A Government-Sponsored Retirement Arrangement (GSRA) is a retirement plan that is either established, regulated, or subsidized by the government. These arrangements are designed to help individuals accumulate savings for their retirement years, providing them with financial stability and a steady income stream after they stop working. GSRAs play a crucial role in retirement planning by offering various savings and investment vehicles that cater to different financial needs and preferences. These arrangements help individuals create a diversified retirement portfolio, minimizing risks and maximizing potential returns. Moreover, GSRAs offer tax advantages and other benefits, making them an essential component of a comprehensive retirement strategy. Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible individuals. Funded through payroll taxes, Social Security serves as a vital safety net, ensuring a basic level of financial support for retirees. While Social Security benefits alone may not be sufficient to maintain one's desired lifestyle in retirement, they can serve as a foundation upon which to build additional retirement savings. A 401(k) plan is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax earnings to a tax-deferred investment account. Employers may also offer matching contributions up to a certain percentage, providing an additional incentive for employees to save for retirement. The funds in a 401(k) account grow tax-deferred until withdrawn, at which point they are taxed as ordinary income. Pension plans, also known as defined benefit plans, are employer-sponsored retirement plans that promise a specified monthly benefit to employees upon retirement. The benefit is typically based on factors such as years of service, salary, and age at retirement. Although traditional pension plans have become less common in recent years, they still represent an essential component of the retirement landscape for many individuals. Individual Retirement Accounts (IRAs) are tax-advantaged retirement savings vehicles that allow individuals to contribute a portion of their income to a dedicated account. There are several types of IRAs, including Traditional IRAs, Roth IRAs, and SIMPLE IRAs, each with its own set of rules and tax benefits. These accounts provide individuals with the opportunity to invest in a range of securities, such as stocks, bonds, and mutual funds, in order to grow their retirement savings. Annuities are long-term, tax-deferred investment contracts issued by insurance companies. They are designed to provide a guaranteed income stream during retirement. Annuities come in various forms, including fixed, variable, and indexed, each with its own set of features and benefits. These products can be an attractive option for individuals seeking a reliable income source in retirement, particularly in the face of increasing life expectancies and market volatility. One of the primary advantages of GSRAs is the tax benefits they offer. Depending on the type of GSRA, individuals may enjoy tax deductions on contributions, tax-deferred growth of investments, or tax-free withdrawals in retirement. These tax advantages can significantly enhance the long-term growth potential of retirement savings. Many GSRAs, such as 401(k) plans and pension plans, involve employer contributions. This can be a significant benefit, as it allows individuals to grow their retirement savings more quickly and with less personal financial commitment. Moreover, employer contributions can act as an incentive for employees to save more for retirement, as they essentially represent "free money" that should not be left on the table. Certain GSRAs, such as pension plans and annuities, provide a guaranteed income stream during retirement. This can offer retirees peace of mind, knowing that they will have a stable source of income to rely on, regardless of market conditions. A guaranteed income can also help retirees maintain their desired lifestyle and cover essential living expenses. Many GSRAs are managed by professional investment managers who make investment decisions on behalf of plan participants. This can be a significant advantage for individuals who may not have the time, knowledge, or inclination to manage their own investments. Professional management can help ensure that retirement savings are invested prudently and in line with an individual's risk tolerance and financial goals. GSRAs such as 401(k) plans and IRAs offer portability, which means that individuals can maintain their retirement accounts when changing jobs or retiring. This feature allows for continuity in retirement savings and investment strategies, minimizing disruptions to an individual's long-term financial plan. GSRAs typically have annual contribution limits, which can restrict the amount of money an individual can save for retirement through these vehicles. While these limits may be sufficient for some individuals, others may need to explore additional savings and investment options to ensure they have adequate resources for their retirement years. Withdrawing funds from a GSRA before reaching a specified age, typically 59½, can result in substantial penalties and taxes. This can be a significant drawback for individuals who may need access to their retirement savings earlier than anticipated due to unforeseen circumstances or emergencies. Some GSRAs may offer limited investment options, which can restrict an individual's ability to diversify their retirement portfolio and maximize potential returns. In such cases, individuals may need to explore other investment vehicles to achieve their desired level of diversification and risk management. GSRAs are subject to government regulations and policies, which can change over time. This dependence on government policies can be a drawback for individuals who may be concerned about potential changes in tax laws, Social Security benefits, or other factors that could affect their retirement savings and income. Eligibility for various GSRAs may be subject to age requirements, such as the minimum age to begin receiving Social Security benefits or the age at which an individual can withdraw funds from a 401(k) or IRA without penalties. Understanding these age requirements is essential to effectively plan for retirement and ensure that one's retirement savings are accessible when needed. Certain GSRAs, such as 401(k) plans and pension plans, are tied to an individual's employment status. Eligibility for these plans may be contingent upon meeting specific service requirements or maintaining full-time employment with a sponsoring employer. It is crucial for individuals to understand the employment-related eligibility criteria for their chosen GSRAs and to consider the impact of potential career changes on their retirement planning. Some GSRAs, such as Roth IRAs, have income limits that restrict eligibility for high-income earners. These limits can affect an individual's ability to contribute to certain retirement savings vehicles and may necessitate exploring alternative options to maximize tax-advantaged retirement savings. As previously mentioned, GSRAs have annual contribution limits that can affect an individual's ability to save for retirement. It is essential to be aware of these limits and to plan one's retirement savings strategy accordingly, ensuring that maximum contributions are made to each eligible GSRA. A Government-Sponsored Retirement Arrangement (GSRA) is a retirement plan established, regulated, or subsidized by the government. GSRAs play a vital role in retirement planning, providing individuals with various savings and investment vehicles to help them achieve financial stability during their retirement years. Additionally, GSRAs provide tax advantages and other benefits, making them an integral part of a comprehensive retirement strategy. While GSRAs offer numerous advantages, including tax benefits, employer contributions, guaranteed income in retirement, professional management, and portability, they also have some drawbacks. These include contribution limits, early withdrawal penalties, limited investment options, and dependence on government policies. By carefully considering these factors, individuals can make informed decisions about which GSRAs to incorporate into their retirement planning and how to maximize the benefits while minimizing the drawbacks.What Is a Government-Sponsored Retirement Arrangement (GSRA)?

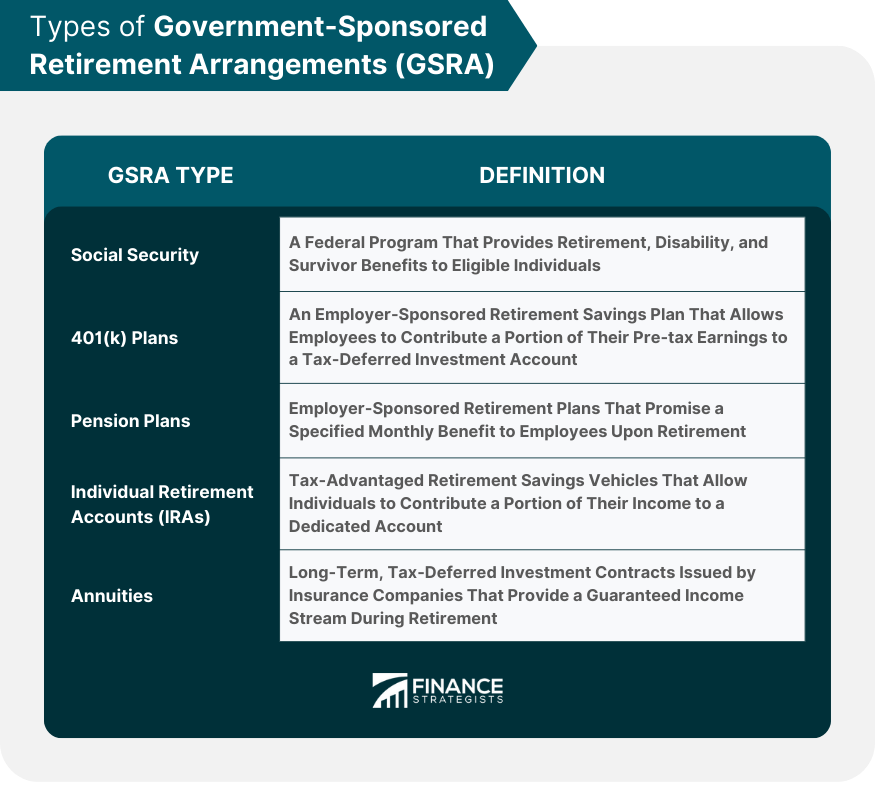

Types of GSRA

Social Security

401(k) Plans

Pension Plans

Individual Retirement Accounts (IRAs)

Annuities

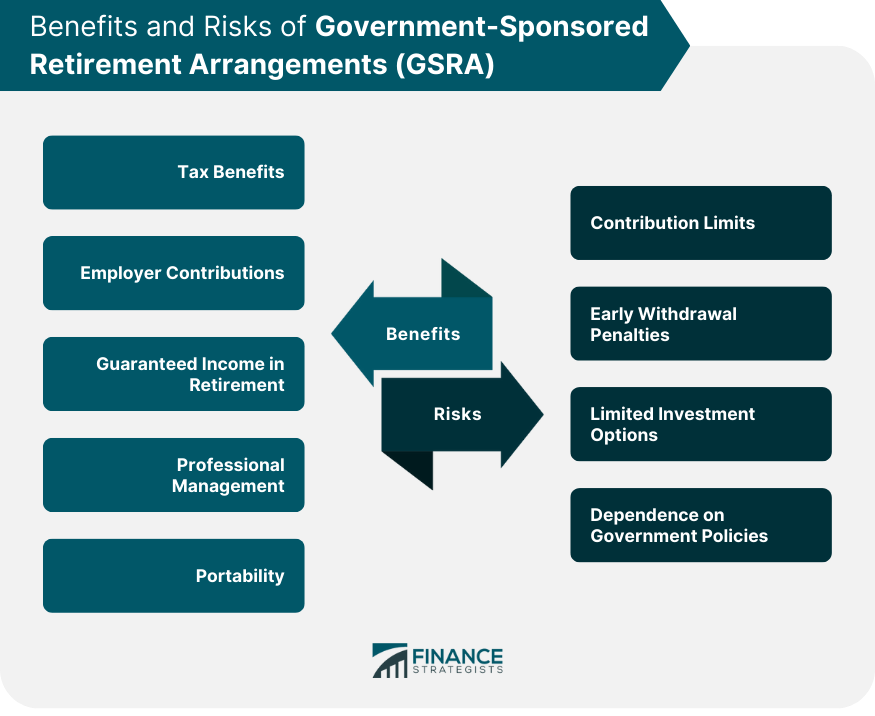

Benefits of GSRA

Tax Benefits

Employer Contributions

Guaranteed Income in Retirement

Professional Management

Portability

Risks of GSRA

Contribution Limits

Early Withdrawal Penalties

Limited Investment Options

Dependence on Government Policies

Eligibility for GSRA

Age Requirements

Employment Status

Income Limits

Contribution Limits

Conclusion

Government-Sponsored Retirement Arrangement (GSRA) FAQs

GSRA refers to retirement savings plans that are sponsored or supported by the government, such as Social Security, 401(k) plans, and pensions.

GSRA plans offer several benefits, including tax benefits, employer contributions, guaranteed income in retirement, professional management, and portability.

Yes, some of the drawbacks of GSRA plans include contribution limits, early withdrawal penalties, limited investment options, and dependence on government policies.

Eligibility for GSRA plans varies depending on the specific plan, but generally, there are age requirements, employment status, income limits, and contribution limits that must be met.

The future of GSRA plans is uncertain, but with an aging population and concerns about the long-term sustainability of Social Security, it is likely that there will be ongoing discussions and potential changes to these retirement savings plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.