The 412(i) Plan, named after the Internal Revenue Code section that defines it, is a type of fully insured defined benefit pension plan. It is designed for small businesses, typically those with fewer than ten employees, and offers tax-advantaged retirement savings. Recognizing that small businesses may not have the resources to offer traditional pension plans, the federal government created the 412(i) plan as a fully-insured, guaranteed retirement income option. The 412(i) plan differs from other types of pension plans in several key ways. Unlike traditional defined benefit plans, the 412(i) plan is fully insured, which means it is backed by an insurance company, reducing the risk to the employer. It also allows for larger tax-deductible contributions than other plans, making it an attractive option for business owners looking to save more for retirement. The 412(i) Plan consists of several key components. First, it is fully insured, which means the funds in the plan are guaranteed by an insurance company. This reduces the risk to the employer and ensures that employees will receive their promised benefits. Second, the plan requires fixed annual contributions from the employer, determined by an actuary. These contributions are based on the employee's age, salary, and years of service. The goal is to accumulate enough funds to provide a defined benefit at retirement. Third, the 412(i) Plan offers a guaranteed retirement income based on the contributions and the insurance contract. This provides employees with the certainty of a set income when they retire. The assets in a 412(i) Plan are held in a trust and are invested in life insurance and annuity contracts. The life insurance component provides a death benefit to the employee's beneficiaries, while the annuity component guarantees a steady stream of income in retirement. In a 412(i) Plan, the employer is responsible for making all contributions, managing the plan, and ensuring compliance with IRS regulations. The employer also chooses the insurance company that will provide the life insurance and annuity contracts. Employees, on the other hand, have few responsibilities in a 412(i) Plan. They are not required to make contributions, but they do have the option to transfer their benefits to another qualified plan if they leave the company before retirement. The 412(i) plan is typically suited for small businesses with fewer than ten employees. Since the premiums for a 412(i) plan can be quite high, it's best for businesses where the owners are older and have a high income and where the employees are significantly younger and earn less. In a 412(i) plan, the employer is solely responsible for making contributions. These contributions are determined by an actuary and must be sufficient to fund the future retirement benefits of the employees. The contributions are tax-deductible for the employer, offering substantial tax advantages. Unlike other pension plans, employees are not required, nor do they typically contribute to a 412(i) plan. The plan is fully funded by the employer. This feature can make the 412(i) plan an attractive benefit for potential employees. The 412(i) plan stands out because it allows for significantly larger contributions than other retirement plans. The actual limit depends on several factors, including the employee's age, years of service, and compensation. However, it's important to note that these contributions must be consistent and predictable, which may limit the flexibility of the employer's cash flow. The IRS has strict regulations governing 412(i) plans. These rules cover aspects such as contribution limits, nondiscrimination requirements, and reporting obligations. Failure to comply can lead to severe penalties, including plan disqualification. As the plan sponsor, the employer has a fiduciary duty to act in the best interests of the plan participants. This includes making the required contributions, ensuring that the plan complies with all legal and regulatory requirements, and providing participants with accurate and timely information about their benefits. Non-compliance with 412(i) plan regulations can lead to serious consequences. In addition to plan disqualification, the employer may face financial penalties and may be required to make corrective contributions or distributions. Additionally, plan participants may lose some or all of their promised benefits. The plan administrator plays a crucial role in managing a 412(i) plan. Responsibilities include monitoring the plan's funded status, ensuring legal compliance, coordinating with the insurance provider, and communicating with plan participants. Proper record-keeping is vital for a 412(i) plan. This includes maintaining accurate records of contributions, earnings, distributions, and any other transactions affecting the plan. Additionally, the plan administrator must regularly provide participants with statements detailing their benefits and the plan's status. In a 412(i) plan, the plan's assets are invested in life insurance and annuity contracts. The insurance provider manages these investments, which typically offer a guaranteed return. The plan administrator and the employer must carefully select the insurance provider and monitor the performance of these investments. There are several reasons an employer might choose to terminate a 412(i) plan. These include changes in the company's financial situation, changes in tax laws or regulations, or a shift in the company's benefits strategy. Terminating a 412(i) plan involves several steps. These include notifying plan participants, distributing plan assets, filing a final plan return with the IRS, and ensuring that all contractual obligations with the insurance provider are met. Plan termination can have a significant impact on both employees and employers. Employees may lose their promised retirement income, while employers may face financial penalties and reputational damage. Deciding whether a 412(i) plan is the right fit for your business involves several considerations. These include the age and compensation of the business owner and employees, the financial capacity of the business to make consistent contributions, the business's tax situation, and the administrative capabilities of the business to manage the plan. If a 412(i) plan doesn't suit your business, there are several alternatives to consider. These include other defined benefit plans, defined contribution plans like 401(k)s or SIMPLE IRAs, or even SEP IRAs. Each of these options has its own advantages, disadvantages, and regulatory requirements. The 412(i) plan offers several tax advantages. The contributions made by the employer are tax-deductible, reducing the company's taxable income. Additionally, the earnings on the plan's investments grow tax-deferred until retirement, when they're distributed to the employees. One of the main attractions of a 412(i) plan is that it provides a guaranteed retirement income for employees. The retirement benefits are defined and backed by an insurance contract, providing a stable and predictable income in retirement. Another significant advantage of the 412(i) plan is the potential for higher contributions compared to other retirement plans. This feature is particularly beneficial for small business owners who are nearing retirement and wish to boost their retirement savings. Small businesses can leverage the 412(i) plan as a tool to attract and retain top talent. By offering a guaranteed retirement income fully funded by the employer; small businesses can provide a competitive benefits package. At the same time, the tax advantages can help offset the costs of running the plan. While the 412(i) plan has several benefits, it's important to note the drawbacks as well. The foremost among these is the high cost of funding the plan. The premiums for life insurance and annuity contracts can be expensive, particularly for older employees. Another risk is the potential for changes in tax laws that could affect the plan's tax benefits. Furthermore, if the employer is unable to make the required contributions, the plan could be disqualified, leading to significant tax penalties. A 412(i) plan also comes with complex administrative requirements. Employers must ensure that the plan complies with all IRS regulations and must maintain accurate records of all contributions and distributions. This complexity can be a burden, particularly for small businesses without dedicated human resources or finance departments. The 412(i) plan is a fully insured defined benefit pension plan designed for small businesses. It offers tax advantages and a guaranteed retirement income, making it an attractive option for businesses with fewer than ten employees. The plan is funded by fixed annual contributions from the employer based on employee age, salary, and years of service. Employees have minimal responsibilities, and the plan's assets are invested in life insurance and annuity contracts. However, there are considerations and risks to keep in mind. Compliance with IRS regulations is crucial, and plan management requires careful administration and selection of insurance providers. The high funding costs, potential changes in tax laws, and administrative complexity should be weighed against the benefits. Exploring alternatives and considering business factors are important for decision-making.412(i) Plans Overview

Understanding the 412(i) Plan Structure

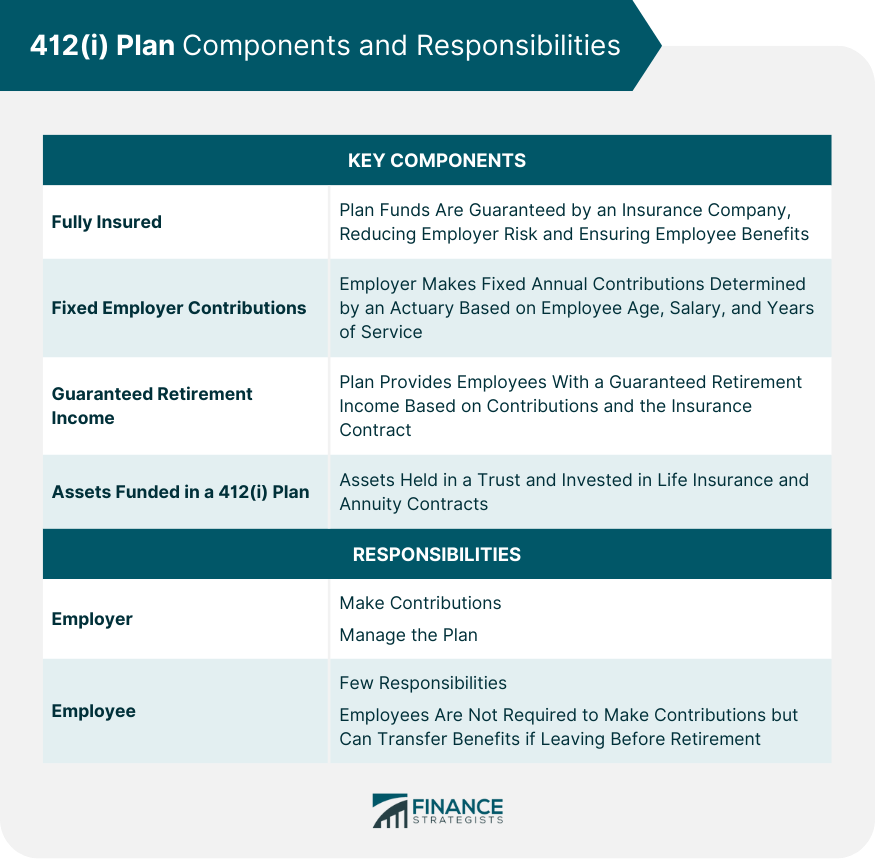

Key Components of a 412(i) Plan

Roles and Responsibilities of the Employer and Employee in a 412(i) Plan

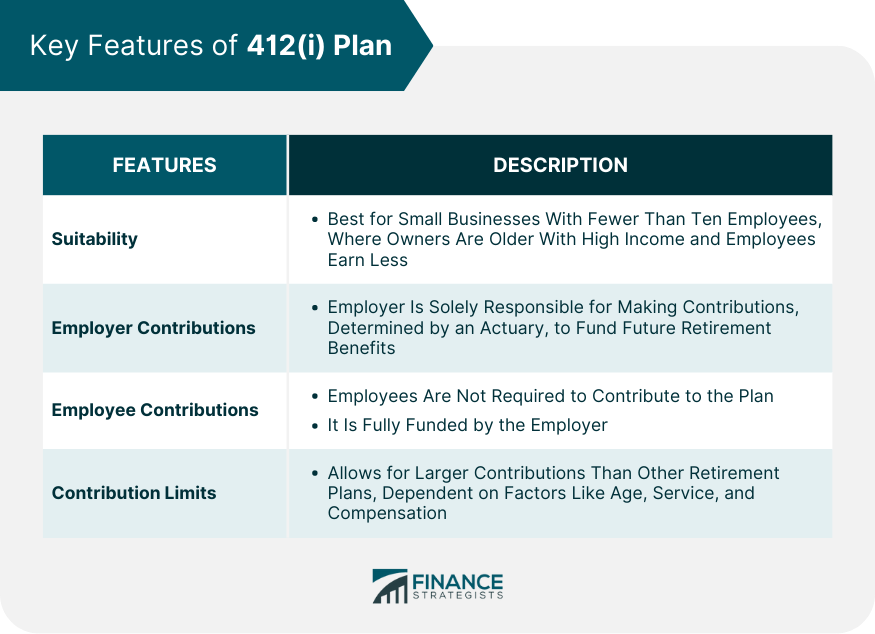

Key Features of 412(i) Plan

Employer Contributions to a 412(i) Plan

Employee Contributions to a 412(i) Plan

Contribution Limits for a 412(i) Plan

Regulations and Legal Aspects of a 412(i) Plan

IRS Regulations on a 412(i) Plan

Legal Obligations of the Employer Under a 412(i) Plan

Consequences of Non-Compliance With 412(i) Plan Regulations

Management of 412(i) Plan

Managing a 412(i) Plan

Terminating a 412(i) Plan

Factors to Consider When Deciding on a 412(i) Plan

Alternatives to a 412(i) Plan

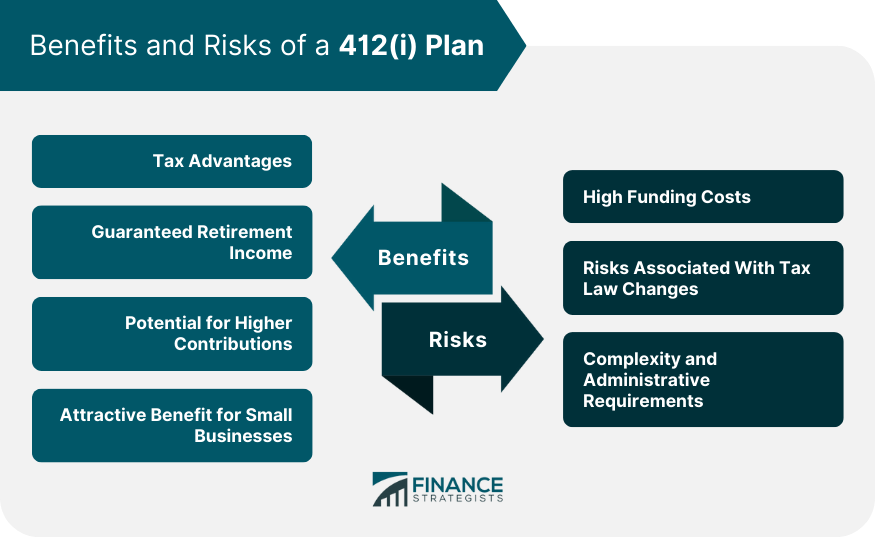

Benefits of a 412(i) Plan

Tax Advantages of a 412(i) Plan

Guaranteed Retirement Income Through a 412(i) Plan

Potential for Higher Contributions in a 412(i) Plan

Beneficial Tool for Small Businesses

Risks of a 412(i) Plan

High Funding Costs of a 412(i) Plan

Risks Associated With a 412(i) Plan

Complexity and Administrative Requirements of a 412(i) Plan

Conclusion

412(i) Plans FAQs

A 412(i) plan is a fully insured defined benefit pension plan designed for small businesses. It's fully funded by the employer and is invested in life insurance and annuity contracts. The plan provides a guaranteed retirement income based on the contributions and the insurance contract.

A 412(i) plan is typically suited for small businesses with fewer than ten employees. It's best for businesses where the owners are older and have a high income and where the employees are significantly younger and earn less.

The 412(i) plan offers several benefits, including tax advantages, a guaranteed retirement income, and the potential for higher contributions compared to other retirement plans. Small businesses can also leverage the plan as a tool to attract and retain top talent.

The high cost of funding the plan is the primary risk associated with a 412(i) plan. The potential for changes in tax laws that could affect the plan's tax benefits and failure to comply with IRS regulations can also lead to severe penalties.

Deciding whether a 412(i) plan is right for your business involves several considerations, such as the age and compensation of the business owner and employees, the financial capacity of the business to make consistent contributions, the business's tax situation, and the administrative capabilities of the business to manage the plan. Consultation with financial and legal professionals can help you make the right decision for your business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.