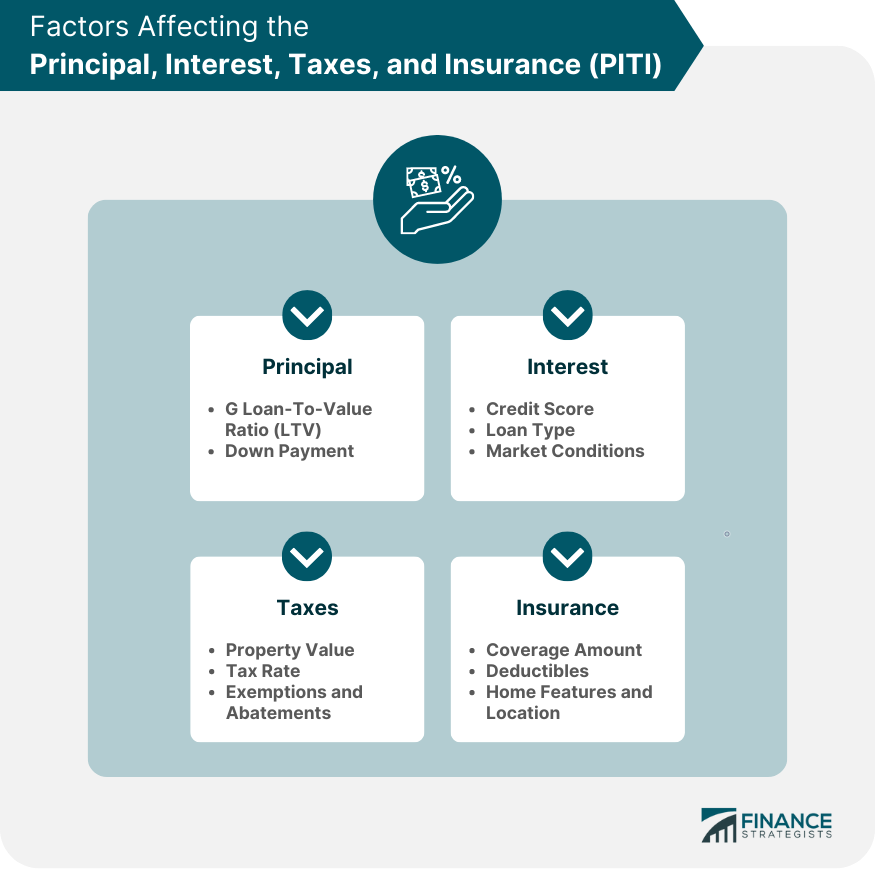

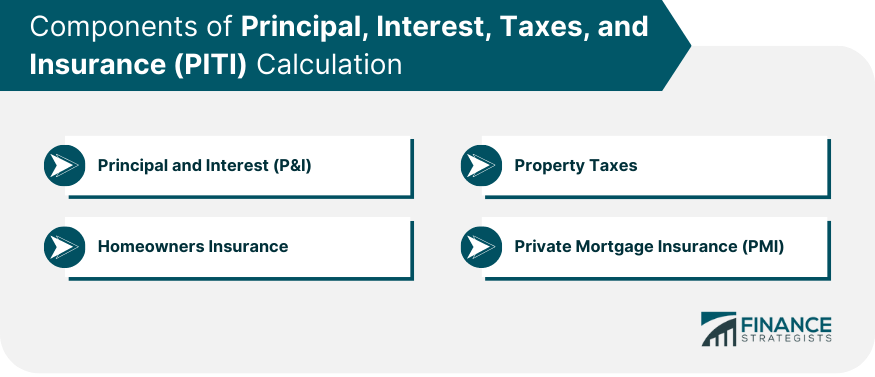

Principal, Interest, Taxes, and Insurance (PITI) is a term commonly used in the context of mortgage loans. It represents the four main components of a homeowner's monthly mortgage payment. The principal refers to the portion of the payment that goes towards reducing the outstanding loan balance. Interest represents the cost of borrowing the money from the lender. Taxes refer to property taxes assessed by local governments, which are usually included in the monthly payment to ensure they are paid. Insurance typically includes homeowner's insurance, which protects the property against damage or loss. Lenders often require borrowers to escrow funds for taxes and insurance, adding them to the monthly payment. Understanding PITI is essential for homeowners to budget and manage their mortgage obligations effectively. The principal refers to the original loan amount borrowed to purchase a property or the remaining mortgage balance. This is the portion of the mortgage payment that goes towards reducing the outstanding loan balance. Several factors can affect the principal amount in a mortgage, including: Loan-To-Value Ratio (LTV): The LTV represents the ratio of the loan amount to the appraised value of the property. A higher LTV may result in a higher principal amount and potentially higher interest rates. Down Payment: A larger down payment reduces the amount that needs to be borrowed, thus lowering the principal amount. Repayment of the principal amount typically follows an amortization schedule, which outlines the distribution of principal and interest payments over the loan term. Making extra payments or choosing a shorter loan term can help borrowers reduce the principal amount more quickly, ultimately saving on interest costs. Interest is the cost of borrowing money and represents the lender's compensation for providing the loan. The interest rate is typically expressed as a percentage of the principal amount and is paid in addition to the principal repayment. Several factors can influence the interest rate on a mortgage, including: Credit Score: A higher credit score indicates a lower risk for the lender and may result in a lower interest rate. Loan Type: Different loan types, such as conventional, FHA, or VA loans, may have different interest rates based on various factors. Market Conditions: Interest rates fluctuate based on economic indicators and other market factors, which can affect mortgage rates. There are several types of interest rates available for mortgages: Fixed-Rate Mortgage: This type of mortgage has an interest rate that remains unchanged for the duration of the loan term. Adjustable-Rate Mortgage (ARM): An ARM has an interest rate that can change periodically based on a specific index and margin. Interest-Only Mortgage: This type of mortgage allows borrowers to make interest-only payments for a specified period before principal payments are required. Property taxes are levied by local governments to fund various public services, such as schools, infrastructure, and emergency services. The amount of property tax a homeowner pays is based on the assessed value of the property and the local tax rate. Several factors can influence property tax amounts, including: Property Value: The assessed value of a property is typically determined by a local tax assessor and is based on factors such as location, size, and amenities. Tax Rate: Each jurisdiction sets its tax rate, which can vary based on local needs and budget requirements. Exemptions and Abatements: Some homeowners may qualify for exemptions or abatements, which can lower their property tax burden. Owning a home can have several tax implications, including: Mortgage Interest Deduction: Homeowners can deduct the interest paid on their mortgage from their taxable income, potentially reducing their overall tax liability. Property Tax Deduction: Property taxes paid by homeowners can also be deducted from their taxable income, subject to certain limitations. Capital Gains Tax: When selling a property, homeowners may be subject to capital gains tax on the profit made from the sale. However, certain exemptions and exclusions may apply, reducing or eliminating the capital gains tax liability. Insurance, in the context of homeownership, refers to two primary types: homeowners insurance and private mortgage insurance (PMI). Homeowners insurance covers damage to the property and personal belongings, as well as liability protection. PMI is typically required when a borrower has a down payment of less than 20% of the property's value and protects the lender in case of default. Homeowners insurance policies can include various types of coverage, such as: Dwelling Coverage: This coverage protects the physical structure of the home, including walls, roof, and flooring. Personal Property Coverage: This coverage protects the homeowner's personal belongings, such as furniture, electronics, and clothing. Liability Coverage: This coverage protects the homeowner from liability claims arising from injuries or property damage sustained by others while on the insured property. Insurance premiums for homeowners insurance can be influenced by several factors, including: Coverage Amount: A higher coverage amount typically results in higher premiums. Deductibles: A higher deductible can lower the premium, as it shifts more financial responsibility to the policyholder in the event of a claim. Home Features and Location: Factors such as the age and condition of the property, as well as its location in relation to natural hazards or crime rates, can impact insurance premiums. Calculating PITI is essential for determining the true cost of homeownership and assessing affordability. It also plays a crucial role in mortgage qualification, as lenders use PITI to evaluate a borrower's ability to repay the loan. The components of PITI include: Principal and Interest (P&I): These represent the monthly payments towards the principal amount and the interest on the mortgage. Property Taxes: The annual property tax amount, divided by 12, represents the monthly property tax portion of PITI. Homeowners Insurance: The annual insurance premium, divided by 12, represents the monthly insurance portion of PITI. Private Mortgage Insurance (PMI), if applicable: The annual PMI premium, divided by 12, represents the monthly PMI portion of PITI for borrowers with less than 20% down payment. Lenders use the debt-to-income ratio (DTI) to assess a borrower's ability to manage monthly debt payments, including PITI. DTI is calculated by dividing the borrower's total monthly debt payments, including PITI, by their gross monthly income. A lower DTI indicates a better ability to handle debt and may result in more favorable loan terms. Calculating Principal, Interest, Taxes, and Insurance (PITI) is crucial for understanding the costs of homeownership and mortgage affordability. PITI consists of principal and interest, property taxes, homeowners insurance, and private mortgage insurance (if applicable). Each component is influenced by various factors such as loan-to-value ratio, credit score, property value, tax rates, coverage amounts, and home features. These factors impact the overall cost of homeownership and monthly mortgage payments. Lenders use PITI and the debt-to-income ratio (DTI) to assess borrowers' ability to manage their mortgage payments. It is important for prospective homeowners to consider PITI when budgeting and evaluating their financial readiness for homeownership. Understanding the components of PITI and their influencing factors enables informed decision-making in the homebuying process.Principal, Interest, Taxes, and Insurance (PITI) Overview

Principal

Definition and Explanation of Principal

Factors Affecting Principal Amount

Principal Repayment

Interest

Definition and Explanation of Interest

Factors Affecting Interest Rate

Types of Interest Rates

Taxes

Definition and Explanation of Property Taxes

Factors Affecting Property Taxes

Tax Implications of Homeownership

Insurance

Definition and Explanation of Insurance

Types of Homeowners Insurance Coverage

Factors Affecting Insurance Premiums

Calculating PITI

Importance of Calculating PITI

Components of PITI Calculation

PITI and Debt-To-Income Ratio (DTI)

Bottom Line

Principal, Interest, Taxes, & Insurance (PITI) FAQs

Understanding PITI is crucial for homeowners, as it represents the primary component of the total monthly housing expenses. By comprehending PITI, homeowners can better assess affordability, plan for future financial responsibilities, and navigate the mortgage qualification process.

Lenders evaluate a borrower's ability to repay the loan by considering PITI in relation to their income. They calculate the debt-to-income ratio (DTI) by dividing the borrower's total monthly debt payments, including PITI, by their gross monthly income. A lower DTI indicates a better ability to handle debt and may result in more favorable loan terms.

Yes, making extra payments towards the principal amount can help reduce the outstanding loan balance more quickly, which in turn can lower the interest paid over the life of the loan. However, making extra principal payments does not directly affect the taxes or insurance components of PITI.

Property taxes are a part of the PITI calculation and represent the homeowner's contribution to local government revenue for public services. The annual property tax amount, divided by 12, is included in the monthly PITI payment.

Homeowners insurance is a crucial component of PITI because it protects both the homeowner and the lender from potential losses due to damage, theft, or liability. The annual insurance premium, divided by 12, is included in the monthly PITI payment, ensuring that the property remains insured throughout the mortgage term.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.