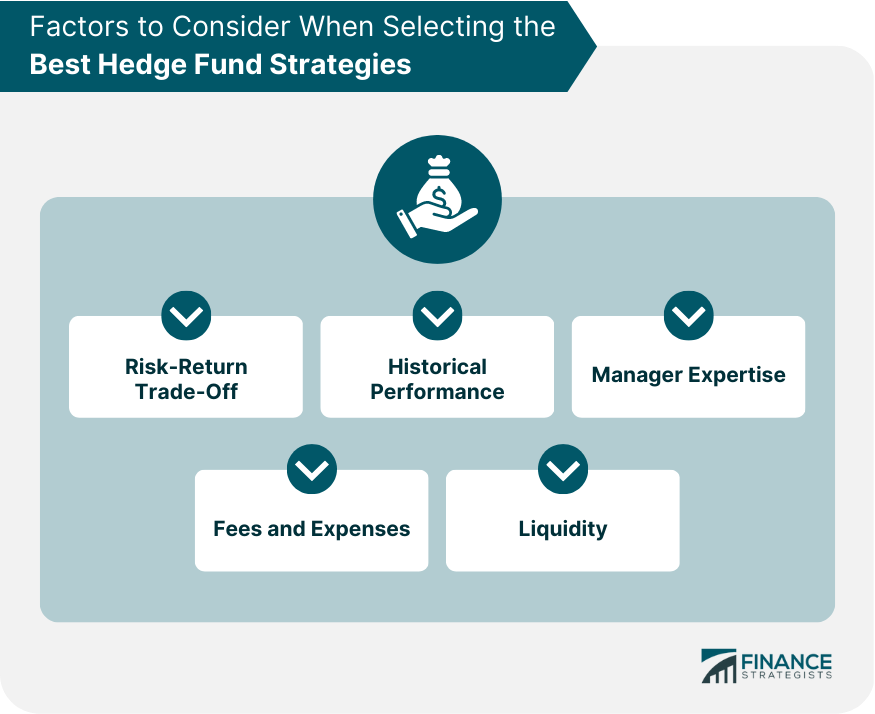

Hedge funds are alternative investment vehicles that are managed by professional investment managers. They are known for their ability to generate high returns but also come with higher risk levels. Hedge fund strategies are the techniques and methods hedge fund managers use to achieve their investment objectives. There is no one "best" hedge fund strategy as the success of a hedge fund strategy depends on a variety of factors, including market conditions, investor preferences, and the skill of the fund manager. Hedge funds chase alpha, but true mastery lies in risk management, not just market beating. The long/short equity strategy is among the most popular hedge fund strategies. It involves buying long positions in undervalued stocks and selling short positions in overvalued stocks. The goal is to generate alpha by identifying mispricings in the market. This strategy is effective in both bull and bear markets and is typically used by equity-focused hedge funds. The event-driven strategy is focused on taking advantage of corporate events that affect the valuation of a company. This could include mergers and acquisitions, spin-offs, or bankruptcies. Event-driven hedge funds analyze these events and invest in companies that they believe are undervalued or overvalued based on the expected outcome of the event. This strategy requires a deep understanding of corporate finance and legal frameworks. The global macro strategy involves taking positions based on macroeconomic events and trends. This strategy relies on the ability to forecast economic trends, interest rate movements, and geopolitical events. Global macro hedge funds may invest in various assets, including currencies, commodities, and equities. This strategy requires a broad understanding of global economics and political events. The relative value strategy involves identifying mispricings between related securities. This could include stocks in the same industry or fixed-income securities with similar maturities. Relative value hedge funds use quantitative analysis to identify these mispricings and take positions in both securities to capture the difference. This strategy is typically used by quantitative hedge funds. Statistical arbitrage involves using quantitative models to identify mispricings between related securities. This strategy involves identifying statistical relationships between securities and exploiting deviations from these relationships. Statistical arbitrage hedge funds use complex mathematical models to identify these mispricings and take positions to capture the difference. High-frequency trading (HFT) involves using computer algorithms to trade securities at high speeds. HFT hedge funds use sophisticated algorithms to identify patterns in the market and execute trades within fractions of a second. This strategy requires a significant investment in technology and infrastructure and access to high-speed data feeds. Algorithmic trading involves using computer algorithms to execute trades. Algorithmic trading hedge funds use quantitative models to identify trading opportunities and execute trades automatically. This strategy requires a deep understanding of mathematical models and programming languages. The diversification strategy involves investing in a variety of assets to reduce risk. Diversification hedge funds invest in various assets, including stocks, bonds, commodities, and currencies. This strategy is designed to reduce the impact of any single asset on the overall portfolio. The hedging strategy involves taking positions to offset potential losses in other positions. Hedging hedge funds use various techniques to hedge their positions, including buying options, short selling, and using derivatives. This strategy is designed to reduce the impact of market volatility on the portfolio. The stop-loss strategy involves setting a predetermined exit point for a position. Stop-loss hedge funds use this strategy to limit losses in their positions. This strategy involves setting a stop-loss order at a predetermined price level, below which the position will be automatically sold. This strategy is designed to limit losses in case the position moves against the fund. The cryptocurrency trading strategy involves investing in digital assets such as Bitcoin, Ethereum, and other cryptocurrencies. Cryptocurrency hedge funds use a variety of strategies to invest in this emerging asset class, including long-term holding, market making, and algorithmic trading. This strategy requires a deep understanding of blockchain technology and cryptocurrency markets. The ESG strategy involves investing in companies that prioritize environmental, social, and governance factors. ESG hedge funds use various techniques to identify companies that align with these values, including screening for specific ESG criteria, engaging with management on ESG issues, and collaborating with other investors on ESG initiatives. This strategy is designed to align the fund's investments with its values. The artificial intelligence/machine learning strategy involves using advanced computer algorithms to identify trading opportunities. AI/ML hedge funds use machine learning algorithms to analyze large datasets and identify patterns in the market. This strategy requires a significant investment in technology and AI, and machine learning expertise. The risk-return trade-off is a key factor to consider when selecting a hedge fund strategy. High-risk strategies may offer the potential for higher returns but also come with a higher risk of losses. Low-risk strategies may offer lower returns but also come with a lower risk of losses. Selecting a strategy that aligns with the fund's risk appetite and investment objectives is important. The historical performance of a hedge fund strategy is an important factor to consider. It is important to look at the strategy's track record and evaluate its performance over time. This can help to identify the strategy's strengths and weaknesses and determine its suitability for the fund's investment objectives. The expertise of the hedge fund manager is a key factor to consider. Evaluating the manager's experience, track record, and investment philosophy is important. This can help to ensure that the manager has the necessary skills and expertise to execute the chosen strategy effectively. Hedge funds typically charge fees that are higher than traditional investment vehicles. Understanding the fees and expenses associated with the chosen strategy and evaluating their impact on the fund's overall returns is important. The liquidity of the chosen strategy is an important factor to consider. It is important to evaluate the liquidity of the assets the strategy holds and ensure that it can meet the fund's liquidity needs. The best hedge fund strategy for an investor depends on their investment goals, risk tolerance, and investment horizon. It is important to do thorough research and due diligence on a fund manager and their strategy before investing. Hedge funds offer investors alternative investment options managed by professional fund managers. However, investors must understand the different investment strategies available to identify the best hedge fund strategies. By considering fundamental, quantitative, risk management, and emerging strategies, investors can select the strategies best suited to their risk appetite and investment objectives. When selecting hedge fund strategies, key factors include risk-return trade-off, historical performance, manager expertise, fees and expenses, and liquidity. Investors seeking assistance with wealth management services can seek professional advice. You may seek professional wealth management services or a financial advisor for guidance on selecting the best hedge fund strategies.What Are Hedge Funds?

Fundamental Strategies for Hedge Funds

Long/Short Equity Strategy

Event-Driven Strategy

Global Macro Strategy

Relative Value Strategy

Quantitative Strategies for Hedge Funds

Statistical Arbitrage Strategy

High-Frequency Trading Strategy

Algorithmic Trading Strategy

Risk Management Strategies for Hedge Funds

Diversification Strategy

Hedging Strategy

Stop-Loss Strategy

Emerging Hedge Fund Strategies

Cryptocurrency Trading Strategy

Environmental, Social, and Governance (ESG) Strategy

Artificial Intelligence/Machine Learning Strategy

Factors to Consider When Selecting the Best Hedge Fund Strategies

Risk-Return Trade-Off

Historical Performance

Manager Expertise

Fees and Expenses

Liquidity

The Bottom Line

Best Hedge Fund Strategies FAQs

A hedge fund strategy is a technique or method used by hedge fund managers to achieve their investment objectives. These strategies can be fundamental, quantitative, risk management, or emerging strategies.

Hedge funds and mutual funds are both investment vehicles, but they differ in several ways. Hedge funds typically have fewer investors and are only available to accredited investors, while mutual funds are available to the general public. Hedge funds also have greater flexibility in terms of investment strategies and are often managed more actively than mutual funds.

Hedge funds can be riskier than other types of investments due to their use of leverage, derivatives, and other complex financial instruments. However, the risk level of a hedge fund can vary depending on the investment strategy used and the expertise of the manager.

Hedge funds typically charge fees that are higher than those associated with traditional investment vehicles. These fees can include a management fee, a percentage of the assets under management, and a performance fee, a percentage of the fund's profits.

Investing in a hedge fund typically requires accreditation as an investor, which means meeting certain income or net worth requirements. Hedge funds are not typically available to the general public and may require a minimum investment amount. Investors can typically invest in hedge funds through a private placement offering or through a fund of hedge funds.