Crypto Asset Management refers to the process of managing digital assets, such as Bitcoin, Ethereum, and other cryptocurrencies, to meet investment goals. It involves creating a diversified portfolio of various crypto assets and systematically tracking and rebalancing it to maximize returns and minimize risks. Similar to traditional asset management, crypto asset management incorporates strategies like fundamental and technical analysis and risk management. However, it also accounts for unique factors like high market volatility, round-the-clock trading, and stringent cybersecurity needs. The landscape is continually evolving due to technological advancements, the emergence of Decentralized Finance (DeFi), regulatory changes, and shifts in the economic environment. Despite its challenges, effective crypto asset management is becoming increasingly significant in the global financial ecosystem. Bitcoin, the first and most well-known crypto asset, has often been called "digital gold". It serves as a decentralized store of value and a potential hedge against inflation. Ethereum, the second-largest crypto asset, offers much more than just a digital currency. Its blockchain enables the creation of smart contracts and decentralized applications (dApps), making it a platform for innovation. "Altcoins" is a collective term for all other cryptocurrencies that came after Bitcoin. These include prominent names like Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each having its own unique features and uses. Stablecoins are cryptocurrencies pegged to a stable asset like the US Dollar. They aim to combine the benefits of crypto, like speed and security, with the stability of traditional currencies. NFTs represent ownership of unique items or content on the blockchain. Unlike standard cryptocurrencies, they aren't interchangeable as each NFT has a distinct value and properties. DeFi tokens are associated with Decentralized Finance projects. They often serve as governance tokens allowing holders to vote on project decisions or utility tokens used within the project's ecosystem. Crypto assets provide financial services to those unbanked or underbanked, creating a more inclusive financial system. Given their volatility, cryptocurrencies have the potential for high returns, making them an attractive alternative investment. Crypto assets enable fast, cross-border transactions with lower fees, compared to traditional banking systems. Cryptocurrencies operate on a decentralized model, providing users with more control over their assets without intermediary involvement. Crypto assets are known for their high price volatility, which can lead to significant financial losses. As crypto assets are relatively new, they face a changing and uncertain regulatory landscape that can affect their value and legality. Being digital, crypto assets are subject to cybersecurity threats such as hacking and phishing attacks. If private keys to crypto wallets are lost or stolen, access to the corresponding crypto assets is irretrievable, leading to a complete loss. A crypto wallet is a digital wallet that allows users to store, send, and receive digital currency. Some wallets are built for a single cryptocurrency, some can be used for more than one coin, and others offer a high level of security. Understanding how to use and secure these wallets is an integral part of crypto asset management. Crypto exchanges are platforms where users can buy, sell, or trade cryptocurrencies for other assets, such as conventional money or other digital currencies. They are crucial in crypto asset management as they provide the marketplace for transactions. Some popular exchanges include Coinbase, Binance, and Kraken. Crypto custodians provide a way for large financial organizations to better manage their investments in crypto assets securely. By securing crypto assets in institutional-grade vaults, they help to mitigate the risk of theft. Crypto custodians also help institutions meet regulatory compliance, as well as provide a host of other asset-supporting services. Crypto portfolio trackers are a valuable tool for tracking the value of your crypto investments in various currencies. They can provide investors with a snapshot of how their portfolio is performing and can assist with tax reporting. On the other hand, analysis tools can help investors make informed decisions about buying or selling based on market trends and comprehensive data. It requires investors to understand the value proposition of a crypto asset, including its market potential and competitive environment. Technical analysis, in contrast, is primarily concerned with price movements and trading volumes. By studying price charts and various statistical trends, investors can attempt to predict future price movements and identify investment opportunities. Risk management is crucial in crypto asset management due to the volatile nature of crypto markets. This could involve setting stop losses or limit orders on your investments, diversifying your portfolio, or only investing money that you're willing to lose. Diversification strategies in crypto asset management seek to optimize returns by investing in a broad spectrum of cryptocurrencies. It's the classic "don't put all your eggs in one basket" strategy. By spreading investments across various crypto assets, investors can potentially reduce risk and increase the likelihood of earning a profit. Crypto Asset Management plays a crucial role in navigating the dynamic digital currency market. It encompasses a diverse set of cryptocurrencies, each with unique attributes, contributing to the broader digital economy. An integral part of this process includes understanding and utilizing tools such as crypto wallets and exchanges alongside stringent security practices like crypto custodianship. Effective asset management also necessitates comprehensive strategies encompassing fundamental and technical analysis, risk management, and diversification. However, the landscape's volatility, regulatory uncertainties, and potential security threats pose considerable challenges. Therefore, strict adherence to regulatory compliance is paramount. As the crypto domain continues to evolve with trends such as DeFi and NFTs, crypto asset management is poised to be a significant facet of the global financial ecosystem, offering opportunities for robust financial inclusion, high return potential, and enhanced user autonomy.Crypto Asset Management Overview

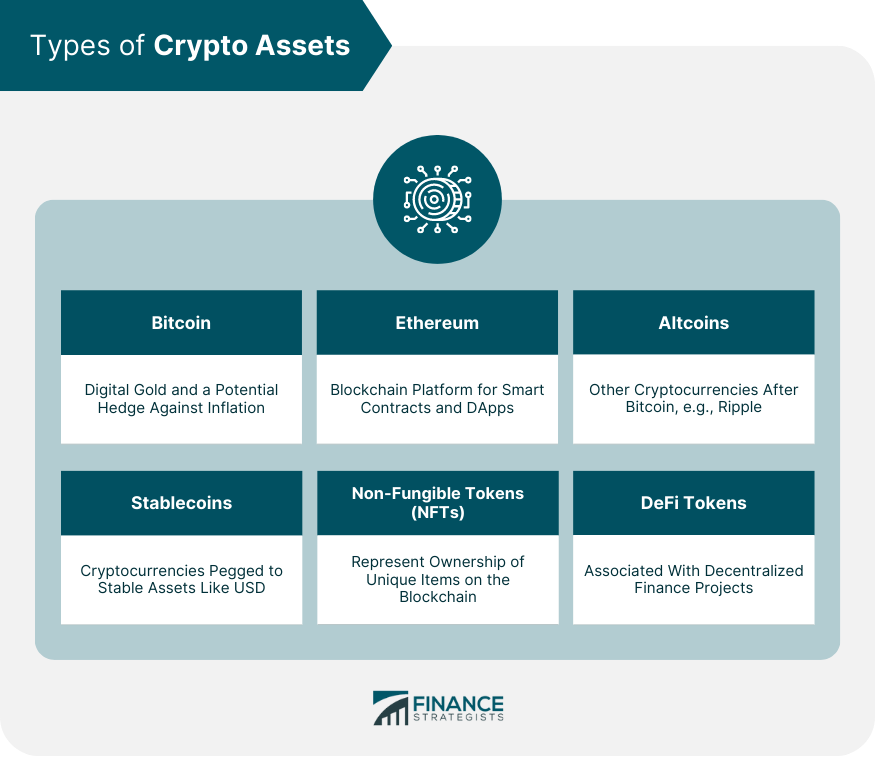

Types of Crypto Assets

Bitcoin

Ethereum

Altcoins

Stablecoins

Non-Fungible Tokens (NFTs)

DeFi Tokens

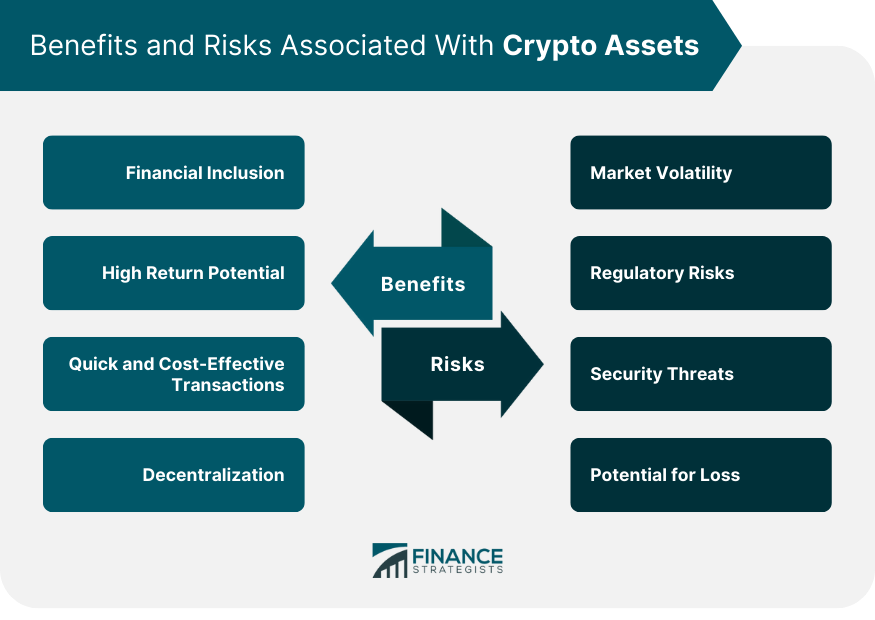

Benefits Associated With Crypto Assets

Financial Inclusion

High Return Potential

Quick and Cost-Effective Transactions

Decentralization

Risks Associated With Crypto Assets

Market Volatility

Regulatory Risks

Security Threats

Potential for Loss

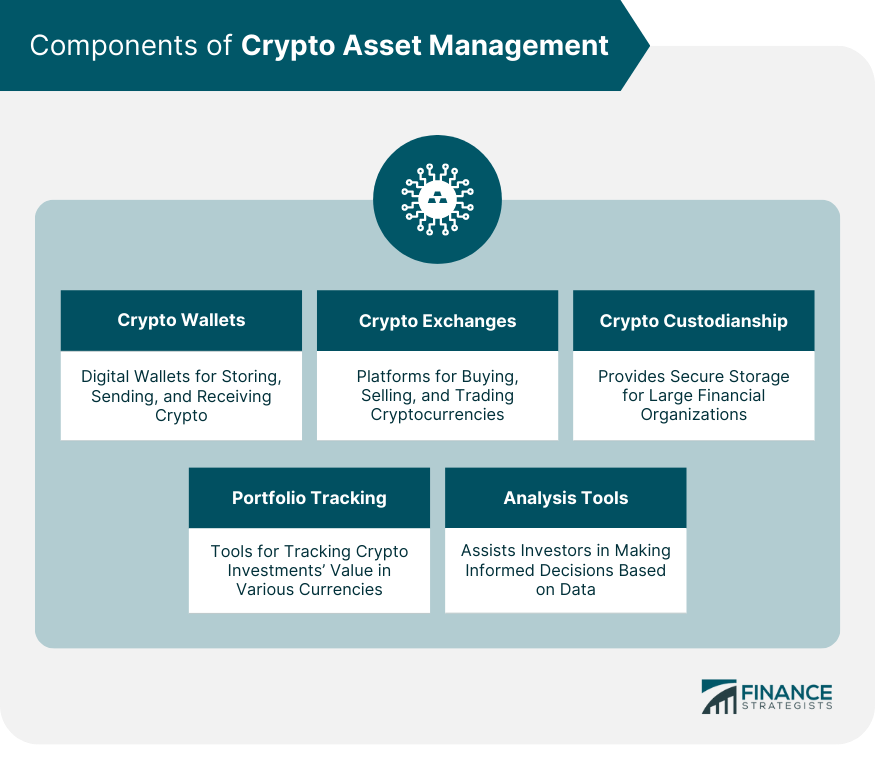

Components of Crypto Asset Management

Crypto Wallets

Crypto Exchanges

Crypto Custodianship

Crypto Portfolio Tracking and Analysis Tools

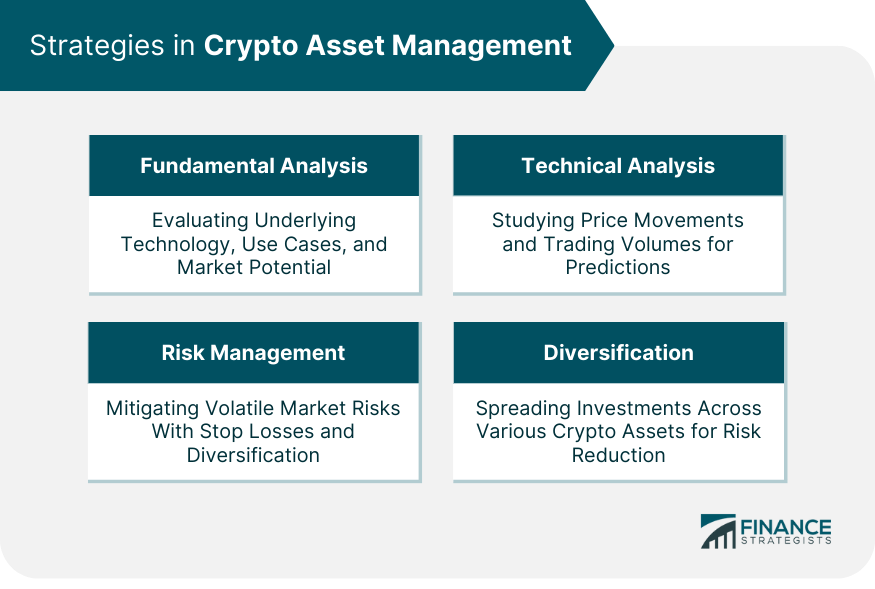

Strategies in Crypto Asset Management

Fundamental Analysis

Crypto asset management involves evaluating a cryptocurrency's underlying technology, specific use cases, and the team behind it.

Technical Analysis in Crypto Asset Management

Risk Management in Crypto Asset Management

Diversification Strategies in Crypto Asset Management

Conclusion

Crypto Asset Management FAQs

Crypto asset management refers to the strategic process of managing a portfolio of cryptocurrencies with the aim of optimizing returns and mitigating risks. It involves creating a diversified portfolio of cryptocurrencies, tracking their performance, and rebalancing the portfolio as needed.

While crypto asset management shares some similarities with traditional asset management, such as the goal of optimizing returns, it also has distinct characteristics. Crypto markets operate 24/7, they experience higher volatility, and there is no central authority governing them. Moreover, managing crypto assets requires understanding unique tools, like digital wallets and blockchain technology.

Crypto wallets are digital tools that allow users to store, send, and receive cryptocurrencies. They are crucial in crypto asset management because they are the primary means for handling crypto assets. Understanding how to securely use and protect these wallets is a key aspect of managing crypto assets.

Regulatory compliance significantly impacts crypto asset management. Regulations can define the legality of certain cryptocurrencies, affect the operations of crypto exchanges, and dictate the tax implications of crypto investments. Ensuring compliance with these regulations is crucial in crypto asset management to avoid legal repercussions.

Emerging trends like Decentralized Finance (DeFi), Artificial Intelligence (AI), Machine Learning (ML), the growth of stablecoins, and the emergence of non-fungible tokens (NFTs) are reshaping the landscape of crypto asset management. These trends provide new opportunities for managing and growing crypto assets, introducing new dimensions to the field.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.