Fannie Mae, also known as the Federal National Mortgage Association, plays a pivotal role in the U.S. housing finance system. Created during the throes of the Great Depression, this government-sponsored enterprise was designed to expand the secondary mortgage market by securitizing mortgages. In doing so, it provides liquidity, stability, and affordability to the U.S. housing market. By purchasing mortgages from banks and other loan originators, Fannie Mae enables these institutions to free up funds, allowing them to offer more mortgages to homebuyers. Over the years, it has helped millions of low- to middle-income Americans secure mortgages and achieve the dream of homeownership. As a cornerstone of the housing market, Fannie Mae continues to facilitate sustainable homeownership and build a stronger housing finance system. Asset depletion income is a methodology employed by lenders to calculate a borrower's income using their liquid assets. This method is particularly useful when the borrower's traditional income is insufficient or irregular, but they hold a significant amount of liquid assets. Asset depletion income thus provides a more complete financial picture, enabling a more inclusive mortgage qualification process. Within the mortgage lending landscape, lenders frequently seek reliable and consistent income. But there are borrowers like retirees or investors who may not receive a regular paycheck, yet possess substantial assets. In such cases, asset depletion income is a valuable tool, enabling these individuals to qualify for loans by spreading out their assets over an extended period. Asset depletion income is of paramount importance in mortgage qualification. It offers a pathway to homeownership, especially for borrowers who lack steady income but have considerable assets. The methodology recognizes the borrower's assets as a potential source of repayment, thus expanding the definition of income for loan qualification and creating more opportunities for homeownership. To calculate asset depletion income for Fannie Mae, you will need to follow these steps: 1. Determine the net documented assets. This is the total amount of eligible assets minus the following: The amount of any penalties that would apply if the assets were distributed early The amount of funds that will be used for down payment, closing costs, and required reserves 2. Divide the net documented assets by the amortization term of the mortgage loan (in months). The resulting amount is the monthly asset depletion income. Here is an example of how to calculate asset depletion income for Fannie Mae: Asset depletion income can play a decisive role in loan qualification. It serves as a lifeline for borrowers with substantial assets but irregular income. By utilizing their assets, these borrowers can qualify for mortgage loans which might have been out of their reach under conventional income calculations. Unlike traditional income sources such as salary or hourly wages, asset depletion income provides a different perspective on a borrower's ability to repay. Traditional income sources reflect current earning power, but asset depletion income focuses on accumulated wealth. This shift provides a broader perspective on financial stability, enhancing the understanding of a borrower's repayment capability. Fannie Mae's guidelines for asset depletion income were established to standardize the procedure. They dictate the types of assets that can be considered, the calculation methods, and how asset depletion income is incorporated into the overall income calculation for mortgage approval. By following these guidelines, lenders can maintain consistency and fairness in the loan approval process. The eligibility criteria for using asset depletion income involve an intricate analysis of the borrower's assets. Eligible assets generally include retirement accounts, investment accounts, and other readily accessible funds. The specific criteria may vary depending on the borrower's circumstances and the policies of the lender, emphasizing the need for a thorough review of each individual case. The utilization of asset depletion income allows borrowers to leverage their accumulated wealth, potentially amplifying their borrowing power. This technique can enable borrowers to qualify for larger loans than those that their regular income might allow. It essentially transforms assets into a viable income source for mortgage qualification. Asset depletion income offers flexibility to borrowers like retirees or investors, who may have irregular or non-traditional income. By taking their total wealth into account, these borrowers can still qualify for loans, reducing the potential barriers to homeownership faced by such individuals. By including asset depletion income in the evaluation, a more holistic representation of a borrower's financial situation is achieved. This methodology extends beyond the narrow view of current earnings to consider accumulated wealth, providing a more accurate reflection of long-term financial stability. This method caters to the needs of non-traditional borrowers. Whether they're self-employed, retired, or living off investments, asset depletion income offers a mechanism to qualify for loans that might be denied by traditional income calculations. One potential drawback of asset depletion income is that loans based on this methodology might carry higher interest rates. As it's a non-traditional form of income, lenders might perceive greater risk and charge more to offset this perceived risk. This could increase the overall cost of borrowing. The use of asset depletion income often necessitates more comprehensive documentation. Borrowers must provide a detailed evidence of their assets, which can involve an extensive amount of paperwork. This requirement might prolong the loan approval process and require a more intensive preparation on the part of the borrower. Another concern is the risk that relying on asset depletion income could lead to financial overextension. Borrowers could deplete their assets faster than anticipated, particularly if they encounter unforeseen expenses. This could potentially cause difficulties in keeping up with mortgage payments over time, putting their homeownership at risk. Fannie Mae's Asset Depletion Income provides an innovative and inclusive avenue for mortgage qualification, especially for borrowers with irregular income but significant assets. It broadens the lens through which financial stability is evaluated, allowing for a more comprehensive representation of a borrower's wealth and long-term financial stability. Despite the potential challenges, such as higher interest rates and increased documentation, the method can be a lifeline for many prospective homeowners. It is crucial, however, for borrowers to understand the implications fully, balancing the immediate benefit of loan qualification against the potential risks associated with asset depletion. In the evolving landscape of mortgage lending, approaches like Asset Depletion Income highlight the industry's commitment to inclusivity, adaptability, and financial empowerment.Overview of Fannie Mae

Understanding Fannie Mae Asset Depletion Income

Initial Definition of Asset Depletion Income

Importance of Asset Depletion Income in Mortgage Qualification

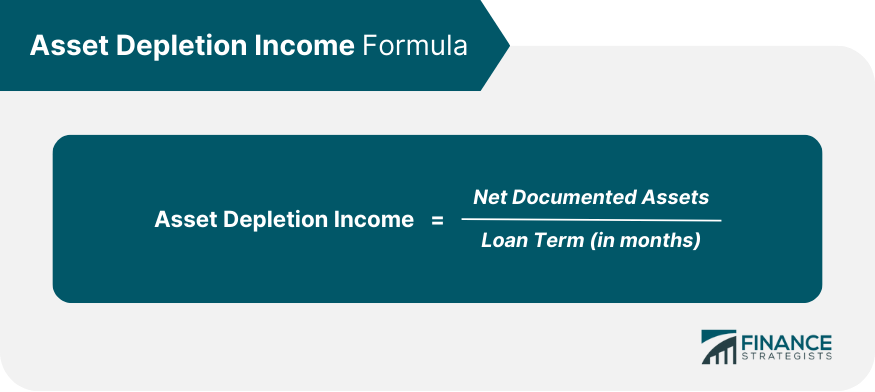

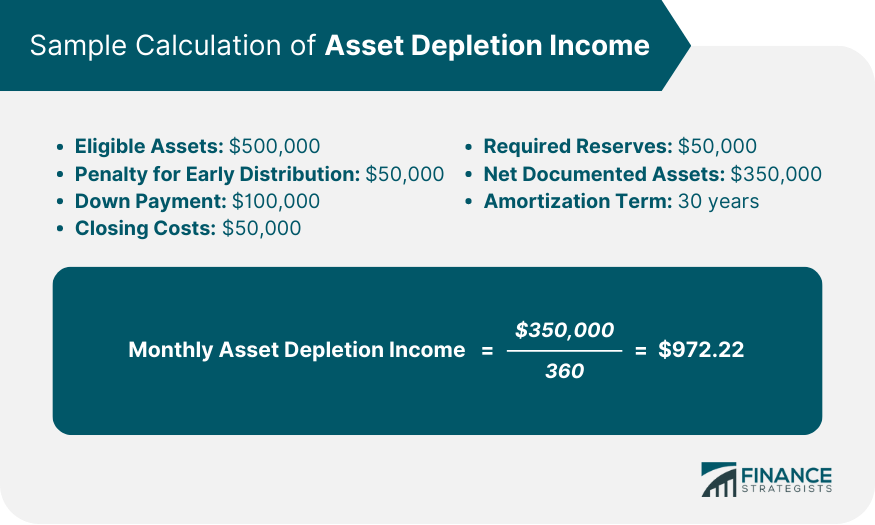

Calculating Asset Depletion Income

Steps to Calculate Asset Depletion Income

Fannie Mae Asset Depletion Income and Loan Eligibility

Role of Asset Depletion Income in Loan Qualification

Comparison to Other Income Types in Loan Qualification

Fannie Mae's Guidelines for Asset Depletion Income

Detailed Description of Guidelines

Discussion on Eligibility Criteria

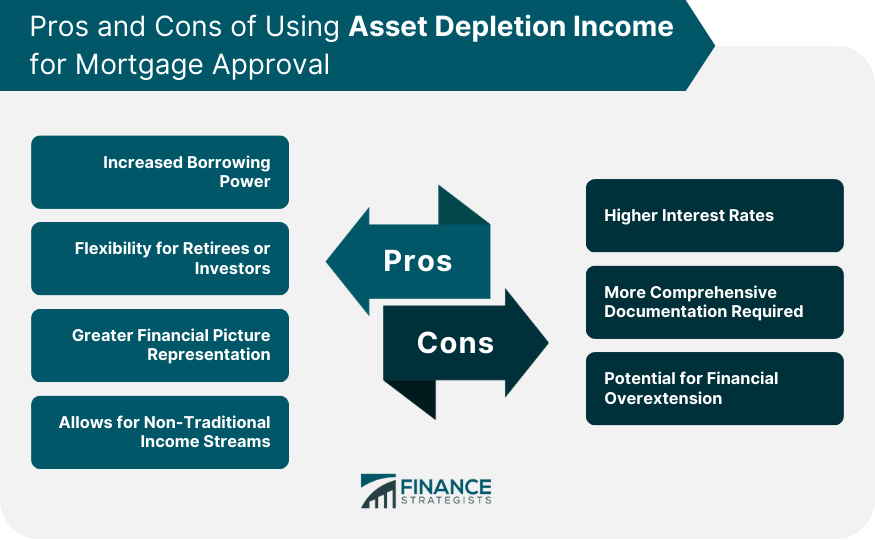

Pros of Using Asset Depletion Income for Mortgage Approval

Increased Borrowing Power

Flexibility for Retirees or Investors

Greater Financial Picture Representation

Allows for Non-Traditional Income Streams

Cons of Using Asset Depletion Income for Mortgage Approval

Higher Interest Rates

More Comprehensive Documentation Required

Potential for Financial Overextension

Bottom Line

Fannie Mae Asset Depletion Income FAQs

Asset depletion income is a method lenders use to calculate a borrower's income based on their liquid assets.

It's calculated by totaling a borrower's eligible assets, subtracting any funds needed for closing costs or reserves, and dividing the remainder by the loan term.

It allows borrowers with substantial assets but irregular income to qualify for mortgage loans by considering their accumulated wealth.

It can increase borrowing power, offer flexibility to retirees or investors, present a broader financial picture, and accommodate non-traditional income streams.

It may result in higher interest rates, require more extensive documentation, and potentially lead to financial overextension.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.