Leverage constraints refer to limitations or restrictions placed on the amount of debt or leverage a company can use to finance its operations. These constraints may be self-imposed by a company's management, or they may be imposed by external factors such as lenders or regulatory agencies. The purpose of leverage constraints is to ensure that a company does not take on too much debt and become financially unstable, which could lead to bankruptcy or other financial difficulties. By limiting the amount of leverage a company can use, leverage constraints help to manage risk and ensure the long-term financial health of the company. Capital requirements are rules set by financial regulators that mandate financial institutions to hold a minimum level of capital relative to their risk-weighted assets. These requirements ensure that institutions have adequate capital buffers to absorb potential losses and reduce the likelihood of financial distress. Margin requirements are regulations that govern the amount of collateral that investors must provide when borrowing funds to invest in financial instruments. These requirements help manage counterparty risks and limit the potential for excessive leverage in the financial markets. Financial institutions often impose internal leverage constraints through risk management policies to control their risk exposure and maintain financial stability. These policies can include limits on the use of borrowed capital, risk concentration limits, and stress testing requirements. Investment mandates, such as those set by pension funds and endowments, may include leverage constraints that restrict the use of borrowed capital in their portfolios. These constraints can help align investments with the institution's risk appetite and fiduciary responsibilities. Leverage constraints can help reduce systemic risk by limiting the potential for financial institutions and investors to take on excessive leverage. This can lower the likelihood of widespread financial distress and contagion effects during periods of market turmoil. By enforcing leverage constraints, financial institutions and investors can build a more resilient financial system that is better equipped to withstand economic shocks and market fluctuations. Leverage constraints can influence investment behavior by altering the composition of portfolios. Investors may need to adjust their asset allocation to meet the imposed constraints, potentially affecting risk-taking and returns. With leverage constraints in place, investors and financial institutions may be less likely to engage in excessive risk-taking, as they are limited in their ability to amplify returns through borrowed capital. The Basel III framework, an international regulatory accord, imposes leverage constraints on banks in the form of capital requirements and a minimum leverage ratio. This framework aims to improve the banking sector's resilience and reduce the likelihood of bank failures. Banks are required to maintain a minimum leverage ratio, defined as the ratio of a bank's tier 1 capital to its average total consolidated assets. This requirement helps ensure that banks have adequate capital buffers even in the absence of risk-weighted measures. Hedge funds often face leverage constraints through prime brokerage financing, where prime brokers may impose limits on the amount of borrowed capital that funds can access. This can help manage counterparty risk and reduce the potential for excessive leverage. In addition to prime brokerage financing, hedge funds may face leverage constraints through counterparty risk management practices. Counterparties may require additional collateral or impose stricter credit terms to manage their exposure to hedge fund clients. The Solvency II framework, a set of regulatory requirements for insurance companies in the European Union, imposes leverage constraints through capital adequacy regulations. These regulations ensure that insurers have sufficient capital to meet their obligations and maintain financial stability. Insurance companies must adhere to capital adequacy regulations that require them to maintain a minimum level of capital relative to their risk exposure. This helps to ensure that insurers have sufficient financial resources to absorb potential losses and fulfill their obligations to policyholders. Monitoring debt-to-equity ratios can help investors and financial institutions assess their leverage levels and ensure compliance with leverage constraints. This ratio compares the amount of borrowed capital to the equity capital in a company or investment portfolio. Another useful measure for monitoring leverage levels is the debt-to-asset ratio, which compares the amount of borrowed capital to the total assets of a company or investment portfolio. This ratio can provide insight into the degree of leverage used and help identify potential risks associated with excessive borrowing. Stress testing is a valuable tool for managing leverage constraints, as it allows financial institutions and investors to evaluate their ability to withstand adverse market conditions and economic shocks. This can help identify potential vulnerabilities and inform adjustments to risk management strategies and leverage levels. Scenario analysis involves assessing the potential impact of various market scenarios on a company or investment portfolio. By considering different scenarios, investors and financial institutions can better understand the implications of leverage constraints and develop strategies to navigate potential risks and challenges. While leverage constraints can promote financial stability, they may also have unintended consequences, such as reduced market liquidity. By limiting the use of borrowed capital, leverage constraints can decrease trading activity, potentially leading to wider bid-ask spreads and increased price volatility. Leverage constraints can also lead to shifts in market structure, as financial institutions and investors adjust their strategies to navigate regulatory and institutional requirements. This may result in a greater reliance on alternative sources of financing, such as the shadow banking system, or an increased focus on off-balance-sheet activities. Financial institutions and investors may engage in regulatory arbitrage to circumvent leverage constraints, potentially increasing risks within the financial system. For example, the shadow banking system, which operates outside of traditional regulatory frameworks, may provide opportunities for firms to access leverage without being subject to the same constraints as regulated entities. Leverage constraints may also incentivize financial institutions to engage in off-balance-sheet activities to bypass regulatory requirements. This can increase the opacity of the financial system and create additional risks that are difficult to monitor and manage. Leverage constraints play a critical role in promoting financial stability, reducing systemic risk, and shaping investment behavior. Understanding the various types of constraints, including regulatory and institutional, enables financial institutions and investors to make informed decisions and implement effective risk management strategies. It is essential to monitor leverage levels and develop strategies that account for potential market scenarios and economic shocks. However, striking the right balance between the benefits of leverage constraints and the potential challenges, such as reduced market liquidity and regulatory arbitrage, remains crucial for a well-functioning financial system.Definition of Leverage Constraints

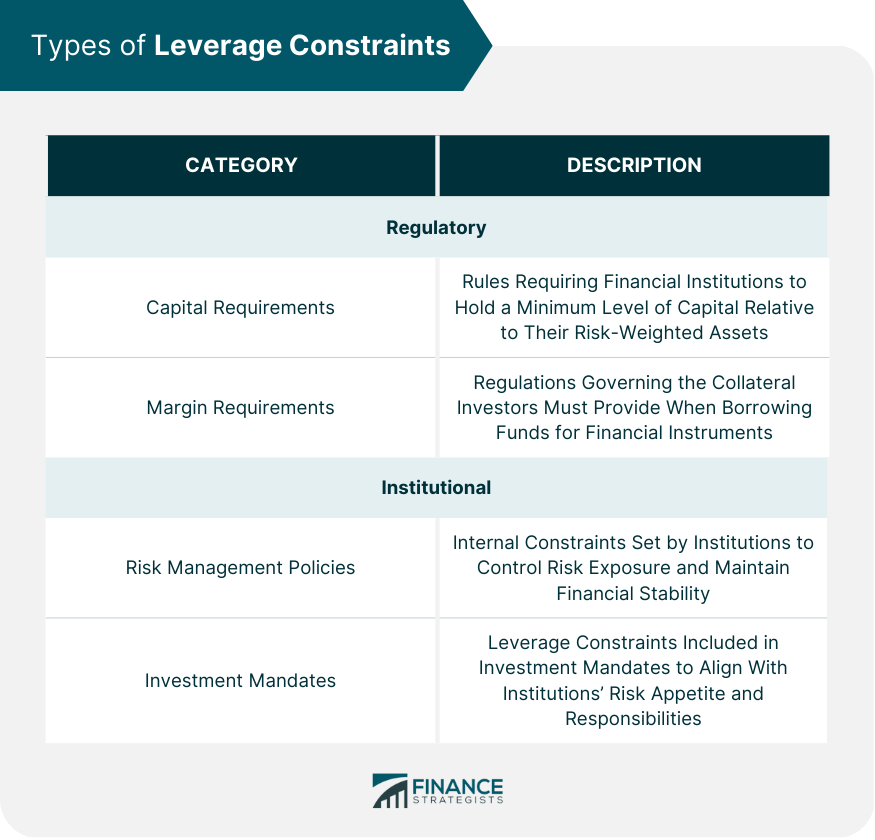

Types of Leverage Constraints

Regulatory Constraints

Capital Requirements

Margin Requirements

Institutional Constraints

Risk Management Policies

Investment Mandates

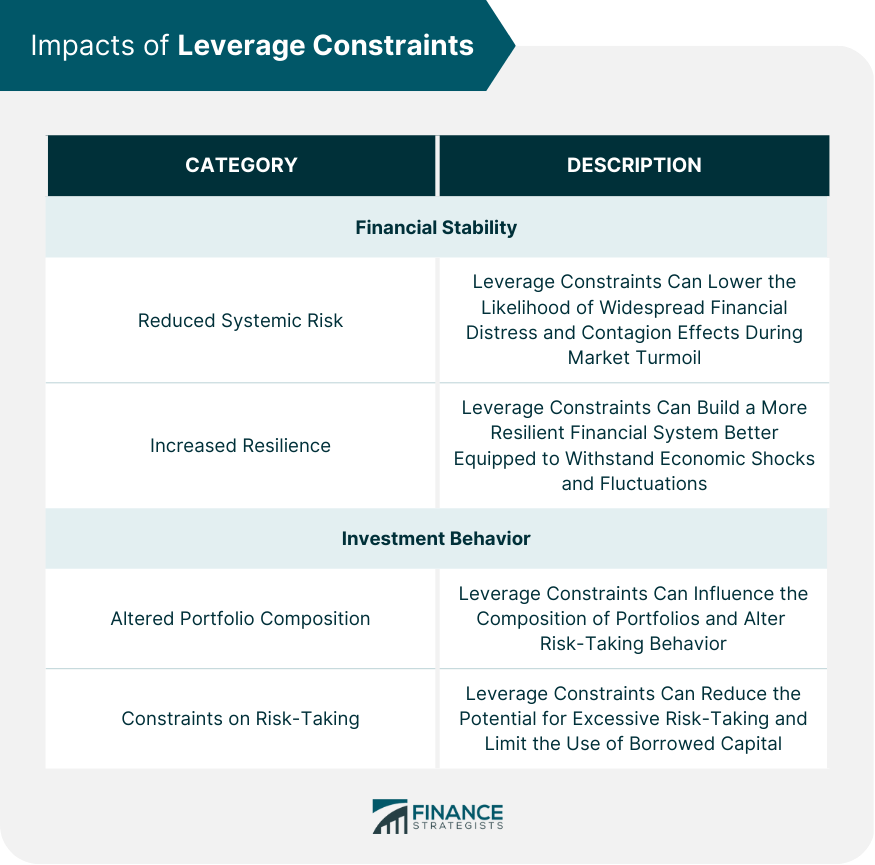

Impacts of Leverage Constraints

Financial Stability

Reduced Systemic Risk

Increased Resilience to Shocks

Investment Behavior

Altered Portfolio Composition

Constraints on Risk-Taking

Leverage Constraints in Different Financial Institutions

Banks

Basel III Framework

Leverage Ratio Requirements

Hedge Funds

Prime Brokerage Financing

Counterparty Risk Management

Insurance Companies

Solvency II Framework

Capital Adequacy Regulations

Managing Leverage Constraints

Monitoring Leverage Levels

Debt-To-Equity Ratios

Debt-To-Asset Ratios

Developing Effective Risk Management Strategies

Stress Testing

Scenario Analysis

Challenges and Limitations of Leverage Constraints

Unintended Consequences

Reduced Market Liquidity

Shifts in Market Structure

Regulatory Arbitrage

Shadow Banking System

Off-Balance Sheet Activities

Final Thoughts

Leverage Constraints FAQs

Leverage constraints are restrictions on the amount of borrowed capital that financial institutions and investors can use to finance their activities or enhance their returns. They are important because they help maintain financial stability, reduce systemic risk, and influence investment behavior.

The main types of leverage constraints include regulatory constraints, such as capital and margin requirements, and institutional constraints, which can involve risk management policies and investment mandates.

Leverage constraints promote financial stability by reducing systemic risk and increasing resilience to economic shocks. They also influence investment behavior by altering portfolio composition and limiting risk-taking through the restricted use of borrowed capital.

Effective management of leverage constraints involves monitoring leverage levels using ratios such as debt-to-equity and debt-to-asset ratios and developing risk management strategies that include stress testing and scenario analysis.

The potential challenges and limitations of leverage constraints include unintended consequences, such as reduced market liquidity and shifts in market structure, as well as the risk of regulatory arbitrage through the shadow banking system or off-balance-sheet activities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.