A salary deferral agreement is a legally binding contract between an employee and their employer. It outlines the terms by which a portion of the employee's salary is withheld and invested on their behalf. This deferred compensation is typically allocated to retirement savings plans, stock options, or other investment vehicles. Salary deferral agreements offer employees an opportunity to save and invest for their future while taking advantage of various tax benefits. Employers may also benefit from these agreements by offering competitive benefits packages that help attract and retain top talent. Salary deferral agreements are commonly used in conjunction with employer-sponsored retirement plans, such as 401(k)s, 403(b)s, and deferred compensation plans. They may also be used in situations where employees receive stock options or other forms of equity compensation. There are several components to a salary deferral agreement. The employee is the individual who agrees to defer a portion of their salary for investment purposes. The employer is the organization responsible for withholding and investing the deferred compensation according to the terms of the agreement. The salary deferral agreement may specify a fixed dollar amount to be withheld from each paycheck. Alternatively, the agreement may stipulate that a percentage of the employee's salary is deferred. Short-term deferral periods typically last for a few years and may be used for specific financial goals, such as saving for a down payment on a home. Long-term deferral periods often span decades and are generally geared toward retirement savings. Deferred funds may be invested in an employer-sponsored retirement plan, such as a 401(k) or 403(b). Some salary deferral agreements involve allocating deferred compensation to stock options or other equity-based incentives. Non-qualified deferred compensation (NQDC) plans are another option for investing deferred salary, typically used by highly compensated employees. There are several advantages to salary deferral agreements. Salary deferrals are often made on a pre-tax basis, reducing the employee's taxable income and lowering their current tax liability. Investments in deferred compensation plans typically grow tax-deferred, allowing for potentially higher returns over time. Salary deferral agreements create a structured savings plan, ensuring that employees consistently set aside funds for their future. Many employers offer matching contributions for deferred compensation, effectively increasing the employee's overall compensation. Salary deferral agreements help employees develop disciplined saving habits and work towards their long-term financial goals. By consistently saving and investing through salary deferral, employees can work towards achieving financial security in retirement. Salary deferral agreements also come with several risks and limitations. Salary deferral agreements may limit an employee's access to their deferred funds, potentially creating liquidity issues in case of financial emergencies. Withdrawing funds from deferred compensation plans before a specified age or event may result in taxes and penalties. Investments made through salary deferral agreements are subject to market risk, and the value of the investments may fluctuate over time. In some cases, deferred compensation may be tied to the financial health of the employer, exposing the employee to company-specific risks. Changes in tax laws may impact the tax benefits associated with salary deferral agreements, potentially affecting an employee's financial planning. Regulatory changes may impact retirement plan rules, affecting the structure and benefits of salary deferral agreements. Salary Deferral agreements must follow several legal and regulatory considerations. The Employee Retirement Income Security Act (ERISA) governs many aspects of employer-sponsored retirement plans and may influence the terms of salary deferral agreements. The Internal Revenue Service (IRS) sets rules and regulations for tax-qualified retirement plans and non-qualified deferred compensation plans, which must be adhered to in salary deferral agreements. State and local laws may also influence the terms and conditions of salary deferral agreements, particularly in the case of public sector employees. There are several points that must be considered when negotiating a salary deferral agreement. Employees should carefully consider their financial goals and risk tolerance when negotiating a salary deferral agreement, ensuring that the terms align with their long-term objectives. Before entering into a salary deferral agreement, employees should evaluate their employer's financial stability and the available investment options to minimize potential risks. Employers must ensure they can effectively administer the salary deferral agreement and comply with all relevant regulations. Offering competitive salary deferral options can help employers attract and retain top talent, contributing to the organization's overall success. Both parties should work together to draft and review the salary deferral agreement, ensuring that it accurately reflects their agreed-upon terms and conditions. Salary deferral agreements play a crucial role in helping employees save for their future while providing tax advantages. They also contribute to effective financial planning and long-term financial security. Both employees and employers must weigh the benefits and risks of salary deferral agreements, taking into consideration factors such as liquidity, investment risks, and regulatory changes. To get the most out of your agreement and ensure that it aligns with your financial goals, it is recommended to consult with a retirement planning professional. They can provide personalized guidance and help you navigate the legal and regulatory considerations involved. What Is a Salary Deferral Agreement?

Components of a Salary Deferral Agreement

Parties Involved

Employee

Employer

Deferral Amount and Frequency

Fixed Amount

Percentage of Salary

Deferral Period

Short-Term

Long-Term

Investment Options

Employer-Sponsored Retirement Plans

Stock Options

Deferred Compensation Plans

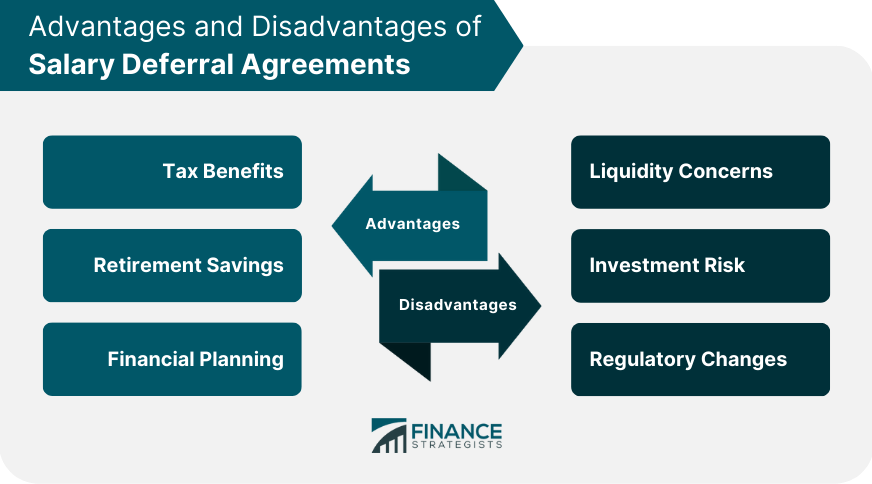

Advantages of Salary Deferral Agreements

Tax Benefits

Pre-Tax Contributions

Tax-Deferred Growth

Retirement Savings

Forced Savings Mechanism

Employer Matching Contributions

Financial Planning

Budgeting and Goal Setting

Long-Term Financial Security

Potential Risks and Limitations

Liquidity Concerns

Limited Access to Deferred Funds

Penalties for Early Withdrawal

Investment Risk

Market Volatility

Employer Financial Health

Regulatory Changes

Tax Law Revisions

Changes in Retirement Plan Rules

Legal and Regulatory Considerations

ERISA Guidelines

IRS Regulations

State and Local Laws

Negotiating a Salary Deferral Agreement

Employee Considerations

Financial Goals and Risk Tolerance

Assessing Employer Stability and Investment Options

Employer Considerations

Plan Administration and Compliance

Employee Retention and Benefits

Drafting and Reviewing the Agreement

Conclusion

Salary Deferral Agreement FAQs

A salary deferral agreement is a contract between an employee and their employer, where a portion of the employee's salary is withheld and invested on their behalf.

Salary deferral agreements offer tax benefits, a forced savings mechanism, and employer-matching contributions, contributing to financial planning and long-term financial security.

Salary deferral agreements may limit access to deferred funds, be subject to market risk, and may have penalties for early withdrawal. They may also be affected by changes in tax laws and retirement plan rules.

Deferred funds can be invested in employer-sponsored retirement plans, stock options, or deferred compensation plans.

Employees should consider their financial goals and risk tolerance, evaluate their employer's financial stability and investment options, and work with their employer to draft and review the agreement to ensure that it accurately reflects their agreed-upon terms and conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.