Expatriate tax planning refers to the process of understanding and managing the tax implications of living and working abroad. This involves evaluating and optimizing tax liabilities, taking advantage of tax treaties and exemptions, and planning for future financial needs. Expatriate tax planning is essential for individuals who live, work, or hold assets in multiple countries, as it can help minimize tax liabilities and ensure compliance with tax laws in each jurisdiction. Proper planning can also prevent tax-related penalties and optimize financial outcomes for expatriates. Expatriate tax issues can arise due to various scenarios, such as accepting an overseas job assignment, retiring abroad, owning foreign assets, or marrying someone with foreign tax obligations. Tax residency refers to the jurisdiction in which an individual is considered a resident for tax purposes. Tax residency is often determined by the number of days spent in a country or by having a permanent home in that country. Domicile refers to an individual's legal home country, which may be different from their tax residency. Domicile can impact tax obligations, particularly in countries that tax individuals based on their domicile status. Citizenship is another factor that can impact an individual's tax obligations. For example, the United States taxes its citizens on their worldwide income, regardless of where they reside. Under a territorial tax system, individuals are taxed only on income derived from sources within the country. This system can be advantageous for expatriates with income from multiple countries, as it can help minimize double taxation. A residence-based tax system taxes individuals on their worldwide income, based on their tax residency status. This system can result in higher tax liabilities for expatriates, as it may subject them to taxation in both their country of residence and their country of citizenship. A citizenship-based tax system taxes individuals based on their citizenship, regardless of where they reside or earn income. The United States is the most notable example of a country with a citizenship-based tax system. Expatriates are generally required to file income tax returns in their country of residence and may also be required to file in their country of citizenship, depending on the applicable tax laws. Expatriates with foreign financial accounts exceeding certain thresholds must report these accounts to the US Department of the Treasury using the Foreign Bank Account Reporting (FBAR) form. The Foreign Account Tax Compliance Act (FATCA) requires US taxpayers to report certain foreign financial assets and offshore accounts to the Internal Revenue Service (IRS). Double Taxation Agreements (DTAs) are treaties between countries designed to prevent individuals from being taxed on the same income in both countries. DTAs can play a crucial role in expatriate tax planning by allocating taxing rights between countries and providing tax relief for expatriates. Tax treaties may also provide tax credits or exemptions for certain types of income or situations. These provisions can help reduce an expatriate's overall tax liability. The Foreign Tax Credit (FTC) is a US tax provision that allows US taxpayers to claim a credit for taxes paid to foreign governments on foreign-source income. To be eligible for the FTC, the foreign tax must be a compulsory payment, imposed on income, and meet certain other requirements. There are limitations on the amount of FTC that can be claimed, which are based on the proportion of foreign-source income to total income. The FTC is calculated by determining the lesser of the actual foreign tax paid or the US tax liability on the foreign-source income. If the FTC is not fully utilized in a given tax year, it can be carried back one year and carried forward for up to ten years, subject to certain limitations. The Foreign Earned Income Exclusion (FEIE) is another US tax provision that allows qualifying taxpayers to exclude a portion of their foreign earned income from US taxation. To qualify for the FEIE, individuals must meet either the bona fide residence test or the physical presence test and have a tax home in a foreign country. The exclusion amount is subject to annual adjustments for inflation. The bona fide residence test requires an individual to be a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year. The physical presence test requires an individual to be physically present in a foreign country for at least 330 full days during a 12-month period. The Foreign Housing Exclusion or Deduction allows qualifying US taxpayers to exclude or deduct certain housing expenses paid or incurred while living abroad. Qualifying housing expenses include rent, utilities (excluding telephone charges), and certain other expenses associated with maintaining a home in a foreign country. The exclusion or deduction amount is calculated based on the excess of actual housing expenses over a base amount, subject to a maximum limit. These amounts are adjusted annually for inflation. International retirement plans, such as foreign pension plans or individual retirement accounts, can provide tax-efficient savings vehicles for expatriates. However, the tax treatment of these plans can vary depending on the jurisdiction and the specific plan. It is essential to understand the tax implications of each plan before making any investment decisions. Contributions to international retirement plans may be tax-deductible or eligible for tax deferral, depending on the plan and the individual's tax situation. Distributions from these plans may also be subject to favorable tax treatment, such as reduced tax rates or tax deferral. Tax diversification involves holding investments in a variety of tax-advantaged accounts to minimize overall tax liability. Expatriates should consider diversifying their investments across different tax jurisdictions and investment types to optimize their tax situation. Asset location optimization refers to strategically allocating investments across various account types to minimize taxes. For example, an expatriate might hold investments with high tax implications in tax-deferred accounts and investments with lower tax implications in taxable accounts. Cross-border estate planning is essential for expatriates to ensure that their assets are distributed according to their wishes and in a tax-efficient manner. Wills and trusts can be effective tools for achieving these goals, but it is crucial to understand the legal and tax implications of these instruments in each relevant jurisdiction. Expatriates should be aware of potential inheritance tax liabilities that may arise when transferring assets to beneficiaries in different countries. Proper planning and the use of tax-efficient structures, such as trusts, can help minimize these liabilities. Estate and gift tax treaties are agreements between countries that govern the taxation of estates and gifts in cross-border situations. These treaties can help minimize double taxation and provide tax relief for expatriates, particularly those with significant assets in multiple countries. Expatriates should also consider the availability of the unified credit and marital deduction in their estate planning. The unified credit is a US tax provision that allows a certain amount of estate and gift tax liability to be offset, while the marital deduction allows an unlimited transfer of assets between spouses without incurring estate or gift tax. Expatriate tax planning is crucial for individuals living and working abroad or holding assets in multiple countries. By understanding their tax obligations and employing effective planning strategies, expatriates can minimize their tax liabilities, ensure compliance, and optimize their financial outcomes. Given the complexity of international tax laws and the potential consequences of non-compliance, it is essential for expatriates to seek professional advice when navigating their tax planning. Tax professionals with expertise in expatriate tax issues can help individuals develop and implement a tailored tax plan that addresses their unique needs and goals. While expatriate tax planning can be complex and challenging, it is also an opportunity for individuals to optimize their financial situation and make the most of their international experiences. By proactively addressing their tax obligations and planning for the future, expatriates can enjoy the benefits of living and working abroad while minimizing the potential financial pitfalls.Definition of Expatriate Tax Planning

Importance of Expatriate Tax Planning

Common Scenarios Triggering Expatriate Tax Issues

Understanding Expatriate Tax Obligations

Residency Status and Tax Implications

Tax Residency

Domicile

Citizenship

Taxation Systems

Territorial Tax System

Residence-Based Tax System

Citizenship-Based Tax System

Tax Filing Requirements

Income Tax Filing

Foreign Bank Account Reporting (FBAR)

Foreign Account Tax Compliance Act (FATCA)

Expatriate Tax Planning Strategies

Tax Treaties and Double Taxation Avoidance

Double Taxation Agreements (DTAs)

Tax Credits and Exemptions

Foreign Tax Credit (FTC)

Eligibility and Limitations

FTC Calculation and Carryovers

Foreign Earned Income Exclusion (FEIE)

Qualifications and Limitations

Bona Fide Residence Test and Physical Presence Test

Foreign Housing Exclusion or Deduction

Qualifying Housing Expenses

Calculation and Limitations

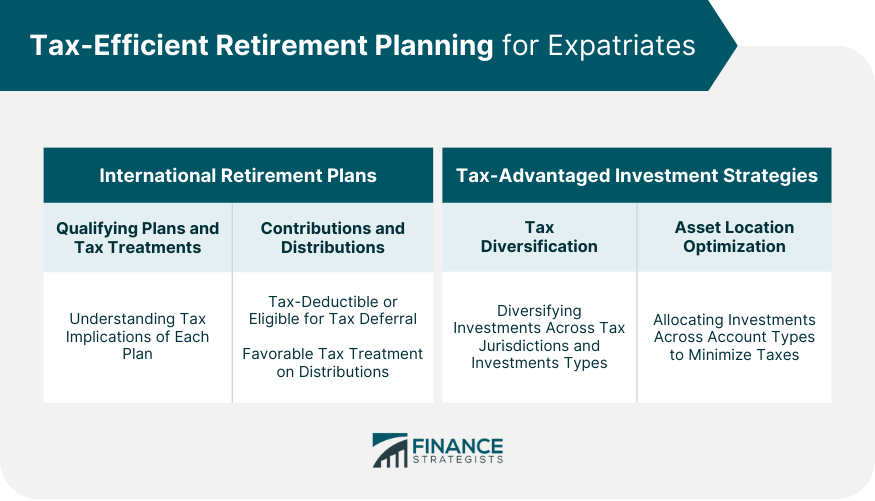

Tax-Efficient Retirement Planning for Expatriates

International Retirement Plans

Qualifying Plans and Tax Treatments

Contributions and Distributions

Tax-Advantaged Investment Strategies

Tax Diversification

Asset Location Optimization

International Estate Planning for Expatriates

Cross-Border Estate Planning

Wills and Trusts

Asset Transfers and Inheritance Tax

Tax Treaties and Estate Tax Relief

Estate and Gift Tax Treaties

Unified Credit and Marital Deduction

Conclusion

Recap of Key Points

Importance of Professional Advice

Embracing the Opportunities and Challenges of Expatriate Life

Expatriate Tax Planning FAQs

Expatriate tax planning refers to the process of organizing your financial affairs in a way that minimizes the tax consequences of living and working as an expatriate in a foreign country.

For tax purposes, an expatriate is someone who lives and works outside their home country for an extended period of time, usually over 183 days in a tax year.

Common tax issues faced by expatriates may include double taxation, foreign tax credits, social security taxes, and reporting requirements for foreign assets.

Some strategies for minimizing expatriate taxes may include using tax treaties and exemptions, taking advantage of foreign tax credits, structuring compensation in a tax-efficient manner, and planning for retirement and investments.

It is advisable to start thinking about expatriate tax planning as early as possible, ideally before accepting a job or moving abroad. However, it is never too late to take steps to minimize your tax liability while living and working as an expatriate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.