One of the most significant advantages of capital loss carryover is the potential for tax savings. It allows the investor to offset future capital gains, reducing the taxable income, which can lead to significant savings over time. Capital loss carryover is also known for its flexibility, as it doesn't expire and can be carried forward indefinitely. This allows investors to strategically plan when they want to use the loss to offset gains, depending on their financial situation. There's no limit to the amount of capital losses you can carry over from year to year. This can prove beneficial to investors who suffer a substantial loss in a given year and can't offset the entire amount right away. Capital loss carryover encourages diversification in your investment portfolio. By offsetting losses from one investment with the gains from others, it provides a form of risk management against poor-performing assets. It acts as a safety net for riskier investments. Knowing that potential losses can be carried forward, investors might feel more confident in taking on investments with higher potential returns. Capital loss carryover can be integrated into long-term financial and tax planning strategies. By forecasting future gains, investors can leverage their losses to mitigate their tax implications. Short-term capital gains are typically taxed at a higher rate than long-term gains. Thus, using capital loss carryovers to offset these gains can lead to substantial tax savings. If an investor expects a higher income year, they can choose to use the capital loss carryover in that year. This can help lower their overall tax liability during these high-income periods. Companies can also utilize capital loss carryovers to minimize their future tax liabilities, thereby improving their bottom line and providing more capital for reinvestment. Knowing that losses can be mitigated in future tax years might encourage more investment activity. This can stimulate the economy by increasing the flow of capital in the market. The primary disadvantage is the annual limitation. Only a maximum of $3,000 can be deducted against other income per year, which might be insufficient for those with substantial losses. Capital loss carryovers require careful record-keeping and can complicate tax preparation. It's essential to keep track of each year's capital gains and losses and how much loss has been carried over. Due to inflation, the value of the tax deduction provided by a loss carryover could decrease over time. This means the same nominal amount of loss will provide less real tax relief in the future. If future tax rates were to decrease, the value of loss carryovers would also diminish. This uncertainty can make it difficult to plan for future tax implications effectively. The tax rates for short-term and long-term capital gains are different, which can complicate calculations when using capital loss carryovers. For a capital loss carryover to occur, you must first experience an actual financial loss. This is never a favorable situation and represents a real economic loss that can't be fully recouped by a tax reduction. Changes in tax laws could impact the benefits of capital loss carryovers. For instance, a significant overhaul of the tax code could potentially eliminate or alter this provision. Capital loss carryovers can only be beneficial if there are future capital gains to offset. If no gains occur in subsequent years, the loss carryover offers no value. Low-income individuals may not find any benefit due to their already low tax rate. The reduction in taxable income might not translate into significant tax savings. For corporations, the use of capital loss carryovers can be limited by ownership change restrictions. This could limit the potential tax savings for businesses. While both individuals and corporations can use capital loss carryovers, the rules, and implications differ. Individuals, for instance, have a limit of $3,000 per year, while corporations face more complex rules regarding changes in ownership. For individuals, the IRS allows a deduction of up to $3,000 of net capital losses from other income. Any remaining net capital loss can be carried forward to offset gains in future years. Corporations, on the other hand, face different rules. They can carry back losses for two years and forward up to 20 years but are subject to limitations if there is a 50% or more change in ownership. Capital loss carryover, while seemingly complex, provides a useful tool for both individual investors and corporations. It offers significant advantages like potential tax savings, the flexibility of indefinite carryovers, no cap on the amount, and it acts as a risk management tool. However, it also comes with constraints, such as annual deduction limitations, a potential decrease in value over time due to inflation, and legislation risk. For corporations, specific rules and limitations apply. Understanding these pros and cons is crucial for making informed investment and tax planning decisions. It's evident that while capital loss carryover cannot negate the impact of a financial loss completely, it provides a silver lining by mitigating future tax liabilities. To leverage it effectively, one needs to stay informed, keep meticulous records, and possibly seek professional tax advice.Pros of Capital Loss Carryover

Tax Savings

Flexibility

No Limit on Amount

Diversification Strategy

Risk Management

Financial Planning Tool

Mitigating Short-Term Capital Gains

Mitigation of High-Income Years

Business Application

Encourages Investment Activity

Cons of Capital Loss Carryover

Annual Limitations

Complications

Decreasing Value Over Time

Uncertain Future Tax Rates

Short-Term vs Long-Term

Loss of Investment

Legislation Risk

Requires Gains to Offset

Not Beneficial for Low-Income Earners

Limited Corporate Use

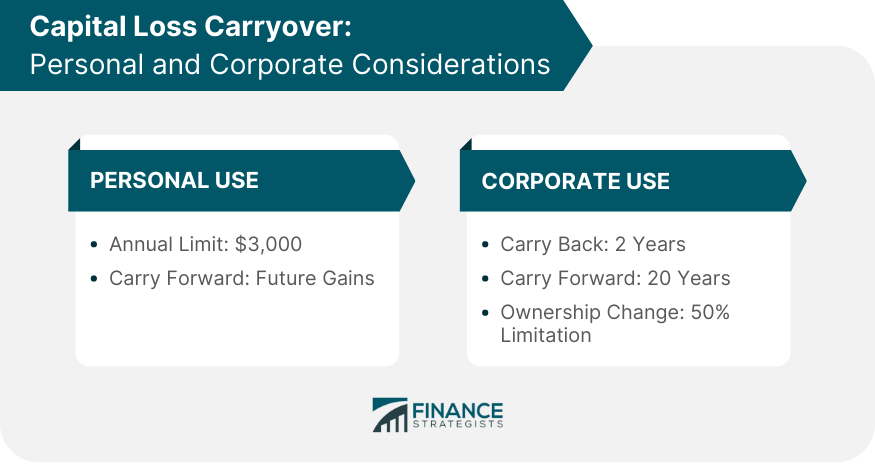

Capital Loss Carryover: Personal and Corporate Considerations

Differences Between Personal and Corporate Use

Specific Rules for Personal Use

Specific Rules for Corporate Use

Conclusion

Capital Loss Carryover Pros and Cons FAQs

A capital loss carryover occurs when your total capital losses exceed your total capital gains in a tax year. The IRS allows you to use this net loss to offset up to $3,000 of other income. If your total net capital loss exceeds this limit, you can carry forward the unused portion to the next year's tax return.

Capital losses can be carried forward indefinitely until the entire loss amount has been offset by future capital gains. There is no expiry for using these losses.

Yes, there is an annual limitation. Individuals can only deduct a maximum of $3,000 ($1,500 if married filing separately) against other income per year. If your capital losses exceed this amount, the remainder can be carried forward to future years.

Like individuals, corporations can also use capital loss carryovers to offset their future capital gains, potentially reducing their tax liabilities. However, specific rules apply, including restrictions related to significant changes in ownership.

The drawbacks of capital loss carryover include the annual limitations on deductions, complications in record-keeping, a potential decrease in value due to inflation and changing tax rates, and the fact that it requires an actual loss of investment. Additionally, for corporations, usage can be limited by ownership change restrictions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.