An orphaned plan is a retirement plan that has been left behind by an employee after they change jobs or the sponsoring employer ceases to exist. These plans often remain unmanaged and can result in lost retirement savings. Orphaned plans can have significant implications for employees' retirement savings. Because these plans are often left unmanaged, the investments within the plan may not be appropriately adjusted over time to align with the employee's changing risk tolerance and retirement goals. This can lead to suboptimal investment performance and potential losses. Additionally, orphaned plans can result in lost retirement savings. If an employee is not aware of an orphaned plan or does not know how to access the funds, they may lose track of these assets. This can result in lower retirement income and financial insecurity in retirement. Understanding and addressing orphaned plans is crucial for ensuring a secure retirement. Employees should be aware of the potential risks associated with these plans and take steps to manage and consolidate their retirement assets. One of the most common reasons for orphaned plans is job loss or a career move. When employees leave a job, they may have a 401(k) or other retirement account with their former employer. If they fail to roll over their savings to a new employer's plan or an IRA, the old account can become orphaned. This situation is especially common for younger workers, who change jobs more frequently than older workers. Another reason for orphaned plans is mergers and acquisitions. When two companies merge or are acquired, the retirement plans sponsored by the companies may be left behind or forgotten. Employees must be proactive in tracking their retirement assets during these transitions, ensuring that their retirement savings remain intact. If an employer goes bankrupt or out of business, the retirement plans it sponsors may become orphaned. This situation is more common with small employers, which may not have the resources to maintain their retirement plans after a business failure. Employees must be aware of their rights and options regarding their retirement assets in these situations, including how to access them and transfer them to a new account. Some orphaned plans result from simple neglect or lack of maintenance. Employees may be unaware of their retirement plan balances or fail to update their contact information with plan administrators. This lack of attention can lead to retirement plans being forgotten or left behind. Regularly reviewing and updating retirement accounts can help prevent this situation from occurring. One of the most significant consequences of orphaned plans is the loss of retirement savings. Unmanaged accounts may not perform as well as actively managed ones, leading to a lower overall retirement income. In addition, orphaned plans may be subject to higher fees and expenses, reducing investment returns over time. Individuals with orphaned plans may also miss out on potential employer contributions, such as matching contributions, which can further reduce retirement savings. Having multiple orphaned plans can make it difficult for individuals to manage their retirement portfolio effectively. Without a clear understanding of their total assets and investment allocations, individuals may be unable to make informed decisions about their retirement savings. This can lead to suboptimal investment choices, increased risk, and a reduced retirement income. Orphaned plans may also result in unexpected tax consequences. For example, if required minimum distributions are not taken when required, individuals may be subject to penalties and additional taxes. In addition, orphaned plans may be subject to different tax rules than other retirement accounts, which can complicate tax planning and preparation. One way to identify orphaned plans is by reviewing old employment contracts and benefits statements. These documents may provide information about previous retirement plans and account balances. Another way to identify orphaned plans is by contacting previous employers to inquire about any retirement plans that may have been left behind. This may help in locating forgotten assets. The National Registry of Unclaimed Retirement Benefits is a resource that can help individuals locate orphaned plans. By providing personal information, the registry can search for any unclaimed retirement accounts. One option for managing orphaned plans is to roll them over into an individual retirement account (IRA) or another employer-sponsored retirement plan. This can help consolidate retirement assets and simplify portfolio management. Rolling over to an IRA may also provide more investment options and flexibility than an employer plan. To roll over an orphaned plan, individuals should first research the different types of retirement accounts and their associated fees and expenses. They should also consider their investment goals and risk tolerance when choosing an account. Once a new account is chosen, individuals can initiate the rollover process with the plan administrator, who will transfer the funds directly to the new account. Another option for managing orphaned plans is to take a lump sum distribution. This option may be appealing to individuals who need immediate access to their retirement savings or who want to invest the funds in other areas. However, taking a lump sum distribution may have tax implications and should be carefully considered before making a decision. Individuals who choose to take a lump sum distribution should be aware of the potential tax consequences. Depending on the age of the account holder and the type of account, the distribution may be subject to income taxes and penalties. In some cases, it may make sense to leave the orphaned plan alone, particularly if the account balance is small or the investment options are favorable. This decision should be made based on an individual's specific circumstances and investment goals. Leaving the plan alone may be a good option if the account is well-managed and has low fees and expenses. An orphaned plan in retirement planning refers to a retirement account that is left without active management, typically due to an employee changing jobs or the sponsoring employer ceasing to exist. Orphaned plans can occur due to several reasons, including job loss or transition, mergers and acquisitions, employer bankruptcy, and lack of attention or maintenance. These plans can pose significant challenges for employees, including lost retirement savings, unmanaged investments, and difficulties in accessing funds. To identify orphaned plans, individuals can review old employment contracts and benefits statements, contact previous employers, or use resources like the National Registry of Unclaimed Retirement Benefits. Once an orphaned plan is identified, it's important to decide on the best course of action. Options for managing orphaned plans include rolling them over into an individual retirement account (IRA) or another employer-sponsored retirement plan, taking a lump sum distribution, or leaving the plan alone. The choice depends on the individual's specific circumstances and investment goals. Understanding and addressing orphaned plans is crucial for ensuring a secure retirement. Employees should be aware of the potential risks associated with these plans and take proactive steps to manage and consolidate their retirement assets. What Is an Orphaned Plan?

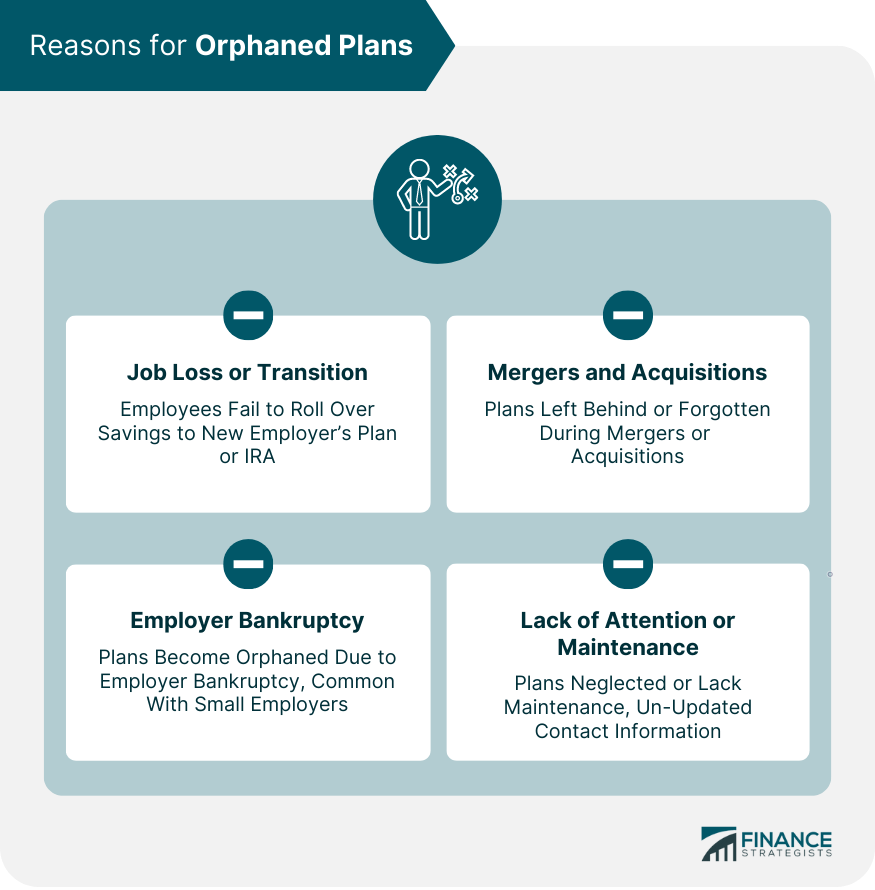

Reasons for Orphaned Plans

Job Loss or Transition

Mergers and Acquisitions

Employer Bankruptcy

Lack of Attention or Maintenance

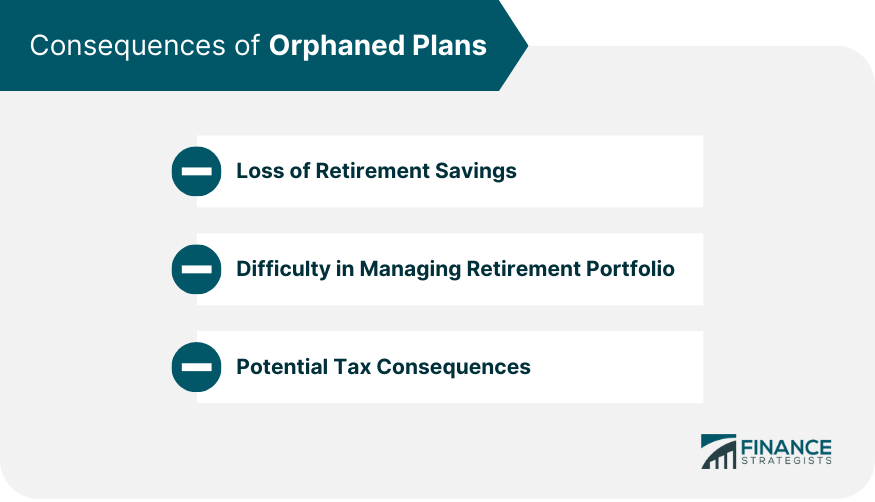

Consequences of Orphaned Plans

Loss of Retirement Savings

Difficulty in Managing Retirement Portfolio

Potential Tax Consequences

How to Identify Orphaned Plans

Reviewing Old Employment Contracts and Benefits Statements

Contacting Previous Employers

Searching the National Registry of Unclaimed Retirement Benefits

What to Do With Orphaned Plans

Roll Over to an IRA or Another Employer Plan

Take a Lump Sum Distribution

Leave the Plan Alone

Conclusion

Orphaned Plan FAQs

An orphaned plan is a retirement plan that has been left behind with a previous employer due to job loss, transition, or lack of maintenance.

You can identify an orphaned plan by reviewing old employment contracts and benefit statements, contacting previous employers, or searching the National Registry of Unclaimed Retirement Benefits.

Leaving an orphaned plan unmanaged can lead to loss of retirement savings, difficulty in managing your retirement portfolio, and potential tax consequences.

You can roll over an orphaned plan to an IRA or another employer plan, take a lump sum distribution, or leave the plan alone.

Managing orphaned plans is important to protect your retirement savings and ensure that you are maximizing your retirement income potential.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.