Homebuyer education courses are designed to prepare potential homeowners for the rigors and responsibilities of owning a home. They equip participants with the knowledge needed to navigate the intricate world of mortgages, real estate transactions, and home maintenance. Simply put, these courses are foundational crash courses on everything related to buying a home. From understanding mortgage rates to recognizing the signs of a worthy property, the aim is to empower individuals to make informed decisions during their home-buying journey. For first-time buyers, the home-buying process can be a daunting experience. The real estate landscape is vast and can be intricate. By investing time in homebuyer education, first-time buyers can demystify the process and avoid common pitfalls. It's about more than just buying a house; it's about securing a home, understanding the financial commitments, and ensuring that the purchase leads to long-term satisfaction and stability. This group stands to benefit the most. Buying a home for the first time can be daunting, and an education course can guide them through the intricate steps, ensuring they make informed decisions. The real estate market evolves. Those who bought homes years ago may find current practices and market conditions unfamiliar. A refresher course helps bridge this knowledge gap. If you're contemplating real estate as an investment opportunity, understanding the basics is crucial. The course can provide insight into property valuation, mortgages, and other essential areas. Mortgages can be complicated. From interest rates to loan types, understanding the nuances can save money in the long run. The course sheds light on these complexities, enabling better financial decisions. Negotiating a property deal requires skill. A homebuyer education course can equip attendees with negotiation strategies and insights, ensuring they get the best deal possible. Realtors, brokers, or anyone venturing into the real estate profession can benefit from a foundational understanding. The course lays down essential groundwork for those new to the industry. If you're thinking about refinancing your home or putting it on the market, understanding current trends and financial implications is crucial. The course provides insights to navigate these processes optimally. Before diving into house hunting, it's crucial to assess personal needs and preferences. What size of property are you looking for? Which neighborhoods resonate with your lifestyle? Recognizing these prerequisites sets a direction for the search, ensuring it's focused and effective. Moreover, being prepared in advance facilitates smoother interactions with real estate professionals, making the entire process more efficient. Owning a home is not just about the mortgage payment. There are property taxes, maintenance costs, insurance, and possibly homeowner association fees to consider. It's essential to grasp the full financial picture to avoid unexpected setbacks. By comprehensively understanding these costs, prospective homeowners can create a realistic budget, ensuring long-term financial stability. Securing a pre-approval for a mortgage is a game-changer. It signals to sellers that you're a serious buyer and can afford the home. The process involves lenders reviewing your financial history and determining the loan amount they're willing to offer. This not only gives clarity on the budget but also provides a competitive edge in heated markets where multiple offers are common. With pre-approval in hand and a clear idea of what you're looking for, the actual home shopping can begin. It's a thrilling phase, filled with tours, open houses, and envisioning future life in potential spaces. But, while excitement is natural, it's essential to remain objective, assessing properties not just for their appeal but for their practicality and long-term value. When the perfect house is found, it's time to make an offer. This step requires finesse. Offering too low might offend the seller or be outbid by competitors. Going too high could strain your budget. The key is to balance market research, property valuation, and personal finances to craft a compelling offer. A mortgage isn't one-size-fits-all. There are various types, each with its pros and cons. This phase involves researching and comparing different mortgage products to determine the best fit. Whether it's a fixed-rate, adjustable, or another type, the right mortgage can save thousands over the loan's lifetime. A home inspection is a safeguard. It's an opportunity to thoroughly assess a property, ensuring there are no hidden issues that might cause future headaches. By identifying problems early, buyers can negotiate repairs or adjustments in the purchase price, ensuring they truly get what they pay for. After settling on the right mortgage type and undergoing the rigorous application process, the next step is securing the loan. This involves providing necessary documents, meeting the lender's conditions, and awaiting the final approval. Once approved, it's one step closer to owning the home. The closing process is the final hurdle. It's where all paperwork is signed, fees are paid, and keys are handed over. While it can be lengthy and might feel overwhelming, being prepared and understanding each step can turn this into a straightforward and celebratory experience. The journey to homeownership is complex, but homebuyers aren't alone. Expert assistance, be it real estate agents, mortgage brokers, or attorneys, can provide invaluable insights, ensuring every decision made is informed and in the buyer's best interest. Being prepared can enhance the learning experience. By having financial documents on hand, such as credit reports, pay stubs, or tax returns, participants can better understand personalized scenarios discussed during the course, making the information more relatable and easier to digest. Clarity of purpose drives effective learning. By identifying clear homebuying goals beforehand, participants can focus on the course's relevant sections, maximizing the benefits. Whether it's understanding mortgages better or navigating property negotiations, a clear goal steers the learning journey. Approaching the course with an open mind is essential. Homebuying is a vast topic, and there's always something new to learn. Being open to absorbing information and asking questions when in doubt ensures participants leave with a well-rounded understanding. Homebuyer.com has stepped up to offer a free online course, ensuring that everyone, regardless of financial constraints, can access quality education. This gesture democratizes information, leveling the playing field for all potential homeowners. While some courses are free, many come with fees, typically ranging from $75-$125. These costs often reflect the course's depth, the materials provided, and the expertise of the instructors. It's essential to ensure the fee aligns with the value offered. As mentioned earlier, courses are available in both online and in-person formats. Online courses provide flexibility, while in-person sessions offer a more interactive experience. Depending on convenience, learning style, and budget, prospective homeowners can choose the format that best suits them. Courses certified by the Department of Housing and Urban Development (HUD) have a standard duration of eight hours. These are comprehensive courses designed to cover all aspects of home buying in detail. While HUD-certified courses are set at eight hours, most courses typically fall within the five to eight-hour range. This duration ensures a thorough overview while also respecting the time commitments of participants. For those pressed for time, Homebuyer.com's course is a godsend. Being self-paced, it can be completed in under two hours, making it perfect for those eager to jumpstart their homebuying journey without extensive time commitments. Register once, and you're set. Homebuyer.com’s platform has no expiration on registration, allowing participants to revisit the course whenever they wish. This is especially beneficial as a refresher or if there's a pause in the homebuying process. Flexibility is at the heart of Homebuyer.com's course. Whether you're a fast learner or prefer taking things slow, the platform accommodates all paces, ensuring a comfortable and efficient learning experience. In today's fast-paced world, time is of the essence. Recognizing this, Homebuyer.com offers a course that, while comprehensive, can be completed quickly by those keen on maximizing their time. It's not just about speed; it's about depth. Despite its shorter duration, the course provides a detailed overview of the home buying process, ensuring participants are well-equipped to make informed decisions. Knowledge dispels fear. By understanding the intricacies of homebuying, participants can approach the process with confidence, reducing the anxiety that often comes with such significant decisions. In the digital age, online homebuyer courses have become increasingly popular. They offer flexibility, allowing participants to learn at their pace. However, in-person courses provide direct interaction with instructors, facilitating deeper discussions. Choosing between the two boils down to personal preference and learning style. Ensuring the course is offered by an accredited organization is paramount. Accreditation guarantees the curriculum's quality and that it's up-to-date with current market trends and regulations. Before enrolling, it's advisable to research the institution, check reviews, and verify its accreditation status. Courses vary in length and cost. While some might be free, others might have associated fees. Additionally, course durations can differ, with some being comprehensive multi-day sessions and others condensed into a few hours. Prospective participants should assess their needs and budget to determine the most suitable option. The journey to homeownership, though rewarding, can be filled with complexities. Homebuyer education courses serve as an invaluable tool in this journey, offering clarity and guidance on various aspects of the home buying process, from understanding mortgages to making an offer. Designed for a range of audiences, from first-time homebuyers to real estate professionals, these courses aim to demystify the intricate world of real estate transactions. Homebuyer.com, in particular, emerges as a beacon for prospective homeowners, providing a comprehensive yet flexible learning platform that caters to the fast-paced lives of modern consumers. The ultimate goal of these courses is not just to facilitate property acquisition but to ensure individuals are making decisions that lead to long-term satisfaction, stability, and financial prudence. Investing in education is more than a step; it's a leap toward a brighter, more informed future in homeownership.Understanding Homebuyer Education Courses

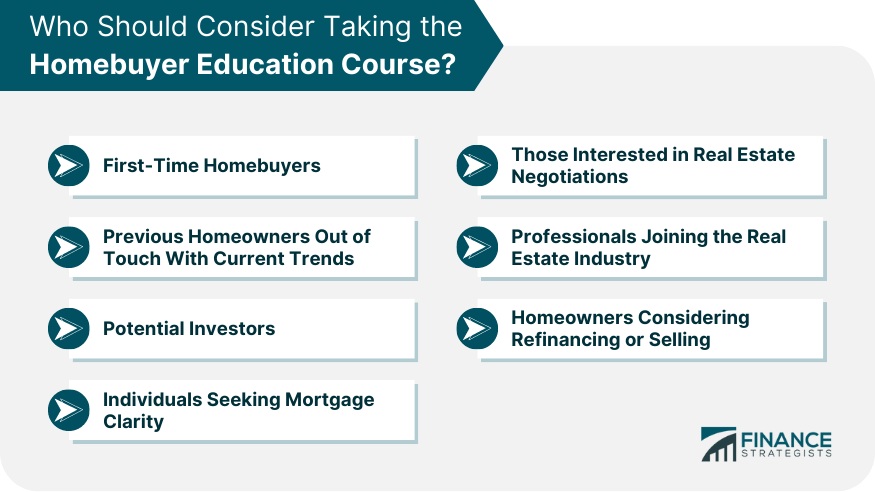

Who Should Consider Taking the Homebuyer Education Course?

First-Time Homebuyers

Previous Homeowners Out of Touch With Current Trends

Potential Investors

Individuals Seeking Mortgage Clarity

Those Interested in Real Estate Negotiations

Professionals Joining the Real Estate Industry

Homeowners Considering Refinancing or Selling

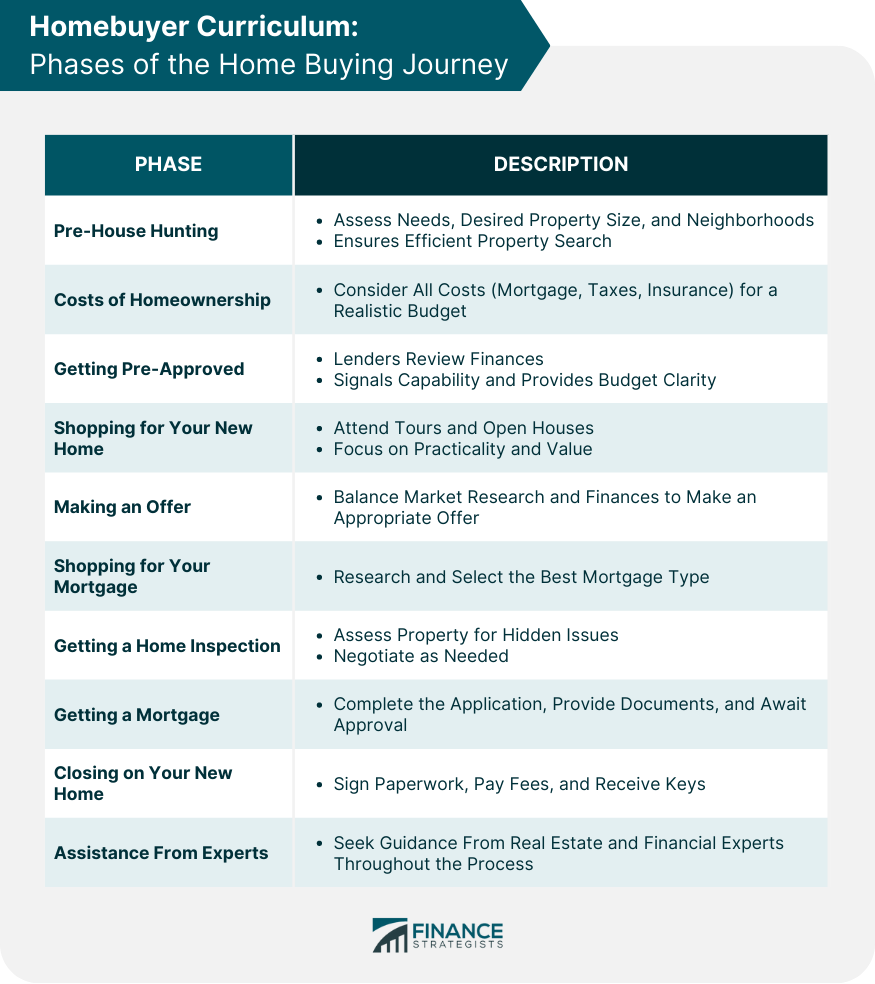

Homebuyer Curriculum: Phases of the Home Buying Journey

Pre-house Hunting

Costs of Homeownership

Getting Pre-approved

Shopping for Your New Home

Making an Offer

Shopping for Your Mortgage

Getting a Home Inspection

Getting a Mortgage

Closing on Your New Home

Assistance From Homebuyer Experts at Every Step

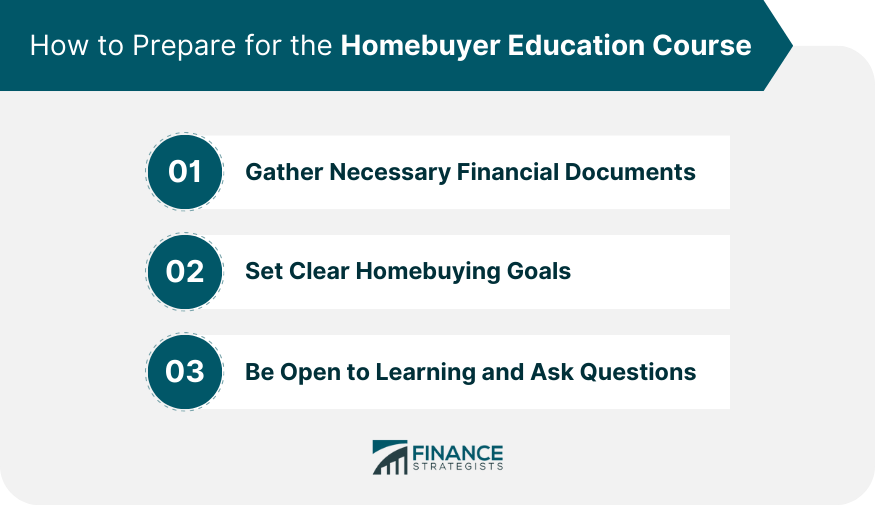

Preparing for the Homebuyer Education Course

Gather Necessary Financial Documents

Set Clear Homebuying Goals

Be Open to Learning and Ask Questions

Costs of Home Buyer Education Classes

Homebuyer.com's Free Online Course

Typical Costs for Other Courses

Available Course Formats

Duration of Home Buyer Education

HUD-Certified Course Duration

Typical Duration of Most Courses

Homebuyer.com's Self-paced Online Course

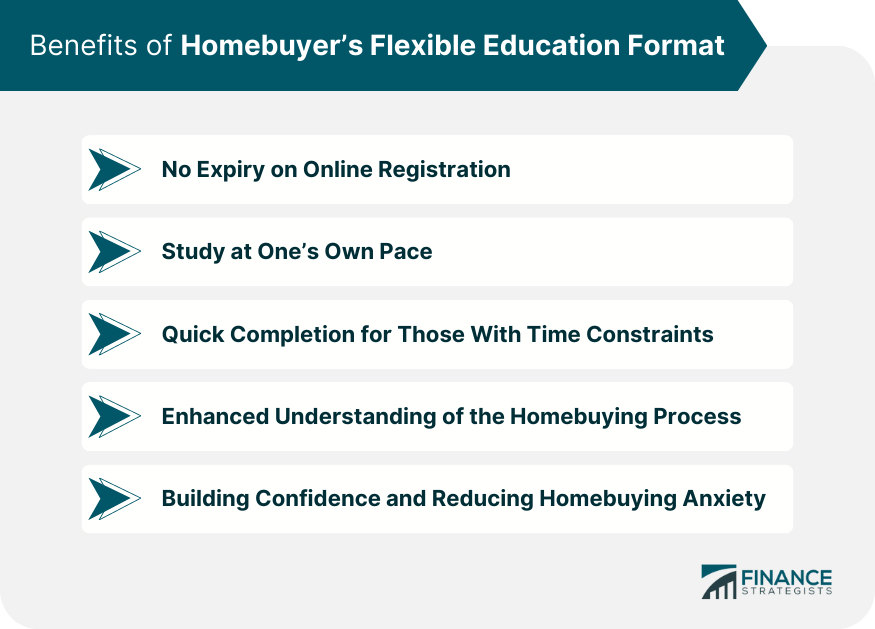

Benefits of Homebuyer’s Flexible Education Format

No Expiry on Online Registration

Study at One’s Own Pace

Quick Completion for Those With Time Constraints

Enhanced Understanding of the Homebuying Process

Building Confidence and Reducing Homebuying Anxiety

Choosing the Right Homebuyer Education Course

Online vs In-Person Courses

Accredited Organizations and Institutions

Duration and Costs Involved

Bottom Line

Homebuyer Education Course FAQs

A homebuyer education course prepares potential homeowners by providing essential knowledge about the entire home buying process.

A HUD-certified homebuyer education class typically lasts eight hours, covering all aspects of homebuying.

Most homebuyer education classes range from $75-$125, although some platforms like Homebuyer.com offer free courses.

Assess your learning style and preferences. Options include online self-paced courses or interactive in-person sessions.

Accredited organizations ensure the quality and relevance of the homebuyer education curriculum, keeping it up-to-date with market trends and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.