A revolving line of credit is a loan type that provides borrowers with ongoing access to funds for short-term financing needs. This type of loan allows borrowers to draw funds up to a predetermined credit limit and repay them as they become available. Unlike traditional loans, which provide borrowers with a lump sum of money that must be repaid on a set schedule, a revolving line of credit offers borrowers ongoing access to funds that can be borrowed and repaid as often as needed. This flexibility is one of the primary benefits of a revolving line of credit, as it allows borrowers to manage cash flow and unexpected expenses more effectively. Borrowers can use a revolving line of credit to pay for regular expenses, such as payroll or inventory management, or to cover unexpected expenses, such as emergency repairs or equipment replacements. Because funds can be borrowed and repaid as needed, a revolving line of credit can provide borrowers with a more stable and predictable funding source compared to other forms of credit. Here are some of the benefits of a revolving line of credit: One of its main benefits is flexibility. Unlike traditional loans, which provide borrowers with a fixed sum of money that must be repaid on a set schedule, a revolving line of credit allows borrowers to draw funds and repay them as they become available. This means that borrowers have access to a continuous flow of funds that can be used to manage daily expenses, pay for unexpected emergencies, or take advantage of opportunities as they arise. Another benefit of a revolving line of credit is that it typically comes with lower interest rates compared to other forms of credit, such as credit cards or personal loans. This is because the lender is taking on less risk by providing a revolving line of credit. They can monitor and adjust the credit limit based on the borrower's creditworthiness and repayment history. A revolving line of credit is also advantageous because it provides borrowers quick and easy access to funds. Unlike traditional loans that may take several days or weeks to process, a revolving line of credit can be approved and funded within a matter of hours or days. This makes it ideal for those requiring immediate cash access for unexpected expenses or opportunities. Finally, responsible usage of a revolving line of credit can help borrowers improve their credit scores over time. This is because a revolving line of credit provides borrowers with a continuous flow of funds that can be used to pay off existing debts or make timely payments on new debts. This demonstrates responsible borrowing and repayment behavior, which can boost a borrower's credit score and increase their chances of being approved for other forms of credit in the future. There are several different types of revolving lines of credit. A personal revolving line of credit is a type of loan that provides individuals with access to funds for personal use. This can include expenses such as home renovations, education expenses, or unexpected emergencies. Personal revolving lines of credit typically come with lower interest rates than credit cards or personal loans, making them an attractive option for those looking to manage their finances responsibly. A business revolving line of credit is a type of loan that provides businesses with access to funds for short-term financing needs. This can include expenses such as payroll, inventory management, or unexpected emergencies. Business revolving lines of credit typically come with higher credit limits than personal revolving lines of credit, making them an ideal choice for businesses with high operating expenses. A secured revolving line of credit is a loan secured by collateral, such as real estate or other assets. This provides the lender with added security if the borrower cannot repay the loan. Secured revolving lines of credit typically come with lower interest rates than unsecured revolving lines of credit, making them an attractive option for those with valuable assets to use as collateral. An unsecured line of credit is a type of loan not secured by collateral. This means the lender is taking on more risk by providing the loan, as they have no collateral to seize if the borrower cannot repay. As a result, unsecured revolving lines of credit typically come with higher interest rates than secured revolving lines of credit. However, they are still attractive to those who need more valuable assets to use as collateral. Below are some of the steps involved in applying for a revolving line of credit. When applying for a revolving line of credit, it is important to gather all necessary documentation before submitting an application. This may include personal or business tax returns, bank statements, financial statements, and proof of income. Before approving a revolving line of credit, lenders will typically evaluate a borrower's creditworthiness by reviewing their credit history, debt-to-income ratio, and other financial factors. This helps lenders determine the borrower's ability to repay the loan and set appropriate credit limits and interest rates. When choosing a lender for a revolving line of credit, it is important to consider factors such as interest rates, fees, credit limits, and repayment terms. It is also important to research the lender's reputation and reliability, read reviews and compare offers from multiple lenders. Once all necessary documentation has been gathered and a lender has been chosen, the borrower can apply for a revolving line of credit. This may include completing an online application, providing additional documentation, or speaking with a representative to answer any questions or concerns. There are several important factors to check when choosing a suitable revolving line of credit. Below are some of them. When choosing a revolving line of credit, it is important to consider the interest rates and fees associated with the loan. This may include annual percentage rates (APRs), transaction fees, and other charges. It is important to compare offers from multiple lenders to ensure the borrower gets the best possible interest rate and fee structure. It is also important to consider the credit limits and repayment terms associated with a revolving line of credit. This may include minimum monthly payments, repayment periods, and credit limits. It is important to choose a revolving line of credit with credit limits and repayment terms that are appropriate for the borrower's financial needs. If applying for a secured revolving line of credit, it is important to consider the collateral requirements associated with the loan. This may include real estate, vehicles, or other valuable assets. Choosing a collateral option appropriate for the borrower's financial situation and repayment ability is important. Finally, it is important to research the reputation and reliability of the lender before choosing a revolving line of credit. This may include reading reviews, checking ratings with the Better Business Bureau (BBB), and researching the lender's history and reputation in the industry. Choosing a reliable and trustworthy lender ensures a positive borrowing experience. In conclusion, a revolving line of credit can be a flexible and beneficial financing option for individuals and businesses with short-term funding needs. Its ability to provide quick and easy access to funds, lower interest rates, and potential for credit score improvement make it an attractive choice. However, when applying for a revolving line of credit, it is essential to consider factors such as creditworthiness, lender reputation, interest rates, fees, and repayment terms. It is recommended to consult with a financial advisor to make an informed decision and ensure responsible usage. You can also consult a mortgage broker if you plan on utilizing your home as collateral for a revolving line of credit.What Is a Revolving Line of Credit?

Benefits of Revolving Lines of Credit

Flexibility of Borrowing and Repaying

Lower Interest Rates Compared to Other Forms of Credit

Ability to Access Funds Quickly and Easily

Improving Credit Scores Through Responsible Usage

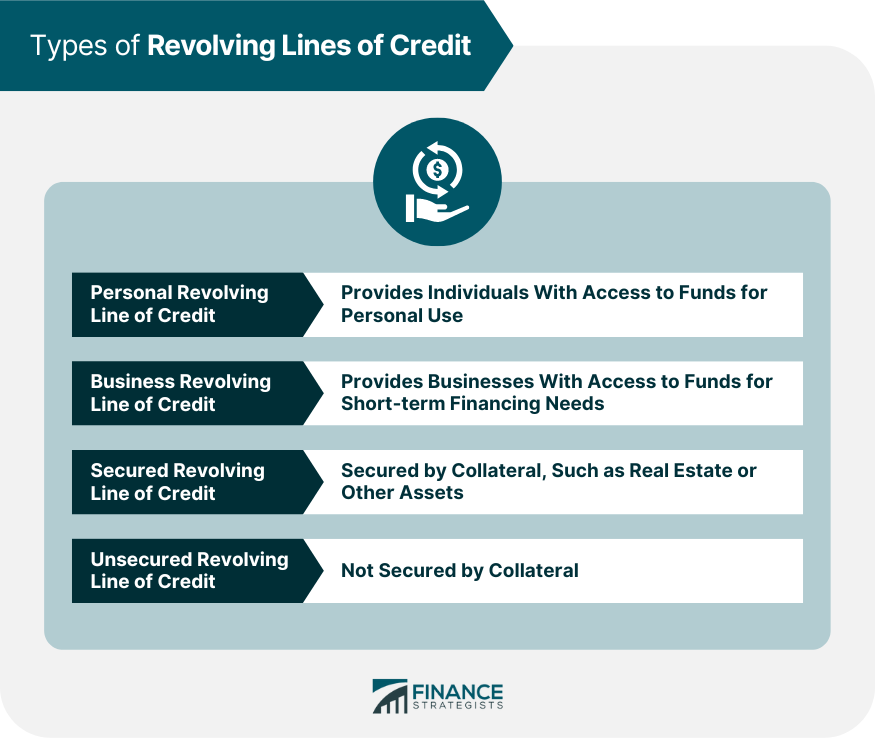

Types of Revolving Lines of Credit

Personal Revolving Line of Credit

Business Revolving Line of Credit

Secured Revolving Line of Credit

Unsecured Revolving Line of Credit

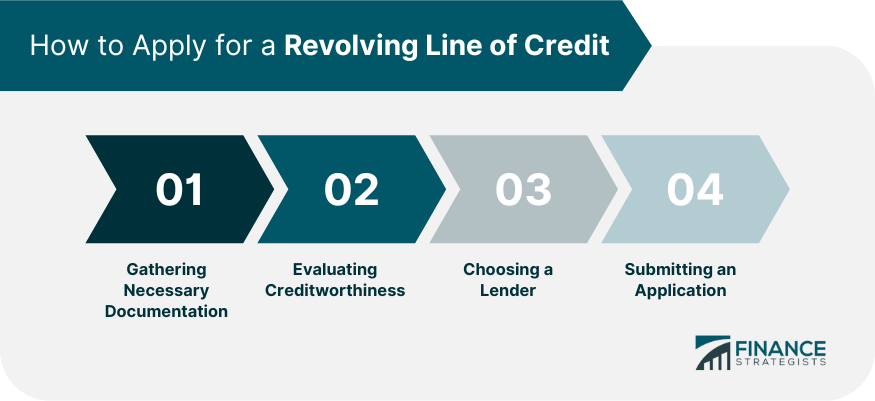

How to Apply for a Revolving Line of Credit

Gathering Necessary Documentation

Evaluating Creditworthiness

Choosing a Lender

Submitting an Application

Factors to Consider When Choosing a Revolving Line of Credit

Interest Rates and Fees

Credit Limits and Repayment Terms

Collateral Requirements

Reputation and Reliability of the Lender

Conclusion

Revolving Line of Credit FAQs

A revolving line of credit is a loan type that provides borrowers with flexible access to funds for short-term financing needs.

A revolving line of credit allows borrowers to draw funds as needed and repay them as they become available, making it an ideal choice for those who require a steady cash flow to manage daily operations or unexpected expenses.

The benefits of a revolving line of credit include flexibility of borrowing and repaying, lower interest rates compared to other forms of credit, the ability to access funds quickly and easily, and the potential to improve credit scores through responsible usage.

When choosing a revolving line of credit, it is important to consider factors such as interest rates and fees, credit limits and repayment terms, collateral requirements, and the reputation and reliability of the lender.

It is recommended to consult with a financial advisor before applying for a revolving line of credit. A financial advisor can help evaluate individual financial situations, provide expert guidance on choosing the right revolving line of credit, and offer tips for responsible usage and repayment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.