A loan offset is a financial arrangement in which a borrower uses the funds in a savings or transaction account to offset the balance of a loan. The borrower's account is linked to their loan account, and the balance in the savings or transaction account is used to reduce the interest charged on the loan. Loan offsets are commonly offered with variable-rate home loans, but they may also be available with other types of loans, such as personal loans. It's important to note that loan offsets may have fees and restrictions, so it's important to read the terms and conditions carefully before signing up for one. A loan offset account is a separate account linked to a borrower's mortgage or other eligible loan. The balance in the offset account is used to "offset" the principal amount of the loan, effectively reducing the interest charged on the remaining loan balance. Interest is calculated daily on the net balance (loan amount minus offset account balance) and applied monthly, enabling borrowers to save on interest payments and potentially reduce their loan term. To illustrate how loan offset works, consider a $300,000 loan with an interest rate of 4% and a 25-year term. Without an offset account, the borrower would pay approximately $1,583 in monthly repayments. If the borrower has an offset account with a $50,000 balance, the interest would be calculated on a $250,000 balance, resulting in monthly repayments of approximately $1,316. This could potentially save the borrower over $80,000 in interest payments and reduce the loan term by around 5 years. Several factors can impact the effectiveness of a loan offset strategy, including: When considering a loan offset account, borrowers must meet certain eligibility requirements to qualify for this type of account. Additionally, not all lenders offer loan offset products and services, so borrowers should also consider the lender's requirements when choosing a loan offset. To qualify for a loan offset account, borrowers typically need to meet certain eligibility requirements, such as: Good Credit Score and History: A good credit score is an indication that a borrower is responsible with credit and has a history of timely payments. Borrowers with a low credit score may not qualify for a loan offset account. Stable Income and Employment: Lenders need assurance that borrowers have a steady source of income to repay the loan. Borrowers with unstable income or employment may not qualify for a loan offset account. Suitable Loan Type: Loan offsets are commonly offered with variable-rate home loans, but they may also be available with other types of loans, such as personal loans. Not all loans are eligible for loan offset accounts, so borrowers should check with their lender. Not all lenders offer loan offset products and services. Borrowers should research and compare various lenders to find the best loan offset options that align with their financial goals and needs. When evaluating lenders, borrowers should consider the following: Loan Type: Loan offsets may only be available for certain loan types, such as variable-rate home loans. Borrowers should ensure that the loan they want to offset is eligible for this type of account. Eligibility Requirements: Lenders may have specific eligibility requirements for borrowers, such as minimum credit score or income level. Borrowers should check with the lender to ensure they meet these requirements. Fees and Charges: Loan offset accounts may have fees and charges associated with them, such as account keeping fees or transaction fees. Borrowers should compare the fees and charges of different lenders to find the best option. Interest Rates: Borrowers should compare the interest rates of different lenders to find the most competitive loan offset account. A small difference in interest rates can result in significant savings over the life of the loan. When selecting a loan offset product, borrowers should compare the features, fees, and charges of different offset accounts. It's essential to choose a product that offers competitive interest rates and minimal fees to maximize the benefits of the loan offset strategy. Regular deposits into the offset account are crucial to ensure the success of a loan offset strategy. Borrowers should monitor their account balance and performance to ensure they're on track with their financial goals. Periodically reviewing and updating the loan offset strategy is essential to ensure its effectiveness. Borrowers may consider refinancing options or switching to a different loan product to take advantage of better interest rates or features. By reducing the interest paid on a loan, borrowers can save a significant amount of money over the life of the loan. This can result in substantial financial savings, enabling borrowers to allocate their funds to other financial goals. A loan offset account provides borrowers with increased financial flexibility by allowing them to overpay their loans without incurring penalties. Additionally, the balance in the offset account remains accessible, which can be beneficial in case of emergencies or other unexpected expenses. Utilizing a loan offset strategy can provide borrowers with a sense of control over their financial situation, reducing financial stress and increasing their motivation to pay off the loan faster. Although having access to funds in an offset account can be beneficial, it can also lead to misuse or overspending. Borrowers should exercise discipline and restraint in managing their offset account funds to avoid jeopardizing their loan repayment progress. Using a loan offset strategy may have an opportunity cost, as borrowers might be able to achieve better returns by investing their funds elsewhere. It is essential to carefully evaluate personal financial goals and risk tolerance before implementing a loan offset strategy. Unexpected changes in financial circumstances, such as unemployment or reduced income, can affect a borrower's ability to maintain a healthy offset account balance. In such cases, borrowers should reevaluate their loan offset strategy and make necessary adjustments to stay on track with their financial objectives. Loan offset is a useful financial arrangement for borrowers looking to reduce their loan interest payments and potentially shorten their loan term. By linking a savings or transaction account to their loan account, borrowers can offset the principal amount of their loan and save on interest charges. However, loan offsets may come with fees and restrictions, and borrowers should carefully evaluate the eligibility requirements and lender policies before signing up for one. Regular deposits and periodic reviews of the loan offset strategy are crucial to ensure its effectiveness. While loan offset provides benefits such as financial savings, increased financial flexibility, and psychological benefits, borrowers should also be aware of potential risks such as overspending, changes in financial circumstances, and opportunity costs. By considering both the benefits and risks, borrowers can make informed decisions and implement successful loan offset strategies.What Is Loan Offset?

Understanding Loan Offset Mechanisms

How Loan Offset Works

Loan Offset Calculation and Examples

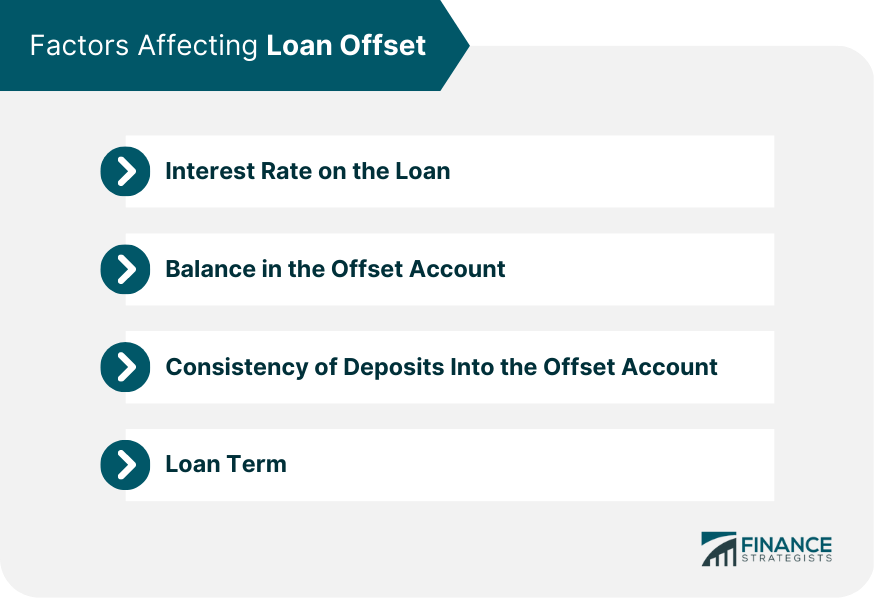

Factors Affecting Loan Offset

Eligibility for Loan Offset

Requirements for Borrowers

Requirements for Lenders

Implementing a Loan Offset Strategy

Choosing a Suitable Loan Offset Product

Managing Your Loan Offset Account

Adjusting the Strategy for Maximum Benefits

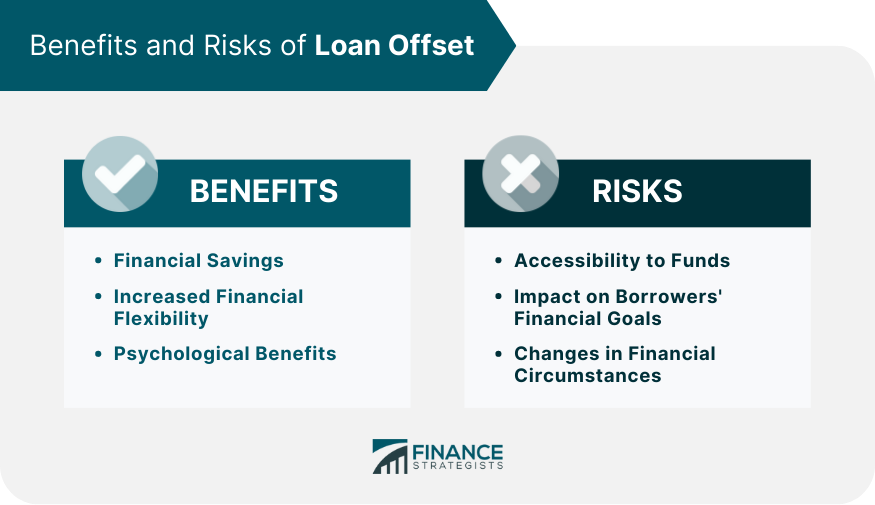

Benefits of Loan Offset

Financial Savings

Increased Financial Flexibility

Psychological Benefits

Potential Risks and Drawbacks of Loan Offset

Accessibility to Funds

Impact on Borrowers' Financial Goals

Changes in Financial Circumstances

The Bottom Line

Loan Offset FAQs

A loan offset account is a separate account linked to a borrower's mortgage or eligible loan. The balance in this account is used to "offset" the principal loan amount, effectively reducing the interest charged on the remaining loan balance. By utilizing a loan offset account, borrowers can save on interest payments and potentially reduce their loan term.

A loan offset strategy can help you save money by reducing the interest paid on your loan. The balance in your offset account reduces the principal amount on which interest is calculated, resulting in lower interest charges. Over the life of the loan, this can lead to significant financial savings.

Loan offset is most commonly associated with mortgages, but it may also be available for other types of loans, such as personal loans or car loans. Eligibility for loan offset depends on the lender and their specific loan products and policies.

The effectiveness of a loan offset strategy is influenced by several factors, including the interest rate on the loan, the balance in the offset account, the consistency of deposits into the offset account, and the loan term. Regular deposits and maintaining a healthy offset account balance are crucial for maximizing the benefits of a loan offset strategy.

While loan offset can provide significant benefits, there are potential risks and drawbacks to consider. Accessibility to funds in the offset account can lead to misuse or overspending, and the opportunity cost of not investing the funds elsewhere should be considered. Additionally, unexpected changes in financial circumstances, such as unemployment or reduced income, can affect a borrower's ability to maintain a healthy offset account balance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.