Deducting real estate fees from capital gains involves several steps. Firstly, list and sum up all the fees associated with the sale of your property, including brokerage commissions, legal fees, advertising costs, and inspection fees. Next, calculate your gross capital gains, which is the selling price of the property minus its original purchase price. Then, subtract the total real estate fees from your gross capital gains to get your net capital gain. This is the amount on which you will be taxed. Keep in mind, that tax laws are complex and vary by location, so always consult a tax professional to ensure accurate deductions and tax reporting. When you sell real estate, the capital gains are calculated similarly. If your property has appreciated over time, the profit from the sale would be considered a capital gain. Capital gains on real estate sales are subject to capital gains tax. In the U.S, if you've owned the property for more than one year, it's considered a long-term capital gain and may be taxed at a lower rate. There are exclusions and deductions that can reduce your capital gains tax liability. For instance, the IRS allows a significant exclusion for the sale of a primary residence if certain conditions are met. Additionally, costs related to the sale, such as real estate agent commissions, can be deducted from your gain. The first step in the process is to list all the real estate fees associated with the sale of your property. These fees can significantly vary but typically include brokerage commissions, legal fees, advertising costs, and inspection fees. Make sure to gather all receipts and documents related to these costs for accurate record-keeping and future reference. Next, calculate your gross capital gains. This involves subtracting the original purchase price of the property from its selling price. This calculation provides you with your gross capital gains – the total profit made from the sale before any fees or deductions are accounted for. Once you've determined your gross capital gains and have a comprehensive list of your real estate fees, you can calculate your net capital gain. This is done by subtracting the total real estate fees from your gross capital gains. The resulting figure is your net capital gain, which forms the basis for your capital gains tax calculation. Due to the complexity of tax laws and their variation from one location to another, it's advisable to consult a tax professional. A tax professional can ensure you've accurately deducted all allowable real estate fees from your capital gains and correctly reported these figures on your tax return. This step is particularly critical to avoid any potential penalties or additional tax liabilities in the future. To compute capital gains, the original purchase price of the property is subtracted from its selling price. However, to calculate net capital gains, which is the figure subjected to capital gains tax, total real estate fees are further deducted from the gross capital gain. The reduced net capital gain ultimately results in a lower tax liability. The ability to deduct real estate fees from gross capital gains not only lessens the capital gains tax owed but also underscores the pivotal role of these fees in shaping the capital gains calculation. By minimizing your net capital gain, these deductions potentially lead to significant tax savings. Identifying all deductible real estate fees and summing them up to add to the original cost of the property forms the adjusted cost basis. This adjusted cost basis becomes instrumental when calculating the capital gain, as it's subtracted from the selling price of the property. The resulting gain, therefore, becomes subject to capital gains tax. Given the intricacies of tax laws and their varying nature depending on the jurisdiction, it's essential to stay updated with the changes in tax laws as they can impact how real estate fees are deducted. In essence, an understanding of these laws facilitates strategic planning around real estate sales and effective capital gains tax management. This is the price you initially paid for the property. It forms the starting point for calculating the adjusted cost basis. Any significant improvements made to the property that increase its value should be added. These could include renovations, extensions, or substantial repairs. Costs associated with the property's purchase and sale, such as real estate agent commissions, legal fees, and advertising costs, should also be added. If the property is a rental or used for business, any depreciation claimed on tax returns should be subtracted from the total. Real estate transactions involve various costs - brokerage commissions, legal fees, inspection fees, and advertising costs, to name a few. These can be deducted from your gross capital gain, potentially reducing your net capital gain and, subsequently, your capital gains tax. Maintaining organized records of these expenses can assist in ensuring maximum deductions. Not all costs related to the sale of a property are deductible. Thus, it's crucial to identify which expenses can be deducted and how they should be reported on tax forms. A good understanding of the tax code or the assistance of a tax professional can prove invaluable in this regard. The timing of a property sale can impact the amount of capital gains tax owed. In the U.S., for instance, holding onto a property for at least one year can qualify the gain as long-term, typically resulting in a lower tax rate. Therefore, timing your property sale strategically can help to optimize your tax savings. Tax laws often provide certain provisions that can reduce your tax liability. In the U.S., for example, the IRS allows a substantial exclusion on the sale of a primary residence under specific conditions. Leveraging these tax provisions can significantly reduce capital gains tax liabilities. The proper deduction of real estate fees from capital gains is a pivotal aspect of maximizing returns from property sales. These fees, encompassing costs such as broker commissions, legal fees, and advertising costs, can significantly lower your net capital gain, reducing the capital gains tax liability. An accurate calculation of the adjusted cost basis, incorporating these fees, forms the bedrock of this process. Being aware of relevant tax laws, along with recent changes, aids in accurately determining deductibles and their impact on tax obligations. By employing best practices in tracking fees and strategically timing property sales, individuals can effectively leverage these deductions for maximum tax savings. However, the complexity of tax laws underscores the importance of consulting a tax professional to ensure appropriate deductions and accurate tax reporting.Deducting Real Estate Fees From Capital Gains: Overview

How Capital Gains Apply to Real Estate

Real Estate and Capital Gains

Capital Gains Tax

Exclusions and Deductions

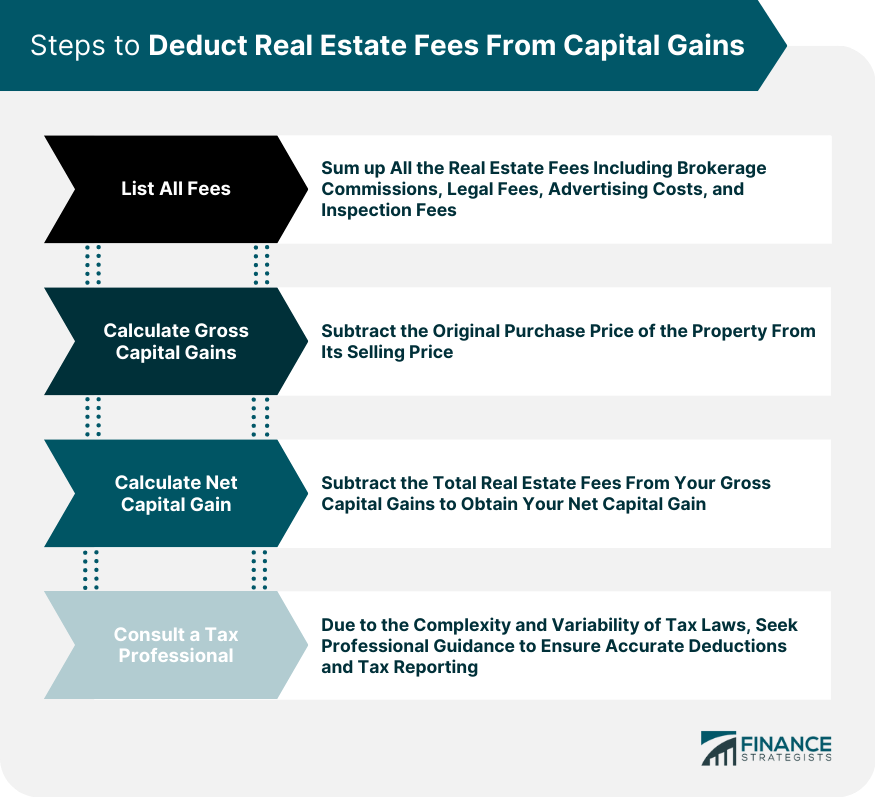

Steps to Deduct Real Estate Fees From Capital Gains

List All Real Estate Fees

Calculate Gross Capital Gains

Calculate Net Capital Gain

Consult a Tax Professional

Role of Real Estate Fees in Capital Gains Calculation

Mechanism of Deduction

Impact on Tax Obligations

Adjusted Cost Basis Calculation

Note on Tax Laws

Calculation of Adjusted Cost Basis

Start With the Original Cost

Add Improvement Costs

Add Sale and Purchase Expenses

Subtract Depreciation

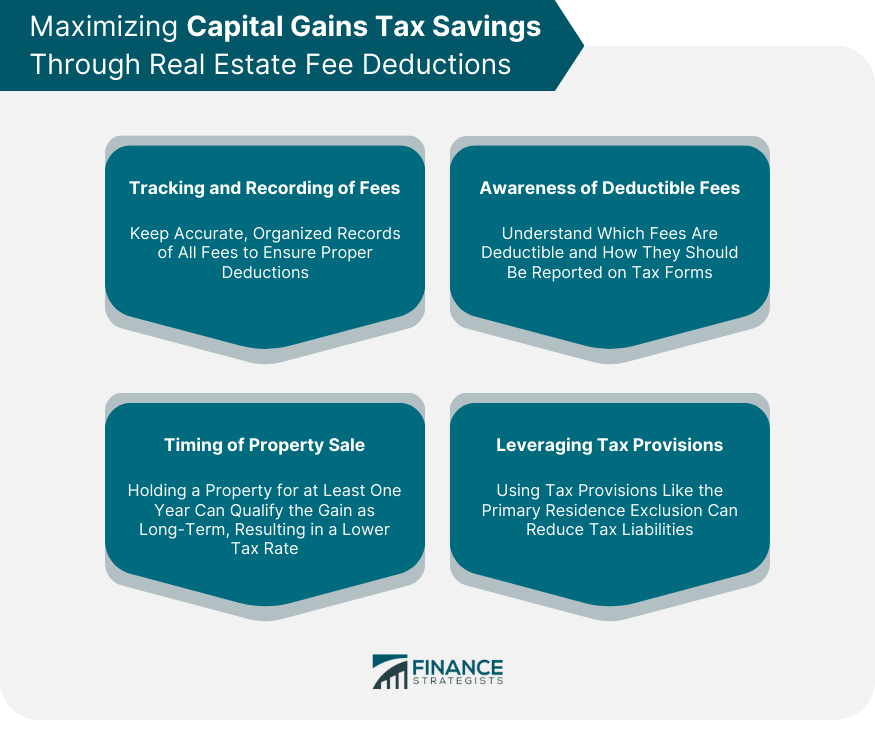

Maximizing Capital Gains Tax Savings Through Real Estate Fee Deductions

Diligent Tracking and Recording of Fees

Awareness and Utilization of Deductible Fees

Strategic Timing of Property Sale

Leverage Tax Provisions

Conclusion

How to Deduct Real Estate Fees From Capital Gains FAQs

Real estate fees that can be deducted from capital gains usually include brokerage commissions, legal fees, inspection fees, and advertising costs related to the sale of the property.

Deducting real estate fees from your capital gains effectively lowers the capital gain amount, which in turn may decrease the capital gains tax you owe.

Yes, real estate fees can be deducted from capital gains on any property sale, including the sale of personal residences, rental properties, or investment properties.

Tax laws regarding the deduction of real estate fees from capital gains can be complex and vary by jurisdiction. In general, the IRS allows specific selling expenses to be deducted from the capital gain.

To calculate your adjusted cost basis, add the real estate fees you incurred from selling the property to the original purchase price. This adjusted cost basis is then subtracted from the selling price to calculate the capital gain.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.