Weekly premium insurance is a type of insurance policy where the policyholder pays the premium on a weekly basis. This can be applied to various types of insurance, such as life, health, auto, and home insurance. Integrating weekly premium insurance into financial planning helps individuals maintain a more manageable budget. By paying insurance premiums weekly, policyholders can distribute their insurance costs over smaller, more frequent payments. This approach can make insurance more accessible for individuals with tight budgets or irregular income streams. Term life insurance provides coverage for a specified period, usually between 10 and 30 years. If the policyholder passes away during the term, the insurer pays out a death benefit to the beneficiaries. Weekly premium term life insurance allows policyholders to pay smaller premiums more frequently, making it more budget-friendly. Whole life insurance offers lifetime coverage, and it includes a cash value component that can be borrowed against or withdrawn. Weekly premium whole life insurance enables policyholders to maintain their coverage while managing their cash flow effectively. Individual and family health insurance plans are designed to cover medical expenses for the policyholder and their dependents. Weekly premium health insurance policies offer flexibility in premium payments, making it more manageable for individuals and families to maintain their coverage. Group health insurance plans are provided by employers to their employees as a benefit. Weekly premium group plans can help employees manage their insurance costs more efficiently, particularly if they are contributing to the premium payments. Liability auto insurance covers bodily injury and property damage caused by the policyholder in an accident. Weekly premium liability coverage allows policyholders to manage their auto insurance costs more effectively by breaking down payments into smaller, more frequent amounts. Comprehensive and collision auto insurance cover damages to the policyholder's vehicle resulting from various events, such as accidents, theft, or natural disasters. Weekly premium comprehensive and collision coverage provides policyholders with increased affordability and flexibility in managing their insurance expenses. Home insurance policies typically include building and contents coverage to protect against damages or losses to the physical structure and personal belongings within the home. Weekly premium home insurance offers policyholders the opportunity to manage their insurance costs more effectively by paying smaller, more frequent premiums. Additional living expenses coverage provides financial assistance for policyholders if they are temporarily displaced from their home due to a covered event, such as a fire or natural disaster. Weekly premium additional living expenses coverage allows policyholders to maintain this essential protection while managing their budget more effectively. The age of the policyholder plays a significant role in determining insurance rates. Generally, younger individuals are considered lower risk and will receive lower premiums, while older individuals may face higher premiums due to increased risk factors. Gender can also influence insurance premiums. For example, men may pay higher auto insurance premiums due to statistical data showing they are involved in more accidents than women. Similarly, women may pay higher premiums for life insurance due to their longer life expectancy. Certain occupations may be considered higher risk, leading to increased insurance premiums. For example, individuals working in high-risk professions, such as construction or mining, may face higher life or health insurance premiums. A policyholder's health history plays a critical role in determining premiums for life and health insurance. Individuals with pre-existing conditions or a history of chronic illnesses may face higher premiums due to increased risk factors. The duration of the insurance policy can impact premium rates. Longer policy terms may result in higher overall costs, while shorter terms may offer lower premiums but provide less coverage. The amount of coverage selected by the policyholder will influence premium rates. Higher coverage amounts typically result in higher premiums, while lower coverage amounts may offer more affordable rates but less financial protection. A deductible is the amount the policyholder must pay out-of-pocket before the insurance company begins to cover costs. Higher deductibles can lead to lower premium rates, while lower deductibles may result in higher premiums. Policyholders can customize their insurance policies by adding riders, which are additional benefits or coverage options. Adding riders to a policy may increase premium rates, depending on the specific rider selected. Insurance companies often use credit scores as a predictor of risk, with individuals with higher credit scores considered lower risk and eligible for lower premiums. Conversely, those with lower credit scores may face higher premiums due to increased risk factors. A policyholder's claims history can significantly impact their insurance premiums. Individuals with a history of frequent claims may be considered at higher risk, leading to increased premiums. The policyholder's location can also influence insurance premiums. Factors such as local crime rates, natural disaster risks, and regional medical costs can all impact insurance rates. Weekly premium insurance policies offer several benefits to policyholders, making them an attractive option for individuals looking to manage their insurance costs more effectively. Some key advantages of weekly premium insurance policies include: By breaking down insurance premiums into smaller, more frequent payments, weekly premium insurance policies make it easier for individuals to afford essential insurance coverage. This increased affordability is particularly beneficial for those on tight budgets or with irregular income streams, as it allows them to maintain coverage without overextending their finances. Weekly premium insurance policies help policyholders manage their budgets more effectively by distributing insurance costs over smaller, predictable amounts. By paying premiums on a weekly basis, policyholders can better track their expenses and ensure they have sufficient funds allocated to cover their insurance costs. This improved budgeting can help prevent lapses in coverage due to missed payments and provide policyholders with greater financial stability. One of the primary benefits of weekly premium insurance policies is the enhanced flexibility they offer policyholders. With weekly payments, policyholders can adjust their payment schedules to suit their changing financial circumstances, such as temporary income fluctuations or unexpected expenses. This flexibility allows policyholders to maintain their insurance coverage even during periods of financial uncertainty, providing them with ongoing protection and peace of mind. Weekly premium insurance policies can also simplify payment management for policyholders. By making smaller, more frequent payments, policyholders may find it easier to stay on top of their insurance obligations and avoid missed payments. This can lead to a more positive relationship with the insurance provider, as well as a potentially better claims experience and lower premiums in the future. Lastly, weekly premium insurance policies often provide opportunities for customization, allowing policyholders to tailor their coverage to suit their specific needs and preferences. This may include adjusting coverage amounts, adding riders, or choosing between different types of insurance policies, such as term life, whole life, or various health, auto, and home insurance options. By offering increased flexibility and customization options, weekly premium insurance policies enable policyholders to create insurance plans that best align with their unique requirements and financial goals. Before selecting a weekly premium insurance policy, it is essential for individuals to assess their personal needs and budget. This assessment will help policyholders identify the most suitable coverage options and premium payment schedules. To find the best weekly premium insurance policy, policyholders should compare quotes from multiple insurance companies. This process will help them identify the most affordable and comprehensive coverage options available. Policyholders should research the financial strength and reputation of potential insurance providers. An insurer's financial stability is crucial in ensuring they can meet their obligations to policyholders, while a strong reputation indicates a history of reliable service and support. It is essential for policyholders to thoroughly review and understand the terms and conditions of their insurance policies. This understanding will help ensure they are aware of their coverage limits, exclusions, and any additional fees or charges associated with their policies. Policyholders should consider any additional benefits or riders that may enhance their coverage and provide added financial protection. These add-ons can help customize policies to better suit the specific needs of the policyholder. A healthy lifestyle can help lower insurance premiums, particularly for life and health insurance policies. Regular exercise, a balanced diet, and avoiding tobacco use can all contribute to improved health and reduced risk factors. A higher credit score can lead to lower insurance premiums, as it indicates lower risk to insurers. Policyholders can improve their credit scores by paying bills on time, reducing debt, and periodically checking their credit reports for errors. Many insurance companies offer discounts for bundling multiple insurance policies, such as auto, home, and life insurance. By combining these policies under a single insurer, policyholders can potentially save on their overall insurance costs. Choosing a higher deductible can lead to lower premium rates. However, policyholders should ensure they can afford the higher out-of-pocket costs associated with increased deductibles in the event of a claim. Policyholders should inquire about available discounts and promotions from their insurance providers. Examples of potential discounts include good driver discounts for auto insurance, non-smoker discounts for life insurance, and multi-policy discounts for bundling policies. Filing an insurance claim with a weekly premium insurance policy typically involves a series of steps to ensure a smooth and efficient process. The following steps outline the general process for filing a claim: As soon as an incident or loss occurs, policyholders should contact their insurance company to report the event. Prompt reporting is essential, as delays may impact the claim's approval and processing. When notifying the insurer, be prepared to provide basic information about the incident, such as the date, location, and a brief description of what occurred. Policyholders must gather and submit all required documentation to support their claims. This may include police reports (for theft, vandalism, or accidents), medical records and bills (for health-related claims), repair estimates (for property damage claims), or any other documentation relevant to the specific claim. Providing comprehensive documentation will help expedite the claim process and increase the likelihood of a favorable outcome. The insurance company will typically provide claim forms that policyholders must complete and submit. These forms may require detailed information about the incident, any parties involved, and the extent of the loss or damage. It is essential to fill out these forms accurately and completely, as inaccuracies or omissions can lead to delays or denial of the claim. In some cases, the insurance company may conduct an investigation to verify the validity of the claim. This process may involve interviews with the policyholder, witnesses, or other relevant parties, as well as an examination of the damage or loss. Policyholders should cooperate fully with the insurer's investigation by providing any requested information, making themselves available for interviews, and facilitating access to any relevant documents or evidence. After submitting all required documentation and cooperating with the insurer's investigation, policyholders must wait for the insurance company to review the claim and make a decision regarding approval or denial. The timeline for this process may vary depending on the complexity of the claim and the insurer's internal processes. Policyholders should maintain regular communication with their insurers to stay informed about the status of their claims and address any questions or concerns that may arise. The specific documentation required for an insurance claim will depend on the type of policy and the nature of the incident. Common documents required for insurance claims include: Police report (for auto or home insurance claims involving theft or vandalism) Medical records and bills (for health or life insurance claims) Repair estimates (for auto or home insurance claims involving property damage) Photos or videos of the incident or damage (for auto or home insurance claims) If an insurance claim is approved, the insurer will typically issue a payout to the policyholder or directly to the service provider (such as a repair shop or medical facility). The specific payout process and timeline will depend on the insurer and the nature of the claim. If a policyholder's insurance claim is denied, they have the right to appeal the decision. The appeals process may involve submitting additional documentation, providing further evidence, or requesting a review by an independent third party. Policyholders should familiarize themselves with their insurer's appeals process and follow the required steps to seek a fair resolution. Weekly premium insurance refers to insurance policies where the policyholder pays the premium on a weekly basis. These policies offer increased affordability, flexibility, and budgeting capabilities, making it easier for individuals to maintain essential insurance coverage. Weekly premium insurance can be applied to various types of insurance, including life, health, auto, and home insurance. Each type of insurance offers different coverage options and benefits that cater to the specific needs of policyholders. Weekly insurance premium rates are influenced by factors including personal information (age, gender, occupation, and health history), coverage details (policy term, coverage amount, deductibles, and riders), and risk factors (credit score, claims history, and location). Understanding these factors can help policyholders make informed decisions about their insurance policies. When choosing a weekly premium insurance policy, individuals should consider their needs, compare quotes, assess insurer reliability, understand terms, and evaluate add-ons. By carefully evaluating these factors, policyholders can choose the most suitable policy that meets their needs and financial circumstances.What Is Weekly Premium Insurance?

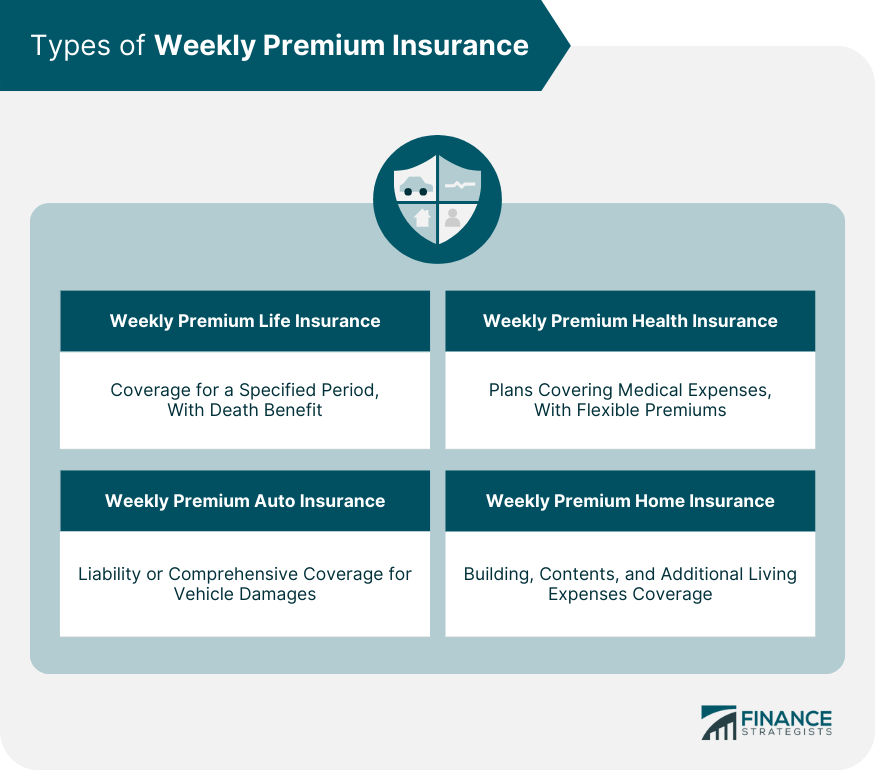

Types of Weekly Premium Insurance

Weekly Premium Life Insurance

Term Life Insurance

Whole Life Insurance

Weekly Premium Health Insurance

Individual and Family Plans

Group Plans

Weekly Premium Auto Insurance

Liability Coverage

Comprehensive and Collision Coverage

Weekly Premium Home Insurance

Building and Contents Coverage

Additional Living Expenses Coverage

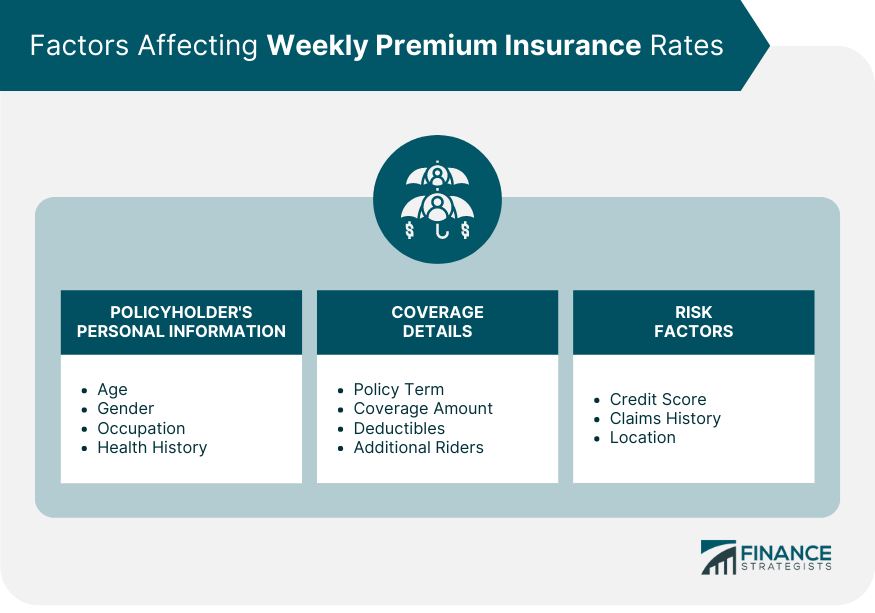

Factors Affecting Weekly Premium Insurance Rates

Policyholder's Personal Information

Age

Gender

Occupation

Health History

Coverage Details

Policy Term

Coverage Amount

Deductibles

Additional Riders

Risk Factors

Credit Score

Claims History

Location

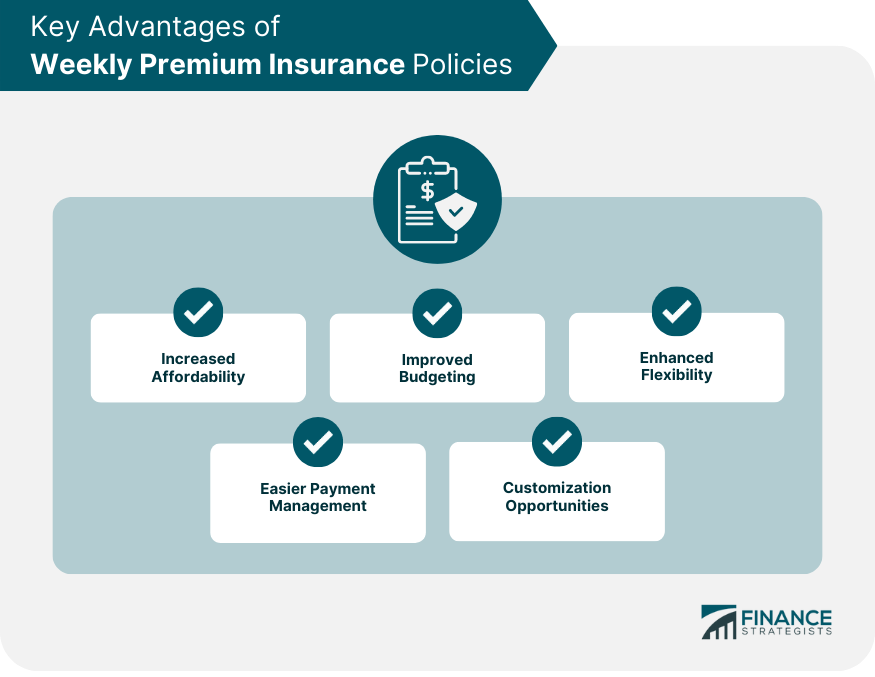

Key Advantages of Weekly Premium Insurance Policies

Increased Affordability

Improved Budgeting

Enhanced Flexibility

Easier Payment Management

Customization Opportunities

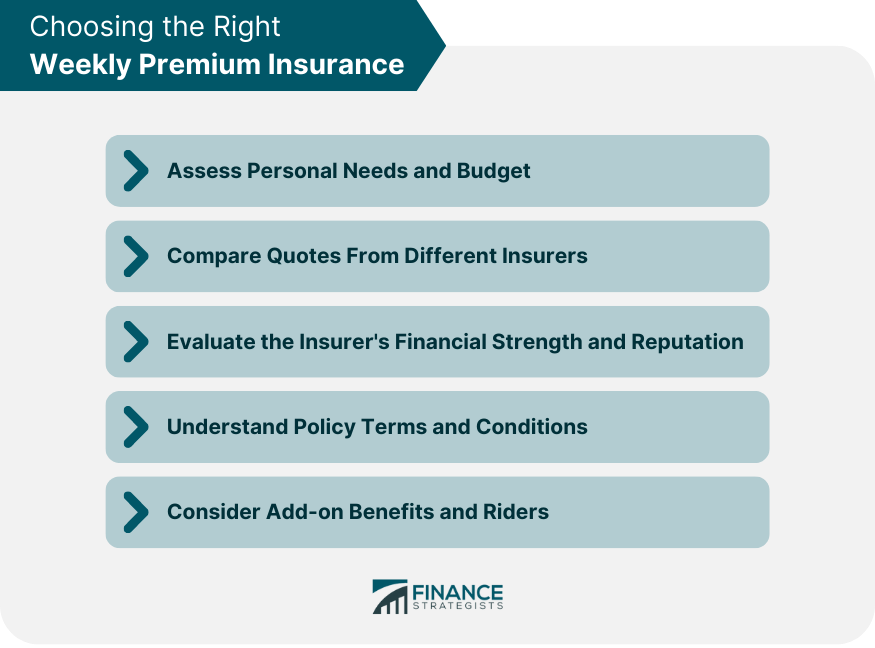

Choosing the Right Weekly Premium Insurance

Assessing Personal Needs and Budget

Comparing Quotes from Different Insurers

Evaluating the Insurer's Financial Strength and Reputation

Understanding Policy Terms and Conditions

Considering Add-on Benefits and Riders

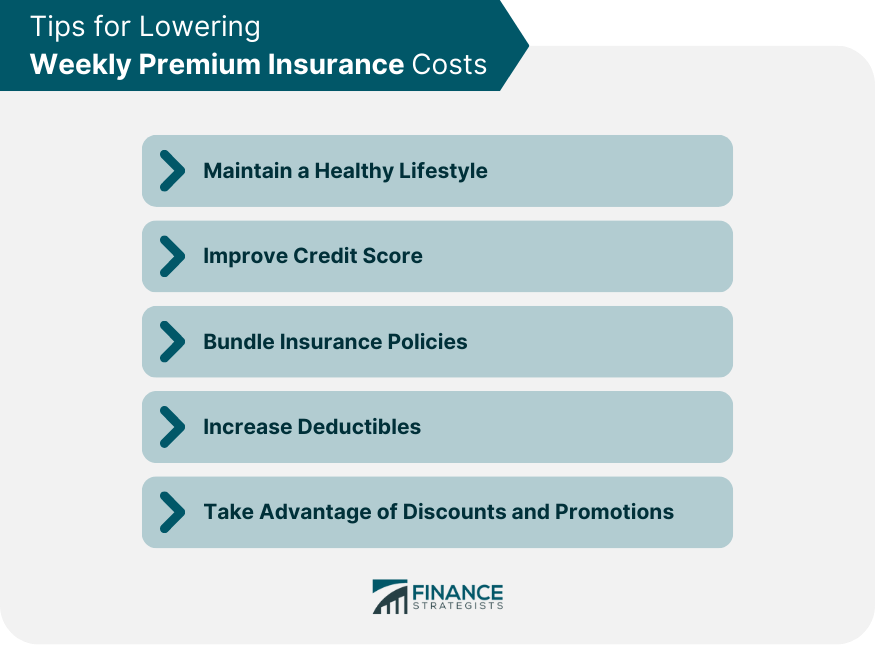

Tips for Lowering Weekly Premium Insurance Costs

Maintaining a Healthy Lifestyle

Improving Credit Score

Bundling Insurance Policies

Increasing Deductibles

Taking Advantage of Discounts and Promotions

Claim Process for Weekly Premium Insurance

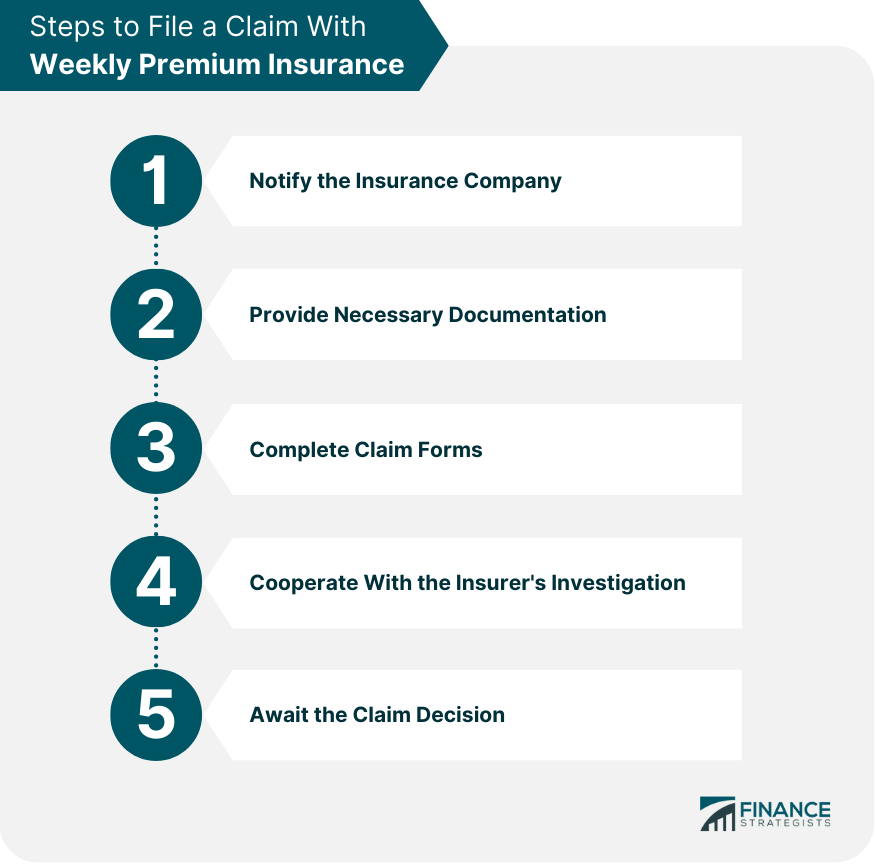

Steps to File a Claim With Weekly Premium Insurance

Step 1: Notify the Insurance Company

Step 2: Provide Necessary Documentation

Step 3: Complete Claim Forms

Step 4: Cooperate With the Insurer's Investigation

Step 5: Await the Claim Decision

Documentation Required

Claim Approval and Payout Process

Appealing a Denied Claim

Final Thoughts

Weekly Premium Insurance FAQs

Weekly premium insurance is a type of insurance policy where the policyholder pays the premium on a weekly basis. It offers increased affordability and flexibility, making it easier for individuals to manage their insurance costs. Weekly premium insurance can be applied to various types of insurance, such as life, health, auto, and home insurance.

Weekly premium insurance allows policyholders to distribute their insurance costs over smaller, more frequent payments, making it more manageable for individuals with tight budgets or irregular income streams. By paying insurance premiums weekly, policyholders can better manage their budgets and maintain essential insurance coverage.

There are various types of weekly premium insurance, including weekly premium life insurance (term and whole life), weekly premium health insurance (individual and family plans, group plans), weekly premium auto insurance (liability, comprehensive, and collision coverage), and weekly premium home insurance (building and contents coverage, additional living expenses coverage).

Several factors can influence weekly premium insurance rates, such as the policyholder's personal information (age, gender, occupation, health history), coverage details (policy term, coverage amount, deductibles, additional riders), and risk factors (credit score, claims history, location). Understanding these factors can help you make informed decisions about your insurance policies.

To find the best weekly premium insurance policy, assess your personal needs and budget, compare quotes from multiple insurance companies, evaluate the insurer's financial strength and reputation, understand policy terms and conditions, and consider add-on benefits and riders. By carefully evaluating these factors, you can select the most suitable policy that meets your needs and financial circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.