A small business loan is a type of financing that helps entrepreneurs and business owners start or grow their businesses. A credit union is a nonprofit financial cooperative that offers banking services to its members, who share a common bond such as location, occupation, or affiliation. Such a loan from a credit union may have some advantages over other sources of funding, such as lower interest rates, fewer fees, more flexible terms, and personalized service. However, a small business loan from a credit union may also have some drawbacks, such as limited availability, stricter eligibility criteria, a longer approval process, and lower loan amounts. Therefore, a small business owner should weigh the pros and cons of getting a small business loan from a credit union before applying for one. Credit unions pride themselves on being deeply rooted in their local communities. This ingrained sense of community sets them apart from traditional financial institutions. Unlike larger banks that may be detached from individual communities, credit unions typically operate with a deep understanding of the local business landscape. This knowledge provides a unique advantage for small business owners, as decisions are often based on local economic conditions and community well-being. The community-based approach of credit unions often means a more holistic view of lending. Rather than just looking at numbers, they consider the business's role in the community, its potential for local job creation, and its overall contribution to local growth. Beyond the figures and paperwork, credit unions often stand out for their impeccable customer service, which is customized to cater to the individual needs of businesses. Businesses often benefit from the tailored financial advice credit unions provide. Whether it's insights into local market trends or guidance on cash flow management, businesses are not just loan recipients but partners in growth. At credit unions, the emphasis is often on forging lasting relationships. Loan officers work closely with businesses, understanding their challenges and triumphs and ensuring that financial solutions evolve with the business's needs. For any business, interest rates on loans can significantly impact financial health. Credit unions, with their unique operational model, often offer competitive rates. On average, credit unions have lower overheads compared to traditional banks. This cost-saving often translates to lower interest rates for borrowers, ensuring businesses can maximize their capital investment. Being not-for-profit entities, credit unions prioritize member benefits over profit margins. This ethos means any savings or profits are often channeled back to members in the form of reduced interest rates or enhanced services. Every business is unique, and so are its financial needs. Recognizing this, credit unions offer flexible loan terms that can be tailored to suit individual business requirements. Credit unions often provide more flexibility in repayment structures. Whether a business needs seasonal adjustments or prefers a balloon payment structure, credit unions can accommodate these requirements, easing financial stress. While traditional banks might have stringent collateral requirements, credit unions, with their deeper understanding of local businesses, can sometimes offer loans with alternative or more flexible collateral arrangements. Unforeseen fees and penalties can strain a business's finances. Credit unions, with their member-centric approach, often have a clearer and more forgiving fee structure. While banks may have multiple fees, from processing to early repayment penalties, credit unions tend to have fewer and lower fees. This transparency helps businesses plan their finances more predictably. With a lean operational model, credit unions don’t carry the hefty overheads that big banks do. These savings result in fewer fees, benefiting small businesses that are already grappling with various operational costs. Being part of a credit union is like being part of an exclusive financial club, where membership comes with distinct advantages. Once a business secures a loan from a credit union, it can also access other financial products, such as business credit cards, checking accounts, or even merchant services, often at discounted rates or with added benefits. Some credit unions reward their members by distributing a part of their profits as dividends. This additional financial boost can be a pleasant surprise for businesses, reaffirming the benefits of credit union membership. In the world of finance, trust is paramount. Credit unions, with their transparent operations, often foster a deeper sense of trust with their members. Transparency is a hallmark of credit unions. Whether it's about loan terms, interest rates, or potential fees, credit unions ensure businesses are well-informed, mitigating unforeseen financial surprises. Being community entities, credit unions often participate in local initiatives, sponsor events, or support local causes. This involvement not only builds trust but also reinforces their commitment to the community's well-being. Venturing into the business world with a startup can be challenging, especially when seeking financial support. Credit unions often step up to back these new ventures. Understanding the potential of startups and their role in community development, credit unions often have specialized loan products or guidance tailored for startups, helping them navigate the initial challenging phases. Whether it's a startup, a business poised for expansion, or one undergoing restructuring, credit unions offer tailored solutions, ensuring businesses get the right financial support at every growth stage. Informed decision-making is crucial in business, and credit unions play a pivotal role in educating their members. Many credit unions offer financial literacy programs, ensuring business owners are equipped with the knowledge to make informed financial decisions, from managing cash flows to understanding market trends. Frequent workshops on topics like digital marketing, tax planning, or inventory management provide businesses with the tools and knowledge to thrive, showcasing the credit union's commitment beyond just financial lending. Before applying for a loan, ensure your financial records are up-to-date, your business plan is solid, and you know exactly how much you need to borrow and for what purpose. Credit unions typically require you to be a member and meet certain lending criteria. These may include specific credit score requirements, business stability, and potentially other financial metrics. Next is the loan application process. This involves filling out an application form, submitting necessary financial documents, and possibly meeting with a loan officer for a loan interview. Be prepared to discuss your business plan, how you'll use the funds, and your repayment plan. Small Business Loans from Credit Unions emerge as a compelling option for entrepreneurs. Prioritizing community welfare, credit unions offer unparalleled benefits that go beyond just competitive interest rates. Their keen insight into local markets, combined with a commitment to transparent operations, makes them an ally for businesses, especially startups. Personalized service, fewer fees, and flexible loan terms are just the tip of the iceberg. These institutions emphasize building lasting relationships, offering tailored advice, and even providing educational resources to empower businesses. Moreover, membership often unlocks a plethora of additional financial services, underscoring the holistic support credit unions bring to the table. For businesses seeking a community-centric, transparent, and supportive financial partner, a small business loan from a credit union is undeniably worth considering.What Is a Small Business Loan From a Credit Union?

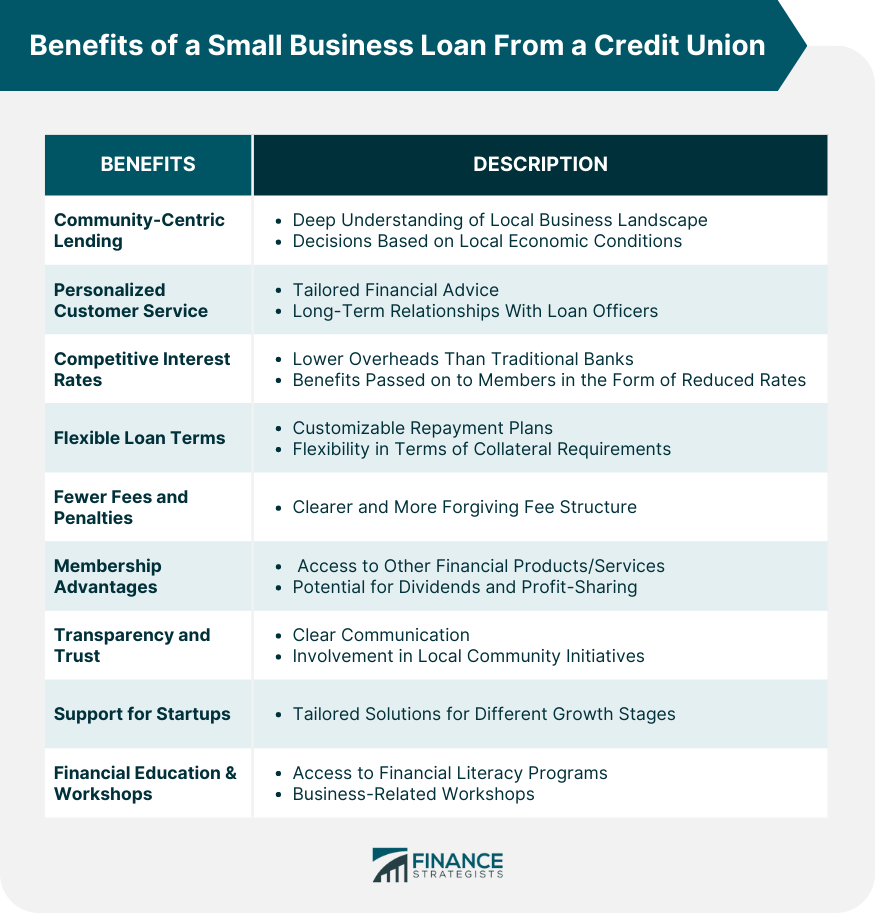

Benefits of a Small Business Loan From a Credit Union

Community-Centric Lending

Personalized Customer Service

Competitive Interest Rates

Flexible Loan Terms

Fewer Fees and Penalties

Membership Advantages

Transparency and Trust

Support for Startups and New Businesses

Financial Education and Workshops

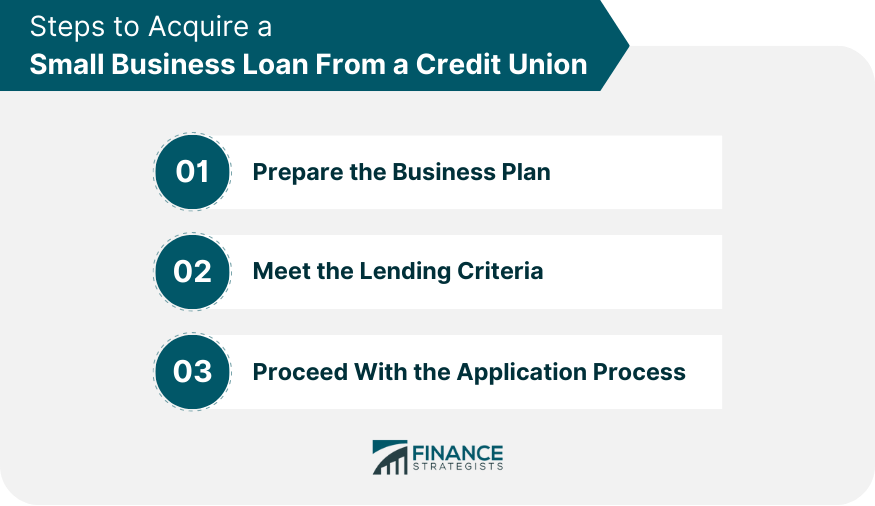

Steps to Acquire a Small Business Loan From a Credit Union

Prepare the Business Plan

Meet the Lending Criteria

Proceed With the Application Process

Conclusion

Benefits of a Small Business Loan From a Credit Union FAQs

Credit unions offer competitive interest rates, flexible loan terms, personalized customer service, and are community-centric, making them a viable option for small businesses seeking tailored financial solutions.

Generally, credit unions offer more competitive interest rates than traditional banks due to their not-for-profit model, passing savings onto their members.

Yes, many credit unions are willing to support startups and new businesses, often providing tailored solutions and guidance to help them navigate initial challenges.

Absolutely. Most credit unions offer financial literacy programs and workshops tailored for small businesses, ensuring they're equipped with the knowledge to make informed decisions.

Yes, obtaining a loan often provides access to other credit union financial products and services. Additionally, members might benefit from potential dividends and profit-sharing, depending on the credit union's performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.