Supplemental Executive Retirement Plans (SERPs) are non-qualified deferred compensation plans designed to provide additional retirement benefits to select executives. These plans are typically offered by companies to attract, retain, and reward top talent. SERPs serve to address the limitations of traditional retirement plans, such as 401(k)s and pension plans, by providing enhanced benefits to key executives. They help companies remain competitive by offering attractive compensation packages to top talent. SERPs differ from traditional retirement plans in several ways, including eligibility, funding mechanisms, and tax treatment. Unlike qualified retirement plans, SERPs are not subject to certain regulations, providing more flexibility for both employers and employees. Defined Benefit SERPs promise a specified retirement benefit to executives, often based on a formula that takes into account factors like years of service and final average compensation. These plans guarantee a predetermined payout upon retirement. Advantages of Defined Benefit SERPs include predictable benefits for executives and potentially lower funding requirements for employers. However, they may also present risks due to market volatility and potential underfunding of the plan. Defined Contribution SERPs establish individual accounts for executives, with employer contributions based on a predetermined formula. Retirement benefits depend on the performance of investments within the account, rather than a guaranteed payout. Defined Contribution SERPs offer flexibility in investment options and allow executives to share in investment gains. However, they also shift the investment risk from the employer to the executive, making retirement benefits less predictable. Hybrid SERPs combine elements of both defined benefit and defined contribution plans, offering a blend of guaranteed benefits and investment-based returns. These plans can provide a balance between predictability and flexibility for both employers and executives. Hybrid SERPs can offer the best of both worlds by providing a guaranteed benefit while still allowing executives to participate in investment growth. However, they may also present increased complexity and administrative challenges. When designing a SERP, companies must establish eligibility criteria that typically include factors such as job position, tenure, and performance. These criteria help ensure that SERPs are targeted toward key executives and align with the company's compensation strategy. Companies must determine the appropriate benefit formula for defined benefit SERPs or contribution rates for defined contribution SERPs. These decisions should consider factors like market competitiveness, company performance, and executive compensation objectives. For defined contribution and hybrid SERPs, employers must select investment options and strategies that align with the plan's objectives and executive preferences. This may include offering a range of investment choices or utilizing a specific investment strategy. Proper administration and record-keeping are essential for the successful implementation and management of a SERP. Companies may choose to handle these tasks internally or engage a third-party administrator to ensure compliance with applicable regulations and reporting requirements. Employers generally receive a tax deduction for SERP contributions when the benefits become taxable to the executive. However, unlike qualified retirement plans, SERP contributions are not tax-deductible when made, and plan assets remain subject to the company's creditors. Executives typically pay income taxes on SERP benefits when they are received, with the rate depending on the form of the SERP. Lump-sum payments from defined benefit SERPs are generally subject to ordinary income tax rates, while payments from defined contribution and hybrid SERPs are subject to capital gains tax rates. Several strategies may help executives reduce the tax burden associated with SERP benefits. These include deferring SERP benefits until retirement, utilizing tax-efficient investment options within the plan, and structuring the SERP as a split-dollar life insurance policy. While SERPs are not subject to the same regulations as qualified retirement plans, they are still subject to the Employee Retirement Income Security Act (ERISA) and other regulations governing non-qualified plans. Compliance with these regulations is essential for avoiding penalties and ensuring the plan's legal and financial soundness. Certain types of SERPs may be subject to SEC registration and reporting requirements, particularly if the plan involves investments in securities. Employers should consult with legal and financial advisors to ensure compliance with these regulations. The IRS provides guidelines and rules for the design, implementation, and taxation of SERPs. Employers must ensure that their SERPs comply with these guidelines, including rules regarding eligibility, contribution limits, and taxation. Supplemental Executive Retirement Plans (SERPs) offer both advantages and potential risks to employers and executives. The benefits of SERPs include providing enhanced retirement benefits to executives, which can be an effective tool to retain top talent within the organization. SERPs can also provide flexibility in designing executive compensation packages that align with both company objectives and the individual needs of executives. However, SERPs also come with potential risks and drawbacks that employers and executives need to consider. These include increased administrative complexity, potential legal and regulatory compliance issues, and market risks associated with investment-based plans. Here are the strategies that employers and executives can use to mitigate the risks associated with SERPs: 1. Careful Plan Design: Employers and executives should carefully design the plan to align with company objectives and executive preferences. This includes choosing the right type of SERP, determining eligibility criteria, and setting funding and vesting schedules. 2. Monitoring Funding and Investment Performance: Employers and executives should regularly monitor the plan's funding and investment performance to ensure that it remains adequately funded and is meeting performance expectations. 3. Regular Plan Review and Adjustment: Employers and executives should regularly review and adjust the plan to meet changing circumstances, such as changes in tax laws, market conditions, or the company's financial situation. By implementing these strategies, employers and executives can help mitigate the risks associated with SERPs and maximize the benefits for both the company and its executives. SERPs play a critical role in attracting and retaining top talent by offering enhanced retirement benefits and flexibility in compensation packages. Companies must carefully design and implement SERPs to align with their objectives and comply with regulations. Organizations considering implementing SERPs must carefully weigh the benefits and risks, including administrative complexity and market risks, and ensure compliance with applicable regulations and guidelines. Employers and executives considering implementing SERPs should seek the guidance of a financial advisor and legal counsel to ensure compliance, soundness, and effectiveness of the plan.What Are Supplemental Executive Retirement Plans (SERPs)?

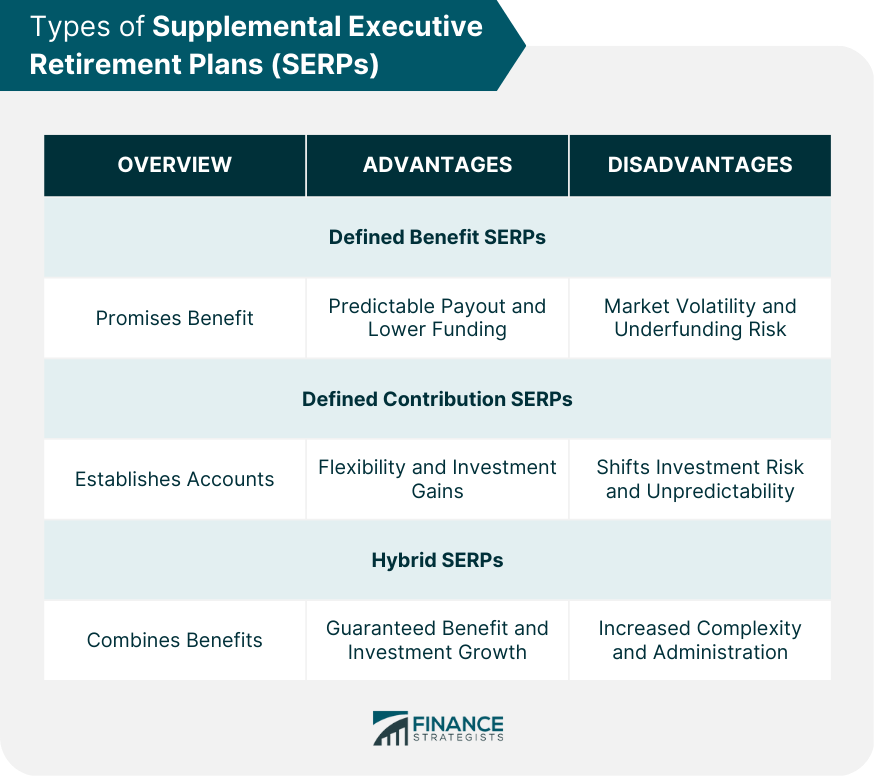

Types of SERPs

Defined Benefit SERPs

Defined Contribution SERPs

Hybrid SERPs

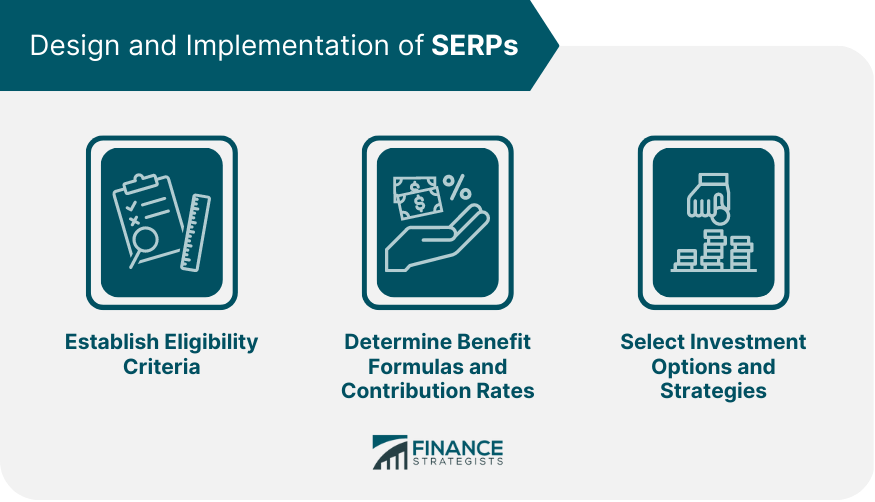

Design and Implementation of SERPs

Establish Eligibility Criteria

Determine Benefit Formulas and Contribution Rates

Select Investment Options and Strategies

Set Up Plan Administration and Record-Keeping

Tax Implications of SERPs

Tax Treatment for Employers

Tax Treatment for Executives

Strategies to Minimize Tax Burdens

Regulatory and Compliance Considerations

ERISA and Non-Qualified Plan Regulations

Securities and Exchange Commission (SEC) Requirements

Internal Revenue Service (IRS) Guidelines

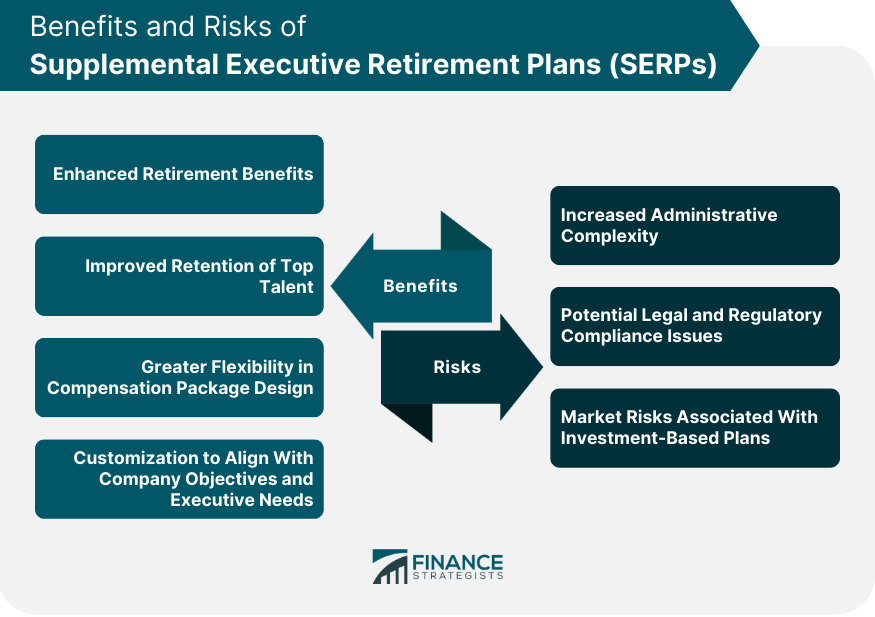

Benefits and Risks of SERPs

SERPs Strategies

Final Thoughts

Supplemental Executive Retirement Plans (SERPs) FAQs

SERPs, or Supplemental Executive Retirement Plans, are retirement plans designed to provide enhanced retirement benefits to executives and other highly compensated employees.

There are three main types of SERPs: defined benefit SERPs, defined contribution SERPs, and hybrid SERPs. Each type has its own advantages and disadvantages.

SERPs are subject to tax at various stages, including at contribution, vesting, and distribution. Employers and executives must carefully consider these tax implications when designing and implementing SERPs.

Employers and executives can mitigate the risks associated with SERPs by carefully designing the plan, monitoring the plan's funding and investment performance, and regularly reviewing and adjusting the plan to meet changing circumstances.

Best practices for implementing SERPs include conducting a thorough needs assessment and cost-benefit analysis, engaging legal and financial advisors, effectively communicating the plan to executives, and regularly monitoring and adjusting the plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.