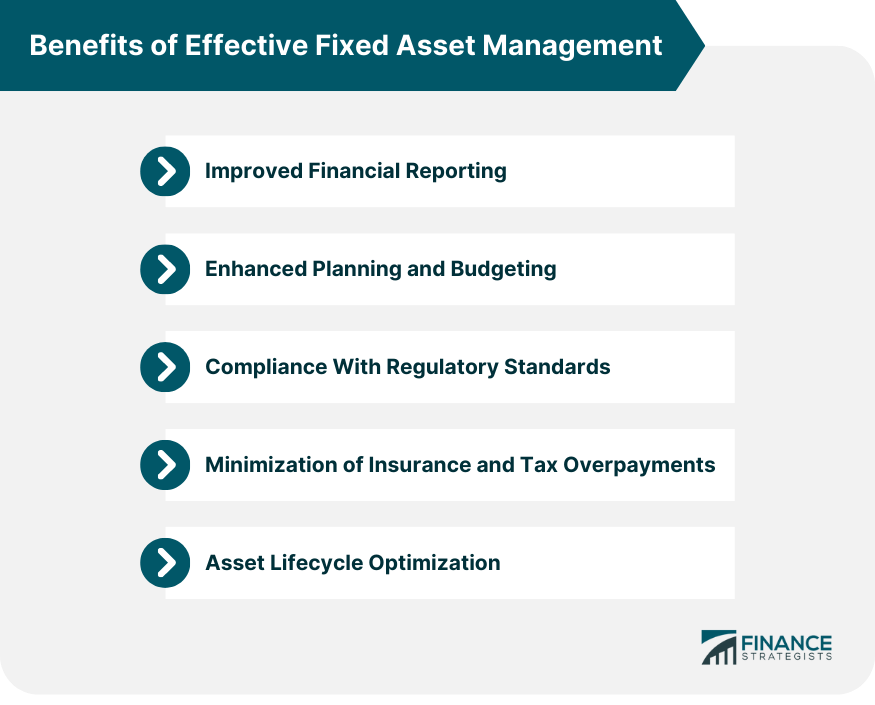

Fixed asset management is an essential business process that offers multiple benefits. It provides accurate tracking, valuation, and control over tangible assets such as buildings, machinery, or vehicles. This leads to enhanced financial reporting by reflecting the true value of assets, taking depreciation into account. It also improves planning and budgeting as companies gain clear insight into their assets' lifespan and maintenance needs. Furthermore, effective fixed asset management ensures regulatory compliance, minimizing risks of sanctions or penalties. Importantly, it prevents insurance and tax overpayments by avoiding overvaluation of assets. The adoption of modern technology in fixed asset management can automate these processes, leading to greater efficiency and cost savings. Thus, fixed asset management contributes significantly to the overall business efficiency and financial health of an organization. Implementing fixed asset management effectively can bring numerous benefits to a business. Fixed assets represent a significant investment for most businesses. Correctly tracking these assets and their depreciation can provide a more accurate picture of a company's financial position, enhancing the quality of financial reporting. With a clear understanding of their fixed assets, companies can make more informed decisions about future investments, operational costs, and potential asset disposals. This clarity can significantly improve planning and budgeting processes. Many jurisdictions have regulations that require businesses to manage and report on their fixed assets accurately. Effective fixed asset management can help ensure compliance with these standards, reducing the risk of penalties or sanctions. Accurate tracking and valuation of assets can help businesses avoid overpaying insurance premiums and taxes. By reflecting the true, depreciated value of assets, companies can save significant costs. By managing assets effectively throughout their lifecycle, businesses can maximize the value they get from each asset, prolong their operational life, and make more informed decisions about when to dispose of or replace them. Fixed asset management involves several key components that, together, ensure assets are tracked, maintained, and valued appropriately throughout their lifecycle. This refers to managing an asset from acquisition to disposal. It involves understanding when to purchase an asset, how to use it most efficiently during its operational life, and when and how to dispose of it effectively. Managing the asset lifecycle can help businesses optimize costs and improve productivity. Depreciation accounts for the decrease in an asset's value over time. Various methods can be used to calculate depreciation, such as straight-line, declining balance, and units of production. Proper management of depreciation helps companies to reflect the true value of their assets and avoid financial discrepancies. Asset tracking involves keeping track of where assets are, who is using them, and how they are being used. Inventory control, on the other hand, ensures there is an accurate record of all assets held by a company. Accurate asset tracking and inventory control can help to prevent loss or misuse of assets. Asset maintenance ensures assets are kept in good working condition, reducing the likelihood of downtime due to repairs or replacements. Regular maintenance can extend an asset's operational life and enhance its performance. At the end of an asset's useful life, it needs to be disposed of correctly. This might involve selling the asset, recycling parts, or even writing it off completely. Effective management of this process can help companies to recover some of the initial costs and minimize environmental impact. Fixed asset management also contributes significantly to overall business efficiency. By ensuring that assets are in good working condition and that they are replaced or repaired when necessary, fixed asset management can help to avoid disruptions to business operations and enhance overall productivity. Fixed asset management provides critical information that can inform capital investment decisions. With clear visibility of current assets and their condition, businesses can make more strategic decisions about future investments. Regular audits are a requirement for many businesses. Accurate and comprehensive fixed asset management can simplify this process and make it easier to demonstrate compliance with relevant regulations. In case of disasters such as fires or floods, having a comprehensive record of fixed assets can significantly speed up the recovery process. It can help businesses to identify what was lost, facilitate insurance claims, and plan for the replacement of essential assets. The first step to choosing the right fixed asset management solution is understanding your needs. This includes analyzing the size and complexity of your asset portfolio, the lifecycle stages of your assets, and the regulatory environment in which you operate. Identifying your requirements can help you select a system that provides the necessary features and functionalities. The reputation of the software vendor is an essential factor to consider. A reputable vendor is more likely to provide reliable software that meets your needs. In addition, the support services offered by the vendor can be critical for the successful implementation and ongoing use of the system. These services can include training, technical support, and regular software updates. When choosing a fixed asset management solution, it's important to evaluate the features of potential systems. These may include asset tracking capabilities, depreciation calculation methods, maintenance scheduling, and reporting functionalities. In addition, consider the usability of the software. A user-friendly system can facilitate quicker adoption and increase efficiency. The cost of a fixed asset management solution is a significant factor, but it should not be the sole determinant. It's important to also consider the return on investment the system can deliver. A more expensive system may provide greater efficiencies, more accurate tracking and reporting, and better compliance capabilities, all of which can yield significant long-term savings. Finally, consider the scalability and flexibility of the system. Your fixed asset management needs may evolve over time, so it's crucial to choose a solution that can grow with your business. A scalable system allows you to add more assets and users as needed, while a flexible system can adapt to changing regulations and business practices. Fixed asset management stands as a vital process within any organization, significantly contributing to business efficiency and financial health. By accurately tracking, valuing, and controlling tangible assets, organizations can enhance financial reporting, improve planning and budgeting, and ensure regulatory compliance. A noteworthy factor includes digital technology, offering automation that bolsters efficiency and accuracy. The components of fixed asset management, including asset lifecycle management, depreciation calculations, asset tracking, maintenance management, and asset disposal, further ensure comprehensive oversight. Making an informed choice in fixed asset management solutions requires an understanding of one's needs, consideration of vendor reputation, a thorough evaluation of system features, an analysis of cost against return on investment, and careful consideration of system scalability. Ultimately, effective fixed asset management helps companies maximize asset value, drive strategic decision-making, and bolster overall operational efficiency.Benefits of Fixed Asset Management

Benefits of Effective Fixed Asset Management

Improved Financial Reporting

Enhanced Planning and Budgeting

Compliance With Regulatory Standards

Minimization of Insurance and Tax Overpayments

Asset Lifecycle Optimization

Components of Fixed Asset Management

Asset Lifecycle Management

Depreciation Methods and Calculations

Asset Tracking and Inventory Control

Asset Maintenance Management

Disposal and Retirement of Assets

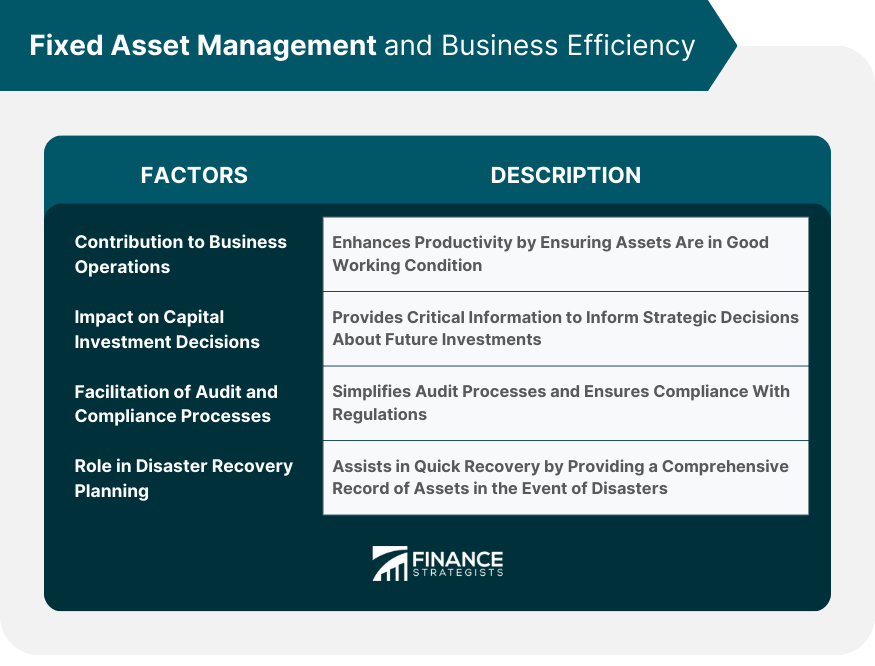

Fixed Asset Management and Business Efficiency

Contribution to Business Operations

Impact on Capital Investment Decisions

Facilitation of Audit and Compliance Processes

Role in Disaster Recovery Planning

Choosing the Right Fixed Asset Management Solution

Understand the Needs

Vendor Reputation and Support Services

Evaluate Features and Usability

Consider Cost and Return on Investment

Importance of Scalability and Flexibility

Conclusion

Benefits of Fixed Asset Management FAQs

The main benefit of fixed asset management is that it allows companies to track, manage, and optimize the use of their fixed assets throughout their lifecycle. This enhances financial reporting, assists in planning and budgeting, ensures regulatory compliance, and contributes to business efficiency.

Fixed asset management improves financial reporting by providing accurate and up-to-date information about a company's fixed assets and their depreciation. This allows companies to reflect the true value of their assets, leading to more accurate financial statements.

Many jurisdictions have regulations requiring companies to accurately track and report on their fixed assets. Fixed asset management helps ensure that all such information is accurate and readily available, which can facilitate compliance with these regulations and reduce the risk of penalties.

Technology plays a critical role in modern fixed asset management. It can automate various processes, from tracking assets and calculating depreciation to scheduling maintenance and managing asset disposal. This can improve efficiency, accuracy, and compliance, leading to substantial cost savings.

Choosing the right fixed asset management solution involves evaluating the company's needs and comparing them against the features, cost, and scalability of potential solutions. It also involves considering the vendor's reputation, support services, and the ease of use of the software.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.