The Income Replacement Ratio (IRR) is a financial metric that helps individuals estimate the percentage of their pre-retirement income needed to maintain their desired standard of living during retirement. It is an essential component of retirement planning, providing a target for saving and investing throughout one's working years. Understanding and planning for an appropriate IRR ensures financial security during retirement. By estimating the percentage of pre-retirement income required to cover living expenses, retirees can create a retirement income strategy that meets their needs and helps maintain their desired lifestyle. Several factors influence an individual's desired IRR, including: Pre-Retirement Income: The higher the income before retirement, the higher the IRR may need to be. Desired Retirement Lifestyle: Luxurious or more modest lifestyles will have different IRR requirements. Inflation and Cost of Living Adjustments: Increases in the cost of goods and services over time must be considered. Taxes: Retirement income is often subject to taxation, which impacts the IRR. Healthcare Costs: Healthcare expenses typically increase as people age, affecting the IRR. Social Security Benefits: These benefits can help supplement retirement income, influencing the IRR. There are two primary methods for calculating an individual's IRR: Rule of Thumb (70-80%): A common guideline suggests that retirees need 70-80% of their pre-retirement income to maintain their standard of living. This method is simple but may not accurately reflect individual needs. Customized Approach: A more personalized calculation considers specific factors such as retirement lifestyle, inflation, taxes, and healthcare costs. This method provides a more accurate IRR for each individual. Assessing personal IRR goals is crucial to ensure that individuals are on track to meet their financial objectives. It helps to measure the success of investments and identify areas that need improvement. Moreover, personal IRR goals act as a benchmark for evaluating the performance of investment portfolios and making informed decisions about future investments. There are several strategies to help individuals achieve their target IRR: Retirement Savings Accounts: Contributing to employer-sponsored retirement plans and individual retirement accounts can help accumulate savings for retirement. Diversification and Asset Allocation: A well-diversified investment portfolio with an appropriate mix of stocks, bonds, and other assets can help manage risk and potentially increase returns. Annuities: These insurance products can provide guaranteed income for life, supplementing other retirement income sources. Real Estate Investments: Real estate can generate income through rental properties and appreciate in value, contributing to overall retirement income. As personal circumstances change, individuals may need to adjust their IRR goals to reflect their new financial situation. For example, if an individual experiences a significant increase in income, they may want to set a higher IRR goal to maximize their investment returns. On the other hand, if an individual experiences a decrease in income, they may need to adjust their IRR goal to a more realistic level. Changes in the financial markets can also impact personal IRR goals. If the financial markets are performing well, individuals may need to adjust their IRR goals upward to take advantage of the favorable conditions. Conversely, if the financial markets are performing poorly, individuals may need to adjust their IRR goals downward to account for the increased risk. When transitioning into retirement, a well-structured income strategy is essential: Withdrawal Rates: Establishing a safe withdrawal rate from retirement accounts can help ensure savings last throughout retirement. The Sequence of Returns Risk: Managing the risk of poor investment returns early in retirement can help protect retirement savings. Tax-Efficient Withdrawals: Structuring withdrawals to minimize taxes can help maximize retirement income. In retirement, it is important to distinguish between essential and discretionary expenses and adjust spending accordingly: Essential vs. Discretionary Expenses: Essential expenses include housing, food, and healthcare, while discretionary expenses involve travel, entertainment, and hobbies. Retirees must prioritize essential expenses and adjust discretionary spending as needed. Managing Healthcare Costs: Healthcare expenses tend to increase with age, so retirees should plan for these costs and consider supplemental insurance or savings to cover them. Downsizing and Relocation Considerations: Retirees may consider downsizing their homes or relocating to areas with lower costs of living to help reduce expenses and meet their IRR goals. There are several risks and challenges that can affect the ability to achieve the desired IRR: Market Risks: Investment returns can be unpredictable, and market downturns can impact retirement savings. Longevity Risk: Retirees may live longer than expected, which could lead to depleted savings and insufficient income. Inflation Risk: Rising prices can erode purchasing power, making it difficult to maintain the desired standard of living. Healthcare and Long-Term Care Costs: Unexpected healthcare or long-term care expenses can significantly impact retirement savings and achieve the desired IRR. Unexpected Life Events: Unanticipated events such as job loss, divorce, or the death of a spouse can impact retirement savings and the ability to meet IRR goals. The Income Replacement Ratio (IRR) is a crucial metric for retirement planning, as it estimates the percentage of pre-retirement income needed to maintain one's desired standard of living during retirement. Several factors such as pre-retirement income, desired retirement lifestyle, inflation, taxes, healthcare costs, and social security benefits influence an individual's desired IRR. There are two primary methods for calculating IRR: the rule of thumb and the customized approach. Saving for retirement requires strategies such as contributing to retirement savings accounts, diversification, and asset allocation, annuities, and real estate investments. Assessing personal IRR goals periodically and adjusting them as necessary is essential to ensure that individuals are on track to meet their financial objectives. Finally, risks and challenges such as market risks, longevity risk, inflation risk, healthcare and long-term care costs, and unexpected life events can impact the ability to achieve the desired IRR. A well-structured retirement income strategy and distinguishing between essential and discretionary expenses can help retirees adjust to retirement expenses and meet their IRR goals.What Is the Income Replacement Ratio (IRR)?

Determining the Income Replacement Ratio

Factors Affecting IRR

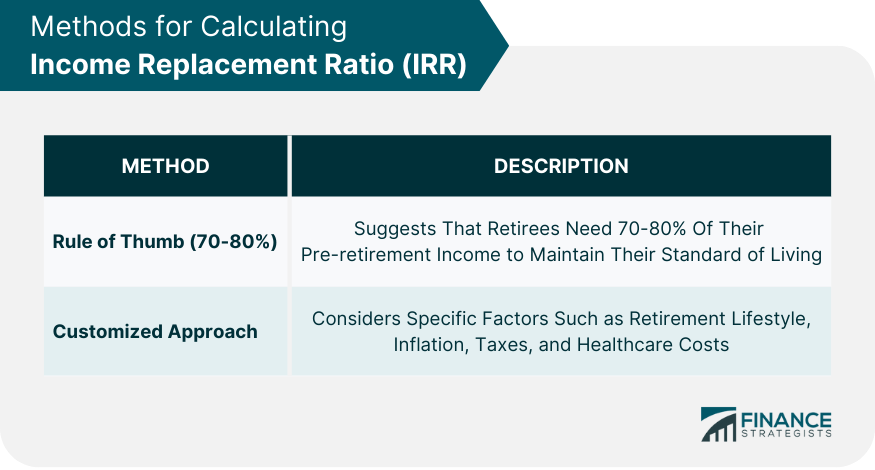

Methods for Calculating IRR

Assessing Personal IRR Goals

Saving for Retirement With IRR in Mind

Strategies for Achieving the Desired IRR

Monitoring and Adjusting IRR Goals

Implementing the Income Replacement Ratio in Retirement

Creating a Retirement Income Strategy

Adjusting to Retirement Expenses

Risks and Challenges in Achieving the Desired IRR

Conclusion

Income Replacement Ratio FAQs

Income replacement ratio is a financial term that refers to the percentage of your pre-retirement income that you need to replace in retirement to maintain the same standard of living.

Income replacement ratio is calculated by dividing your estimated retirement income by your pre-retirement income. For example, if your pre-retirement income is $100,000 and your estimated retirement income is $70,000, your income replacement ratio would be 70%.

Income replacement ratio is important for retirement planning because it helps you determine how much money you will need to save to maintain your standard of living in retirement.

A good income replacement ratio is around 80%. However, the actual percentage you need will depend on your circumstances, such as your expenses and lifestyle.

Yes, you can increase your income replacement ratio by saving more money for retirement, delaying your retirement age, and investing in assets that provide higher returns. However, it's important to note that there are no investment guarantees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.