The constant-dollar withdrawal strategy is a retirement income approach that involves withdrawing a fixed percentage of the initial portfolio value each year, with annual adjustments for inflation. This strategy aims to provide retirees with a consistent stream of income while preserving their purchasing power over time. The primary purpose of the constant-dollar withdrawal strategy is to create a sustainable income stream for retirees that maintains its purchasing power throughout retirement. This approach can help retirees manage their spending and budget more effectively, ensuring they have sufficient income to cover their expenses. The first step in implementing a constant-dollar withdrawal strategy is to determine the initial withdrawal percentage. This percentage is typically based on the retiree's anticipated annual spending needs, expressed as a percentage of their initial portfolio value. A common starting point is the "4% rule," which suggests withdrawing 4% of the portfolio's initial value in the first year of retirement. To maintain purchasing power, the constant-dollar withdrawal strategy adjusts annual withdrawals for inflation. This is typically done using a consumer price index (CPI) or another measure of inflation. Each year, the withdrawal amount is increased by the rate of inflation, ensuring that the retiree's income keeps pace with rising prices. A constant-dollar withdrawal strategy requires careful management of the retiree's investment portfolio, with an appropriate mix of stocks, bonds, and other assets. The asset allocation should balance the need for growth to support withdrawals with the need to manage risk and preserve capital. Regular rebalancing of the investment portfolio is essential in a constant-dollar withdrawal strategy. Rebalancing ensures that the portfolio maintains its target asset allocation and reduces the risk of overexposure to any one asset class. This can help manage the impact of market volatility on the retiree's income and investment returns. When implementing a constant-dollar withdrawal strategy, it is essential to consider the retiree's personal risk tolerance. This will help determine the appropriate asset allocation and withdrawal rate that balances the need for income and capital preservation. Understanding the retiree's retirement income needs is critical when implementing a constant-dollar withdrawal strategy. This information will inform the initial withdrawal percentage and help ensure that the plan is sustainable over the long term. The retiree's investment time horizon will also play a role in determining the appropriate withdrawal rate and asset allocation. A longer time horizon may allow for a higher withdrawal rate or a more aggressive asset allocation, while a shorter time horizon may require a more conservative approach. A well-diversified portfolio is essential when implementing a constant-dollar withdrawal strategy. Diversification can help manage risk and reduce the impact of market volatility on the retiree's income and investment returns. The constant-dollar withdrawal strategy's primary benefit is its ability to maintain the retiree's purchasing power over time. By adjusting withdrawals for inflation, this approach ensures that retirees can continue to cover their expenses and maintain their desired lifestyle throughout retirement. Another advantage of the constant-dollar withdrawal strategy is its simplicity. By establishing a fixed withdrawal percentage and adjusting it annually for inflation, retirees can easily manage their income and budget effectively. The constant-dollar withdrawal strategy allows retirees flexibility in their portfolio's asset allocation. This enables them to strike an appropriate balance between growth and risk management, tailored to their specific circumstances and investment objectives. One of the primary risks associated with the constant-dollar withdrawal strategy is the sequence of returns risk. This refers to the potential negative impact of poor investment returns in the early years of retirement, which can significantly deplete the portfolio and jeopardize its sustainability over the long term. Another risk associated with the constant-dollar withdrawal strategy is longevity risk, or the risk of outliving one's retirement savings. If the retiree lives longer than anticipated or experiences higher-than-expected inflation, their withdrawals may not be sufficient to cover their spending needs. While the constant-dollar withdrawal strategy adjusts withdrawals for inflation, there is still a risk that inflation could outpace the adjustments, eroding the retiree's purchasing power over time. This could result in reduced spending power and difficulty in covering expenses. Market volatility can also pose a challenge for the constant-dollar withdrawal strategy. Significant market downturns can impact portfolio values, making it more difficult for retirees to maintain their desired withdrawal rate without depleting their savings too quickly. The percentage of portfolio withdrawal strategy involves withdrawing a fixed percentage of the portfolio's value each year, regardless of the initial value or inflation. This approach can provide more flexibility in managing withdrawals, but it can also result in significant fluctuations in annual income. The constant-percentage withdrawal strategy involves withdrawing a fixed percentage of the remaining portfolio value each year. This approach can help protect against longevity risk and provide a more stable income stream. However, it may not adequately account for inflation, potentially resulting in diminished purchasing power over time. The required minimum distribution (RMD) strategy involves withdrawing a minimum amount from retirement accounts each year, based on the retiree's age and account balance, as mandated by the IRS. This approach can help ensure that retirees do not outlive their savings but may not provide sufficient income or protection against inflation. Selecting the right withdrawal strategy depends on the retiree's individual financial circumstances, goals, and risk tolerance. It is essential to carefully consider the pros and cons of each approach and consult with a financial advisor to develop a personalized retirement income plan. Financial advisors can play a crucial role in developing a personalized constant-dollar withdrawal plan that aligns with the retiree's financial goals and circumstances. They can help determine the appropriate withdrawal rate, asset allocation, and rebalancing strategy, ensuring that the plan is sustainable and meets the retiree's needs. Financial advisors can also help monitor and adjust the constant-dollar withdrawal plan as needed to account for changes in personal circumstances, market conditions, or tax laws. This ongoing support can help ensure that the retiree's income remains stable and sufficient throughout their retirement. Working with a financial advisor can help retirees strike the right balance between risk and return in their constant-dollar withdrawal strategy. This can help manage the potential risks associated with this approach while optimizing investment returns and income stability. A well-planned withdrawal strategy is essential for retirees to ensure they have a sustainable income stream that maintains its purchasing power throughout their retirement years. The constant-dollar withdrawal strategy offers several advantages, including simplicity, flexibility, and inflation protection. However, it is essential to be aware of the potential risks and drawbacks associated with this approach. When considering the constant-dollar withdrawal strategy, it is crucial to weigh the pros and cons and evaluate how well it aligns with individual financial goals and circumstances. Retirees should consult with a financial advisor to develop a personalized retirement income plan, which may include the constant-dollar withdrawal strategy or an alternative approach that better suits their needs. By carefully considering the implications of the constant-dollar withdrawal strategy and working with a knowledgeable financial advisor, retirees can develop a comprehensive retirement income plan that helps ensure their financial security and peace of mind throughout their golden years.What Is the Constant-Dollar Withdrawal Strategy?

How the Constant-Dollar Withdrawal Strategy Works

Initial Withdrawal Percentage

Adjusting Withdrawals for Inflation

Portfolio Asset Allocation

Rebalancing the Portfolio

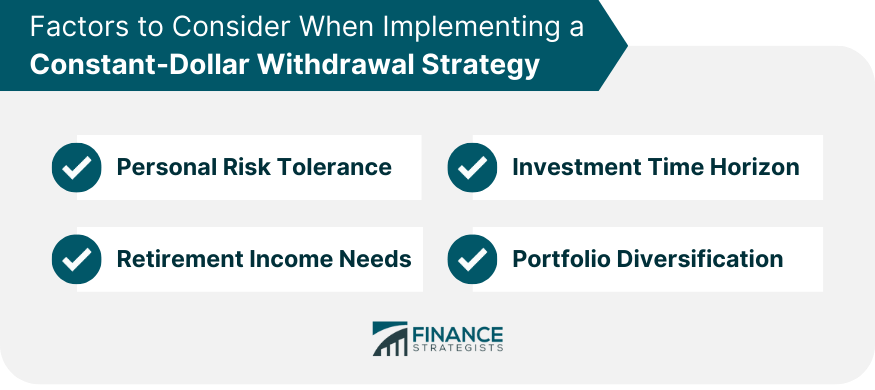

Factors to Consider When Implementing a Constant-Dollar Withdrawal Strategy

Personal Risk Tolerance

Retirement Income Needs

Investment Time Horizon

Portfolio Diversification

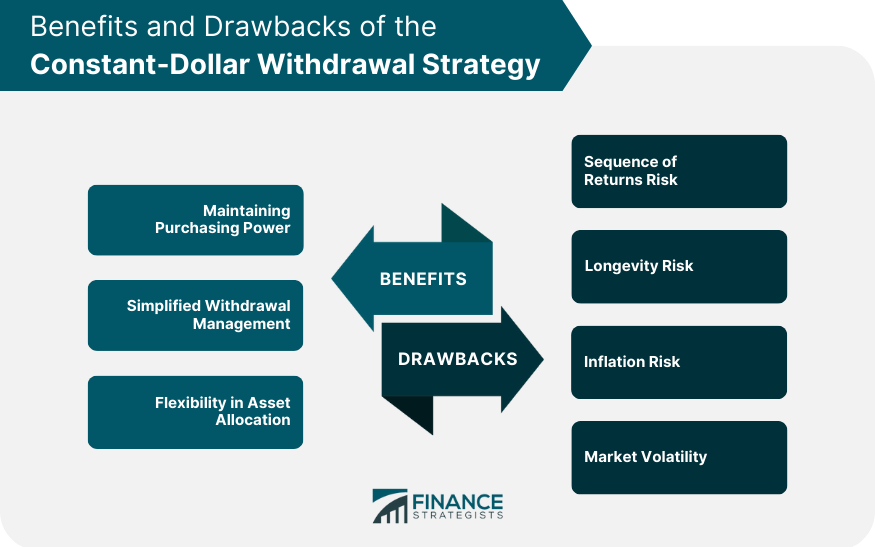

Benefits of the Constant-Dollar Withdrawal Strategy

Maintaining Purchasing Power

Simplified Withdrawal Management

Flexibility in Asset Allocation

Potential Risks and Drawbacks

Sequence of Returns Risk

Longevity Risk

Inflation Risk

Market Volatility

Comparison With Other Withdrawal Strategies

Percentage of Portfolio Withdrawal Strategy

Constant-Percentage Withdrawal Strategy

Required Minimum Distribution (RMD) Strategy

Choosing the Appropriate Withdrawal Strategy

Role of Financial Advisors in Implementing a Constant-Dollar Withdrawal Strategy

Developing a Personalized Withdrawal Plan

Ongoing Monitoring and Adjustments

Balancing Risk and Return

Conclusion

Constant-Dollar Withdrawal Strategy FAQs

A constant-dollar withdrawal strategy is a retirement income strategy where a fixed amount is withdrawn from a retirement portfolio every year, adjusted for inflation. The goal of this strategy is to maintain the purchasing power of the retirement income over time, by accounting for the impact of inflation.

A constant-dollar withdrawal strategy differs from other withdrawal strategies, such as the fixed-percentage and variable withdrawal strategies, in that it aims to maintain a consistent purchasing power over time. The fixed-percentage strategy involves withdrawing a percentage of the portfolio balance each year, while the variable strategy involves adjusting the withdrawal amount based on portfolio performance.

The advantages of a constant-dollar withdrawal strategy include the ability to maintain a consistent standard of living throughout retirement, the potential to mitigate the impact of inflation on retirement income, and the ease of implementation and understanding of the strategy.

One potential downside of a constant-dollar withdrawal strategy is that it may not be suitable for retirees with variable income needs or those who face unexpected expenses. Additionally, this strategy requires careful planning and monitoring to ensure that the withdrawal rate remains sustainable over the long term.

To implement a constant-dollar withdrawal strategy, you should first calculate the annual withdrawal amount based on your projected retirement expenses and the expected rate of inflation. You should also carefully consider your investment portfolio allocation and ensure that it is balanced to provide adequate growth and income to support the withdrawal rate. Regular monitoring of the portfolio and adjustments to the withdrawal amount may be necessary to ensure the sustainability of the strategy over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.