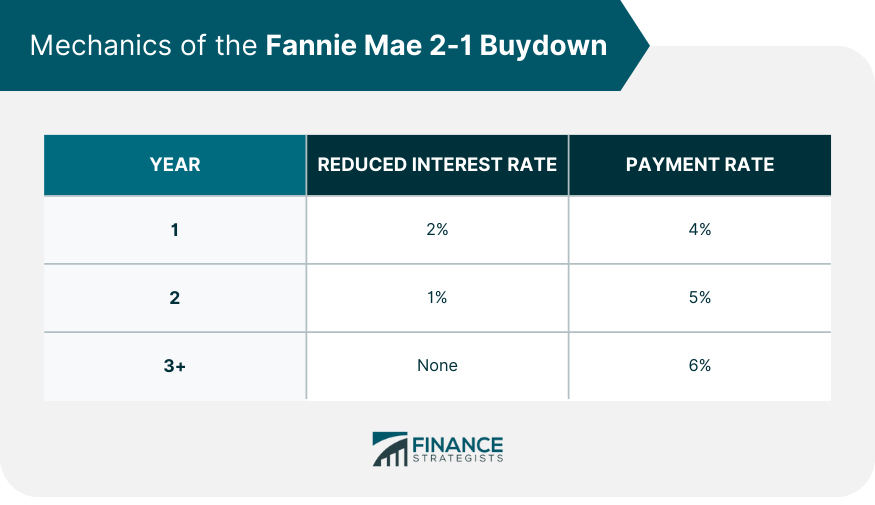

The Fannie Mae 2-1 Buydown is a specialized mortgage loan program designed to offer borrowers temporary financial relief in the initial stages of their loan. The structure of this buydown reduces the loan's interest rate by 2% below the permanent rate in the first year and 1% below in the second year. By the third year, the interest rate adjusts to the agreed-upon permanent or prevailing rate. The primary purpose of the 2-1 Buydown is to make homeownership more accessible and affordable in the early years, particularly for those who anticipate a rise in their income in the near future. By providing this financial cushion, the 2-1 Buydown allows borrowers to transition more smoothly into regular payments, minimizing the shock of adjusting to standard mortgage rates. The 2-1 Buydown begins with a 2% reduction in the first year. For instance, if the permanent rate is 6%, the borrower would pay at a 4% rate in year one. This significant drop can translate into substantial savings in the early stages of the mortgage. In the second year, the rate reduction lessens to 1% below the permanent rate. Building on our earlier example, with a 6% permanent rate, the borrower would be obligated to a 5% rate in year two. By the third year, the interest rate reverts to the agreed-upon permanent rate. At this juncture, the borrower must be prepared for the jump in monthly payments. Proper financial planning can ensure a smooth transition. To illustrate, if a borrower has a $300,000 loan at a permanent rate of 6%, using the 2-1 Buydown, the first-year payments would be based on a 4% rate, the second year at 5%, and subsequent years at 6%. The immediate benefit of the 2-1 Buydown is the alleviation of financial pressure, making it attractive for young professionals or those awaiting a foreseeable rise in income. The initial lower payments could mean qualification for a larger loan amount, allowing borrowers to invest in properties they might not afford under traditional mortgage terms. A borrower can leverage the initially lower rates by considering refinancing options as the permanent rate nears, potentially locking in more favorable terms. Incorporating a 2-1 Buydown option significantly enhances a property's appeal. Particularly in a market crowded with numerous property listings, differentiating offerings become paramount. A 2-1 Buydown not only catches the attention of potential buyers but also communicates a sense of flexibility and understanding of their immediate financial needs. Such features often foster trust, making buyers more inclined to finalize the purchase. Economic downturns or slow real estate markets can challenge even the most seasoned sellers. Introducing a 2-1 Buydown during such times can be a game-changer. It serves as a unique selling point, drawing in those buyers who are hesitant due to the uncertain economic landscape. The short-term financial relief provided by this buydown may be the motivation a potential buyer needs to commit, thereby accelerating sales even when the market is slow. The progressive nature of the 2-1 Buydown—where interest rates rise incrementally—offers a more digestible adjustment for borrowers. This ensures they aren't caught off-guard by sudden payment spikes. As a result, borrowers are more likely to stay consistent with their repayments. For lenders, this means a reduced risk of loan defaults, ensuring a more predictable and secure return on their investment. Furthermore, the trust built through such borrower-friendly strategies often results in positive referrals, expanding the lender's customer base. Possibility of Borrower Default After Rate Resets: While staged increases mitigate payment shock, some borrowers might still struggle with the transition, potentially leading to defaults. Market Volatility and Future Rate Predictions: Borrowers need to remain cognizant of market conditions. If rates plummet, they might end up paying more than necessary. Restrictions and Terms to Be Aware Of: Certain conditions apply to 2-1 Buydowns. For instance, some require the borrower to live in the property, preventing property flipping. Fixed-rate mortgages present a stark contrast to the 2-1 Buydown by maintaining a constant interest rate throughout the duration of the loan. This consistency allows borrowers to predict monthly payments with certainty, eliminating the need to budget for fluctuations. However, while this option offers peace of mind and long-term financial stability, it might not provide the initial savings seen with a 2-1 Buydown. Borrowers looking for an uninterrupted, predictable mortgage plan often lean towards fixed-rate options. Adjustable-Rate Mortgages (ARMs), as the name suggests, come with interest rates that adjust according to market dynamics. Initially, they might present more attractive rates compared to fixed-rate mortgages, leading to lower initial payments. However, the uncertainty associated with ARMs means that borrowers could face significantly higher payments in the future if market interest rates rise. The allure of ARMs lies in potential short-term savings, but they require borrowers to be comfortable with a degree of unpredictability. The 2-1 Buydown is just one configuration in the spectrum of buydown options available to borrowers. Alternatives like the 3-2-1 structure provide three years of stepped rate reductions, whereas a 1-0 Buydown offers a single year of reduced rates. The choice among these variations hinges on a borrower's financial trajectory and how long they desire reduced rates before transitioning to the permanent rate. Evaluating individual circumstances and future income prospects can guide borrowers in selecting the most suitable buydown structure. Upfront Costs for the Buydown: While the 2-1 Buydown offers savings, there's an upfront fee. It's vital to balance these costs against future savings. Who Typically Pays? (Seller, Builder, or Buyer): Traditionally, sellers or builders might offer the buydown as an incentive. However, buyers can opt for it, too, weighing the initial outlay against future benefits. Implications on Loan-To-Value (LTV) and Equity: A 2-1 Buydown can affect a property's LTV ratio and, consequently, equity. Borrowers should discuss the implications with their lenders. The Fannie Mae 2-1 Buydown stands out as a distinctive mortgage solution, offering borrowers a temporary respite with reduced interest rates in the initial two years of their loan. This program is particularly tailored for those who foresee a growth in their income, allowing a smoother transition to regular payments. While it offers immediate financial benefits, especially in a competitive market, and the possibility to qualify for bigger loans, it's essential to understand its mechanics and implications fully. It contrasts significantly with other mortgage options like fixed-rate mortgages, which offer long-term rate stability, and ARMs, which carry inherent unpredictability. Like any financial instrument, the 2-1 Buydown comes with its set of pros and cons, and understanding them in the context of individual financial scenarios is crucial. As with all mortgage choices, due diligence, and tailored financial advice are paramount to making the right decision.What Is the Fannie Mae 2-1 Buydown?

Mechanics of the Fannie Mae 2-1 Buydown

Initial Reduced Interest Rate: "2" in 2-1

Second-Year Adjustment: "1" in 2-1

Transitioning to Permanent Interest Rate After Two Years

Payment Calculations and Examples

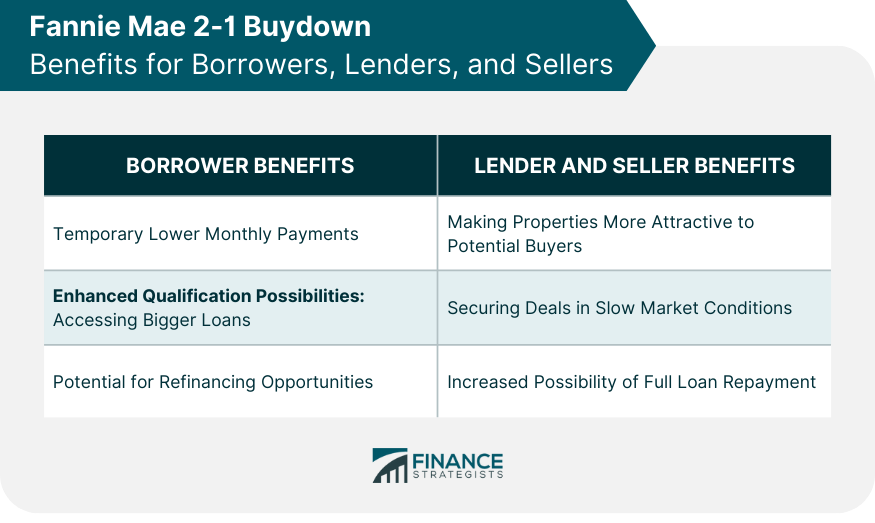

Fannie Mae 2-1 Buydown Benefits for Borrowers

Temporary Lower Monthly Payments

Enhanced Qualification Possibilities: Accessing Bigger Loans

Potential for Refinancing Opportunities

Fannie Mae 2-1 Buydown Benefits for Lenders and Sellers

Making Properties More Attractive to Potential Buyers

Securing Deals in Slow Market Conditions

Increased Possibility of Full Loan Repayment Due to Gradual Rate Increases

Potential Drawbacks and Risks of the Fannie Mae 2-1 Buydown

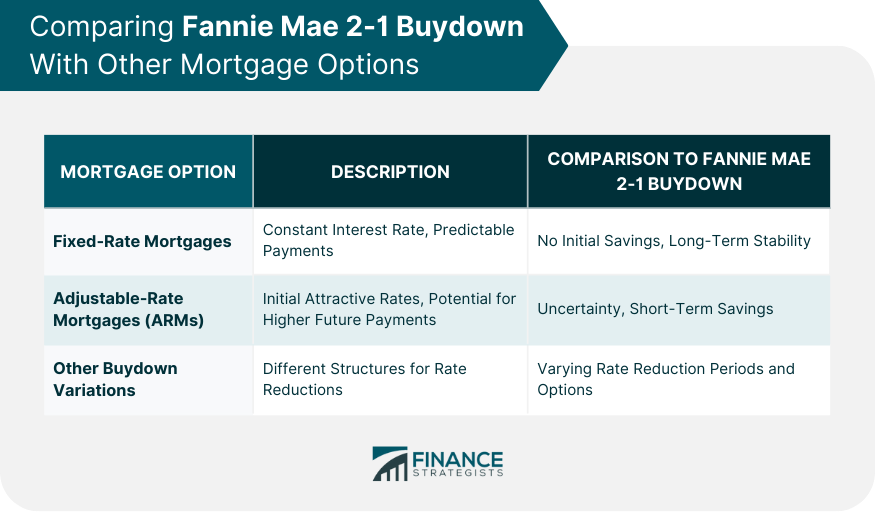

Comparing the Fannie Mae 2-1 Buydown With Other Mortgage Options

Fixed-Rate Mortgages

Adjustable-Rate Mortgages (ARMs)

Other Buydown Variations and Structures

Fannie Mae 2-1 Buydown Cost Implications and Financing

Bottom Line

Fannie Mae 2-1 Buydown FAQs

A Fannie Mae 2-1 Buydown is a mortgage loan program that offers a temporary interest rate reduction for the first two years. The interest rate is 2% below the permanent rate in the first year and 1% below in the second year. From the third year onward, the rate adjusts to the permanent or prevailing rate.

While a fixed-rate mortgage lock in a specific interest rate for the duration of the loan, a 2-1 Buydown offers a temporarily reduced rate for the initial two years, which then adjusts to the permanent rate from the third year onwards.

The upfront costs of a 2-1 Buydown can be paid by sellers or builders as an incentive to entice buyers. However, buyers can also choose to pay for the buydown, weighing the initial fee against potential future savings.

Yes, one of the primary risks for borrowers is the possibility of defaulting after the rate resets to the permanent rate. Furthermore, market volatility might result in borrowers paying more if overall interest rates drop during the loan's term.

Yes, there are other buydown variations, such as the 3-2-1 or 1-0 structures. Each offers different rate reductions and is tailored to specific borrower needs and market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.