High-LTV refinance, at its core, refers to a refinancing option where the new loan has a high Loan-to-Value (LTV) ratio. This implies that a significant portion of the property's value is financed through the loan. For many homeowners, especially those with little equity in their homes, high-LTV refinance offers a route to better loan terms even if traditional refinancing isn’t a fit. Fannie Mae's High-LTV refinance is designed specifically for borrowers like this. Rather than being sidelined due to the potential risk factor a high-LTV can sometimes present, they are given an avenue to potentially better their financial position. Fannie Mae, central to the U.S. mortgage landscape, champions high-LTV refinances. Their dedication to a balanced housing market has spurred this refinance option's growth. Their backing ensures lenders' confidence to serve high-LTV borrowers and guarantees responsible refinancing, benefiting both homeowners and the broader market. One of the standout features of this refinancing option is the ability to transfer mortgage insurance from the original loan to the new one. This can be a game-changer for many borrowers, as it means that they won't have to take out—and pay for—a new mortgage insurance policy when they refinance. Furthermore, for those who might have been considering dropping their insurance, this feature offers a seamless way to maintain coverage, ensuring peace of mind alongside new loan terms. The paperwork can often be the most daunting part of any financial process. Recognizing this, the Fannie Mae High-LTV refinance option simplifies the documentation requirements for employment, income, and assets. Gone are the mountains of paperwork and the intricate documentation checks, replaced by a more streamlined and efficient process. This not only reduces the burden on borrowers but also speeds up the refinancing process, getting homeowners to their new terms faster and with less hassle. Flexibility is key in any financial product, and this refinancing option offers it in spades. Lenders can choose to use the Desktop Underwriter (DU) for a more automated underwriting process or opt for manual underwriting if they believe it's more suitable. This dual option ensures that a broader range of borrowers can be catered to, with lenders having the tools they need to offer the best possible terms tailored to individual circumstances. For homeowners, the choice of servicer can be deeply personal. Some might have developed a rapport with their current servicer, while others might be looking for a fresh start. The Fannie Mae High-LTV refinance option keeps this in mind, allowing borrowers to stick with their current servicer or switch to a new one. This freedom of choice ensures that borrowers remain in control of their refinancing journey, able to make the choices that best fit their unique needs and preferences. The property, as a foundational asset of the refinancing equation, has its own stipulations. Whether a single-family home, a unit in a multi-family complex, or even a condo, the property must meet Fannie Mae’s standards. Additionally, the use of the property, whether owner-occupied, a second home, or an investment, can influence eligibility. It's imperative for borrowers to familiarize themselves with these nuances, ensuring their property aligns with the High-LTV refinancing parameters. The current loan, its history, and its performance play a crucial role in determining eligibility. Typically, the existing loan should be a conventional loan backed by Fannie Mae. Consistent payment history with no recent late payments can strengthen the borrower's position. It's not just about the now; it's about the past too. A borrower’s journey with their existing loan can be as significant as their current LTV ratio. As is evident from its name, the LTV ratio is at the heart of this refinancing option. While the specifics may evolve based on broader economic conditions and Fannie Mae's own guidelines, there usually is an upper limit to the LTV ratio for eligibility. Borrowers should be proactive in determining their current LTV ratio, and how it aligns with Fannie Mae's parameters, ensuring they truly qualify for this refinancing avenue. While both standard and High-LTV refinancing aim to offer better loan terms, their pathways and target audiences differ. Standard refinancing typically caters to those with substantial equity in their homes and who meet conventional LTV thresholds. In contrast, High-LTV refinancing reaches out to those with less equity. The choice between the two isn't just about present circumstances but also about future financial strategies and goals. While Fannie Mae’s DU Refi Plus program may be a relic of the past, understanding its features vis-à-vis the High-LTV Refinance can offer insights. The DU Refi Plus was also designed to help borrowers with high LTV ratios, but its specific terms, advantages, and limitations differed. Even though it's discontinued, knowing its contours can help contextualize the evolution of refinancing options and appreciate the nuances of the present High-LTV refinancing option. Many who delve into the world of refinancing do so with one primary goal: reducing their monthly payments. With the Fannie Mae High-LTV option, this is a tangible benefit. By adjusting the terms of the loan or securing a lower interest rate (or both), borrowers can often lower their monthly principal and interest payments. The ripple effects of this can be profound. Not only does it free up cash flow for other expenses or investments, but it can also provide much-needed financial relief for households under strain. Interest rates: they're the silent force behind every loan, quietly shaping the financial futures of borrowers. The Fannie Mae High-LTV refinance option offers a pathway to potentially lower these rates. In a climate of fluctuating interest rates, locking in a lower rate can lead to significant long-term savings. By reducing the interest rate, even by a fraction, borrowers can save thousands over the life of their loan, making this one of the most enticing benefits of the High-LTV refinance option. For those who dream of being mortgage-free sooner, this refinance option might just be the ticket. It offers borrowers the opportunity to opt for a shorter amortization term. This means that while monthly payments might be higher, the overall loan can be paid off more quickly. Such a choice can be both a financial and psychological boon. Not only can it lead to less interest paid over time, but the thought of owning one's home outright in a shorter span can provide immense peace of mind. The world of mortgages is vast, with products ranging from adjustable-rate mortgages (ARMs) to fixed-rate ones. For those in ARMs, the fluctuating interest rates can be a source of stress. The Fannie Mae High-LTV refinance option allows for a transition from these variable products to more stable, fixed-rate mortgages. The stability of a fixed rate, especially in an era of unpredictability, can be a cornerstone of financial planning, allowing homeowners to plan with greater certainty. A high LTV suggests the borrower has invested less of their own money into the property, making them seem riskier to lenders. As compensation, lenders might charge higher interest rates to these borrowers. Higher LTV borrowers, even when refinancing for favorable terms, might face increased interest rates, leading to higher overall costs in the long run. Refinancing can offer reduced monthly payments but might result in a longer loan term. While monthly payments might decrease, extending the loan duration can lead to more interest paid over the life of the loan. This prolongs the debt period, potentially offsetting short-term financial relief. The broader economic landscape and interest rate fluctuations can influence the benefits of refinancing. While borrowers may chase lower rates today, they should also consider potential rate hikes in the future, especially if considering adjustable-rate products. An ever-changing market can be both a boon and a bane, emphasizing the importance of timing in the refinancing decision. Refinancing isn't a free endeavor. There are closing costs to consider, which can sometimes offset the potential savings from a lower interest rate or shorter loan term. These costs can include application fees, appraisal fees, title searches, and more. It's essential to factor in these expenses when calculating the true benefits of the High-LTV refinancing option. While the High-LTV Refinance option boasts of streamlined documentation, it doesn't mean borrowers are exempt from all paperwork. There are still essential documents to collate, from proof of income to credit reports. Each piece of paperwork serves to paint a comprehensive picture of the borrower's financial standing, ensuring lenders make informed decisions. Patience is often said to be a virtue, and in the world of refinancing, it's a necessity. From the initial application to the final nod of approval, there's a timeline to navigate. While some refinances might be swift, taking just a few weeks, others might extend over a couple of months. This variance is influenced by myriad factors, from the borrower's promptness in submitting documents to the lender's own processing speed. Setting realistic expectations can temper anxiety and pave the way for a smoother refinancing journey. The Fannie Mae High-LTV Refinance Option emerges as a strategic pathway for homeowners, especially those with limited equity, seeking improved loan terms. Central to this proposition is its design to cater to high Loan-to-Value (LTV) ratios, which traditionally pose a perceived risk. Noteworthy features such as transferable mortgage insurance, simplified documentation, and the flexibility of underwriting methods enhance its attractiveness. Borrowers can potentially achieve reduced monthly payments, secure lower interest rates, and even aim for a quicker loan payoff. However, while the advantages are manifold, potential pitfalls like possible higher interest rates, market volatility, and associated closing costs merit consideration. Borrowers need a comprehensive cost-benefit analysis, factoring in both the current and evolving market conditions, to ensure they maximize the benefits of this refinancing avenue.Understanding the Fannie Mae High-LTV Refinance Option

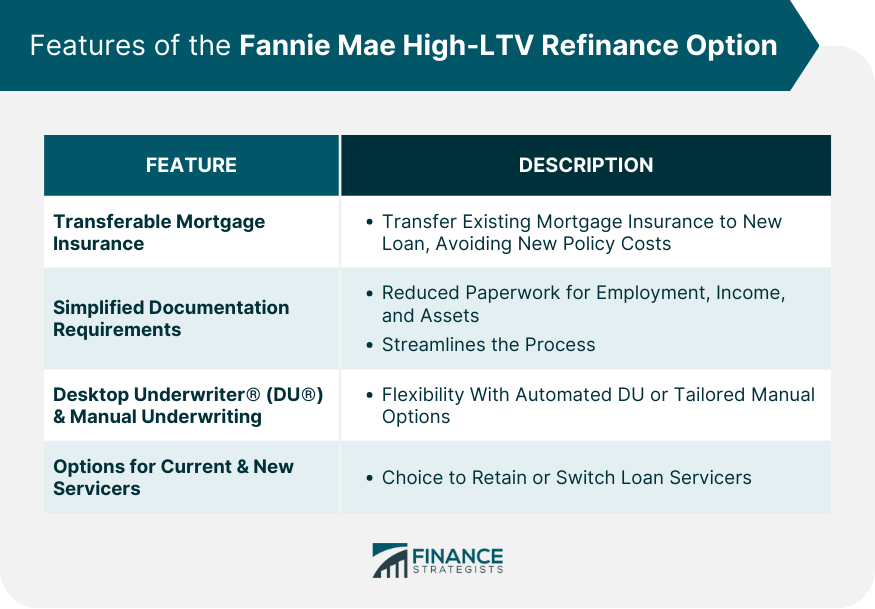

Features of the Fannie Mae High-LTV Refinance Option

Transferable Mortgage Insurance to the New Loan

Simplified Documentation Requirements for Employment, Income, and Assets

Both Desktop Underwriter® (DU®) and Manual Underwriting Options Available

Options Open to Both Current and New Servicers

Eligibility Criteria of Fannie Mae High-LTV Refinance Option

Property Types and Uses

Existing Loan Requirements

LTV Ratio Boundaries and Determination

Fannie Mae High-LTV Comparison With Other Refinance Options

Standard Refinance vs High-LTV Refinance

Fannie Mae's DU Refi Plus Program (Discontinued) vs High-LTV Refinance

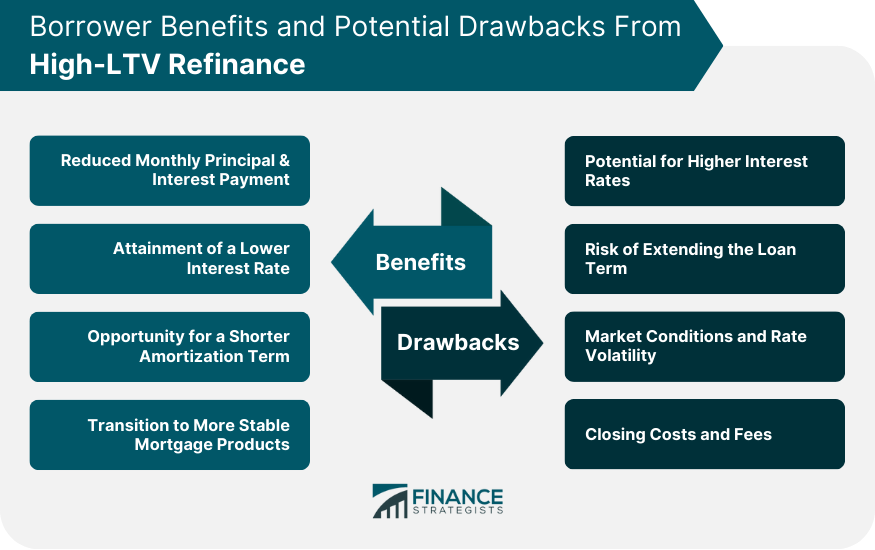

Borrower Benefits From High-LTV Refinance

Reduced Monthly Principal and Interest Payment

Attainment of a Lower Interest Rate

Opportunity for a Shorter Amortization Term

Transition to More Stable Mortgage Products

Potential Drawbacks and Considerations of Fannie Mae High-LTV Refinance Option

Potential for Higher Interest Rates

Risk of Extending the Loan Term

Market Conditions and Rate Volatility

Closing Costs and Fees

Application Process and What to Expect

Documentation and Paperwork

Timeline From Application to Approval

Bottom Line

Fannie Mae High-LTV Refinance Option FAQs

It's a refinancing choice for homeowners with a high Loan-to-Value ratio, offering them better loan terms and potential financial benefits.

This option can reduce monthly payments, offer lower interest rates, enable shorter loan terms, and allow transitions to stable mortgage products.

Yes, criteria include specific property types and uses, existing loan requirements, and certain LTV ratio boundaries.

While both aim to offer better terms, High-LTV is tailored for those with less equity, whereas standard refinancing typically suits those meeting conventional LTV thresholds.

Potential drawbacks include borrower risk factors, market rate volatility, and associated closing costs and fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.