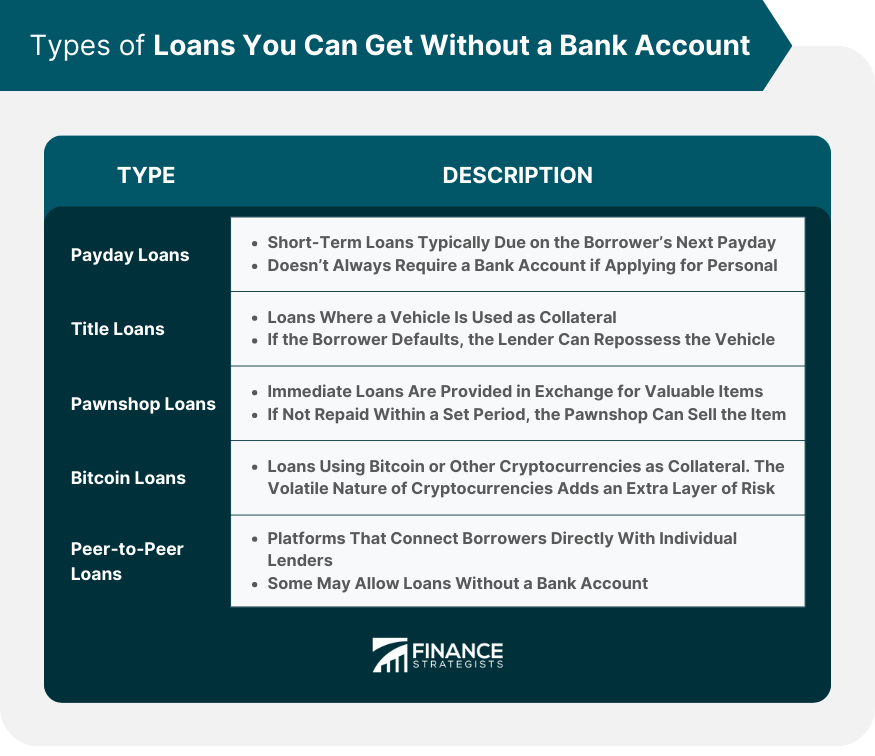

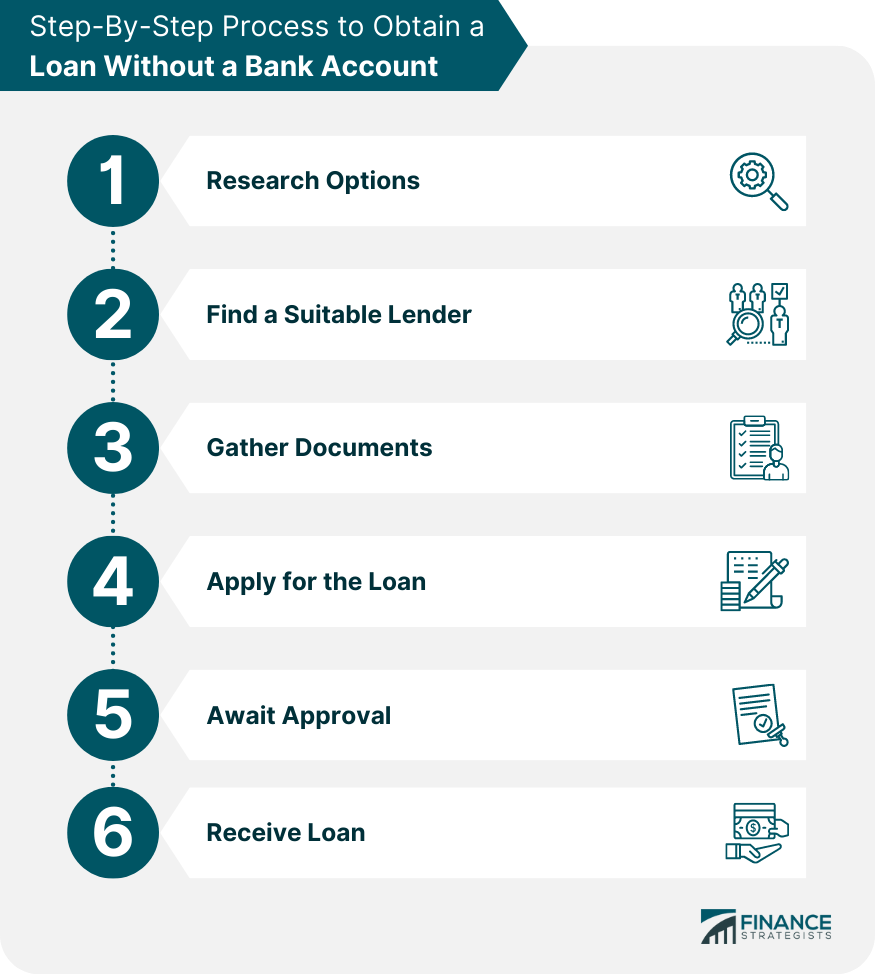

Absolutely, you can obtain a loan without a bank account, though your options may be limited and often come with higher interest rates and fees. Traditional banks usually require a bank account for loan approval, but other lenders like payday loan providers, pawnshops, and certain fintech companies can provide loans without this requirement. You might be able to get payday loans, title loans (using your vehicle as collateral), pawn loans (using personal belongings as collateral), or even loans backed by cryptocurrency. However, the risks associated with these loans are often higher, as are the costs. Therefore, while it's possible, it's essential to consider the financial implications carefully before securing such a loan. Payday loans are small, short-term loans typically due on the borrower's next payday. These loans don't always require a bank account if the borrower applies in person. However, they come with high fees and annual percentage rates (APRs), making them a costly form of credit. Title loans allow borrowers to use their vehicle as collateral to secure a loan. The lender places a lien on the car title in exchange for the loan amount. If the borrower defaults, the lender can repossess the vehicle to recover the loan amount. Pawnshops provide an immediate loan in exchange for valuable items. The loan amount is usually a fraction of the item's actual value. If the loan is not repaid within a set period, the pawnshop can sell the item to recover the loan amount. With the emergence of cryptocurrencies, Bitcoin loans have become an alternative for individuals without a bank account. These loans use Bitcoin or other cryptocurrencies as collateral. However, the volatile nature of cryptocurrencies adds an extra layer of risk to these types of loans. Peer-to-peer lending platforms connect borrowers directly with individual lenders, bypassing traditional banking intermediaries. Some of these platforms may allow loans without a bank account, using alternative methods for loan disbursement and repayment. Before diving into the loan process, it's important to understand what loan options are available for those without a bank account. These options include payday loans, title loans, pawnshop loans, cryptocurrency loans, and peer-to-peer loans. Understand the requirements and implications of each type of loan to select the one best suited to your needs. Once you know what type of loan you're seeking, find a lender that offers such loans. Payday loan providers, pawnshops, and certain fintech companies are common lenders for individuals without a bank account. Most lenders will require proof of identity, proof of income, and potential collateral. Gather your documents, such as government-issued ID and pay stubs, in preparation for your loan application. The application process will vary depending on the type of loan and the lender. You might be able to apply online or you may need to visit a physical location. Fill out the application form with the required information and submit your documents. Once you've submitted your application, the lender will assess your ability to repay the loan. This might involve checking your income and evaluating your collateral. If approved, you'll need to agree to the loan's terms and conditions. After approval and acceptance of the loan terms, you will receive your loan. The disbursement method may vary; some lenders might offer cash, checks, or even a prepaid debit card. Keep in mind that while this process can provide you with the needed funds, loans without a bank account often come with higher interest rates and fees. Carefully consider these factors before committing to such a loan. Loans without a bank account often come with high-interest rates and fees due to the increased risk to the lender. These costs can add up quickly, making the loan significantly more expensive than initially perceived. Due to the high costs associated with loans without a bank account, borrowers can easily fall into a cycle of debt. If a borrower cannot repay the loan on time, they may have to take out another loan, leading to a cycle that can be hard to break. Certain types of loans without a bank account, such as payday loans, are heavily regulated or even banned in some states due to their high-cost nature. Borrowers must be aware of the legal implications and regulations in their state before taking such a loan. Defaulting on a loan without a bank account can have severe consequences on one's credit score. This negative mark can make it difficult to get credit in the future, affecting the individual's financial opportunities. The simplest alternative to getting a loan without a bank account is to open one. Having a bank account can improve access to cheaper and more varied credit options. It can also facilitate financial management and savings, providing an array of benefits beyond just loan access. Credit unions are member-owned financial institutions that often offer more personalized services than traditional banks. Some credit unions may offer small-dollar loans to individuals without a bank account, making them a viable alternative. Microfinance institutions and some nonprofit organizations offer small loans to individuals who lack access to traditional banking services. These loans often come with lower interest rates and more favorable terms than payday loans or title loans. With the rise of the digital economy, online platforms like crowdfunding sites have emerged as alternative sources of funds for individuals without a bank account. These platforms allow individuals to raise money for personal needs, business startups, or other projects from a large number of people. While it's entirely feasible to obtain a loan without a bank account, the associated risks and costs are considerably high. Options like payday loans, title loans, and pawnshop loans provide immediate financial solutions but come with steep interest rates and potential pitfalls. These forms of credit can entangle individuals in cycles of debt and may impact their credit scores detrimentally. However, it's crucial to note that there are safer alternatives available, such as opening a bank account, seeking assistance from credit unions, microfinancing institutions, or exploring crowdfunding platforms. Each option has its own set of requirements and benefits, so it's essential to carefully research and consider the implications before committing to a particular financial decision.Can I Get a Loan Without a Bank Account?

Types of Loans You Can Get Without a Bank Account

Payday Loans

Title Loans

Pawnshop Loans

Bitcoin Loans

Peer-to-Peer Loans

Step-By-Step Process to Obtain a Loan Without a Bank Account

Step 1: Research Your Options

Step 2: Find a Suitable Lender

Step 3: Gather Your Documents

Step 4: Apply for the Loan

Step 5: Await Approval

Step 6: Receive Your Loan

Challenges of Loans Without a Bank Account

High-Interest Rates and Fees

Dangers of Cycle of Debt

Legal Implications and Regulations

Impact on Credit Score and Future Financial Opportunities

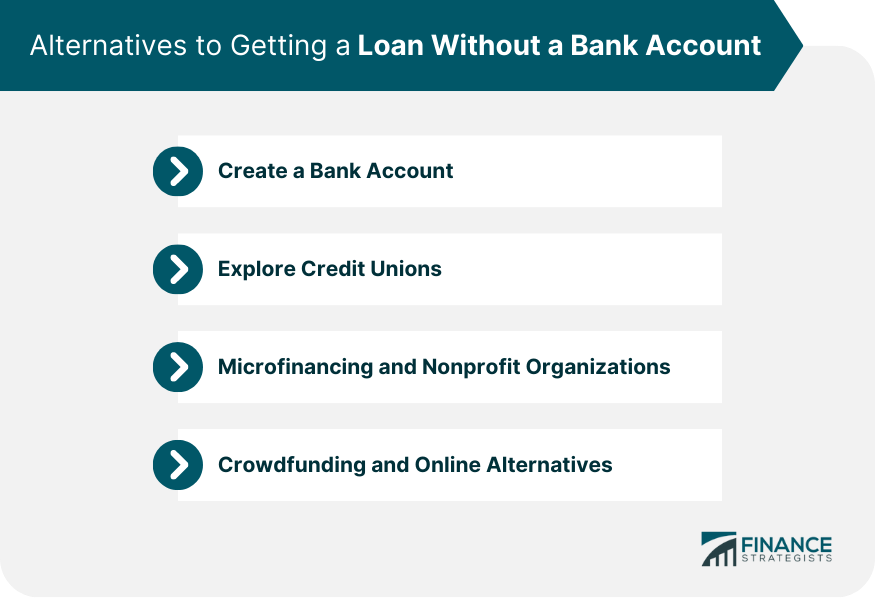

Alternatives to Getting a Loan Without a Bank Account

Creating a Bank Account

Exploring Credit Unions

Microfinancing and Nonprofit Organizations

Crowdfunding and Other Online Alternatives

Conclusion

Can I Get a Loan Without a Bank Account FAQs

There are several types of loans you can get without a bank account, including payday loans, title loans, pawnshop loans, Bitcoin loans, and peer-to-peer loans. These loans typically require proof of income and identity and may need collateral.

Yes, typically, loans without a bank account come with higher interest rates and fees due to the increased risk to the lender. This could make these loans significantly more expensive compared to traditional bank loans.

The risks include high-interest rates and fees, a potential cycle of debt, and the possibility of legal implications. Additionally, defaulting on such loans can have a negative impact on your credit score, affecting future financial opportunities.

Yes, alternatives include opening a bank account, joining a credit union, seeking assistance from microfinancing or nonprofit organizations, or using online crowdfunding platforms.

It's possible but difficult. Most lenders, even those offering loans without a bank account, require proof of a steady income source. However, some lenders may consider other forms of income or collateral, like a car for title loans or valuable items for pawnshop loans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.