Retirement is a time when many individuals look forward to enjoying the fruits of their labor and embarking on a new chapter in life. However, for those on a fixed income, choosing the right place to retire becomes a critical consideration. It is essential to find a location that not only caters to your desired lifestyle but also aligns with your financial capabilities. Finding the best places to retire on a fixed income involves a comprehensive evaluation of various factors, and by carefully assessing these criteria, you can narrow down your choices and identify locations that offer an enjoyable retirement lifestyle while ensuring financial stability. Affordability is paramount for retirees living on a fixed income. Consequently, a lower housing cost often serves as the primary criterion for their choice of retirement location. In this respect, options range from states with generally lower real estate prices to specific towns known for their affordable housing facilities for seniors. Besides housing, daily living expenses, such as food and utilities, should be factored into the cost of living. Economically priced local markets and energy-efficient cities can considerably lower these costs. Healthcare is another significant expense for retirees. Hence, states offering affordable and comprehensive healthcare services for seniors are often a preferred choice. A state's tax policies can make a substantial difference to a retiree's net income. Some states offer specific tax exemptions for retirees, while others have low overall tax rates. Such states can be particularly beneficial for retirees looking to make the most of their fixed income. Retirees, especially those living alone, often prioritize safety when choosing their retirement destination. Thus, cities and towns with low crime rates are typically preferred. The climate can significantly influence a retiree's lifestyle and well-being. Some may prefer warmer climates, while others may thrive in cooler regions. A favorable climate can also reduce healthcare costs associated with weather-related health issues. Access to recreational amenities such as parks, libraries, community centers, and cultural events add to the quality of life. These not only provide entertainment but also opportunities for social engagement. With advancing age, access to quality healthcare has become increasingly important. Proximity to reputed hospitals and medical centers is a vital factor in choosing a retirement location. The availability of dedicated senior healthcare services, such as senior clinics, geriatric specialists, and home healthcare options, can enhance the healthcare experience for retirees. Active retiree communities provide opportunities for social interaction, community involvement, and mutual support – all factors contributing to a better quality of life. Cities that host social events and activities catering to seniors can enhance their social life, thereby contributing to their overall happiness and well-being. With its lower cost of living compared to other major cities, Lancaster offers quality healthcare facilities and a vibrant arts and culture scene. Its close-knit community makes it a comfortable place to retire. Pennsylvania's capital city, Harrisburg, offers a mix of urban and suburban life. The city has a lower cost of living than the national average, with a plethora of recreational activities and good access to healthcare facilities. Pensacola, with its beautiful beaches and warm climate, is a haven for retirees. The city offers affordable housing and a lower cost of living, making it an attractive destination for those on a fixed income. Known for its pleasant weather, Tampa offers a low cost of living and tax advantages for retirees. The city boasts a range of recreational activities and quality healthcare facilities. York offers an affordable cost of living along with access to quality healthcare. Its historic downtown, rich cultural scene, and the presence of active senior communities make it an ideal retirement location. The timing of your move, strategic downsizing, and managing logistics are vital elements of the relocation process. This includes selecting the optimal season for the move, identifying essential possessions to bring along, and arranging reliable moving services. Effective management of fixed retirement income is crucial for financial stability. This involves setting realistic budgets that account for lifestyle needs, potential healthcare costs, and leisure activities. Leveraging financial planning resources can provide a roadmap to maximizing the utility of your fixed income. Maintaining an active lifestyle and fostering community connections are key components of a fulfilling retirement, irrespective of financial constraints. Explore local clubs, volunteer opportunities, and community events to build relationships, stay engaged, and enjoy a vibrant social life in your new retirement location. Retirement on a fixed income necessitates a strategic choice of location, with cities like Lancaster, Harrisburg, Pensacola, Tampa, and York offering a mix of affordability, quality of life, and community engagement. Key factors influencing this decision include the cost of living encompassing housing, daily expenses, and healthcare, tax benefits for retirees, and access to comprehensive healthcare services. Safety, favorable climate, and recreational amenities are also paramount in ensuring a high-quality life post-retirement. It's equally essential to plan the relocation wisely, manage finances astutely, and remain an active participant in the community. These elements not only contribute to financial stability but also foster an enriching retirement experience. By considering these factors, retirees on a fixed income can choose a location that fits their budget while offering an enjoyable, fulfilling lifestyle. Remember, retirement is a new chapter filled with possibilities – choose wisely and live well.Finding the Ideal Retirement Destination on a Fixed Income

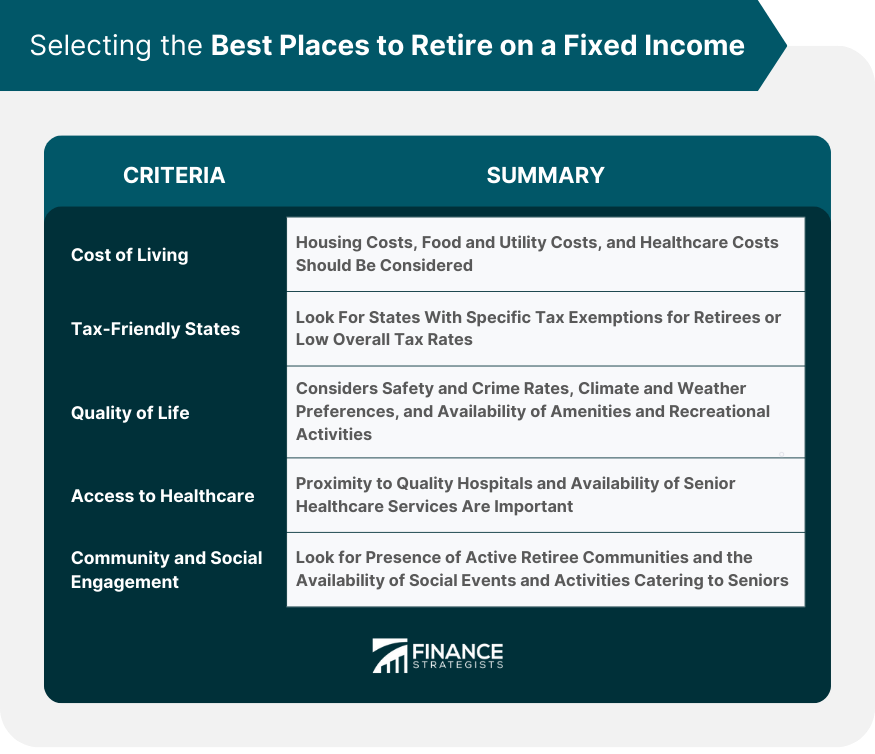

Criteria for the Best Places to Retire on a Fixed Income

Cost of Living

Housing Costs

Food and Utility Costs

Healthcare Costs

Tax-Friendly States for Retirees

Quality of Life

Safety and Crime Rates

Climate and Weather

Amenities and Recreation

Access to Healthcare

Proximity to Quality Hospitals

Availability of Senior Healthcare Services

Community and Social Engagement Opportunities

Presence of Active Retiree Communities

Availability of Social Events and Activities

Best Places to Retire in the US on a Fixed Income

Lancaster, PA

Harrisburg, PA

Pensacola, FL

Tampa, FL

York, PA York

Tips for Transitioning to Fixed-Income Retirement Locations

Strategizing the Relocation

Fiscal Management and Budgeting Post-Retirement

Ensuring Active Community Engagement

The Bottom Line

Best Places to Retire in the US on a Fixed Income FAQs

Some of the best places to retire in the U.S. on a fixed income include Lancaster, PA; Harrisburg, PA; Pensacola, FL; Tampa, FL; and York, PA. These cities offer a combination of affordability, amenities, and quality of life that make them attractive for retirees on a budget.

When choosing a retirement location on a fixed income, it's important to consider factors such as the cost of living, including housing, food, utilities, and healthcare costs. Additionally, tax-friendly states, quality of life indicators like safety and climate, access to healthcare, and community engagement opportunities should be taken into account.

To manage your finances and budget effectively on a fixed income in retirement, it's important to set realistic budgets that account for your lifestyle needs, potential healthcare costs, and leisure activities. Utilize financial planning resources and seek professional advice to maximize the utility of your fixed income.

When relocating to a fixed-income retirement location, consider the timing of your move, downsize strategically, and manage logistics efficiently. Choose the optimal season for the move, identify essential possessions to bring along, and arrange reliable moving services to ensure a smooth transition.

Regardless of financial constraints, it's important to maintain an active lifestyle and foster community connections in retirement. Explore local clubs, volunteer opportunities, and community events to build relationships, stay engaged, and enjoy a vibrant social life in your retirement location.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.