Life insurance policy loans are loans that are taken out against the cash value of a life insurance policy. When you purchase a permanent life insurance policy, a portion of your premium payments goes towards building up the cash value of the policy. Over time, this cash value can grow, and you may be able to borrow against it through a life insurance policy loan. Policy loans typically offer low interest rates, and the loan amount can be up to the amount of cash value that has accumulated in the policy. The loan must be repaid with interest, and if you do not repay the loan, the outstanding balance will be deducted from the death benefit that your beneficiaries receive when you die. Whole life insurance is a type of permanent life insurance policy that provides coverage for the insured's entire life. These policies build cash value over time, which can be borrowed against through a policy loan. Universal life insurance is another form of permanent life insurance that offers more flexibility than whole-life policies. Policyholders can adjust their premium payments and death benefits, and the policy also accumulates cash value that can be accessed through loans. Indexed universal life insurance is a variation of universal life insurance that ties the policy's cash value growth to a specific market index, such as the S&P 500. Like other permanent life insurance policies, policyholders can take out loans against the accumulated cash value. Variable life insurance policies allow policyholders to invest their cash value in a range of investment options, such as stocks, bonds, and mutual funds. These policies can also be used to secure policy loans. Life insurance policy loans enable policyholders to borrow against the cash value of their policy without having to withdraw the funds. The loan amount is typically limited to a certain percentage of the policy's cash value. Policy loans accrue interest, which is determined by the insurance company. The interest rate may be fixed or variable and is generally lower than that of personal loans or credit cards. Policy loans offer flexible repayment options. Policyholders can choose to repay the loan in full or make partial payments. It is also possible to defer repayment altogether, but any unpaid loan balance and accrued interest will reduce the policy's death benefit. If structured correctly, policy loans can be tax-free, as the loan is not considered income. However, if the policy lapses or is surrendered with an outstanding loan balance, the policyholder may be subject to income taxes on the loan amount. Personal loans are an alternative borrowing option that can be used for various purposes, such as consolidating debt or financing a large purchase. They typically have fixed interest rates and repayment terms. Homeowners can borrow against the equity in their home through home equity loans or lines of credit. These options often offer lower interest rates than personal loans or credit cards but require the borrower's home as collateral. Credit cards can be used for short-term financing needs, but they typically come with high-interest rates and may not be suitable for large expenses or long-term borrowing. Some retirement accounts, such as 401(k) plans and IRAs, allow account holders to borrow against their account balance. However, this option can have significant tax implications and may negatively impact retirement savings. Policy loans do not require a credit check or approval process, making them an attractive option for those with less-than-perfect credit or those who need funds quickly. Repayment terms for policy loans are typically more flexible than other loan options, allowing policyholders to tailor their repayment plans to their individual circumstances. When structured correctly, policy loans can provide tax-free borrowing, offering a financial advantage over other loan options that may be subject to taxes. Policy loans can provide much-needed financial support during emergencies or unexpected expenses, allowing policyholders to avoid withdrawing from their retirement accounts or taking on high-interest debt. An outstanding policy loan balance and accrued interest will reduce the death benefit payable to beneficiaries, potentially leaving them with less financial support than originally intended. If the loan balance and accrued interest exceed the policy's cash value, the policy may lapse, resulting in the loss of coverage and potential tax consequences. Interest on policy loans can accumulate quickly, leading to a larger outstanding loan balance and a reduction in the policy's cash value and death benefit. Taking out a policy loan can slow down the growth of the policy's cash value, as a portion of the cash value is now tied up in the loan. This can reduce the overall financial benefits of the policy in the long term. Before taking out a policy loan, it's important to assess your financial situation and determine whether the loan is necessary and financially beneficial. Consider your income, expenses, and other outstanding debts. Examine your life insurance policy, including its cash value, death benefit, and any restrictions on policy loans. Ensure that you understand the potential consequences of taking out a policy loan, such as a reduced death benefit or policy lapse. Consider the advantages and disadvantages of policy loans in comparison to other borrowing options, such as personal loans or home equity lines of credit. Evaluate the interest rates, repayment terms, and tax implications of each option. Speak with a financial professional, such as a financial planner or insurance agent, to discuss your options and determine whether a life insurance policy loan is the best choice for your financial needs. Life insurance policy loans are a valuable financial tool that allows policyholders to borrow against the cash value of their permanent life insurance policies. By understanding the types of policies that allow loans, how policy loans work, and their advantages and disadvantages, you can make informed decisions about whether they are the right option for your unique financial situation. Additionally, it's essential to explore alternatives to policy loans, such as personal loans, home equity loans, credit cards, or borrowing from retirement accounts. Assessing your financial situation, evaluating your life insurance policy, weighing the pros and cons of each option, and consulting with a financial professional are crucial steps to determining if a life insurance policy loan is the best choice for your financial needs.What Is Life Insurance Policy Loans?

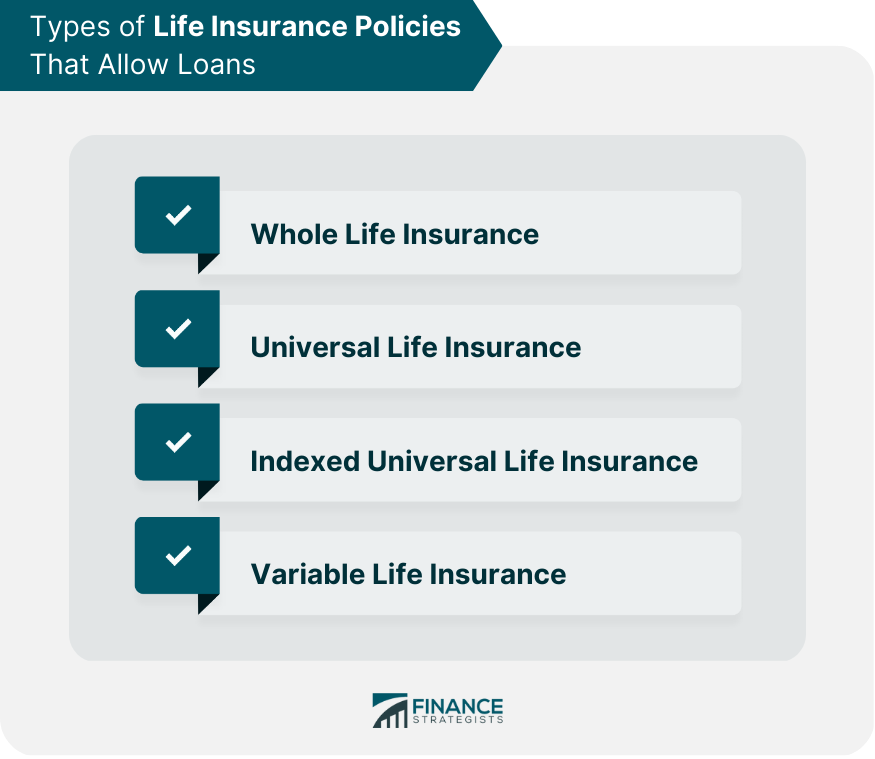

Types of Life Insurance Policies That Allow Loans

Whole Life Insurance

Universal Life Insurance

Indexed Universal Life Insurance

Variable Life Insurance

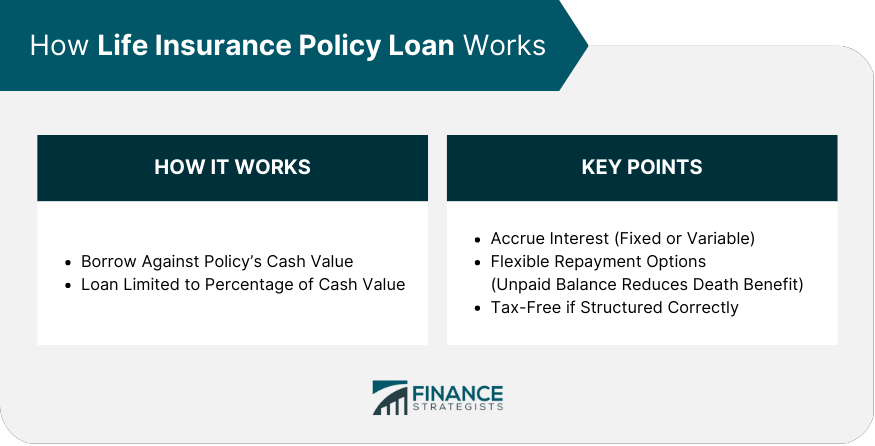

How Life Insurance Policy Loans Work

Borrowing Against the Policy's Cash Value

Interest Rates on Policy Loans

Repayment Options

Tax Implications

Alternatives to Life Insurance Policy Loans

Personal Loans

Home Equity Loans or Lines of Credit

Credit Cards

Borrowing From Retirement Accounts

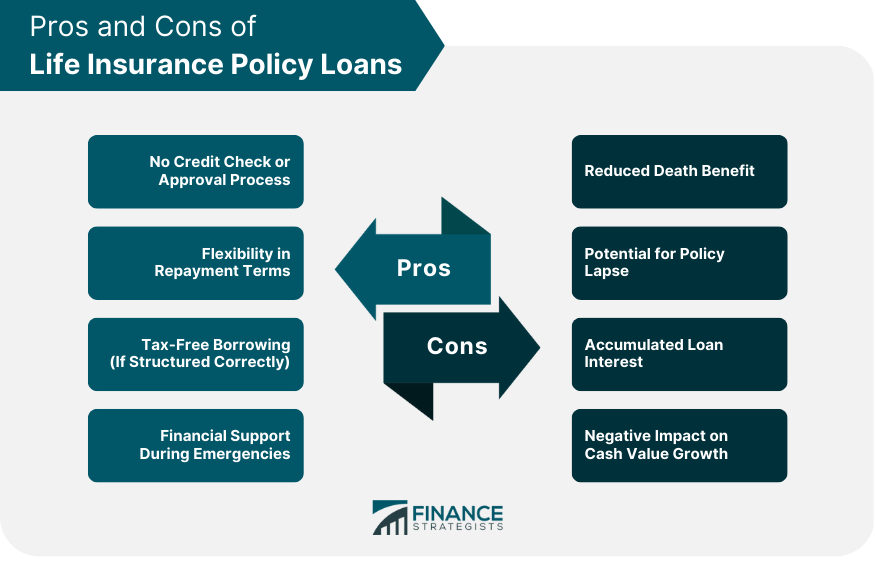

Pros of Life Insurance Policy Loans

No Credit Check or Approval Process

Flexibility in Repayment Terms

Tax-Free Borrowing (If Structured Correctly)

Financial Support During Emergencies

Cons of Life Insurance Policy Loans

Reduced Death Benefit

Potential for Policy Lapse

Accumulated Loan Interest

Negative Impact on Cash Value Growth

How to Decide if a Life Insurance Policy Loan Is Right for You

Assessing Your Financial Situation

Evaluating Your Life Insurance Policy

Weighing the Pros and Cons

Consulting With a Financial Professional

Conclusion

Life Insurance Policy Loans FAQs

Life insurance policy loans are a financial tool that allows policyholders to borrow against the cash value of their permanent life insurance policies, such as whole, universal, indexed universal, or variable life insurance. These loans offer flexible repayment options and do not require credit checks or approval processes. However, they can impact the policy's death benefit and cash value growth.

No, life insurance policy loans are generally available only for permanent life insurance policies, such as whole life, universal life, indexed universal life, and variable life insurance. Term life insurance policies, which do not accumulate cash value, typically do not offer policy loans.

Life insurance policy loans offer several benefits, including no credit checks or approval processes, flexible repayment terms, and tax-free borrowing when structured correctly. They can also provide financial support during emergencies, making them an attractive option for those who need funds quickly or have less-than-perfect credit.

Yes, there are risks involved with life insurance policy loans. These include a reduced death benefit, potential for policy lapse, accumulated loan interest, and negative impact on cash value growth. It's essential to carefully consider these risks and discuss them with a financial professional before taking out a policy loan.

To determine if a life insurance policy loan is suitable for your financial situation, assess your income, expenses, and outstanding debts. Evaluate your life insurance policy, including its cash value, death benefit, and any restrictions on policy loans. Weigh the pros and cons of policy loans compared to other borrowing options and consult with a financial professional to discuss your options and make an informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.