Homemade leverage refers to a strategy employed by investors to increase their exposure to an investment or asset class by using their existing resources rather than relying on traditional leverage provided by financial institutions. It involves borrowing funds externally at a low-interest rate, such as through a mortgage or personal loan, and then investing those funds in higher-yielding assets. This form of leverage is different from corporate leverage, which is typically created through the use of debt financing by companies. Homemade leverage allows investors to amplify their potential returns through the use of borrowed funds while also increasing their financial risk exposure. Proper risk assessment and management are crucial when using homemade leverage. Financial leverage refers to the use of debt to amplify the potential returns on investment. By employing debt, investors can increase the size of their investments without committing additional personal funds. The borrowed money allows investors to potentially achieve higher returns but also exposes them to a greater degree of financial risk. Operating leverage, on the other hand, relates to a company's fixed costs structure and how it impacts the company's profitability. Higher operating leverage indicates that a larger proportion of a company's costs are fixed, which means that the company's profits are more sensitive to changes in sales. While this concept is relevant to the analysis of company financials, it is not directly related to homemade leverage. The first component of homemade leverage is borrowing money. This can be accomplished through various means, such as personal loans, home equity lines of credit, or margin loans from brokerage accounts. The borrowed funds are then used to invest in assets, amplifying the investor's exposure to the potential returns and risks of the investments. The second component of homemade leverage is investing the borrowed funds in assets. These investments can include stocks, bonds, real estate, or other types of assets that the investor believes will generate returns sufficient to cover the cost of borrowing and provide additional profits. One way to measure homemade leverage is by calculating the debt-to-equity ratio. This ratio compares an investor's total debt to their total equity, with higher ratios indicating greater leverage. For example, if an investor has $100,000 in debt and $50,000 in equity, their debt-to-equity ratio would be 2:1. Another method for measuring homemade leverage is the degree of total leverage (DTL). The DTL is calculated by dividing the percentage change in an investor's return on equity (ROE) by the percentage change in their return on assets (ROA). A higher DTL indicates a greater degree of leverage. One key strategy for managing homemade leverage is diversification. By spreading investments across a variety of asset classes and sectors, investors can reduce the overall risk associated with their leveraged investments and potentially mitigate losses in the event of poor performance in one area. Regularly monitoring and adjusting leverage levels is another important strategy for managing homemade leverage. By staying aware of their debt-to-equity ratio and degree of total leverage, investors can make informed decisions about whether to reduce or increase their leverage based on their risk tolerance and financial goals. Effective debt management techniques, such as refinancing loans to obtain lower interest rates or consolidating debts, can help investors manage their homemade leverage more effectively. This can lead to lower borrowing costs and improved financial stability. Conducting scenario analysis and stress testing can help investors better understand the potential outcomes of their homemade leverage strategies. By modeling various scenarios, such as changes in interest rates or investment performance, investors can assess the potential impact on their financial situation and make adjustments as needed. Homemade leverage offers investors a high degree of customization and control over their financial strategies. By choosing the amount and type of debt they take on, as well as the assets they invest in, investors can tailor their leverage to align with their individual risk tolerance, investment goals, and financial circumstances. Using homemade leverage allows investors to adjust their financial plans more easily. As their financial goals or risk tolerance change, investors can modify their leverage levels by paying down debt, taking on additional debt, or adjusting their investment mix. By amplifying their investment exposure with borrowed funds, investors can potentially achieve higher returns than they would by investing only their own money. This can help investors reach their financial goals more quickly, such as accumulating wealth for retirement, funding a child's education, or purchasing a home. In some cases, the interest paid on loans used for investment purposes can be tax-deductible, reducing the overall cost of borrowing. This tax advantage can further enhance the benefits of homemade leverage, making it an attractive option for some investors. While homemade leverage can amplify potential returns, it also increases the investor's exposure to financial risk. The use of borrowed funds means that investors are responsible for repaying their debts, regardless of the performance of their investments. If the investments do not generate returns sufficient to cover the cost of borrowing, the investor may face financial difficulties or even bankruptcy. Homemade leverage can also create liquidity concerns, particularly if the investments are illiquid or difficult to sell. In such cases, an investor may struggle to access the funds needed to repay their debts, leading to potential default or forced asset sales. The use of leverage magnifies both potential gains and potential losses. If investments perform poorly, the losses can be much larger than if the investor had not used leverage. This can result in significant financial setbacks and delay the achievement of financial goals. Using homemade leverage can have an impact on an investor's creditworthiness. High levels of debt can negatively affect credit scores, making it more difficult to secure additional financing or obtain favorable interest rates on future loans. Homemade leverage and corporate leverage differ in their risk profiles. While both types of leverage involve the use of borrowed funds to amplify potential returns, homemade leverage is typically riskier for the individual investor. This is because the investor is personally responsible for repaying the debt, whereas corporate debt is backed by the company's assets and future cash flows. Corporate leverage often involves access to larger amounts of capital at more favorable interest rates than individual investors can obtain. This is due to the larger size and creditworthiness of corporations compared to individual investors, as well as the greater variety of financing options available to companies, such as issuing bonds or taking on bank loans. The tax implications of homemade leverage and corporate leverage can also differ. While interest payments on some types of personal debt may be tax-deductible for individual investors, corporations can often deduct interest expenses from their taxable income, providing a more significant tax advantage. Investor perceptions of homemade leverage and corporate leverage can differ as well. While corporate leverage can sometimes be viewed as a positive sign of growth and expansion, high levels of homemade leverage may raise concerns about an individual investor's financial stability and risk management. Homemade leverage is a powerful financial tool that enables individual investors to amplify their investment returns and achieve their financial goals more quickly. By understanding the mechanics of homemade leverage, such as calculating and monitoring debt-to-equity ratios and the degree of total leverage, investors can make informed decisions and tailor their strategies to align with their risk tolerance and objectives. However, homemade leverage also comes with increased risks, including liquidity concerns and potential losses. Therefore, it is crucial for investors to carefully manage these risks through diversification, debt management techniques, and scenario analysis. While homemade leverage can be a valuable addition to an investor's financial toolkit, it is essential to approach it with caution and a thorough understanding of the potential advantages and drawbacks. For those considering employing homemade leverage, seeking professional advice from a financial advisor can provide valuable guidance and help ensure the optimal implementation of this strategy in their personal finance plan.Definition of Homemade Leverage

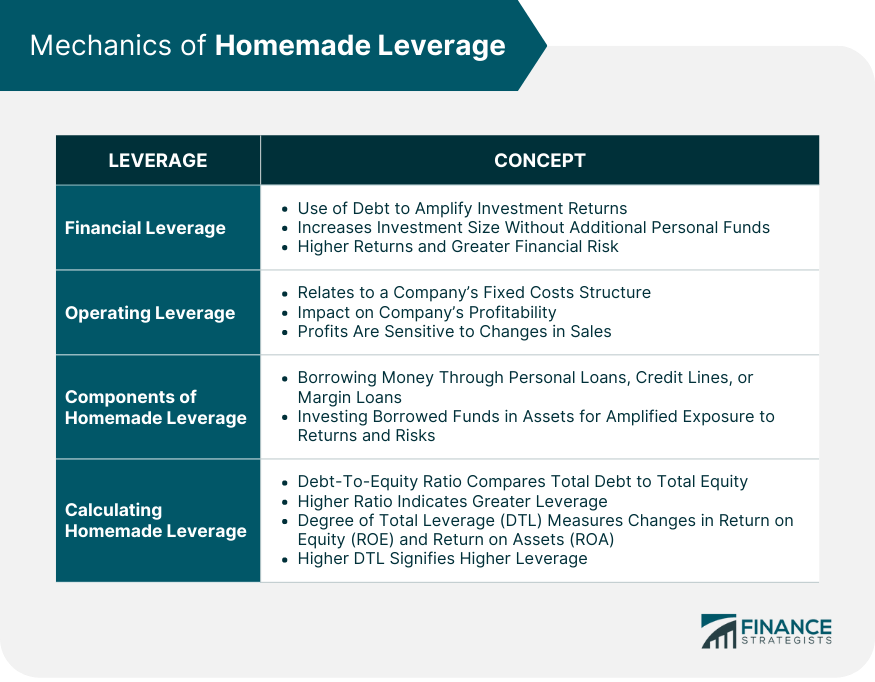

Mechanics of Homemade Leverage

Financial Leverage

Operating Leverage

Components of Homemade Leverage

Borrowing Money

Investing in Assets

Calculating Homemade Leverage

Debt-To-Equity Ratio

Degree of Total Leverage

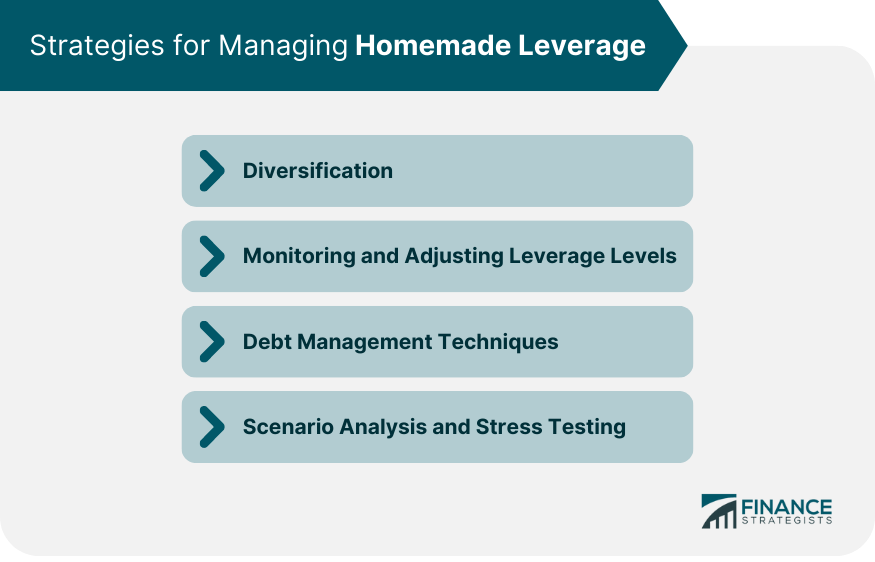

Strategies for Managing Homemade Leverage

Diversification

Monitoring and Adjusting Leverage Levels

Debt Management Techniques

Scenario Analysis and Stress Testing

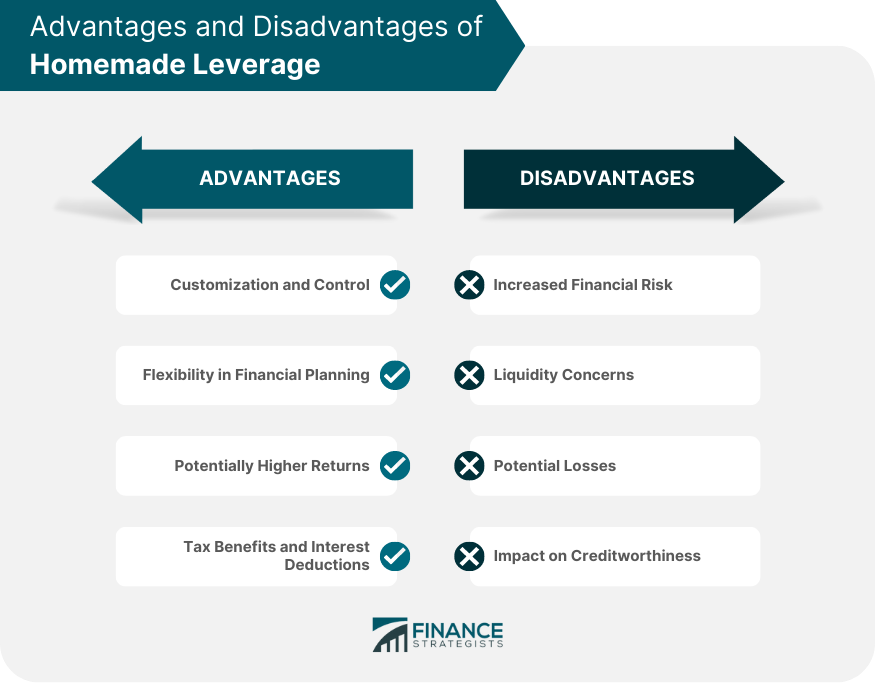

Advantages of Homemade Leverage

Customization and Control

Flexibility in Financial Planning

Potentially Higher Returns

Tax Benefits and Interest Deductions

Disadvantages of Homemade Leverage

Increased Financial Risk

Liquidity Concerns

Potential Losses

Impact on Creditworthiness

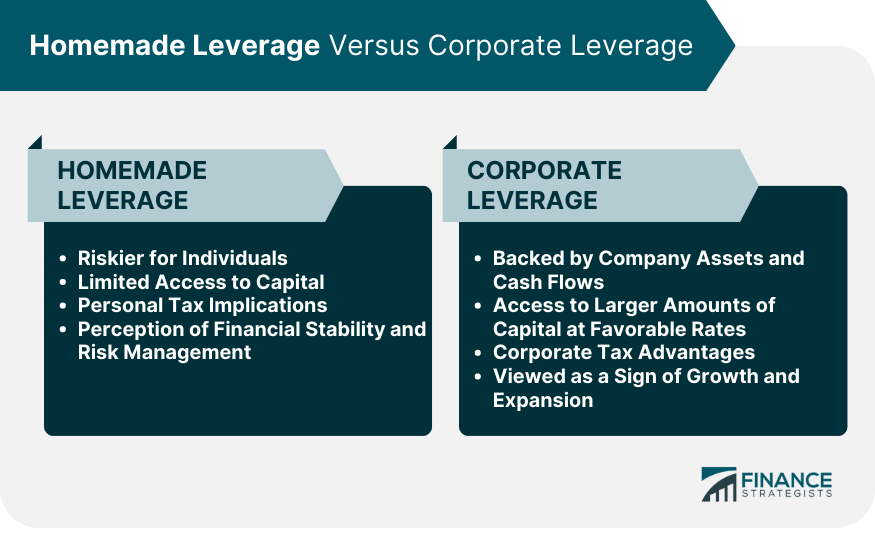

Homemade Leverage Versus Corporate Leverage

Differences in Risk Profiles

Access to Capital

Tax Implications

Investor Perception

Conclusion

Homemade Leverage FAQs

Homemade leverage refers to the process by which individual investors create their own leverage by borrowing money and investing in assets, such as stocks or real estate. It is important because it allows investors to potentially enhance their investment returns, achieve financial goals more quickly, and customize their financial strategies according to their risk tolerance and objectives.

You can calculate homemade leverage using the debt-to-equity ratio, which compares an investor's total debt to their total equity, or the degree of total leverage (DTL), which is calculated by dividing the percentage change in an investor's return on equity (ROE) by the percentage change in their return on assets (ROA).

The main advantages of using homemade leverage include customization and control, flexibility in financial planning, potentially higher returns, and tax benefits and interest deductions (in some cases, interest paid on loans used for investment purposes can be tax-deductible).

The risks and disadvantages of homemade leverage include increased financial risk, liquidity concerns, potential losses, and the impact on creditworthiness. Investors need to carefully consider these risks and manage them effectively to ensure the successful use of homemade leverage.

To manage the disadvantages associated with homemade leverage, you can implement strategies such as diversification, monitoring and adjusting leverage levels, employing debt management techniques, and conducting scenario analysis and stress testing. These approaches can help you optimize your financial strategies and make more informed decisions when using homemade leverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.